January 23rd, 2026

From Gratitude to Growth: Converting Your Inherited Thanksgiving Heirlooms Into Modern Opportunities

As families gather around Thanksgiving tables this season, many discover themselves inheriting precious estate jewelry and luxury timepieces that carry decades of family history. While these inherited pieces hold sentimental value, they also represent significant financial opportunities that can transform your future. Converting your thanksgiving heirlooms into liquid assets isn't about diminishing their legacy—it's about honoring your family's investment while creating new possibilities for growth.

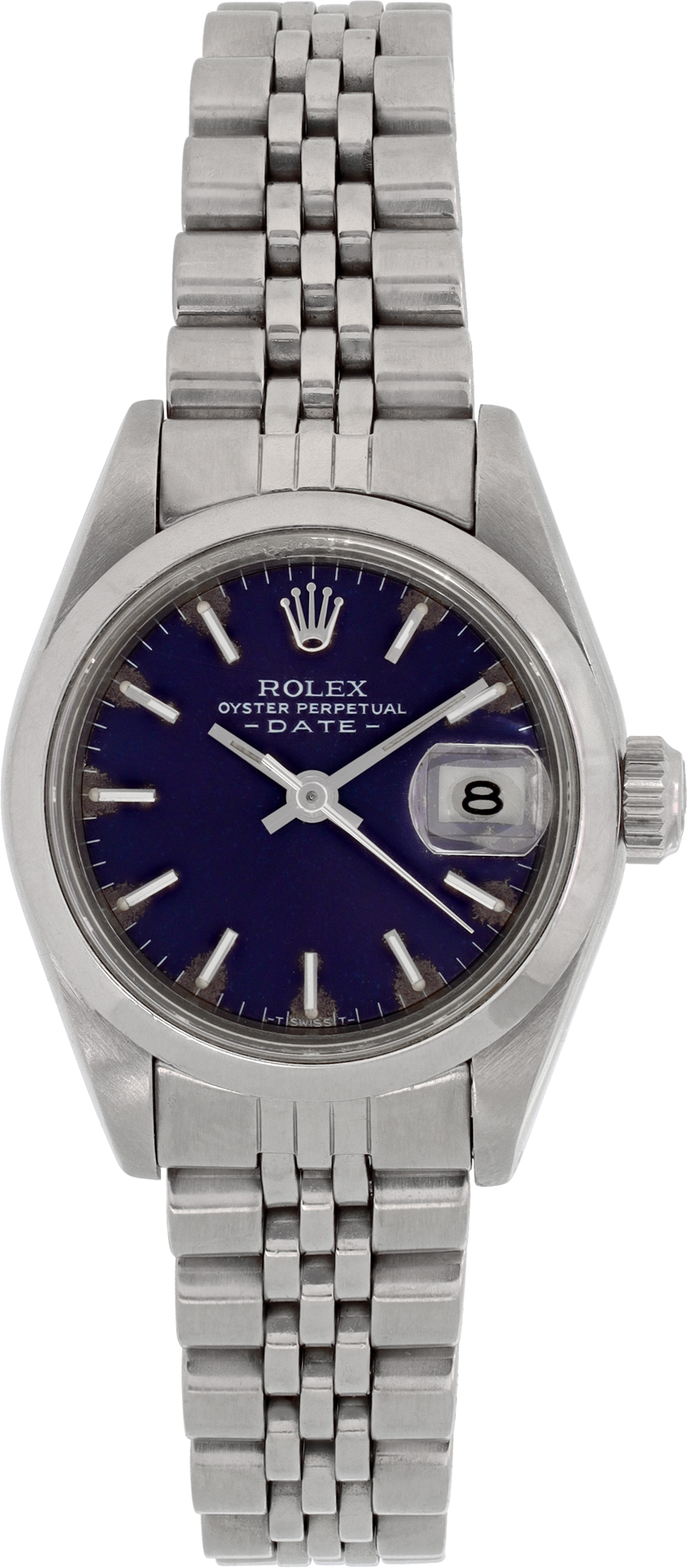

The decision to sell grandmothers estate jewelry online has become increasingly common as families seek practical solutions for managing inherited luxury items. Whether you've received vintage Rolex watches, diamond engagement rings, or sterling silver collections, these pieces often represent substantial value that can support your current financial goals while preserving the gratitude you feel for your family's generosity.

Understanding the True Value of Your Inherited Treasures

Estate jewelry encompasses far more than simple accessories—these pieces represent craftsmanship, precious metals, and gemstones that often appreciate in value over time. Many families underestimate the worth of inherited items, particularly when dealing with luxury brands like Cartier, Tiffany & Co., or Van Cleef & Arpels. Professional evaluation reveals the true market value of these pieces, often surprising inheritors with their substantial worth.

The luxury watch market has experienced remarkable growth, making inherited timepieces particularly valuable assets. If you're wondering where to sell a rolex or other premium Swiss watches, understanding current market conditions is essential. Vintage Rolex models, Omega Speedmasters, and Patek Philippe pieces often command premium prices due to their enduring quality and collector demand.

When considering reasons to sell your jewelry, practical factors often outweigh emotional attachments. Perhaps you need funds for home improvements, education expenses, or investment opportunities. Maybe the inherited pieces don't align with your personal style, or you prefer to consolidate multiple small items into one significant purchase that better serves your lifestyle.

The Modern Approach to Estate Jewelry Sales

Today's jewelry buyer landscape offers sophisticated options that didn't exist for previous generations. Professional buyers now provide comprehensive evaluation services, secure transaction processes, and competitive pricing that reflects true market value. The key lies in finding established buyers who understand luxury brands and can properly assess craftsmanship, condition, and current market demand.

For those located in South Florida, working with local experts provides additional advantages. A miami cartier watch buyer or boca raton rolex buyer offers face-to-face consultation and immediate evaluation. However, even sellers across the United States can access professional services through secure shipping and online assessment programs designed specifically for luxury items.

The best place to sell my rolex isn't necessarily the first option you encounter. Established buyers with decades of experience, master-trained watchmakers, and transparent pricing structures provide the security and expertise necessary for high-value transactions. Look for buyers who specialize in luxury brands and can demonstrate their knowledge of current market conditions.

Strategic Timing for Maximum Returns

Understanding market timing can significantly impact the value you receive for inherited luxury items. The current luxury watch market shows strong demand for vintage Rolex models, particularly rolex submariner pieces and GMT Master collections. Similarly, estate diamond jewelry continues to appreciate, especially pieces featuring high-quality stones with proper certification.

Rolex prices have demonstrated consistent growth over the past decade, making inherited Rolex watches particularly valuable assets. The rolex price increase 2020 marked a significant shift in the luxury watch market, with many models experiencing double-digit appreciation. This trend continues, making now an opportune time to sell my rolex for maximum return.

The holiday season presents unique opportunities for jewelry consignment and direct sales. Many buyers seek luxury gifts during this period, creating increased demand for estate pieces. Additionally, year-end financial planning often motivates individuals to liquidate assets, making this an ideal time to convert inherited jewelry into cash or investment opportunities.

Specialized Categories Worth Particular Attention

Certain categories of inherited luxury items command exceptional attention from collectors and buyers. Cartier juste un clou bracelets, chopard happy diamonds pieces, and david yurman collections represent brands with strong resale markets and consistent demand. These pieces often retain or exceed their original purchase price, particularly when maintained in excellent condition.

Vintage watches present particularly compelling opportunities. Omega speedmaster models, especially those with space program connections, command premium prices from collectors. Similarly, patek philippe timepieces represent some of the most sought-after luxury watches available, with certain models appreciating significantly over time.

For those with diverse inherited collections, consider the value of sterling silver flatware and decorative pieces. While individual items may seem modest, complete sets from prestigious manufacturers like Tiffany & Co. or Cartier can represent substantial value. Professional buyers understand the nuances of silver grading and can properly assess these collections.

The Professional Evaluation Process

Working with experienced luxury jewelry and watch buyers ensures accurate assessment and fair pricing for your inherited items. The evaluation process typically begins with detailed photography and description, allowing experts to provide preliminary assessments. For high-value pieces, in-person evaluation provides the most comprehensive analysis of condition, authenticity, and market value.

Professional buyers examine multiple factors when assessing inherited jewelry and watches. Brand reputation, current market demand, condition, rarity, and provenance all influence final valuations. For watches, mechanical condition, service history, and completeness of original components significantly impact value. Jewelry evaluation focuses on gemstone quality, metal purity, craftsmanship, and designer attribution.

The jewelry quotes you receive should reflect current market conditions and include detailed explanations of valuation factors. Reputable buyers provide transparent pricing structures and can explain how they arrived at their offers. This transparency helps you make informed decisions about whether to sell immediately or explore consignment options for potentially higher returns.

Maximizing Value Through Professional Expertise

Sell Us Your Jewelry specializes in helping families navigate the complex process of converting inherited luxury items into financial opportunities. As the purchasing and consignment division of Gray & Sons, we bring over four decades of experience to every transaction. Our team includes master-trained watchmakers and experienced jewelers who understand the nuances of luxury brand evaluation and current market conditions.

Our comprehensive services extend beyond simple purchase transactions. We evaluate each piece individually, considering factors like brand heritage, current market demand, and condition to provide accurate valuations. Whether you're looking to sell cartier jewelry, sell patek philippe watch collections, or sell tiffany jewelry, our expertise ensures you receive fair market value for your inherited treasures.

The process begins with our secure evaluation system, designed specifically for high-value items. Through our online assessment platform, you can receive preliminary quotes for jewelry pieces, while our specialized watch evaluation service handles luxury timepieces with the expertise they deserve. For those with precious stones, our GIA diamond assessment ensures proper evaluation of certified stones.

From Inheritance to Investment: Creating New Opportunities

Converting inherited heirlooms into liquid assets opens doors to new investment opportunities that can provide long-term financial growth. Rather than allowing valuable pieces to remain unused in safety deposit boxes, liquidating these assets can fund education, real estate investments, or other financial goals that create ongoing value for your family's future.

Many families discover that selling inherited luxury items provides the financial flexibility needed to pursue opportunities that weren't previously accessible. Whether funding a child's education, making a down payment on real estate, or starting a business venture, the proceeds from estate jewelry sales can serve as catalysts for significant life improvements.

Consider also the practical benefits of consolidation. Instead of managing multiple inherited pieces that require insurance, storage, and maintenance, converting these items to cash allows for simplified financial management while preserving the value your family members worked to create.

Conclusion: Honoring Legacy Through Practical Action

The decision to sell inherited luxury items represents a thoughtful approach to honoring your family's legacy while creating practical opportunities for growth. Rather than allowing valuable pieces to remain unused, converting these assets demonstrates gratitude for your family's investments while ensuring their value continues to benefit future generations.

Sell Us Your Jewelry understands the emotional complexity of selling inherited items and approaches each transaction with the respect and professionalism these family treasures deserve. Our comprehensive evaluation process, transparent pricing, and secure transaction methods provide the confidence you need to make informed decisions about your inherited luxury items.

Ready to explore the value of your inherited heirlooms? Begin with our secure online evaluation process for jewelry pieces, or use our specialized watch assessment service for luxury timepieces. Our team of experts is ready to help you understand the true value of your family's treasures and guide you through the process of converting gratitude into growth.

For personalized assistance with your inherited luxury items, contact our team of specialists who understand both the financial and emotional aspects of estate jewelry transactions. Let us help you honor your family's legacy while creating new opportunities for your future.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG