October 30th, 2025

Fall Portfolio Moves: Strategic September Gold Coin Sales

As autumn approaches, many savvy investors are reconsidering their precious metals holdings, making September an opportune time to sell gold coins and precious metals. The fall season traditionally brings portfolio rebalancing opportunities, particularly for those looking to capitalize on favorable market conditions. Whether you're holding American Eagle gold coins, vintage Liberty Head pieces, or inherited precious metals, understanding the current landscape can help you make informed decisions about gold coin liquidation.

The precious metals market in September often experiences unique dynamics as investors prepare for the final quarter of the year. With economic uncertainty and inflation concerns continuing to influence investment strategies, many are choosing to diversify their holdings or convert physical gold into liquid assets. For those searching for reliable gold buyers near me, this seasonal shift presents an excellent opportunity to work with established dealers who understand both market timing and fair valuation practices.

Understanding September Gold Market Dynamics

September gold prices often reflect broader economic trends as institutional investors adjust their portfolios before year-end reporting. This period can create favorable selling conditions for individual holders of gold coins and precious metals. Market volatility during this time may present windows of opportunity for those considering liquidation, particularly when working with experienced buyers who can provide real-time market assessments.

The timing of fall precious metals sales often coincides with increased demand from dealers building inventory for the holiday season and year-end investment strategies. This increased demand can translate to more competitive offers for sellers, especially those with well-documented pieces like certified American Eagle coins or graded historical gold pieces. Understanding these market rhythms can significantly impact the value received from your precious metals portfolio.

When evaluating the best time to sell gold, consider that September often marks a transitional period where summer market lulls give way to increased activity. Professional buyers during this period are typically more aggressive in their purchasing, as they prepare for the traditionally active fourth quarter precious metals market.

Strategic Portfolio Rebalancing with Precious Metals

Many sophisticated investors use September as a strategic checkpoint for portfolio rebalancing, particularly when precious metals represent a significant portion of their holdings. The decision to liquidate gold coins often stems from a desire to diversify into other asset classes or to take advantage of gains accumulated over years of ownership. This rebalancing approach allows investors to maintain exposure to various market sectors while optimizing their overall portfolio performance.

Estate jewelry and inherited precious metals often become part of these fall portfolio moves, as beneficiaries seek to convert family assets into more liquid investments. The combination of estate jewelry evaluation and precious metals assessment provides a comprehensive approach to portfolio optimization. Professional buyers who understand both markets can offer valuable insights into timing and valuation strategies.

For collectors looking to sell my rolex or other luxury timepieces alongside precious metals, September's market dynamics often favor comprehensive portfolio liquidation strategies. The interconnected nature of luxury goods markets means that precious metals prices can influence decisions about high-end watches and jewelry sales.

Gold Coin Types and Liquidation Strategies

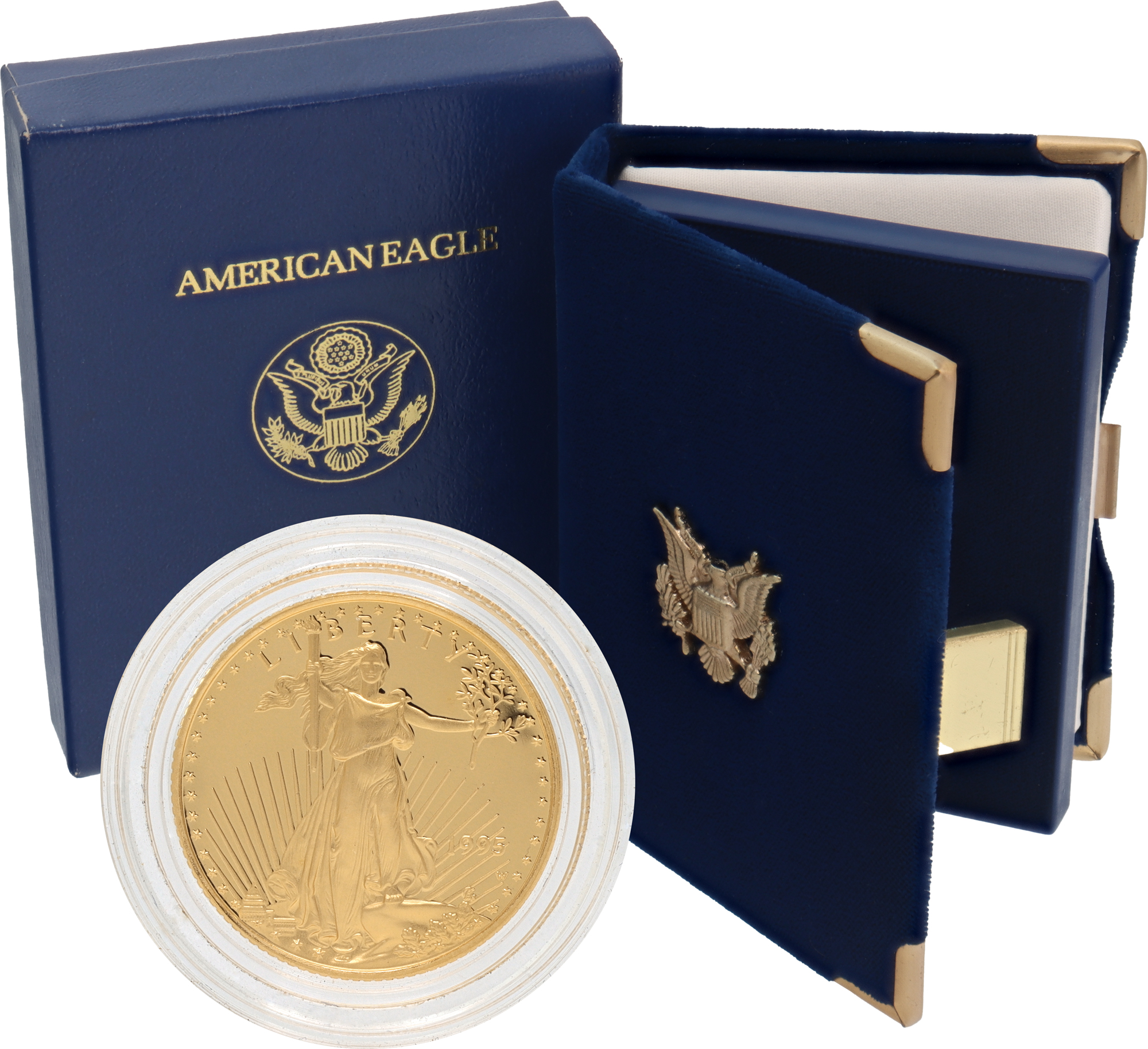

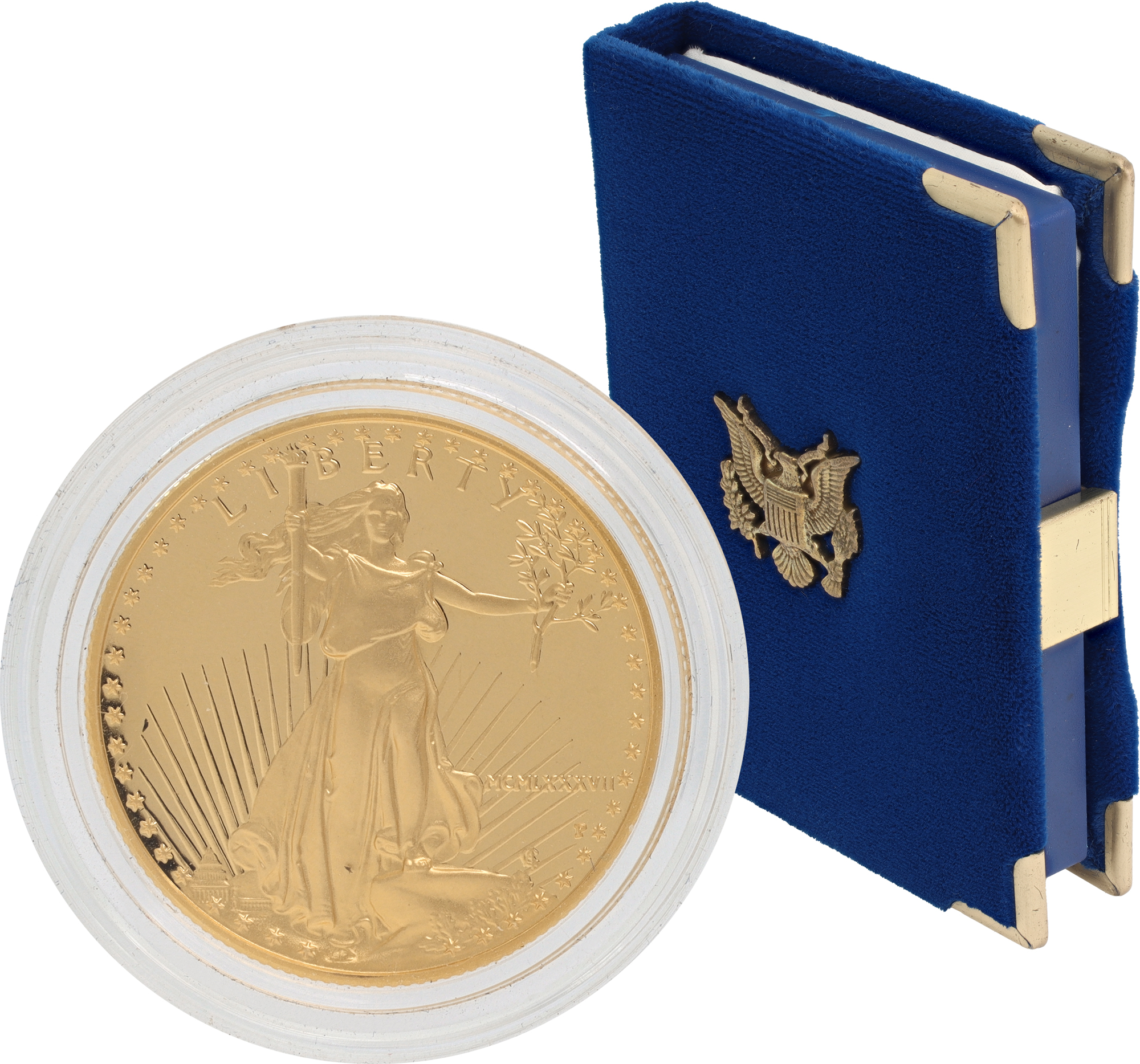

American Eagle gold coins represent one of the most liquid segments of the precious metals market, with their government backing and standardized weights making them highly desirable to buyers. When considering gold coin liquidation, these modern bullion pieces often command premiums over spot gold prices due to their recognized authenticity and consistent quality. The original packaging and documentation, such as certificates of authenticity, can significantly enhance their resale value.

Historical gold coins, including Liberty Head and St. Gaudens pieces, require specialized evaluation due to their numismatic value beyond precious metal content. These vintage pieces often attract both precious metals investors and coin collectors, potentially creating competitive bidding situations that benefit sellers. Professional grading by services like PCGS or NGC can substantially impact the final sale price of these historical pieces.

Fractional gold coins, such as 1/4 oz and 1/2 oz pieces, offer flexibility for partial portfolio liquidation while maintaining some precious metals exposure. This approach allows investors to take profits on portions of their holdings while preserving others for potential future appreciation. The strategy is particularly effective when working with buyers who understand the nuanced market for various gold coin denominations.

Comprehensive Luxury Asset Evaluation

Beyond gold coins, many sellers discover that September's favorable market conditions extend to other luxury assets in their portfolios. Diamond jewelry, particularly pieces with GIA certification, often experiences strong demand during this period as dealers prepare for holiday inventory needs. The combination of precious metals and diamond engagement rings evaluation can provide comprehensive portfolio liquidation strategies.

Swiss luxury watches, including prestigious brands like Patek Philippe and Rolex, often complement precious metals in sophisticated investment portfolios. Those looking to sell patek philippe watch pieces or sell rolex submariner models find that professional buyers experienced in both markets can provide valuable cross-category insights. This expertise is particularly beneficial when timing sales across different luxury asset classes.

The integration of sterling silver flatware and jewelry evaluation alongside precious metals assessment provides a holistic approach to luxury asset liquidation. Many families discover significant value in inherited silver pieces that complement their gold holdings, creating opportunities for comprehensive estate liquidation strategies.

Professional Evaluation and Market Timing

Working with established luxury buyers who understand precious metals market timing can significantly impact the success of September selling strategies. Professional evaluation services that combine expertise in gold coins, precious metals, and luxury goods provide comprehensive assessments that individual sellers might miss. This expertise becomes particularly valuable when dealing with mixed portfolios containing various asset types.

The evaluation process for gold coins involves multiple factors beyond simple weight and purity calculations. Market premiums, historical significance, condition grades, and documentation all contribute to final valuations. Professional buyers with decades of experience can quickly assess these variables and provide accurate market-based pricing that reflects current demand conditions.

For South Florida residents, local expertise in precious metals markets provides additional advantages, particularly when dealing with boca raton rolex buyer or miami patek philippe buyer services that understand regional market conditions. This local knowledge can be especially valuable for timing sales to maximize returns in the current market environment.

Maximizing Returns Through Professional Channels

The decision to sell gold or liquidate precious metals portfolios requires careful consideration of market timing, professional evaluation, and buyer selection. September's unique market dynamics create opportunities for those prepared to work with established professionals who understand both precious metals and luxury goods markets. The combination of favorable timing and expert evaluation can significantly impact the final returns from portfolio liquidation strategies.

Professional buyers who specialize in gold coins and precious metals offer several advantages over general dealers or online platforms. Their deep market knowledge, established networks, and ability to assess numismatic value alongside precious metal content ensures that sellers receive fair market valuations. Additionally, their expertise in related luxury goods markets provides opportunities for comprehensive portfolio evaluation.

The fall portfolio rebalancing season presents an ideal opportunity to reassess precious metals holdings and make strategic decisions about liquidation. Whether motivated by investment diversification, estate settlement, or simple profit-taking, September's market conditions often favor sellers who work with knowledgeable professionals capable of maximizing returns across various luxury asset categories.

Ready to explore your precious metals selling options this September? Our expert team specializes in gold coin evaluation, precious metals assessment, and comprehensive luxury asset liquidation. Get a professional quote for your gold coins or explore our complete range of buying services to discover how we can help maximize returns from your precious metals portfolio. Whether you're holding American Eagles, vintage gold coins, or inherited precious metals, our experienced professionals provide the market expertise and fair valuations you need for successful fall portfolio moves.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG