January 26th, 2026

December's Final Days: Strategic Luxury Asset Liquidation for Last-Minute 2025 Tax Optimization

As the calendar year draws to a close, December presents a unique window of opportunity for strategic year end tax planning through luxury asset liquidation. Whether you're looking to sell luxury watch pieces, diamond jewelry, or other high-value items, the final days of 2025 offer compelling financial advantages for those who act decisively. Understanding how to leverage this critical timeframe can transform unused luxury assets into valuable tax deductions and portfolio optimization opportunities.

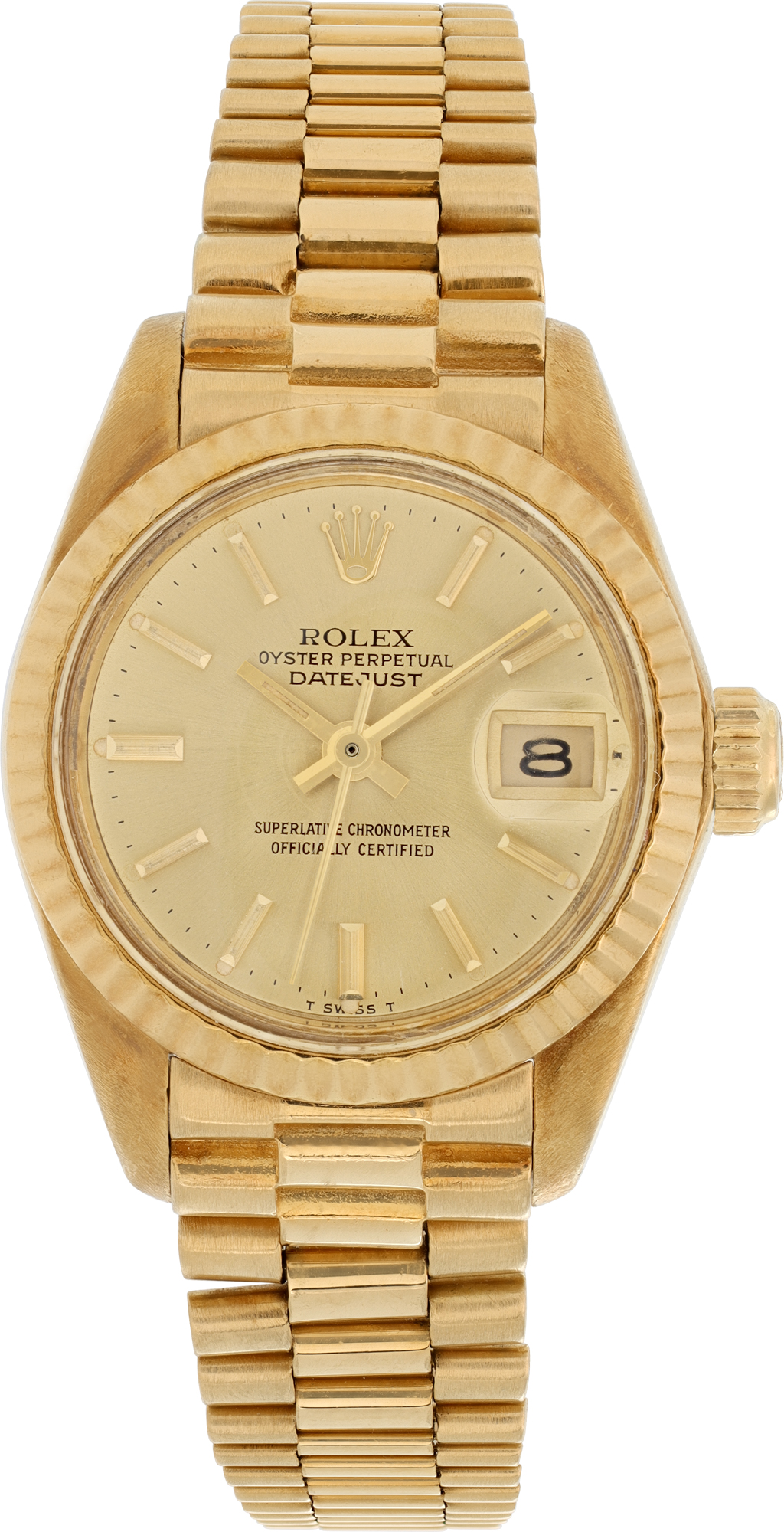

The approaching December 31st deadline creates urgency for individuals seeking to offset capital gains, rebalance investment portfolios, or establish charitable contribution deductions. If you're considering whether to sell Rolex, sell Patek Philippe, or liquidate other luxury holdings, the strategic timing of these transactions can significantly impact your 2025 tax position and set the foundation for a more optimized financial portfolio in 2026.

Understanding Year-End Tax Advantages Through Luxury Asset Sales

Luxury assets represent more than just beautiful possessions—they constitute tangible investments that can be strategically liquidated to achieve specific tax objectives. When you decide to sell diamond jewelry or premium timepieces during December's final weeks, you're not simply converting assets to cash; you're potentially creating tax-loss harvesting opportunities, offsetting unexpected capital gains, or establishing documented charitable contributions before the calendar year closes.

The intersection of luxury asset liquidation and tax strategy becomes particularly relevant for collectors who have seen certain pieces appreciate substantially while others have depreciated in value. By selectively choosing which items to sell my Rolex or other luxury holdings, you can strategically realize losses that offset gains elsewhere in your portfolio. This approach requires working closely with your tax advisor to ensure compliance while maximizing benefits.

For those in South Florida seeking immediate assistance, our expertise as a Miami Patek Philippe buyer and Boca Raton Rolex buyer means you can complete transactions quickly during this critical window. Our understanding of both luxury markets and the urgency of year-end planning ensures smooth, efficient transactions.

Premium Timepieces: Strategic Liquidation for Portfolio Rebalancing

High-end watches from manufacturers like Rolex, Patek Philippe, Omega, and Audemars Piguet represent substantial investments that may warrant reassessment as part of year-end portfolio reviews. If you're contemplating to sell Patek Philippe Nautilus models or considering options to sell Rolex Submariner, December's final days provide the ideal timeframe for executing these transactions with tax year 2025 benefits intact. The pre-owned luxury watch market has demonstrated resilience, ensuring that quality pieces retain strong valuations.

When evaluating whether to liquidate premium timepieces, consider both market conditions and personal financial objectives. Perhaps you've accumulated multiple pieces over the years, some of which no longer align with your collection goals or lifestyle. Maybe certain models have appreciated significantly, creating an opportunity to sell my Audemars Piguet watch and reinvest proceeds more strategically. Whatever your motivation, professional evaluation ensures you understand true market value before making decisions.

Our services extend throughout Florida, with specialized expertise as a West Palm Beach Patek Philippe buyer, Fort Myers Rolex watch buyer, and Naples Rolex watch buyer. This regional presence means sellers across the state can access professional evaluations and competitive offers without unnecessary delays during this time-sensitive period.

For those seeking comprehensive guidance on the selling process, our watch quote service provides expert evaluations on all major luxury watch brands. Whether you're looking to sell Omega watch models like the Speedmaster, or considering options to sell my Hublot watch or sell Breitling watch pieces, our team brings decades of expertise to every transaction.

Diamond Jewelry and Precious Metals: Tax-Smart Liquidation Strategies

Diamond engagement rings, estate jewelry, and designer pieces represent another category of luxury assets suitable for strategic year-end liquidation. If you're positioned to sell diamond engagement ring pieces or contemplating whether to sell my diamond engagement ring from a previous relationship, the tax implications of timing these transactions warrant careful consideration. High-quality diamonds with GIA certifications typically maintain strong market values, making them reliable assets for liquidation when strategic timing matters.

Beyond diamonds, precious metal jewelry from prestigious houses offers significant value. Those looking to sell Cartier jewelry, sell Tiffany jewelry, or sell Van Cleef and Arpels jewelry can benefit from our expertise in evaluating designer pieces. Specific items like Cartier Juste un Clou bracelets, which remain highly desirable in the secondary market, often command premium prices that make liquidation advantageous from both financial and tax perspectives.

Our comprehensive approach extends to all forms of luxury jewelry. Whether you need to sell Bvlgari jewelry, sell Chopard jewelry, or sell David Yurman jewelry, our evaluation process accounts for brand heritage, current market demand, condition, and authenticity. We understand that pieces like David Yurman bracelets, Tiffany bracelets, and Van Cleef & Arpels bracelets carry both intrinsic precious metal value and significant brand premiums.

For those with comprehensive jewelry collections, our jewelry quote service streamlines the evaluation process across multiple pieces. This is particularly valuable when selling your pre owned luxury watch alongside jewelry items as part of a broader portfolio liquidation strategy.

Sterling Silver Assets: Often Overlooked Year-End Opportunities

Sterling silver flatware, serving pieces, and decorative items frequently represent overlooked opportunities for year-end asset liquidation. Many individuals inherit sterling silver collections that remain stored and unused, representing dormant capital that could serve better purposes within an optimized financial strategy. As an established sterling silver flatware buyer, we provide professional evaluations that account for both precious metal content and collectible value of pieces from prestigious manufacturers.

The market for quality sterling silver remains robust, particularly for complete flatware sets from renowned silversmiths like Tiffany & Co., Cartier, Gorham, and Georg Jensen. If you're considering options to sell gold jewelry alongside sterling silver pieces, December's final days provide an opportune moment to consolidate these transactions efficiently. Our expertise extends to evaluating Cartier flatware buyer needs and other prestigious silver manufacturers.

Geographic accessibility matters when timing is critical. Our presence as a trusted buyer means South Florida residents can efficiently complete transactions. For those seeking the fastest way to sell silver in Hollywood or throughout the region, our streamlined process eliminates unnecessary delays while ensuring competitive valuations that reflect current precious metal markets.

Understanding what your sterling silver is worth begins with professional evaluation. Our team assesses weight, purity, manufacturer, pattern rarity, and condition to provide comprehensive valuations that inform your decision-making during this critical tax planning window.

Geographic Advantages: South Florida's Premier Luxury Asset Buyer

Location matters significantly when time-sensitive transactions are essential. Our established presence in South Florida positions us as the region's premier resource for those seeking a Bal Harbour Rolex watch buyer, Coral Gables Cartier watch buyer, Brickell Avenue Rolex watch buyer, or Key Biscayne Rolex watch buyer. This extensive regional footprint means sellers throughout Miami-Dade, Broward, and Palm Beach counties can access professional services without traveling significant distances.

Beyond Miami's immediate metropolitan area, our expertise extends throughout the state. Whether you're searching for a Boca Raton Omega buyer, Fort Myers Cartier watch buyer, Hollywood Patek Philippe buyer, or Sunny Isles Patek Philippe buyer, our comprehensive service network ensures consistent professionalism regardless of your location. We understand the unique dynamics of Florida's luxury market and maintain relationships with collectors and dealers nationwide.

For those outside our immediate service areas, our national reach means you're never too far from professional assistance. Our online platform enables secure transactions for sellers throughout the United States, bringing the same expertise and competitive valuations to your doorstep regardless of geographic location. This accessibility proves particularly valuable during December's final days when timing constraints make efficiency paramount.

Discover more about our brands to understand the comprehensive range of luxury watches and jewelry we purchase. From Rolex Submariner two tone models to rare Vacheron Constantin pieces, our expertise spans the entire spectrum of collectible luxury assets.

The Professional Liquidation Process: Efficiency Meets Expertise

Understanding the easiest way to sell your jewelry online begins with recognizing that professional buyers offer advantages far exceeding peer-to-peer marketplaces or pawn transactions. When you work with established luxury buyers, you benefit from decades of market expertise, transparent evaluation processes, competitive pricing backed by market knowledge, and secure transaction protocols that protect both parties throughout the engagement.

Our process begins with your inquiry, whether submitted online through our evaluation forms or conducted in person at our South Florida location. For watches, our evaluation considers manufacturer, model, reference number, condition, completeness of original packaging and documentation, service history, and current market demand. This comprehensive approach ensures accurate valuations that reflect true market conditions rather than arbitrary pricing.

Jewelry evaluations follow similarly rigorous protocols. When you sell my Cartier jewelry or other designer pieces, our gemologists and jewelry experts assess precious metal content and purity, gemstone quality including cut, color, clarity, and carat weight for diamonds, brand authenticity and provenance, condition and any necessary repairs, and current market demand for specific designers and styles. This thoroughness protects your interests while ensuring fair, market-based pricing.

Learn more about how our process works to understand each step from initial inquiry through final payment. Our transparent approach eliminates uncertainty and ensures you maintain control throughout the transaction timeline.

Designer Jewelry: Maximizing Value Through Brand Expertise

Luxury jewelry from prestigious design houses commands premium valuations when evaluated by experts who understand brand heritage and market dynamics. If you're positioned to sell Tiffany rings, sell Cartier rings, or sell Van Cleef & Arpels rings, working with specialized buyers ensures you capture the full brand premium beyond simple precious metal and gemstone values. Specific collections like Tiffany Paper Flowers, Chopard Happy Hearts, Roberto Coin Venetian Princess, and Chopard Happy Diamonds carry distinct market positions that inform accurate valuations.

The secondary market for designer jewelry demonstrates particular strength in certain categories. Tiffany Keys pieces, Tiffany Else Peretti designs, and Roberto Coin Animalier collections maintain devoted followings that support robust resale values. Similarly, items like David Yurman Albion ring pieces and Roberto Coin Classica Parisienne jewelry benefit from enduring design aesthetics that transcend temporary fashion trends.

Our expertise extends to evaluating complete collections or individual pieces. Whether you need to sell Cartier earrings, sell Bvlgari earrings, sell Chopard earrings, or sell David Yurman earrings, our evaluation process accounts for matching sets, original packaging, certificates of authenticity, and current market demand. This comprehensive approach ensures accurate valuations that reflect all value factors.

For necklaces and pendants, similar principles apply. Those looking to sell Cartier necklace pieces, sell Bvlgari necklaces, sell Tiffany necklace items, or sell Van Cleef & Arpels necklaces benefit from our understanding of how length, clasp types, pendant designs, and gemstone settings affect market valuations across different designer collections.

Specialized Timepiece Categories: From Sport Models to Complications

The luxury watch market encompasses diverse categories, each with distinct characteristics affecting market value and collectibility. Sport models like the Rolex Submariner have achieved iconic status, with vintage and contemporary examples commanding strong prices. If you're exploring options to sell Rolex Submariner Boca Raton locations or considering whether to sell Rolex Submariner Miami, understanding how factors like production year, dial variations, bracelet types, and service history affect valuation proves essential.

Beyond Submariners, other sport models maintain devoted collector followings. Those positioned to sell Rolex GMT Master pieces, sell Rolex Sea Dweller watches, or sell Rolex Milgauss buyer targeted models can expect robust interest from collectors seeking these specialized tool watches. Similarly, if you're looking to sell Panerai Radiomir watches or considering options to sell my Panerai watch, these distinctive Italian-designed timepieces maintain strong market positions.

Complicated watches represent another distinct category. Pieces with perpetual calendars, chronographs, world time functions, or tourbillons command premium valuations reflecting their mechanical sophistication. If you're contemplating whether to sell Patek Philippe Perpetual Calendar models or exploring options to sell Jaeger LeCoultre complicated pieces, professional evaluation ensures you understand the premium these features command in current markets.

Our expertise extends to evaluating timepieces from manufacturers including those looking to sell my A Lange Sohne watch, sell my Blancpain watch, sell my Breguet watch, sell my Zenith watch, sell my Ulysse Nardin watch, and sell Vacheron Constantin watch pieces. Each manufacturer brings distinct heritage, technical innovation, and market positioning that informs accurate valuation.

Estate Jewelry and Inherited Pieces: Transforming Sentiment into Strategy

Estate jewelry represents a unique category within luxury asset liquidation, often carrying emotional significance alongside financial value. Many individuals inherit jewelry collections from parents or grandparents, creating portfolios of pieces that may not align with personal style preferences while representing substantial financial value. December's final days offer an opportune moment to evaluate these inherited assets through the lens of year-end tax strategy while honoring family legacy through intelligent financial stewardship.

When considering whether to sell grandmothers estate jewelry online or liquidate other inherited pieces, understanding current market conditions proves essential. Vintage and antique jewelry often carries value beyond simple precious metal and gemstone content, with period-specific designs, craftsmanship techniques, and provenance affecting overall valuations. Our expertise in evaluating estate jewelry Orlando and throughout Florida ensures you receive accurate assessments that account for all value factors.

The decision to liquidate inherited jewelry frequently involves balancing practical financial considerations with emotional attachments. Our approach respects both dimensions, providing transparent information that empowers informed decision-making without pressure or urgency beyond your own timeline requirements. For those facing year-end tax deadlines, we streamline processes to accommodate necessary timeframes while maintaining thorough evaluation standards.

Our comprehensive jewelry evaluation services provide the foundation for intelligent decisions regarding inherited collections. Whether pieces ultimately sell individually or as complete collections, understanding accurate market valuations ensures you maximize returns while honoring the legacy these pieces represent.

Completing Strategic Transactions: Timeline Considerations for December

Successfully executing year-end luxury asset liquidation requires understanding realistic timelines for each transaction phase. While professional buyers can complete evaluations and extend offers relatively quickly, sellers should account for shipping times for remote transactions, evaluation periods including authentication and appraisal, offer review and acceptance processes, and payment processing and fund transfers. Beginning this process immediately in mid-December provides necessary buffer time to ensure completion before December 31st deadlines.

For those in South Florida, in-person transactions at our location offer the fastest path to completion. You can visit our facility, receive immediate professional evaluation, review offers in real-time, and complete transactions with same-day payment when appropriate. This efficiency proves particularly valuable during December's final weeks when timing constraints make every day significant.

Remote sellers should initiate contact immediately to discuss shipping protocols, insurance requirements, and expected timelines. Our team provides detailed guidance on secure packaging, recommended shipping methods with appropriate insurance coverage, tracking protocols to monitor shipment progress, and expected evaluation timeframes upon receipt. This transparency ensures you maintain realistic expectations throughout the process.

Understanding what you're looking to sell helps us expedite evaluation processes by preparing necessary tools, reference materials, and market comparisons in advance of receiving your items. This preparation reduces evaluation time and accelerates the overall transaction timeline.

Beyond December: Building Long-Term Relationships with Trusted Buyers

While December's year-end deadline creates immediate urgency, establishing relationships with trusted luxury buyers offers ongoing value extending far beyond any single transaction. As your collection evolves, market conditions fluctuate, and personal circumstances change, having established contacts with professional buyers simplifies future transactions while ensuring consistent, fair treatment based on ongoing market expertise.

Our commitment extends beyond individual purchases to building lasting relationships with clients throughout Florida and nationwide. Whether you're a collector periodically refining your holdings, an estate executor managing inherited assets, or an individual navigating life transitions requiring asset liquidation, our consistent presence and expertise provide reliable resources for whatever circumstances arise.

The luxury market continues evolving, with specific models, designers, and categories experiencing fluctuating demand cycles. Maintaining awareness of these market dynamics helps inform intelligent decisions about when to hold certain pieces and when liquidation timing proves optimal. Our ongoing market insights, shared through direct consultation and content resources, help clients navigate these decisions with confidence.

For those interested in exploring both buying and selling opportunities within the luxury market, our parent company Gray & Sons offers extensive inventory of certified pre-owned watches and jewelry, providing a comprehensive luxury marketplace experience.

Taking Action: Your Next Steps for December Liquidation

Time sensitivity makes immediate action essential for those seeking to complete luxury asset liquidation before year-end deadlines. Whether you're positioned to sell luxury watch pieces, diamond jewelry, sterling silver, or comprehensive collections, beginning the process now ensures adequate time for professional evaluation, offer review, and transaction completion before December 31st.

The straightforward path forward begins with contacting our team through your preferred communication channel. Online submission forms provide convenient 24/7 access for initial inquiries, while direct phone contact enables immediate conversation with knowledgeable team members. For South Florida residents, scheduling in-person appointments at our location offers the fastest path to completed transactions.

When initiating contact, having basic information readily available streamlines preliminary discussions. For watches, this includes manufacturer and model identification, approximate purchase date or age, condition assessment including functionality, and completeness of original packaging and documentation. For jewelry, relevant details include designer or manufacturer if applicable, precious metal type and any hallmarks, gemstone types and approximate sizes, and overall condition including any damage.

Our expertise as a luxury jewelry and watch buyer means we handle diverse assets within single transactions, simplifying portfolio liquidation when multiple categories require liquidation simultaneously. This comprehensive capability proves particularly valuable for estate executors or individuals downsizing substantial collections during compressed timeframes.

Secure Your 2025 Tax Advantages Today

December's remaining days represent your final opportunity to strategically leverage luxury asset liquidation for 2025 tax optimization. Whether you're seeking to offset capital gains, rebalance investment portfolios, establish charitable contributions, or simply convert dormant assets into working capital, professional evaluation and efficient transaction processing make these objectives achievable even with limited remaining time.

Don't let this critical window close without exploring your options. Contact our team today to begin the evaluation process for your luxury watches, jewelry, diamonds, or sterling silver. Our decades of expertise, transparent processes, and commitment to competitive valuations ensure you maximize returns while meeting year-end deadlines.

Start your evaluation now:

- Get your watch valued - Expert evaluations on all luxury watch brands

- Request a jewelry quote - Comprehensive assessments for all designer pieces

- Discover your diamond's worth - GIA-certified diamond evaluations

- Learn about sterling silver values - Professional precious metal assessments

Visit our Surfside showroom across from Bal Harbour Shops, or let us come to you through our secure nationwide shipping program. Time is precious—let's make these final December days count toward your financial optimization goals. Learn more about us and discover why sellers throughout Florida and across the nation trust Sell Us Your Jewelry for their luxury asset liquidation needs.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG