February 10th, 2026

Downsizing with Dignity: Your Complete Guide to Evaluating and Selling Inherited Sterling Silver Flatware During Retirement Transitions

Retirement transitions often bring moments of reflection and the need to simplify our living spaces. Among the treasured possessions many retirees inherit or have collected over decades, inherited sterling silver flatware holds a special place—both sentimentally and financially. Whether you've inherited your grandmother's Gorham service or possess a complete Reed & Barton collection, understanding how to sell sterling silver flatware with dignity and confidence can transform these cherished pieces into financial resources for your next chapter.

The decision to part with family heirlooms during retirement downsizing requires both emotional consideration and practical knowledge. Many retirees find themselves custodians of beautiful estate silver that no longer fits their simplified lifestyle, yet they want to ensure these pieces find appropriate homes while receiving fair market value. This comprehensive guide will walk you through evaluating your estate silver, identifying quality makers like Georg Jensen, and connecting with reputable buyers who understand the true value of your inherited treasures.

Understanding the Value of Your Inherited Sterling Silver Flatware

Sterling silver flatware represents more than mere utensils—these pieces embody craftsmanship, history, and often significant precious metal content. Authentic sterling silver contains 92.5% pure silver, with most pieces bearing hallmarks that verify their authenticity and maker. The value of your inherited collection depends on several factors: the manufacturer's reputation, pattern rarity, condition, completeness of the set, and current silver market prices. Renowned makers such as Gorham flatware, Reed & Barton, Georg Jensen, Towle, and International Silver command premium prices due to their exceptional quality and design heritage.

Beyond the intrinsic silver content, collectors and buyers seek complete or near-complete sets, particularly in popular patterns like Reed & Barton's "Francis I" or Georg Jensen's iconic "Acorn" design. Even incomplete sets or individual pieces hold value, especially serving pieces, which often contain more silver. Understanding these value factors empowers you to approach potential buyers with realistic expectations and confidence in your collection's worth.

When you're ready to receive a professional evaluation, working with an established sterling silver buyer ensures you'll receive accurate market-based pricing. Reputable buyers examine not only the weight and purity of your silver but also consider the collectible value of specific patterns and manufacturers.

Identifying Quality Markers and Manufacturer Hallmarks

Before approaching buyers, take time to examine your flatware carefully for identifying marks. Most quality sterling silver pieces feature hallmarks on the back of each utensil, typically including the word "STERLING," the manufacturer's name or logo, and sometimes a pattern name or number. These marks authenticate the silver content and help determine the piece's origin and age. American manufacturers like Gorham, Reed & Barton, and Wallace typically stamp clear hallmarks, while European makers like Georg Jensen use distinctive maker's marks alongside fineness stamps.

The condition of these hallmarks matters significantly during evaluation. Well-preserved marks indicate less wear and potentially higher value. Additionally, examine your flatware for monograms, which were common on inherited pieces. While monograms can slightly reduce value in some cases, many buyers understand their historical significance and won't dramatically decrease their offer. The overall condition—including the depth of pattern detail, presence of scratches, and any repairs—also influences final valuation.

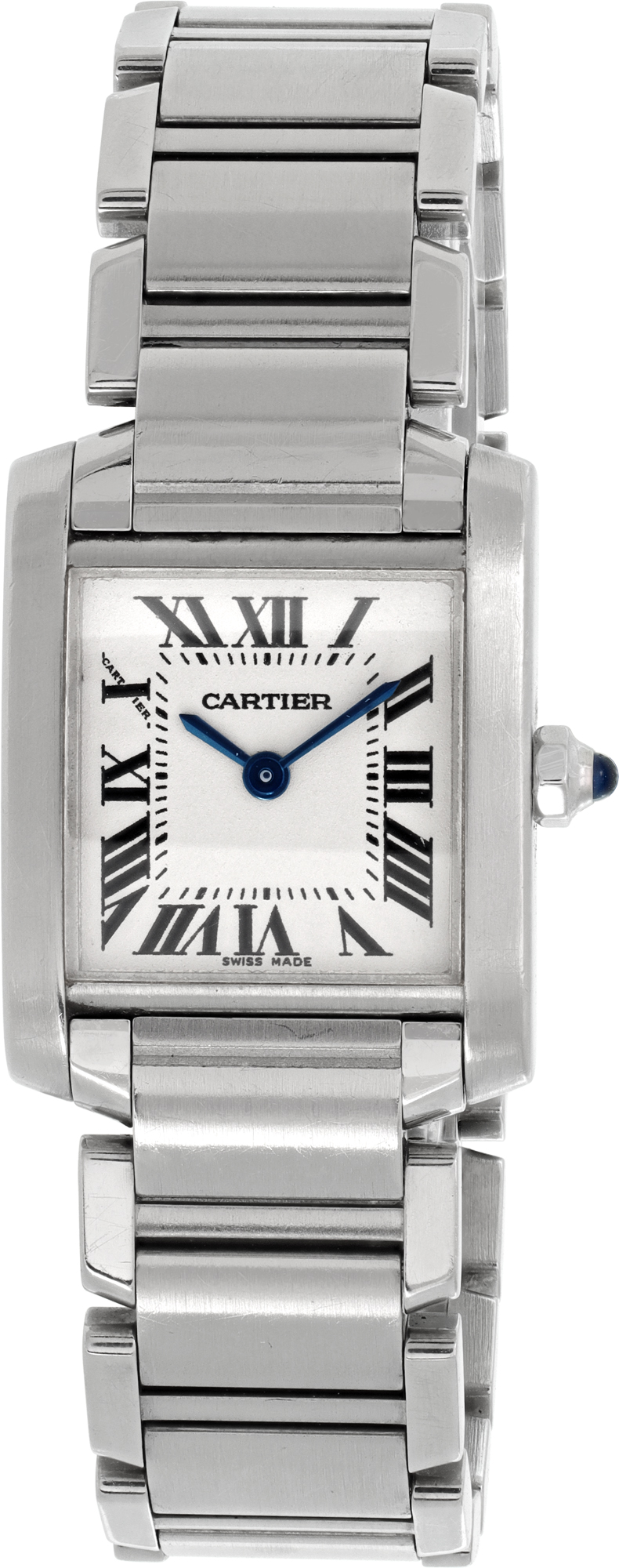

If you've inherited other luxury items alongside your silver flatware, such as fine timepieces or jewelry, you might also consider exploring opportunities to sell your watch or sell your jewelry during this transition period. Many retirees find consolidating their valuables into more liquid assets simplifies estate planning and provides financial flexibility.

The Emotional Journey of Letting Go During Downsizing

Parting with inherited sterling silver flatware involves more than a financial transaction—it's an emotional journey that deserves recognition and respect. These pieces often carry memories of family gatherings, holiday dinners, and the relatives who once treasured them. Acknowledging these feelings is an important part of downsizing with dignity. Many retirees find comfort in documenting their silver's history through photographs or written memories before selling, creating a lasting record that preserves the emotional connection even after the physical items have moved on.

Consider that selling inherited silver doesn't diminish the love or respect you hold for those who passed these treasures to you. Instead, it represents a practical decision that honors both your current needs and the inherent value your relatives invested in quality pieces. By ensuring these items reach appreciative buyers or collectors, you're giving them renewed purpose rather than letting them remain unused in storage. This perspective can transform the selling process from one of loss to one of purposeful transition.

Many individuals going through retirement transitions also discover they have other valuable items that no longer serve their simplified lifestyle. Whether you're considering selling Cartier jewelry pieces, looking to sell Tiffany & Co. jewelry that's been stored away, or evaluating inherited timepieces, working with experienced buyers who understand both the financial and emotional aspects of these transactions makes the process more comfortable and dignified.

Preparing Your Sterling Silver for Professional Evaluation

Proper preparation enhances both the presentation and evaluation of your sterling silver flatware. Begin by conducting a thorough inventory, counting each type of piece (dinner forks, salad forks, soup spoons, etc.) and noting any serving pieces. Create a simple list or spreadsheet that documents quantities and identifies any damaged or heavily worn items. This organization demonstrates care and helps buyers provide more accurate preliminary estimates.

Gentle cleaning can improve appearance without risking damage. Use warm water with mild dish soap and a soft cloth, avoiding abrasive cleaners or harsh scrubbing that might remove hallmarks or pattern details. For heavily tarnished pieces, consider whether professional cleaning is worth the investment—reputable sterling silver buyers typically evaluate pieces based on their silver content and pattern regardless of tarnish, as they have professional cleaning capabilities. Never use silver dips or harsh chemicals that might damage valuable pieces.

Once your inventory is complete and pieces are presentably clean, photograph your collection. Clear images of hallmarks, complete sets, and any unique or ornate serving pieces provide valuable documentation. These photos also help you obtain preliminary online estimates from buyers like Sell Us Your Jewelry, who specialize in purchasing estate silver, luxury jewelry, and fine timepieces. Having visual records ensures you can confidently discuss your collection with multiple buyers if desired.

Choosing a Reputable Sterling Silver Buyer

Selecting the right buyer represents one of the most crucial decisions in your selling journey. Reputable sterling silver buyers distinguish themselves through transparency, fair pricing based on current market conditions, and respectful treatment of sellers and their inherited treasures. Look for established businesses with verifiable credentials, positive reviews from previous sellers, and clear explanations of their evaluation and payment processes. Companies that have served the luxury market for decades, like Sell Us Your Jewelry—the purchasing division of Gray & Sons, established in 1980—bring expertise and trustworthiness to every transaction.

Avoid buyers who pressure you into immediate decisions or offer prices that seem disconnected from current silver market values. Legitimate buyers welcome questions about their evaluation methods and provide detailed explanations of how they calculated their offers. They should clearly distinguish between pricing based on silver content (melt value) versus collectible value for sought-after patterns and complete sets. The best buyers consider both factors to ensure you receive maximum value for your inherited pieces.

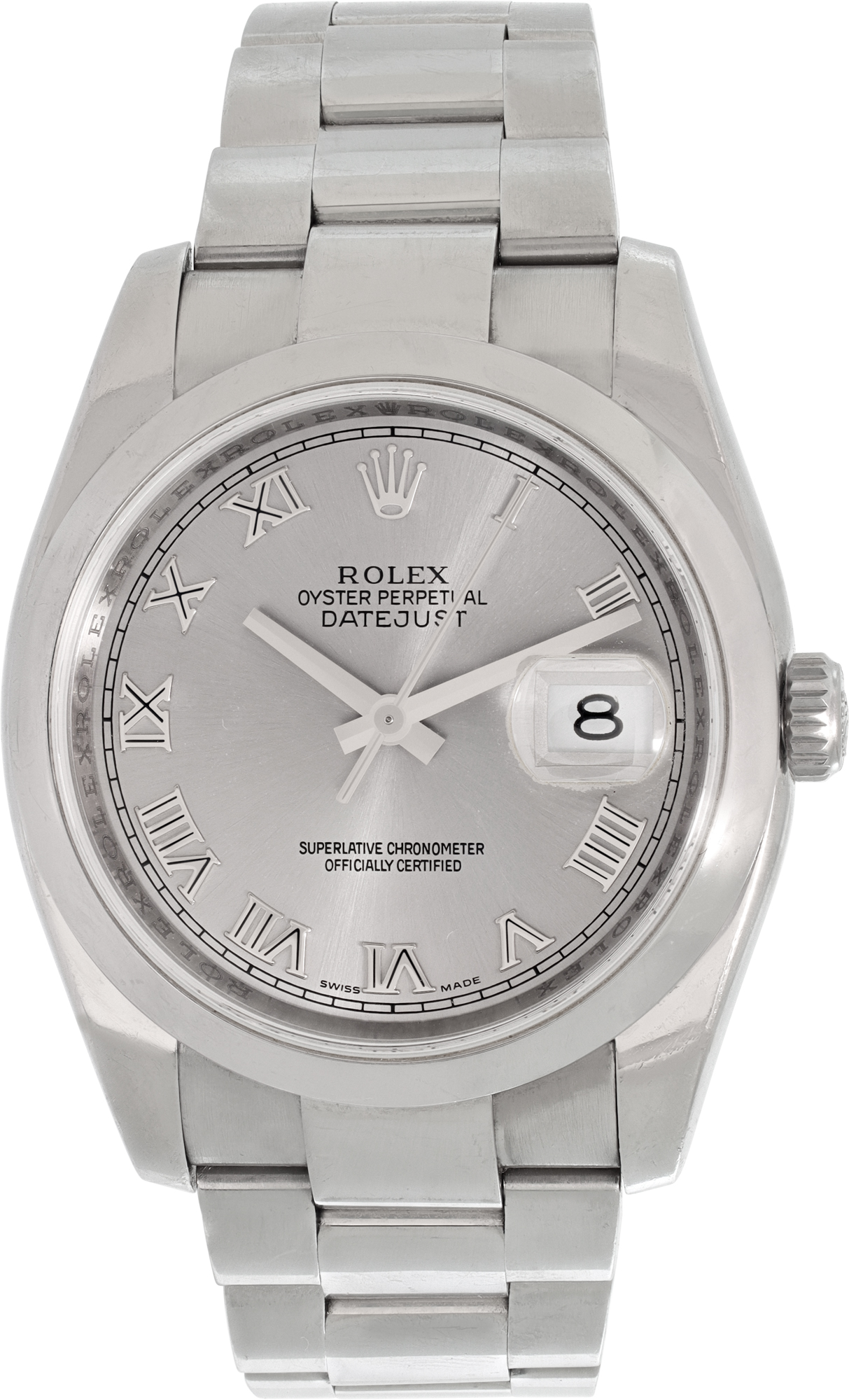

If you're also considering selling other luxury items during your downsizing process, working with a comprehensive buyer who handles multiple categories simplifies the experience. Whether you need to sell sterling silverware, fine jewelry from designers like Bvlgari or Van Cleef & Arpels, or luxury watches including Rolex, Omega, or Patek Philippe timepieces, choosing a jewelry buyer with broad expertise ensures consistent, professional service across all your valuables.

Understanding Market Value: Silver Content vs. Collectible Worth

Sterling silver flatware value encompasses two distinct components: intrinsic silver content and collectible premium. The silver content value, often called "melt value," reflects the current spot price of silver multiplied by the total weight of pure silver in your pieces. This baseline value fluctuates with precious metals markets and represents the minimum amount quality buyers should offer. However, this calculation alone significantly undervalues many inherited flatware collections, particularly those from prestigious manufacturers or in sought-after patterns.

Collectible value recognizes that certain patterns, manufacturers, and complete sets command premiums far exceeding their melt value. Georg Jensen pieces, especially in iconic patterns like "Acorn" or "Blossom," attract serious collectors worldwide. Similarly, complete services for twelve in popular Reed & Barton patterns like "Francis I" or Gorham's "Chantilly" carry substantial collectible premiums. Rare serving pieces—including fish servers, asparagus tongs, or punch ladles—often hold particular appeal to collectors completing their sets and may be valued significantly above their silver content.

Experienced buyers who serve both the silver market and collector community can identify when your pieces warrant collectible premiums. When you sell sterling silver flatware through established channels, you benefit from their connections to both markets, ensuring you receive the highest possible value whether your pieces appeal to refiners or collectors.

The Selling Process: What to Expect Step by Step

Understanding the selling process alleviates anxiety and helps you approach the transaction with confidence. Most reputable buyers offer multiple avenues for evaluation: in-person appointments, mail-in services with insured shipping, or preliminary online assessments based on photographs and descriptions. For local sellers in South Florida, visiting the Surfside showroom across from Bal Harbour Shops provides the opportunity to meet experts face-to-face and receive immediate evaluations. For sellers throughout the United States, secure mail-in options with full insurance protection offer convenience without sacrificing security.

The evaluation process typically begins with verification of authenticity through hallmark examination and, if necessary, metal testing. Buyers then weigh your pieces, assess condition and completeness, and research current market values for your specific patterns and manufacturers. Reputable buyers provide detailed explanations of their offers, breaking down silver content value and any collectible premiums. You should never feel rushed into accepting an offer—legitimate buyers allow time for consideration and welcome questions about their evaluation methods.

Upon acceptance, payment processes vary by buyer but should always be secure and well-documented. Options typically include immediate payment for direct purchases, bank transfers, or checks with appropriate verification. Some buyers also offer consignment services for particularly valuable or rare sets, potentially yielding higher returns by connecting your pieces with serious collectors. Understanding these options helps you choose the approach that best aligns with your financial needs and timeline.

Beyond Flatware: Selling Complete Sterling Silver Services

Many inherited collections extend beyond flatware to include complementary sterling silver pieces that enhance overall value. Sterling silver tea sets, serving trays, candlesticks, bowls, and decorative items often accompany flatware inheritances, representing substantial additional value. These pieces typically contain more silver than individual flatware items and may carry significant collectible premiums, especially when they share manufacturers or aesthetic styles with your flatware patterns. Complete services that include both dining pieces and serving accessories present attractive options for serious collectors and can command premium pricing.

When preparing to sell comprehensive sterling silver collections, treat each category with the same careful documentation and evaluation you apply to flatware. Photograph tea sets from multiple angles, showing hallmarks and any decorative details. Measure and document serving trays, noting any monograms or damage. For candlesticks and decorative pieces, verify matching pairs and assess condition. This thoroughness ensures buyers can provide accurate preliminary valuations and demonstrates your commitment to transparent transactions.

If your inheritance includes luxury items beyond silver—perhaps fine jewelry from Cartier, Tiffany & Co., or Chopard, or collectible timepieces—working with a comprehensive luxury jewelry and watch buyer streamlines the downsizing process. Many retirees appreciate the efficiency of evaluating all their valuable items through a single trusted source rather than navigating multiple specialized buyers.

Tax Considerations and Estate Planning Implications

Selling inherited sterling silver flatware during retirement transitions may carry tax implications that warrant professional guidance. In many cases, inherited items receive a "stepped-up basis" equal to their fair market value at the time of inheritance, potentially minimizing capital gains tax liability when sold. However, individual circumstances vary based on inheritance timing, total estate value, and your overall financial situation. Consulting with a tax professional or estate planner ensures you understand any potential tax consequences before completing sales transactions.

Documentation becomes particularly important for tax purposes. Maintain records of your inheritance, including estate documents that establish the property's transfer to you. Save all evaluation reports, correspondence with buyers, and final sale documentation. These records support accurate tax reporting and provide necessary documentation should questions arise. If you're selling substantial collections or multiple inherited items, professional tax guidance becomes even more valuable in optimizing your financial outcomes and ensuring compliance with reporting requirements.

Estate planning considerations extend beyond immediate tax implications. For retirees simplifying their estates, converting physical assets like sterling silver into more easily divisible financial assets can simplify future distribution to heirs. This strategic approach reduces the burden on executors and minimizes potential family disagreements over physical property division. Discussing these considerations with estate planning professionals ensures your downsizing decisions align with broader financial and family goals.

Alternatives to Selling: When Keeping Makes Sense

While this guide focuses on selling inherited sterling silver flatware, some circumstances warrant consideration of alternatives. If certain pieces hold profound emotional significance, you might choose to retain select items while selling the remainder. Many retirees keep a single place setting or a few meaningful serving pieces, displaying them as decorative items rather than functional flatware. This compromise honors both practical downsizing needs and emotional connections to family history.

Consider whether family members might treasure specific pieces from the collection. Before approaching buyers, offer children, grandchildren, nieces, or nephews the opportunity to select meaningful items. This generous approach preserves family heritage while still allowing you to sell remaining pieces. Document these family gifts appropriately, and ensure recipients understand both the monetary and sentimental value of their selections. Such thoughtful distribution often brings more satisfaction than selling complete collections.

If you're uncertain about selling but need to simplify physical storage, professional storage solutions might provide temporary relief while you finalize decisions. However, recognize that storage costs accumulate over time, potentially reducing the net value you ultimately receive from sales. For most retirees committed to downsizing, proceeding with sales through reputable buyers like those who specialize in sterling silver and estate jewelry proves more practical than indefinite postponement.

Making the Most of Your Retirement Transition

Downsizing inherited sterling silver flatware represents just one aspect of broader retirement transitions. This period offers opportunities to thoughtfully evaluate all your possessions, retaining items that serve your current lifestyle while converting others into resources for your next chapter. Whether you're relocating to smaller quarters, simplifying maintenance demands, or optimizing your financial position, approaching these decisions with dignity and intentionality ensures positive outcomes that support your retirement goals.

Many retirees discover unexpected value in comprehensive evaluations of their luxury items. That vintage Rolex watch you inherited might command significant value in today's market, just as your Tiffany jewelry or diamond engagement rings could provide financial resources for travel, hobbies, or family gifts. Taking inventory of all valuable possessions—not just silver flatware—often reveals opportunities to enhance financial security while simplifying your living environment.

The key to successful downsizing lies in working with trustworthy professionals who understand both the financial value of your items and the emotional significance of these transitions. Whether you're evaluating options to sell your sterling silver, considering whether to sell diamonds, or exploring the value of inherited timepieces, choosing experienced buyers with decades of reputation ensures you receive fair treatment and maximum value for your treasured possessions.

Your Next Steps: Taking Action with Confidence

Armed with comprehensive knowledge about evaluating and selling inherited sterling silver flatware, you're prepared to take the next steps in your retirement transition journey. Begin by completing your inventory and documenting your pieces through clear photographs. Research current silver prices to understand baseline values, and identify your flatware patterns and manufacturers for potential collectible premiums. This preparation positions you to engage confidently with buyers and ask informed questions about their evaluation processes.

When you're ready to proceed, reach out to established buyers with proven track records in the luxury market. Request preliminary evaluations based on your documentation, and don't hesitate to ask detailed questions about how offers are calculated. Remember that reputable buyers welcome inquiries and provide transparent explanations—if you encounter resistance or pressure tactics, consider that a warning sign to seek alternative buyers.

For comprehensive service covering all your luxury items—from sterling silver flatware and tea sets to fine jewelry from designers like Bvlgari, Cartier, Van Cleef & Arpels, and David Yurman, plus luxury timepieces including Rolex, Patek Philippe, Omega, Audemars Piguet, and more—Sell Us Your Jewelry offers expertise backed by over four decades of experience through Gray & Sons. Our team understands the emotional and financial significance of inherited treasures and provides respectful, professional service to sellers throughout the United States.

Start Your Evaluation Today

Downsizing with dignity means approaching the sale of your inherited sterling silver flatware with both practical knowledge and emotional awareness. By understanding value factors, choosing reputable buyers, and proceeding at your own pace, you can transform cherished heirlooms into financial resources that support your retirement goals. The sterling silver that served your family for generations continues to hold value—ensuring you receive fair compensation honors both the craftsmanship of these pieces and the loved ones who treasured them before you.

Ready to discover the true value of your inherited sterling silver flatware? Get a quote for your sterling silver today and experience a transparent evaluation process designed to respect both you and your treasured pieces. Whether you're in South Florida and can visit our Surfside showroom or prefer the convenience of our secure mail-in service, our team is ready to provide the professional expertise and compassionate service you deserve during this important transition.

If you're also considering selling other valuable items during your downsizing journey—from luxury watches to fine jewelry or GIA-certified diamonds—explore our comprehensive buying services to learn how we can help you convert multiple treasured possessions into financial resources with a single trusted partner. Your retirement transition deserves dignity, respect, and professional expertise—and we're here to provide all three.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG