January 26th, 2026

After the Wrapping Paper: Converting Unwanted Luxury Gifts Into New Year Financial Goals

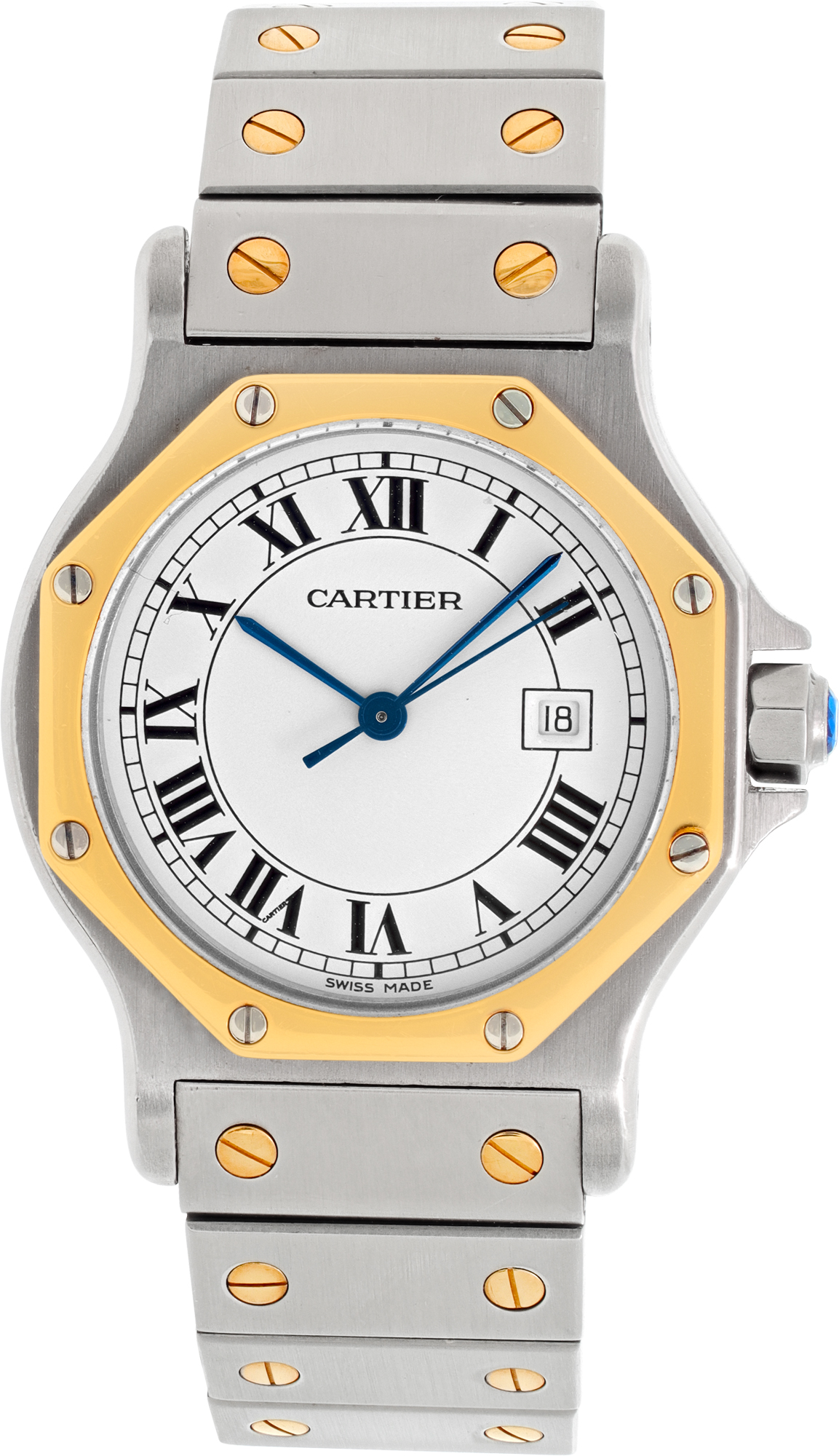

The holiday season brings joy, celebration, and often, beautifully wrapped luxury gifts. But what happens when you unwrap an exquisite piece that doesn't quite match your style or needs? Perhaps you received a stunning piece of Cartier jewelry or a prestigious timepiece that, while valuable, doesn't align with your personal aesthetic or financial priorities. The good news is that unwanted luxury gifts can become the foundation for achieving your New Year financial goals. Whether you're looking to sell Cartier jewelry, sell Tiffany jewelry, or sell luxury watch pieces received as gifts, transforming these high-value items into liquid assets offers a practical path toward your 2026 objectives.

Many gift recipients find themselves in this position each year, wondering what are you looking to sell and how to respectfully convert generous presents into more practical resources. The post-holiday period represents an ideal time to evaluate your luxury items and make strategic decisions about your financial future. By working with a reputable jewelry buyer near me, you can discretely and professionally turn unwanted gifts into cash that supports your real priorities—whether that's paying down debt, building savings, or funding new investments.

Understanding the Value of Unwanted Luxury Gifts

Luxury gifts carry significant monetary value that often goes unrecognized by recipients. A Cartier Love bracelet, Tiffany diamond necklace, or Rolex watch represents not just thoughtfulness but also a substantial financial asset. These pieces are crafted from precious metals, set with genuine gemstones, and carry brand equity that maintains value in the secondary market. Understanding this intrinsic worth transforms your perspective from "unwanted gift" to "financial opportunity."

The pre-owned luxury market has matured significantly, with collectors and buyers actively seeking authentic pieces from prestigious brands. Items from Cartier, Tiffany & Co., Rolex, Patek Philippe, and other renowned manufacturers consistently command competitive prices. When you sell your jewelry through established buyers, you're accessing a marketplace where quality craftsmanship and brand heritage translate directly into fair market value.

Why the New Year Is the Perfect Time to Sell

The weeks following the holidays create optimal conditions for selling luxury items. You've had time to carefully consider each gift, try pieces on, and honestly assess whether they fit your lifestyle. This reflective period allows for thoughtful decision-making without the emotional pressure of the holiday moment. Additionally, luxury buyers and collectors are actively shopping in January, often using year-end bonuses or pursuing New Year resolutions to acquire investment-grade timepieces and jewelry.

From a practical standpoint, converting unwanted luxury gifts into cash early in the year provides immediate resources for your financial goals. Whether you're targeting debt reduction, emergency fund building, or strategic investments, starting January with increased liquidity sets a positive trajectory for the entire year. The process of selling through a trusted jewelry buyer near me typically moves quickly, meaning you can realize your item's value within days rather than months.

For those seeking guidance on the selling process, our team specializes in evaluating everything from Cartier watches to diamond engagement rings. We understand that selling a gift requires discretion and professionalism, and our approach respects both your privacy and the gift-giver's intentions.

Common Luxury Gifts That Can Fund Your Goals

High-end jewelry frequently tops gift lists but doesn't always align with the recipient's style. Sell Tiffany jewelry pieces like signature "T" bracelets, Return to Tiffany heart tags, or Elsa Peretti designs that, while beautiful, may duplicate items you already own or simply don't match your aesthetic. These pieces maintain strong resale value due to Tiffany's enduring brand reputation and quality craftsmanship.

Cartier jewelry represents another category of frequently gifted luxury items. The iconic Love bracelet, Juste un Clou designs, Trinity rings, and Panthère collections are generous presents that carry substantial value. If you're considering options to sell Cartier jewelry, know that these pieces are highly sought after in the pre-owned market. Collectors specifically seek authentic Cartier pieces with proper documentation, making them relatively liquid assets.

Luxury timepieces, particularly from Swiss manufacturers, represent significant financial assets. When you sell Rolex watches, Omega Speedmasters, or Patek Philippe Nautilus models, you're liquidating items that often appreciate or hold steady value. Even if a watch doesn't suit your wrist size or style preferences, its intrinsic value remains substantial. The market for pre-owned luxury watches continues thriving, with knowledgeable collectors valuing authenticity and condition above all else.

How to Approach Selling Gifted Items Respectfully

Many people hesitate to sell gifts due to concerns about the giver's feelings. However, gift-giving's true purpose centers on the recipient's happiness and wellbeing. If converting a luxury item into resources that genuinely improve your life—whether through debt elimination, education funding, or investment opportunities—aligns better with your needs, this represents a responsible and mature decision.

Discretion remains paramount when selling gifted items. Working with established buyers ensures privacy throughout the process. There's no requirement to explain your motivations or justify your decision. Professional watch buyers and jewelry evaluators handle thousands of transactions annually, many involving gifted items, and maintain complete confidentiality regarding your sale.

Understanding how it works helps ease any concerns about the selling process. Reputable buyers provide straightforward evaluations, transparent pricing, and secure transaction methods that protect both parties. You maintain control throughout, accepting or declining offers based solely on whether they meet your financial objectives.

Maximizing Value from Your Unwanted Luxury Items

Preparation significantly impacts the value you'll receive for luxury items. Gather all original documentation, including boxes, certificates of authenticity, purchase receipts, and warranty cards. For watches, service records prove particularly valuable, demonstrating proper maintenance and care. For jewelry, GIA certificates or appraisals provide independent verification of gemstone quality and metal purity.

Clean items gently before evaluation, but avoid aggressive polishing that might inadvertently cause damage. Luxury watches should be wound and functional when presented for appraisal, while jewelry should be free from obvious dirt or residue. These simple preparations demonstrate care and help evaluators accurately assess condition, potentially resulting in higher offers.

When you sell your watch or jewelry, timing can influence offers. While luxury items maintain value year-round, certain models experience periodic demand surges. Professional buyers stay current with market trends and can advise whether selling immediately or waiting briefly might optimize returns. However, for most pieces, especially when funding specific financial goals, selling promptly typically outweighs potential marginal gains from timing markets.

Converting Sale Proceeds into Financial Progress

The transition from unwanted gift to achieved financial goal requires strategic planning. Before selling, clearly define your objective. Are you eliminating high-interest credit card debt? Building an emergency fund to prevent future debt accumulation? Funding professional development or education? Contributing to retirement accounts? Specific goals help maintain focus and prevent sale proceeds from disappearing into general spending.

Consider the psychological impact of transforming a physical luxury item into abstract financial progress. Create tangible reminders of your accomplishment—perhaps a printed statement showing debt reduction or an investment account balance screenshot. These visual confirmations help reinforce that selling was the right decision and provide motivation for continued financial discipline.

For those with multiple unwanted items, prioritize which to sell first based on both value and personal attachment. Items you've never worn or used make obvious initial candidates. Pieces duplicating items you already own and love come next. This methodical approach prevents decision paralysis while still respecting any sentimental considerations.

The Professional Selling Process Explained

Working with established luxury buyers streamlines what might otherwise feel like an overwhelming process. The evaluation begins with authentication, ensuring items are genuine products from stated manufacturers. For watches, this involves examining movement, case construction, serial numbers, and component quality. For jewelry, assessment focuses on metal purity, gemstone authenticity, craftsmanship quality, and brand verification.

Following authentication, condition evaluation determines pricing. Factors including wear patterns, functionality (for watches), clarity and color (for gemstones), and any damage or alterations all influence final offers. Professional buyers assess these elements objectively, applying industry-standard grading criteria that ensure fair, market-appropriate pricing.

The brands we buy include all major luxury manufacturers, from Cartier and Tiffany & Co. to Rolex, Patek Philippe, Audemars Piguet, and many others. This broad expertise means you can sell multiple items through a single trusted source, simplifying the process considerably. Whether you're looking to sell Rolex watches, sell luxury watch collections, or sell Cartier jewelry and Tiffany pieces simultaneously, comprehensive buyers handle diverse luxury categories efficiently.

Beyond Unwanted Gifts: Other Items to Consider

The post-holiday evaluation period offers an excellent opportunity to assess your entire jewelry and watch collection. Beyond unwanted gifts, consider pieces you haven't worn in years, duplicates that serve redundant purposes, or items no longer matching your evolved style. Estate jewelry inherited from family members, though sentimentally significant, might serve your current needs better as financial resources rather than stored possessions.

Many people discover that selling estate jewelry provides funds for experiences or goals that honor loved ones' memories more meaningfully than unused items in safe deposit boxes. Similarly, luxury watches that no longer fit properly, require expensive service, or simply don't suit your lifestyle might be converted into more practical resources.

If you're uncertain about which items to sell, requesting evaluations for multiple pieces provides concrete value information that facilitates decision-making. There's no obligation to sell simply because you've requested an appraisal, and understanding your items' worth helps clarify whether keeping or selling best serves your interests.

Geographic Convenience and National Reach

For South Florida residents, particularly those in Miami, Boca Raton, Fort Lauderdale, and Palm Beach areas, in-person evaluations offer convenience and immediate results. As a Miami Cartier watch buyer and comprehensive luxury buyer serving the region, we welcome clients to our Surfside showroom for personal consultations. This face-to-face approach builds trust and allows immediate transaction completion when terms satisfy all parties.

For clients beyond South Florida, our national reach ensures equal access to professional evaluations and competitive offers. Secure shipping methods protect your items during transit, and comprehensive insurance coverage safeguards against any potential loss. Remote transactions follow the same rigorous authentication and evaluation processes as in-person sales, ensuring consistent, fair treatment regardless of geography.

Whether you're searching for a Boca Raton Rolex buyer, jewelry buyer near me in any major metropolitan area, or a trusted national luxury buyer, the key lies in selecting experienced professionals with transparent processes and established reputations. Reviews, industry standing, and clear communication all indicate buyer credibility and reliability.

Sterling Silver and Alternative Luxury Items

While fine jewelry and watches typically command attention during post-holiday evaluations, don't overlook other luxury items that might fund your goals. Sterling silver flatware, serving pieces, and decorative items frequently occupy cabinet space unused for years. These pieces carry intrinsic metal value plus potential premium pricing for sought-after patterns from manufacturers like Tiffany & Co., Georg Jensen, or Cartier.

When you sell your sterling silver, pricing reflects current precious metal markets plus pattern rarity and condition. Complete sets command higher per-piece pricing than partial collections, but even incomplete sets or individual serving pieces maintain value worth exploring. The post-holiday period's natural inclination toward decluttering makes this an ideal time to assess your entire silver collection.

Similarly, gold jewelry received as gifts but never worn—perhaps due to metal allergies, style preferences, or existing similar pieces—represents readily convertible assets. Gold's intrinsic value provides a reliable value floor, while craftsmanship, brand equity, and gemstone additions increase total worth. These pieces deserve professional evaluation to ensure you understand their full financial potential.

Setting Realistic Expectations

Understanding market realities helps establish appropriate expectations for selling luxury items. Pre-owned pieces typically command 40-70% of original retail pricing, depending on brand, model, condition, market demand, and documentation completeness. This variance reflects market dynamics rather than arbitrary buyer decisions, and reputable professionals explain pricing rationales clearly and transparently.

Certain brands and models maintain value exceptionally well. Rolex sports models, Patek Philippe complications, Cartier Love bracelets, and Tiffany signature collections all demonstrate strong secondary market performance. Other pieces, while still valuable, may experience greater depreciation from original retail prices. Professional evaluations provide realistic assessments based on current market conditions rather than hopeful projections or outdated information.

Remember that retail prices include significant markups covering showroom costs, sales commissions, marketing expenses, and profit margins. The secondary market operates with different economics, directly connecting sellers with buyers and reducing overhead costs. This efficiency benefits sellers through competitive offers while maintaining sustainable business models for professional buyers.

Taking Action Toward Your Financial Goals

Transforming unwanted luxury gifts into achieved financial goals requires only the decision to begin. Request evaluations for items you've identified as conversion candidates, understanding there's no obligation to proceed if offers don't meet your expectations. This risk-free first step provides concrete information that clarifies your options and potential proceeds.

For those ready to move forward, the actual transaction process typically completes quickly—often within 24-48 hours of accepting an offer. This efficiency means your financial goals receive immediate support rather than remaining distant aspirations. Whether you're reducing debt, building savings, funding education, or pursuing investment opportunities, rapid conversion of unwanted items into working capital accelerates progress meaningfully.

The psychological impact of accomplishing financial objectives through strategic asset management extends beyond mere numbers. You'll have demonstrated resourcefulness, financial acumen, and the ability to make practical decisions that prioritize long-term wellbeing over temporary possession of unused items. These successes build confidence for continued financial progress throughout the year.

Start Your Financial Transformation Today

The unwanted luxury gifts you received this holiday season represent more than beautiful objects that don't quite fit your life—they're opportunities for meaningful financial progress. By converting these high-value items into resources that fund your real priorities, you're making strategic decisions that improve your financial health and move you closer to important goals.

At Sell Us Your Jewelry, we've helped thousands of clients transform luxury items into financial progress since 1980. Our expertise spans all major luxury brands, and our process ensures professional, confidential, and fair treatment throughout your selling experience. Whether you received Cartier jewelry, Tiffany pieces, Rolex watches, or other luxury items that don't suit your needs, we're here to help you unlock their value and achieve your New Year financial goals.

Ready to convert your unwanted luxury gifts into financial progress? Start by requesting a complimentary evaluation. Visit our watch quote page for timepieces, our jewelry quote page for fine jewelry, or explore our comprehensive selling process to understand how we can help. Your 2026 financial goals are within reach—let's make them reality together.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG