February 19th, 2026

Compassionate Estate Solutions: How Funeral Directors Connect Families With Professional Jewelry and Watch Valuation Services This February

When families face the loss of a loved one, they're confronted with countless decisions during an already overwhelming time. Among the many responsibilities of settling an estate, determining the value of inherited jewelry and luxury watches often becomes a complex task that requires specialized expertise. This February, funeral directors across the country are increasingly partnering with professional jewelry and watch buyers to provide families with compassionate, trustworthy guidance during the estate settlement process.

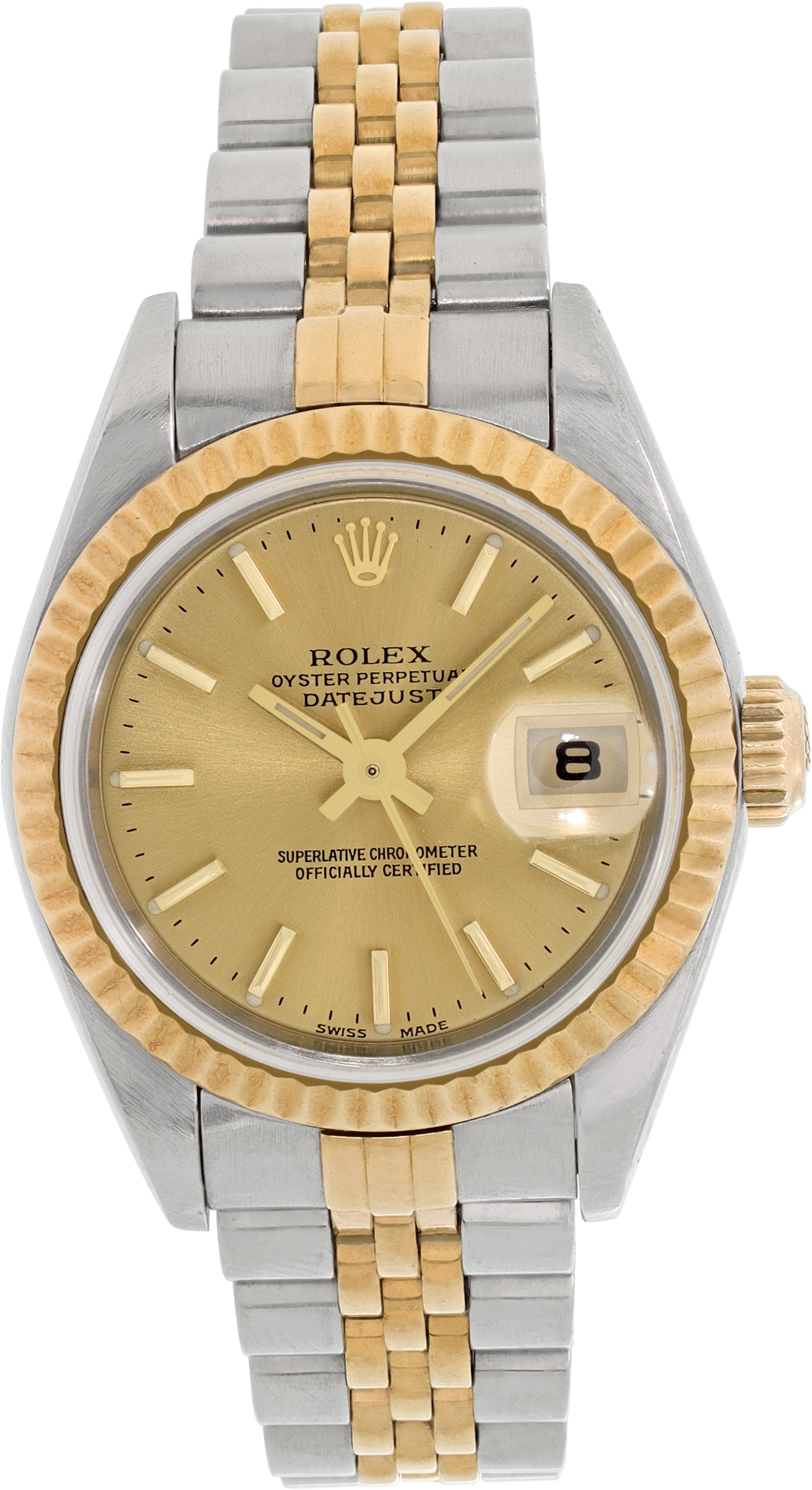

Understanding the true value of estate jewelry, luxury timepieces, and precious heirlooms requires the expertise of trained professionals who can accurately assess these items. Whether you've inherited a collection of Tiffany & Co. jewelry, a vintage Rolex watch, or family diamonds passed down through generations, working with an experienced jewelry buyer near me ensures you receive fair market value while navigating this sensitive time with dignity and respect.

The Growing Partnership Between Funeral Homes and Estate Jewelry Specialists

Progressive funeral directors recognize that their role extends beyond immediate arrangements to helping families manage the practical aspects of estate settlement. Many are now establishing relationships with reputable luxury watch buyers and estate jewelry specialists who can provide professional valuations during this difficult period. These partnerships offer families a trusted pathway to understanding what they've inherited and making informed decisions about keeping, selling, or distributing valuable items among beneficiaries.

The collaboration between funeral professionals and jewelry experts creates a streamlined process that respects both the emotional and financial needs of grieving families. Rather than navigating unfamiliar territory alone, families receive guidance from professionals who understand the sensitivity required when handling cherished possessions. This approach is particularly valuable when dealing with high-value items like Patek Philippe watches, Cartier jewelry, or certified diamonds that require specialized knowledge to evaluate properly.

For those asking where to sell a Rolex or wondering about the value of inherited luxury pieces, working through a funeral director's trusted network provides peace of mind. These established relationships ensure families connect with legitimate buyers rather than risking encounters with less reputable sources.

Understanding Estate Jewelry and Its Emotional Significance

Estate jewelry carries stories, memories, and emotional connections that transcend monetary value. A grandmother's diamond engagement ring represents not just precious stones and metal, but decades of love and family history. When families inherit these treasures, they face the challenge of balancing sentimental attachment with practical financial considerations. Professional estate jewelry evaluation respects both aspects, providing accurate market assessments while acknowledging the personal significance of each piece.

Many families discover that inherited collections include pieces from prestigious designers whose names they may not immediately recognize. Items like Bvlgari rings, Van Cleef & Arpels necklaces, or Chopard pendants often sit in jewelry boxes for years, their true value unknown until professional evaluation. Understanding whether you should sell Bvlgari jewelry or keep it as an heirloom becomes clearer when you receive expert guidance about its worth, rarity, and market demand.

Those considering options to sell their jewelry benefit from professional assessments that consider factors like designer provenance, gemstone quality, precious metal content, and current market conditions. This comprehensive approach ensures families make well-informed decisions about their inherited treasures.

Navigating Probate Jewelry Liquidation With Professional Support

Probate jewelry liquidation presents unique challenges that require both legal understanding and market expertise. Estate executors must accurately inventory and value all assets, including jewelry and watches, to properly settle the estate and distribute assets to beneficiaries. Professional valuation services provide the documentation needed for probate proceedings while ensuring items are neither undervalued nor overestimated, which could create complications during estate settlement.

The probate process often involves selling certain items to provide liquid assets for estate taxes, debts, or equitable distribution among heirs. When families need to sell diamond engagement rings, luxury watches, or designer jewelry pieces, working with established buyers streamlines this process. Whether you're looking to sell Cartier jewelry, liquidate a collection of Rolex watches, or convert sterling silver items to cash, professional buyers understand the urgency and sensitivity surrounding estate sales.

Funeral directors who partner with reputable jewelry and watch buyers help families avoid common pitfalls like accepting lowball offers or dealing with unreliable buyers. These trusted relationships ensure estate executors fulfill their fiduciary responsibilities while maximizing value for beneficiaries.

Luxury Watch Collections and Estate Valuation

Vintage and luxury watch collections often represent significant estate assets that require specialized knowledge to evaluate properly. A collection might include everything from a Patek Philippe pocket watch to modern Omega Constellation timepieces, each with distinct value drivers based on model, condition, provenance, and market demand. Professional watch buyers possess the expertise to identify rare references, assess mechanical condition, and determine authentic market value for these sophisticated timepieces.

Families frequently discover they've inherited watches from prestigious manufacturers like Audemars Piguet, Breguet, or Vacheron Constantin without understanding their significance or worth. Even pieces that appear to need service—broken watches or those requiring restoration—hold considerable value when properly evaluated. The ability to sell my watch through a trusted buyer ensures these timepieces find knowledgeable collectors who appreciate their craftsmanship and heritage.

Those wondering where can I sell my watch benefit from understanding the importance of working with buyers who employ master watchmakers and certified evaluators. This expertise ensures accurate assessments of complicated timepieces, from vintage Rolex Submariners to contemporary Hublot models.

Designer Jewelry Collections: From Tiffany & Co. to Contemporary Pieces

Estate collections often include pieces from world-renowned jewelry houses that carry both intrinsic and brand value. Tiffany & Co. jewelry, for instance, commands premium prices due to the brand's prestigious reputation and distinctive designs. Whether you're considering options to sell Tiffany & Co. jewelry like pieces from the Return to Tiffany collection or Tiffany Paper Flowers designs, professional evaluation accounts for both the precious materials and the designer provenance.

Beyond Tiffany, families may inherit pieces from other prestigious makers whose work deserves expert assessment. Collections might include Cartier Love bracelets, Chopard Happy Diamonds pieces, David Yurman Cable collection items, or Roberto Coin Princess Flower designs. Each designer brings unique characteristics that affect value, from signature design elements to documentation and original packaging. Understanding whether to sell Cartier bracelets or keep them as family heirlooms becomes clearer with professional guidance.

Professional buyers evaluate designer jewelry comprehensively, considering factors like condition, completeness of sets, original documentation, and current market demand. This thorough approach ensures families receive accurate valuations whether they choose to sell Bvlgari bracelets, liquidate Van Cleef & Arpels Alhambra pieces, or explore options for Chanel Camélia collection items.

Sterling Silver and Precious Metal Assets in Estate Settlement

Estate silver often represents a substantial yet overlooked asset category. Many families inherit complete sterling silver flatware sets, tea services, trays, and candlesticks without realizing their considerable value based on precious metal content and craftsmanship. Sterling silver buyer services provide accurate weight-based valuations combined with assessments of pattern desirability and manufacturer prestige.

Beyond everyday silver items, estates may include pieces from luxury houses like Cartier or Tiffany & Co., whose silver items command premiums beyond melt value. Whether you're looking to sell sterling silver flatware from established patterns or unique serving pieces, professional evaluation ensures you receive fair compensation. Even damaged or incomplete sets hold value based on their silver content, making them worth professional assessment.

Families can explore options to sell their sterling silver through reputable buyers who provide transparent pricing based on current precious metal markets. This straightforward approach helps estate executors convert these assets to liquid funds efficiently while ensuring beneficiaries receive appropriate value.

GIA Certified Diamonds and Precious Gemstones

Diamond jewelry often represents the most valuable component of inherited collections. Pieces featuring GIA certified diamonds come with documentation that provides confidence in quality assessments, detailing the four Cs: cut, color, clarity, and carat weight. Professional diamond buyers leverage this certification to provide accurate valuations that reflect current market conditions for stones of specific characteristics.

Estate collections may include everything from solitaire diamond engagement rings to elaborate diamond tennis bracelets and statement necklaces. When families consider whether to sell diamond engagement rings or other significant pieces, professional evaluation examines not just the diamonds themselves but also the quality of settings, overall design, and potential for resale or redesign. Loose stones and mounted diamonds each require different assessment approaches that experienced buyers understand thoroughly.

Those with GIA certified diamonds benefit from working with buyers who respect these certifications while also providing independent verification. This dual approach ensures accuracy and builds trust during what can be an emotionally complex transaction.

The Practical Timeline: When to Begin Estate Jewelry Evaluation

Understanding the optimal timing for estate jewelry and watch evaluation helps families manage the probate process effectively. While there's no requirement to rush these decisions, beginning the valuation process within the first few months after a loss allows estate executors to complete required inventories, assess total estate value, and make informed distribution decisions. Early professional evaluation provides clarity without pressuring families to make immediate selling decisions.

Many families appreciate having professional assessments in hand before making final distribution decisions among beneficiaries. Understanding that grandmother's Patek Philippe watch is worth significantly more than anticipated might influence how other estate assets are divided to ensure fairness. Similarly, discovering that a collection includes valuable pieces from designers like Harry Winston, Graff, or Piaget affects estate planning and tax considerations.

Working with trusted watch buyers and jewelry specialists early in the process provides flexibility. Families can take time to decide which pieces to keep for sentimental reasons and which to liquidate, armed with accurate information about each item's worth.

Ensuring Authenticity and Fair Valuation

One of the primary concerns families face when dealing with inherited luxury items centers on authenticity verification and fair pricing. The market includes both genuine pieces and sophisticated counterfeits, making professional authentication essential. Reputable buyers employ trained specialists who examine hallmarks, construction techniques, serial numbers, and other indicators to verify authenticity before making offers.

For watches, this authentication process involves examining movement serial numbers, case construction, dial authenticity, and overall condition. Whether evaluating a Rolex Submariner, Omega Speedmaster, or vintage Jaeger-LeCoultre, experienced buyers know the subtle details that distinguish genuine pieces from replicas. This expertise protects families from unknowingly accepting offers on counterfeit items or, conversely, dismissing authentic pieces as fake.

The same thorough approach applies to jewelry authentication. Buyers who specialize in designer pieces understand the characteristics that distinguish authentic Bvlgari B.Zero1 collection items, Cartier Panthère collection pieces, or Van Cleef & Arpels Alhambra collection jewelry from convincing imitations.

The Benefits of Local, Established Buyers

While online selling platforms offer convenience, working with established local buyers provides advantages particularly valuable during estate settlement. Face-to-face transactions allow families to ask questions, understand the evaluation process, and develop confidence in the buyer's expertise and integrity. Local jewelry buyers with showroom locations demonstrate stability and accountability that purely online operations cannot match.

For families in South Florida, visiting a showroom in areas like Surfside, near Bal Harbour, provides the opportunity to meet evaluation teams personally. Whether you're searching for a Rolex buyer in Boca Raton or need to sell diamonds in Miami, working with established businesses that have served their communities for decades offers peace of mind during sensitive transactions.

The transparency of in-person evaluations allows families to observe the assessment process, ask questions about how values are determined, and understand market factors affecting prices. This educational component helps estate executors fulfill their responsibilities confidently while ensuring beneficiaries understand the fairness of transactions.

Consignment Options for Maximum Value

Not all inherited pieces require immediate liquidation. For particularly valuable or rare items, consignment arrangements often yield higher returns than direct purchase offers. Professional consignment services connect significant pieces with collectors who appreciate their rarity and are willing to pay premium prices. This approach works especially well for investment-grade watches, exceptional designer jewelry, and pieces with strong collector demand.

Consignment allows families to potentially achieve retail-level pricing while the buyer handles marketing, authentication guarantees, and transaction security. Whether considering consignment for a rare Audemars Piguet Royal Oak Offshore or an exceptional Harry Winston necklace, understanding both direct purchase and consignment options helps families make informed decisions that maximize estate value.

Those exploring consignment opportunities benefit from working with buyers who offer transparent terms, reasonable commission structures, and established collector networks. This collaborative approach often produces better outcomes for truly exceptional pieces.

Special Considerations for Designer Collections

Certain designer brands command particular attention in the luxury resale market due to their enduring popularity and strong collector demand. Understanding these market dynamics helps families recognize when they've inherited pieces of exceptional value. Items from houses like Cartier, Van Cleef & Arpels, and Bvlgari consistently perform well in the secondary market, often achieving prices that reflect both material value and brand premium.

Collections featuring iconic designs—like Cartier Juste un Clou bracelets, Bvlgari Serpenti collection pieces, or David Yurman Cable collection items—deserve specialized evaluation that considers both current market demand and historical significance. These signature designs often appreciate over time, making them particularly valuable estate assets. Professional buyers who specialize in these brands understand subtle details like period characteristics, authentic markings, and model variations that affect value.

Whether you're considering options to sell Chopard jewelry, liquidate Piaget pieces, or evaluate Roberto Coin designs, working with knowledgeable buyers ensures these designer treasures receive appropriate recognition and compensation. Understanding which pieces to sell Gucci jewelry immediately versus which items might benefit from consignment requires expertise that established buyers provide.

Managing Multiple Beneficiaries and Equitable Distribution

Estate settlement becomes more complex when multiple beneficiaries have interests in jewelry and watch collections. Professional valuations provide objective baselines that help families navigate these potentially sensitive discussions. When three siblings inherit their mother's jewelry collection, accurate assessments allow them to divide items equitably, whether each person keeps specific pieces or some items are sold to provide cash distributions.

Clear documentation from professional evaluations also protects estate executors from potential disputes about valuation fairness. If one beneficiary receives grandmother's diamond bracelet while another inherits her Rolex watch, objective appraisals demonstrate the equity of the distribution. This transparency prevents family conflicts that can arise when beneficiaries have different perceptions of value.

For estate executors managing complex situations, working with buyers who can evaluate entire collections comprehensively streamlines the process. Rather than seeking multiple specialists for watches, diamonds, and designer jewelry separately, comprehensive services that handle all categories efficiently serve families' needs during already challenging times.

Understanding Current Market Conditions

The luxury resale market fluctuates based on various factors including precious metal prices, collector demand trends, and economic conditions. Professional buyers stay current with these market dynamics, ensuring valuations reflect today's realities rather than outdated price assumptions. Current market knowledge is particularly important for watches, where specific models can experience significant value changes based on collector interest and brand reputation.

February 2026 market conditions show continued strong demand for pieces from established luxury brands, with particular interest in vintage and neo-vintage watches sized 36-39mm. Designer jewelry from houses like Tiffany & Co., Cartier, and Van Cleef & Arpels maintains consistent value due to brand strength and timeless designs. Understanding these trends helps families recognize opportune times for liquidating certain pieces versus holding others that might appreciate further.

Professional buyers provide current market insights that help families make strategic decisions about timing. Whether market conditions favor immediate sales of Chopard Happy Diamonds collection pieces or suggest waiting for better positioning of vintage Rolex models, experienced guidance proves invaluable.

The Role of Documentation and Provenance

Original documentation significantly enhances the value of inherited luxury items. Boxes, certificates, receipts, and service records provide provenance that increases buyer confidence and justifies premium pricing. Complete documentation can add 10-30% to an item's value, particularly for high-end watches and designer jewelry where authenticity verification is paramount.

Families should gather all available documentation before seeking evaluations. Original Rolex boxes and papers, Tiffany & Co. certificates, or Cartier receipts provide valuable authentication support. Even service records from authorized dealers contribute to establishing provenance and demonstrating proper maintenance history, particularly valuable for complicated timepieces like Patek Philippe watches or Vacheron Constantin models.

When documentation is missing, professional buyers can still authenticate and value pieces, though the process may be more involved. Understanding which pieces came with original packaging helps families prioritize evaluation efforts and set realistic price expectations.

Tax Implications and Professional Valuation Documentation

Estate settlement involves tax considerations that require accurate documentation of asset values. Professional jewelry and watch valuations provide the documentation needed for estate tax filings, ensuring compliance with IRS requirements. These formal appraisals establish fair market value on the date of death, which becomes the cost basis for beneficiaries who later sell inherited items.

Understanding the stepped-up basis rules for inherited property helps families minimize capital gains taxes when liquidating estate jewelry and watches. Items inherited receive a cost basis equal to their fair market value at the time of inheritance, potentially eliminating or reducing capital gains taxes on subsequent sales. Professional buyers who understand these tax implications can provide appropriately documented valuations that serve multiple purposes: estate tax filing, equitable distribution planning, and future sale cost basis establishment.

Estate executors benefit from working with buyers who provide detailed, professionally formatted documentation suitable for legal and tax purposes. This additional service adds significant value beyond simple purchase transactions.

Taking the First Step: Compassionate, Professional Support

Beginning the estate jewelry evaluation process need not feel overwhelming. Reputable buyers understand the emotional context surrounding inherited items and approach each situation with appropriate sensitivity and respect. Professional evaluation services designed for estate situations recognize that families need both accurate information and compassionate guidance during difficult times.

The process typically begins with an informal conversation about what you've inherited, followed by either an in-person consultation or a preliminary remote evaluation based on photographs and descriptions. This initial assessment helps families understand the general scope of what they have before committing to formal evaluations. Whether you have a single significant piece or an extensive collection spanning decades, professional buyers tailor their approach to your specific situation.

For those ready to take the next step, exploring options to sell their watch or obtain a jewelry quote provides clarity and direction. Professional buyers guide families through each stage with transparency, answering questions and providing education about the items they've inherited.

Why Choose Established, Trusted Buyers

The luxury jewelry and watch buying industry includes a wide spectrum of operators, from pawn shops offering quick cash to specialized dealers serving discerning collectors. Choosing established buyers with decades of experience ensures families receive fair treatment, accurate valuations, and appropriate compensation for their inherited treasures. Companies with longstanding reputations prioritize customer relationships over individual transactions, understanding that referrals and repeat business stem from consistently ethical practices.

Look for buyers who maintain physical showroom locations, employ certified specialists, offer transparent evaluation processes, and provide references or reviews from previous clients. These indicators suggest stability, expertise, and commitment to professional standards. Whether you're seeking to sell Tiffany & Co. rings, liquidate a Rolex collection, or evaluate mixed estate jewelry, working with reputable buyers protects your interests.

Understanding what brands professional buyers purchase helps families recognize when they've inherited pieces of particular value. Specialization in luxury brands indicates the expertise necessary to properly evaluate and price premium pieces.

Connect With Compassionate Estate Jewelry Professionals

Navigating estate settlement involves many complex decisions, but determining the value of inherited jewelry and watches need not add to your stress. Professional evaluation services designed specifically for estate situations provide the expertise, transparency, and compassionate support families need during difficult times.

Whether you've inherited a single significant piece or an extensive collection of luxury items, taking that first step toward professional evaluation brings clarity and peace of mind. Our team understands the sensitivity required when handling cherished family possessions and approaches each situation with appropriate respect and professionalism.

Ready to understand the value of your inherited jewelry and watches? We invite you to explore our comprehensive resources:

- Get a professional watch evaluation for inherited timepieces from Rolex, Patek Philippe, Omega, and other prestigious manufacturers

- Obtain a jewelry quote for estate pieces including designer jewelry, diamond items, and precious gemstones

- Request a diamond appraisal for GIA certified diamonds and significant gemstones

- Receive a sterling silver evaluation for flatware, tea services, and decorative items

- Learn about our process and how we provide transparent, professional service

Our experienced team has served families throughout South Florida and across the United States since 1980, building a reputation for integrity, expertise, and fair dealing. We understand that inherited items carry both monetary and sentimental value, and we approach each evaluation with the sensitivity these circumstances deserve.

Contact us today to begin the conversation about your inherited jewelry and watches. We're here to provide the professional guidance and compassionate support you need during this important process.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG