February 20th, 2026

Fresh Start, Fresh Portfolio: Why Late January 2026 Creates Optimal Conditions for Rolex and Omega Collectors to Refine Their Collections

As we settle into late January 2026, collectors of luxury timepieces find themselves at a unique moment—the new year energy remains fresh, yet enough time has passed to thoughtfully evaluate collections with clear perspective. For those considering whether to sell Rolex watch pieces or sell Omega watch models from their portfolios, this transitional period offers distinct advantages that savvy collectors are already capitalizing on. The combination of post-holiday clarity, evolving market dynamics, and renewed financial planning makes this an ideal window for refining your collection.

The luxury watch market has entered 2026 with notable momentum, particularly as collectors shift their focus from holiday acquisition to strategic portfolio management. Whether you're a seasoned collector downsizing your holdings or someone who inherited timepieces you'd like to convert to liquid assets, understanding why this specific timing matters can help you maximize value while simplifying the selling process. The conditions align perfectly for those ready to work with an established luxury watch buyer who understands current market dynamics.

The Post-Holiday Collection Assessment Window

The weeks following the holiday season create an opportune moment for honest collection evaluation. With gift-giving behind us and new timepieces potentially added to collections, many collectors discover they own more watches than they wear regularly. This realization prompts thoughtful questions about which pieces truly deserve wrist time and which might better serve your financial goals. Late January offers the emotional distance needed to make objective decisions about your collection's future direction.

This assessment period coincides with when many collectors receive year-end bonuses or complete tax planning, making it an ideal time to consider liquidating underutilized assets. Working with a reputable Rolex buyer during this window means your transaction can be completed efficiently, potentially providing funds that align with first-quarter financial strategies or investment opportunities that emerge early in the calendar year.

For those wondering where can I sell my watch, late January presents fewer competing sellers than peak seasons. Buyers actively seek quality inventory to meet continuing demand, which can work to your advantage when negotiating fair market value for your timepieces.

Market Dynamics Favoring Rolex and Omega Sellers

The luxury watch market has shown remarkable resilience heading into 2026, with classic Rolex models maintaining strong secondary market appeal. Iconic references like the Rolex Submariner buyer interest remains consistently high, as these tool watches transcend temporary trends. Similarly, those looking to sell Omega watch models—particularly from the Speedmaster and Seamaster lines—benefit from Omega's reputation for producing accessible luxury with substantial horological heritage.

Recent market activity demonstrates that quality pre-owned timepieces move quickly when properly evaluated and priced. Collectors downsizing or changing focus represent a significant segment of sellers, often bringing well-maintained pieces with complete documentation. This creates opportunities for both sellers seeking fair value and buyers searching for authenticated luxury timepieces from established sources.

Working with an experienced Omega watch buyer or used luxury watch buyer ensures your timepiece receives proper evaluation based on current market conditions rather than outdated pricing assumptions. Professional buyers understand which references command premium prices and can identify condition factors that significantly impact value.

Strategic Advantages of Selling During Late January

Timing your sale strategically can influence both the ease of transaction and the value you receive. Late January occupies a sweet spot where serious buyers actively seek inventory while seasonal selling pressure remains relatively low. This dynamic creates favorable conditions for sellers who want straightforward transactions without extended negotiation periods. Additionally, completing transactions early in the year simplifies tax documentation, as the sale falls clearly within the current tax year with months remaining for planning.

Many collectors use this period to establish their yearly collecting budget and priorities. By converting underutilized pieces to capital now, you position yourself to acquire different watches when compelling opportunities emerge throughout the year. This proactive approach to collection management separates strategic collectors from passive accumulators who simply hold onto every timepiece indefinitely.

If you're ready to explore your options, requesting a watch quote provides valuable information about your timepiece's current market value without obligation. This transparency allows you to make informed decisions about whether selling aligns with your collection goals and financial priorities.

Rolex References Commanding Strong Buyer Interest

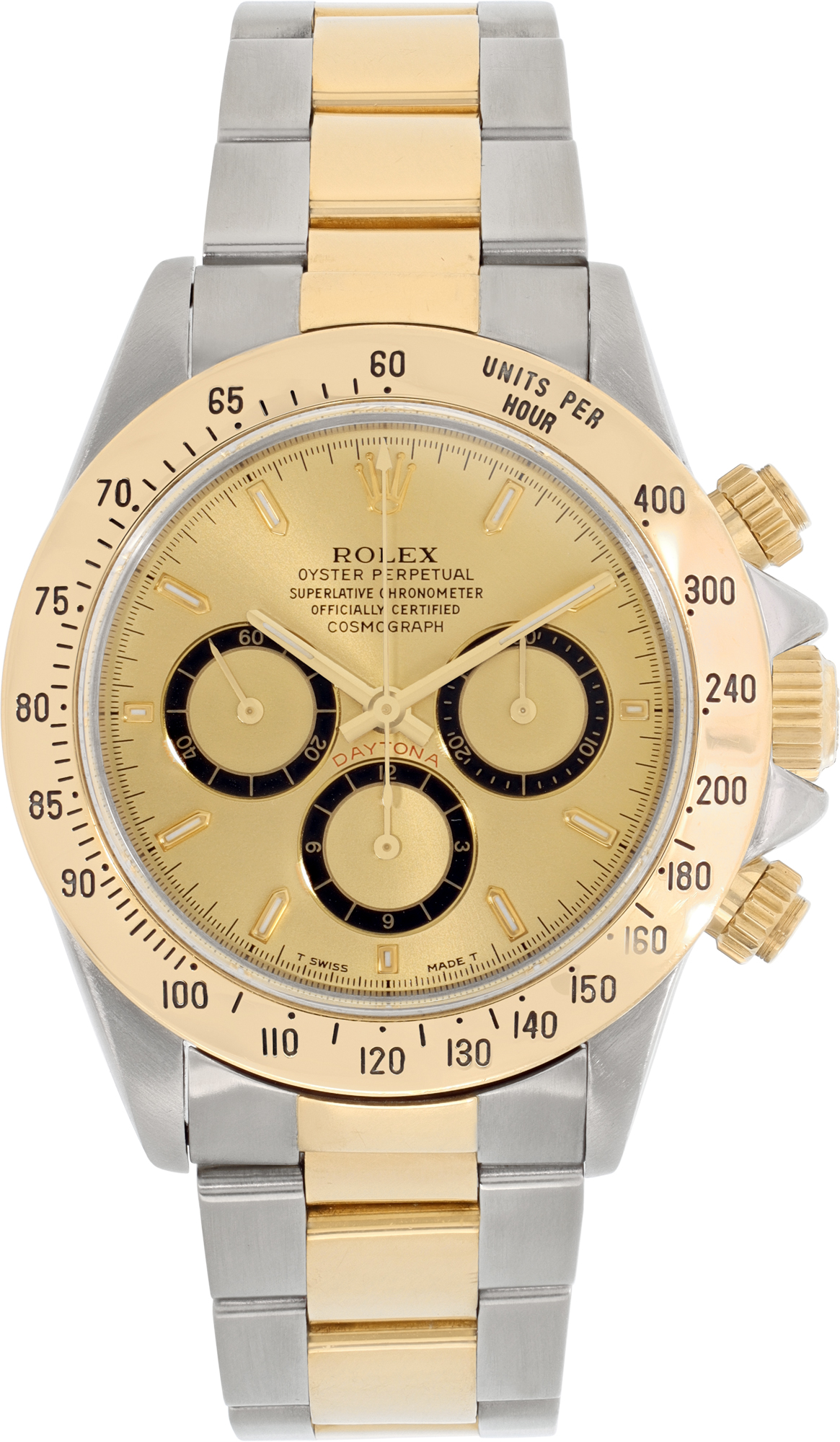

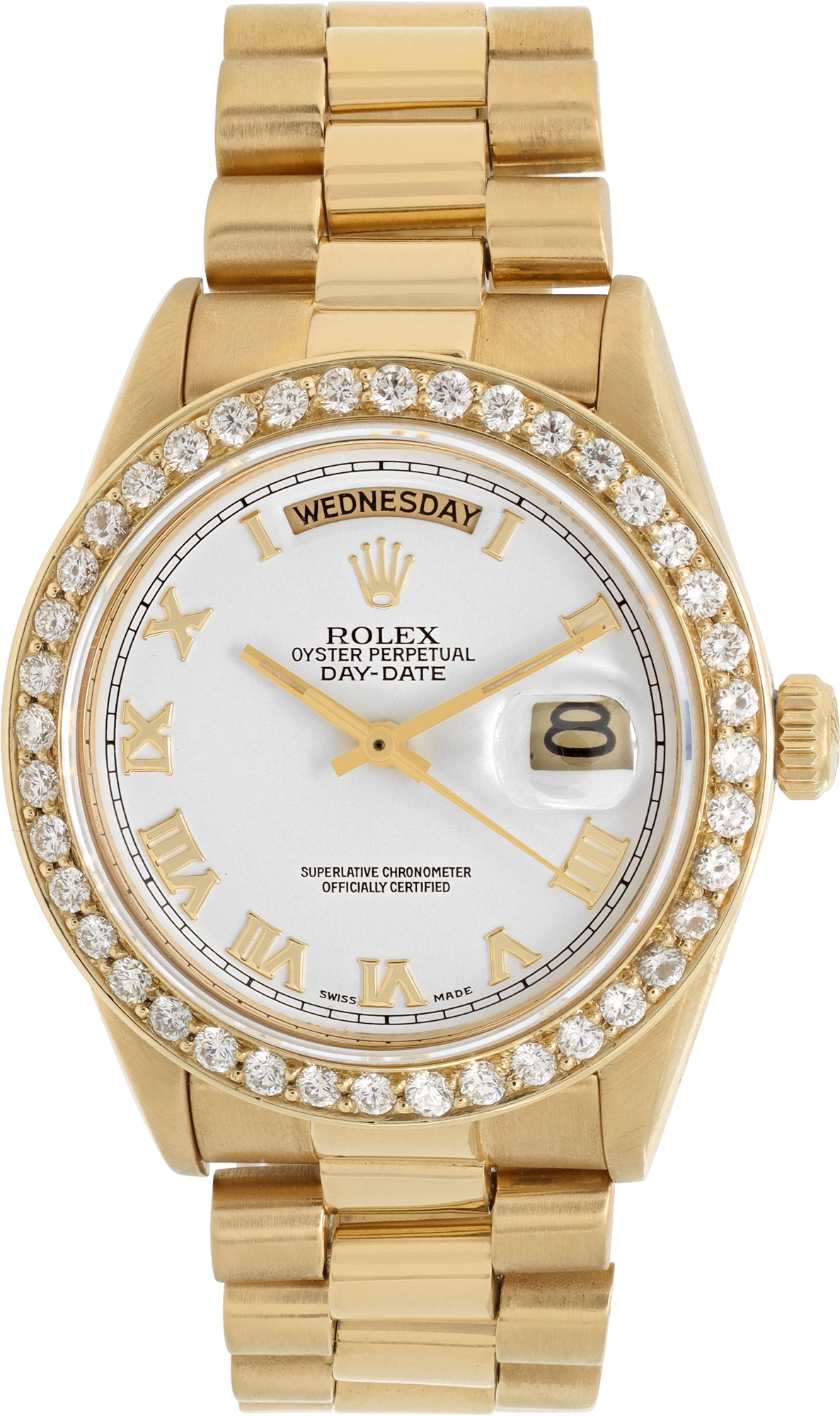

Certain Rolex references consistently attract Rolex buyer attention due to their timeless design, robust construction, and historical significance. Sport models including the Submariner, GMT-Master, and Daytona remain perennially desirable, with specific vintage references commanding particular interest from collectors and dealers alike. Even discontinued references often maintain value remarkably well, especially when accompanied by original boxes, papers, and service documentation that verify authenticity and provenance.

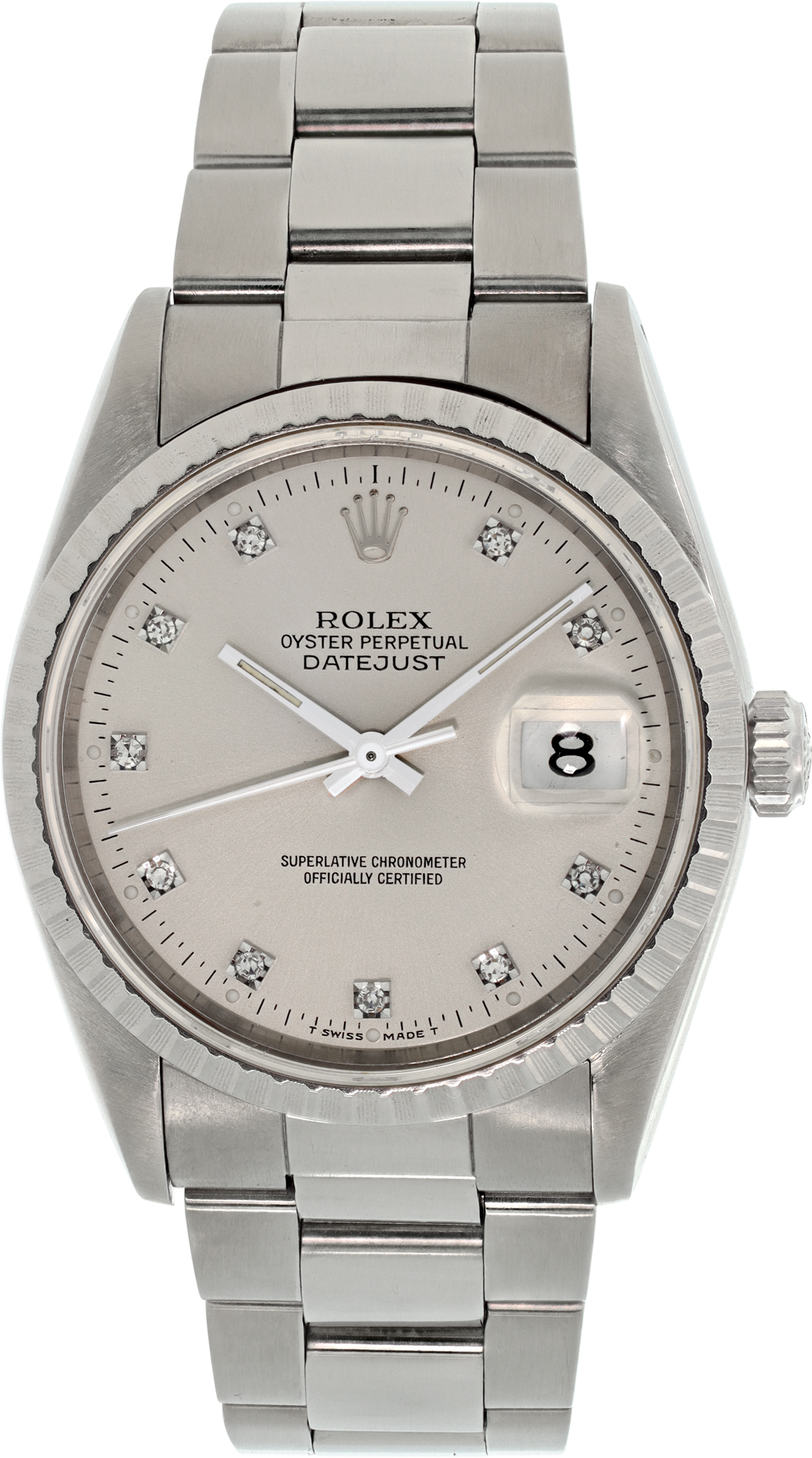

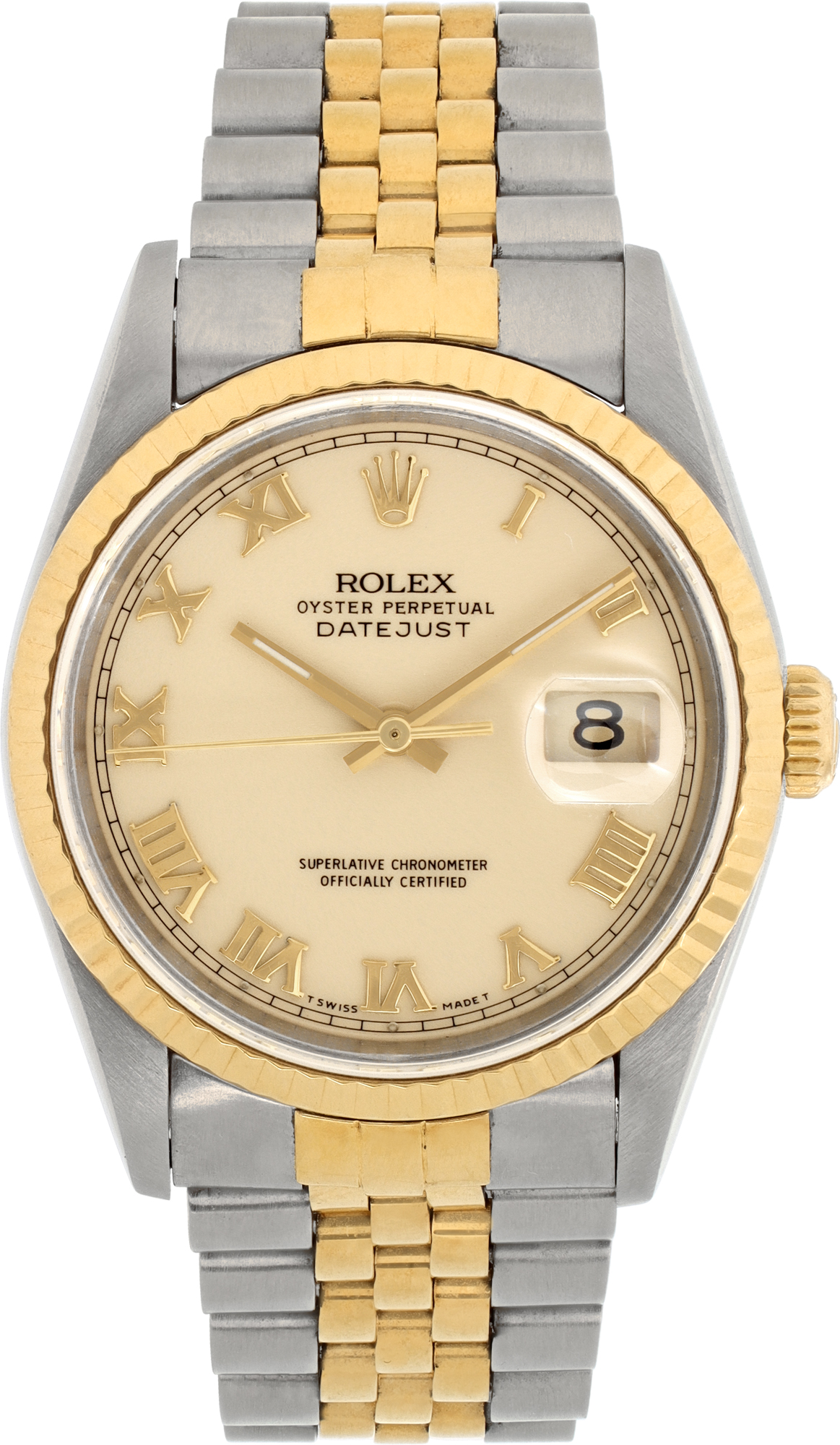

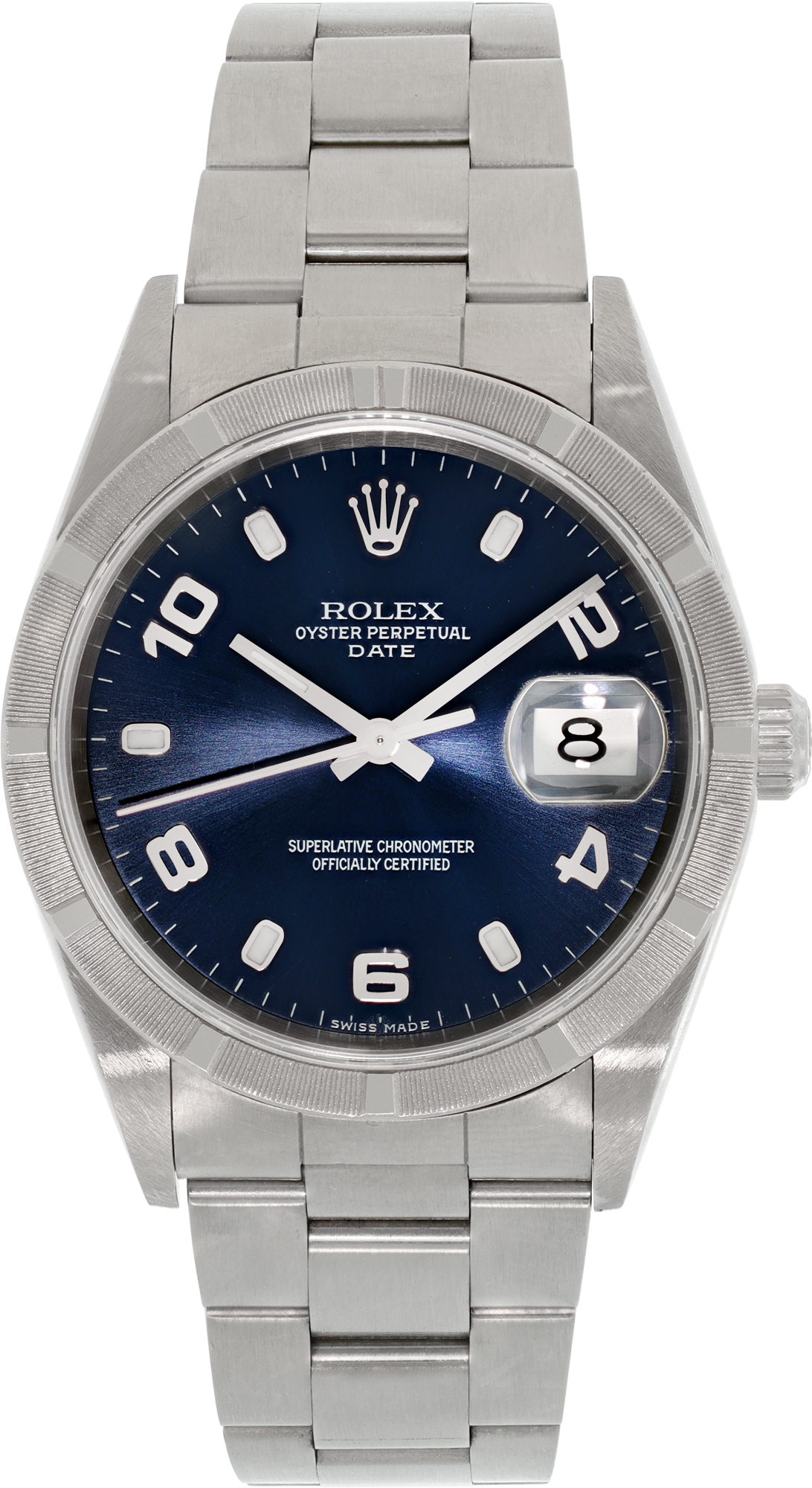

Dress watches like the Datejust and Day-Date appeal to buyers seeking classic elegance with Rolex's trademark reliability. These models span decades of production, with vintage references offering distinctive charm while modern iterations provide contemporary refinements. Whether your piece dates from the 1970s or was purchased recently, a knowledgeable buyer can assess its specific appeal within the current market context.

Even less commonly discussed models such as the Air King, Oyster Perpetual, and Date references find ready buyers when properly presented. These timepieces offer authentic Rolex ownership at more accessible price points, making them attractive to collectors building diverse portfolios. If you're considering whether to sell my Rolex, understanding that virtually all genuine Rolex timepieces hold inherent value can give you confidence in exploring your options.

Omega Timepieces With Enduring Appeal

Omega's reputation rests substantially on two iconic collections: the Speedmaster, famous as the "Moonwatch" worn during Apollo missions, and the Seamaster, James Bond's timepiece of choice in recent films. These models enjoy strong recognition beyond traditional watch collecting circles, which translates to consistent buyer interest. Vintage Speedmasters with manual-wind movements hold particular appeal for collectors seeking historically significant chronographs at more attainable prices than comparable Rolex Daytonas.

The Seamaster line spans professional dive watches to elegant dress variants, offering options for collectors with varied tastes. Limited editions and collaboration models often command premiums when they enter the secondary market, especially if retained in excellent condition with complete accessories. Those looking to sell Omega watch pieces benefit from Omega's extensive production history, which created numerous collectible references across multiple decades.

Beyond these flagship collections, Omega produced numerous other lines including the Constellation, De Ville, and vintage dress watches that appeal to collectors seeking understated elegance. An experienced luxury watch buyer recognizes value across Omega's diverse catalog rather than focusing exclusively on the most famous models. This broader perspective ensures you receive fair evaluation regardless of your specific timepiece.

Beyond Watches: Expanding Your Portfolio Refinement

While timepieces often anchor luxury collections, many collectors also own fine jewelry, diamonds, and sterling silver that could benefit from similar portfolio assessment. The same strategic timing that favors watch sales applies equally to other luxury assets you may be considering liquidating. If you inherited pieces you don't wear or own items that no longer suit your style, converting them to capital creates opportunities to redirect resources toward priorities that better align with your current preferences.

High-end jewelry from prestigious houses commands particular interest from specialized buyers. Those looking to sell Cartier jewelry often discover their pieces retain substantial value, especially iconic designs like the Love bracelet or Panthère collection. Similarly, collectors who sell Van Cleef & Arpels jewelry—particularly pieces from the beloved Alhambra collection—benefit from these timeless designs' enduring popularity. Whether you're considering selling Tiffany & Co. jewelry, Bvlgari jewelry, or pieces from other renowned makers, working with a knowledgeable jewelry buyer ensures proper evaluation.

Certain designers maintain particularly strong secondary markets. Those who sell David Yurman jewelry, especially pieces from the signature Cable collection, find consistent buyer interest. The distinctive aesthetic David Yurman established makes these pieces immediately recognizable, which supports their resale value. Similarly, collectors who sell Roberto Coin jewelry benefit from the brand's reputation for quality craftsmanship and distinctive design elements like the hidden ruby signature.

For European luxury houses, interest remains robust across multiple categories. Collectors who sell Chopard jewelry—particularly from the Happy Diamonds collection with its playful mobile diamonds—discover these conversation pieces attract enthusiastic buyers. Those looking to sell Piaget jewelry find that the brand's dual reputation for both watches and jewelry creates crossover appeal among collectors.

Even contemporary designers maintain strong followings. Collectors who sell John Hardy jewelry, especially pieces from the Classic Chain collection, benefit from the brand's distinctive style and quality construction. Similarly, those looking to sell Judith Ripka jewelry find that her signature use of rock crystal and canary cubic zirconia creates a recognizable aesthetic that appeals to specific collector segments.

Fashion houses have also made substantial impacts in fine jewelry. Those who sell Chanel jewelry, particularly pieces from the Camélia collection, tap into the brand's legendary status and timeless design language. Similarly, collectors who sell Gucci jewelry or sell Louis Vuitton jewelry benefit from these houses' luxury positioning and global recognition.

For the most prestigious names, value potential increases significantly. Collectors who sell Harry Winston jewelry or sell Graff jewelry work with pieces at the pinnacle of diamond quality and craftsmanship. These investment-grade pieces often require specialized expertise to properly evaluate, making professional buyer relationships particularly valuable.

Sterling Silver and Precious Metals Considerations

Beyond jewelry and watches, many households contain sterling silver flatware, tea sets, and decorative items that represent significant value. Late January provides ideal timing to inventory these items, as the post-holiday period often involves organizing storage spaces where silver pieces reside. If you've inherited sterling silver you don't use or own more pieces than you need, converting them to capital eliminates storage concerns while providing funds for more practical purposes.

Those looking to sell sterling silver benefit from working with buyers who understand both precious metal content and collectible value certain patterns command. Well-known makers like Tiffany & Co., Georg Jensen, and Gorham produced flatware patterns that transcend mere metal value, particularly when complete sets remain together. A knowledgeable sterling silver buyer can identify these premiums and ensure you receive appropriate compensation.

The process of selling sterling silver often proves simpler than many sellers anticipate. Unlike jewelry requiring detailed evaluation of gemstones and craftsmanship, silver primarily derives value from weight and purity, though pattern recognition adds important considerations. Professional buyers can quickly assess your items and provide transparent pricing based on current precious metal markets combined with any collectible premiums applicable to your specific pieces.

Diamond and Gemstone Portfolio Evaluation

Quality diamonds represent another category worth evaluating during portfolio refinement. Those who inherited diamond jewelry or own pieces they no longer wear can benefit from professional evaluation, particularly for stones accompanied by certification from recognized laboratories. GIA Certified Diamonds command premium prices due to the Gemological Institute of America's reputation as the industry's most respected grading authority. Similarly, AGL Certified Diamonds and colored gemstones certified by the American Gemological Laboratories benefit from that organization's specialized expertise.

Selling loose diamonds or diamond jewelry requires working with buyers who understand the "Four Cs"—cut, color, clarity, and carat weight—and can properly evaluate how these factors interact to determine value. Market conditions for diamonds vary significantly based on these characteristics, with certain combinations commanding substantial premiums while others prove more challenging to place. Professional evaluation through a diamond quote service provides clarity about your stone's specific market position.

Beyond diamonds, colored gemstones including sapphires, rubies, and emeralds also maintain strong markets when properly certified and evaluated. These stones require particular expertise, as treatments, origins, and quality factors significantly impact value in ways that differ from diamond grading conventions.

Working With Established Buyers: The Process Advantage

Choosing where to sell your luxury items significantly impacts both your experience and the value you receive. Established buyers with decades of market experience bring advantages that extend beyond simple purchase offers. These professionals understand authentication requirements, can identify condition factors affecting value, and maintain relationships with downstream buyers that support their ability to offer competitive prices. When you work with a reputable buyer, you benefit from their market knowledge and established infrastructure.

The selling process through professional buyers typically involves straightforward steps designed for your convenience. Most established operations offer multiple pathways: in-person appointments for local sellers, secure shipping options for those at distance, and transparent evaluation procedures that explain how they determined their offers. This transparency builds confidence and helps sellers understand the factors influencing their items' values.

Learning how it works before beginning the selling process helps set appropriate expectations and ensures you provide the information and documentation that maximizes your items' value. Complete watch boxes, original papers, service records, and purchase receipts all contribute to authentication and provenance, which can significantly impact offers. Similarly, jewelry accompanied by original certificates, receipts, or appraisals provides valuable context that supports pricing.

Regional Considerations for South Florida Sellers

Those located in South Florida enjoy particular advantages when selling luxury items, as the region hosts numerous established buyers with showrooms welcoming in-person consultations. The ability to meet face-to-face, have items evaluated immediately, and receive payment quickly appeals to sellers who prefer direct transactions over shipping valuable items. Additionally, examining a buyer's facilities and meeting their staff provides confidence that may not translate through purely online interactions.

South Florida's luxury market remains robust year-round, supported by both residents and seasonal visitors who maintain sophisticated tastes. This creates consistent demand that benefits sellers working with buyers serving this market. Whether you're in Miami, Boca Raton, or surrounding communities, connecting with an established watch buyer with local presence ensures you receive evaluation from professionals who understand regional market dynamics.

For those beyond the immediate area, many established South Florida buyers also serve national clients through secure shipping programs and remote evaluation processes. This allows sellers throughout the United States to access the expertise and competitive pricing these buyers offer without geographic limitations.

Comprehensive Brand Coverage

Professional luxury buyers maintain expertise across extensive brand portfolios, ensuring proper evaluation regardless of your items' makers. Beyond the Rolex and Omega focus of watch collecting, those looking to sell Patek Philippe watch models work with pieces at the pinnacle of horological achievement. These timepieces require particular expertise to authenticate and value properly, as details invisible to casual observers significantly impact worth. Similarly, collectors who sell Audemars Piguet watch pieces, especially from the Royal Oak family, benefit from buyers who understand these iconic designs' market positioning.

Other prestigious watch brands maintain devoted followings. Those who sell Vacheron Constantin watch timepieces work with another member of the "Holy Trinity" of watchmaking, while collectors who sell Jaeger-LeCoultre watch models benefit from that manufacturer's reputation for technical innovation and refined aesthetics. Even brands like IWC, Panerai, and Hublot command strong interest from buyers seeking diverse inventory.

Independent watchmakers have gained substantial collector interest in recent years. Those who sell F. P. Journe watch or sell Richard Mille watch pieces work with timepieces at the cutting edge of contemporary horology, often commanding six-figure prices for special references. Similarly, collectors who sell A. Lange & Söhne watch models benefit from German watchmaking's resurgence and these timepieces' meticulous finishing.

Even more accessible luxury brands maintain value. Those who sell Breitling watch or sell Tag Heuer watch pieces find consistent buyer interest, particularly for iconic models like the Navitimer or Monaco. Similarly, Rolex's sister brand Tudor has gained substantial collector attention, making this an opportune time to sell Tudor watch pieces, especially vintage references or modern Black Bay models.

Documentation and Condition Factors

Understanding how documentation and condition affect value helps sellers prepare items for evaluation. Complete sets—including original boxes, warranty papers, purchase receipts, and service records—consistently command premiums over watch-only offerings. These accessories verify authenticity, establish provenance, and provide future buyers confidence in their purchases. While incomplete sets certainly retain value, gathering any available documentation before contacting buyers maximizes your potential offers.

Condition assessment extends beyond obvious factors like scratches or wear. For watches, service history significantly impacts value, as timepieces with regular maintenance demonstrate care and typically function better than neglected examples. Original parts versus replacements, dial condition, case integrity, and bracelet stretch all contribute to professional evaluations. Similarly, jewelry condition considers stone security, clasp function, and whether pieces have been altered from original designs.

Even items requiring repair maintain value, though obviously less than pristine examples. Professional buyers regularly purchase watches needing service and jewelry requiring restoration, as they maintain relationships with qualified technicians who can return pieces to sellable condition. Being transparent about condition issues during initial discussions ensures efficient evaluations and prevents surprises that could delay transactions.

The Consignment Alternative

Beyond direct purchase, consignment represents another viable option for certain luxury items. This arrangement involves a seller entrusting their items to a dealer who markets them to potential buyers, with the original owner receiving payment after successful sale. Consignment typically yields higher returns than direct sale but requires longer timeframes and involves uncertainty about final sale prices and timing.

Consignment works particularly well for rare, high-value pieces likely to attract collector interest. Items with provenance, limited production numbers, or exceptional condition may justify the extended marketing period consignment requires. Understanding the differences between direct purchase and consignment helps you choose the approach best suited to your priorities regarding speed, certainty, and potential return.

Established buyers offering both options provide valuable flexibility, allowing you to select the approach matching your circumstances. Some sellers prioritize immediate liquidity and prefer direct purchase certainty, while others can afford patience and pursue maximum returns through consignment. Discussing your specific situation with professional buyers helps identify the optimal strategy for your items and goals.

Taking Action: Your Next Steps

If late January 2026's optimal timing resonates with your collection refinement goals, taking action now positions you to complete transactions efficiently while market conditions remain favorable. Beginning with a professional evaluation provides the information needed to make confident decisions about which items to sell, retain, or consign. This assessment costs nothing but delivers valuable insights about your portfolio's current market value.

The evaluation process typically begins by contacting established buyers and providing basic information about your items. For watches, this includes brand, model, reference number, condition assessment, and documentation availability. For jewelry, descriptions of materials, designers, condition, and any certifications help buyers provide preliminary estimates. Many buyers offer multiple contact methods including phone consultations, online forms, and email communication, allowing you to choose your preferred approach.

Exploring the brands we buy helps confirm your items align with specific buyers' acquisition interests before investing time in detailed communications. While many professional buyers maintain broad purchasing mandates, some specialize in particular categories or brands, making initial research worthwhile.

Building a Relationship With Trusted Buyers

Successful transactions often mark the beginning of ongoing relationships rather than isolated events. Collectors frequently return to buyers who treated them fairly, provided efficient service, and demonstrated expertise during initial transactions. As your collection evolves over time, having established relationships with reputable buyers simplifies future selling decisions and ensures you maintain access to competitive pricing and professional service.

These relationships benefit both parties. Buyers gain access to quality inventory from trusted sources, while sellers enjoy streamlined processes when subsequent selling opportunities arise. Whether you're systematically refining your collection over years or addressing one-time needs, working with professionals who remember your previous transactions and understand your preferences enhances every interaction.

Trust remains fundamental to luxury transactions involving significant values. Choosing buyers with decades of market presence, positive reputations, and transparent business practices provides the confidence essential for comfortable transactions. Taking time to verify credentials, read reviews, and understand processes before committing to work with specific buyers represents due diligence well spent.

Conclusion: Seizing the Late January Opportunity

Late January 2026 presents luxury collectors with a unique window to refine their portfolios under favorable conditions. The combination of post-holiday clarity, early-year financial planning, and strong market dynamics creates an environment where sellers can achieve fair value through efficient transactions. Whether you're looking to sell Rolex watch pieces that no longer align with your collecting direction or sell Omega watch models to fund different acquisitions, acting during this opportune period positions you for success.

Beyond timepieces, the same strategic timing applies to jewelry, sterling silver, and diamonds that deserve evaluation as part of comprehensive portfolio management. Working with established buyers who demonstrate expertise across multiple luxury categories ensures all your items receive proper assessment and competitive offers. The transparency, efficiency, and professionalism these buyers provide transforms what could be stressful transactions into straightforward processes.

Ready to explore what your luxury items are worth in today's market? Request a comprehensive watch quote or jewelry quote to receive professional evaluation from experienced buyers who understand current market conditions. Whether you ultimately choose direct purchase or consignment, beginning with accurate valuation empowers informed decisions about your collection's future. Don't let this optimal window close—discover how strategic portfolio refinement can benefit your collecting journey and financial goals.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG