February 20th, 2026

From Holiday Gifts to Tax Refunds: Strategic January Gold Coin Sales for Maximum 2026 Returns

The post-holiday season presents a unique opportunity for savvy individuals to transform unwanted gifts and unused luxury items into liquid assets. January has long been recognized as an optimal time for selling gold jewelry, precious metals, and luxury watches, particularly when you're looking to maximize returns before tax season. Whether you received gold coins as holiday gifts or you're considering liquidating precious metals from your estate jewelry collection, understanding the strategic timing of January sales can significantly impact your financial outcomes for 2026.

As we enter the new year, many individuals find themselves evaluating their financial goals and looking for ways to optimize their assets. If you're searching for reputable gold buyers near me or considering precious metals liquidation, January offers distinct advantages. The market dynamics, combined with the proximity to tax season, create a window of opportunity that shouldn't be overlooked by those holding valuable gold jewelry, coins, or other luxury items.

Why January is Prime Time for Precious Metals Liquidation

January represents a convergence of several factors that make it an ideal month for selling gold and other precious metals. The holiday spending season has concluded, and many individuals are reassessing their financial positions. This natural evaluation period often reveals opportunities to convert underutilized assets into cash that can serve more immediate needs or investment goals. The beginning of the year also brings clarity to financial planning, making it easier to understand how proceeds from selling gold coins or jewelry can contribute to your overall 2026 strategy.

Beyond personal financial planning, January often sees stabilized market conditions following holiday fluctuations. Buyers are actively seeking inventory to replenish after the busy holiday season, which can translate to competitive offers for quality pieces. When working with established gold jewelry buyers, you'll find that the market appetite remains strong, particularly for authenticated pieces and precious metals with verifiable purity.

If you're holding gold coins received as gifts or inherited gold jewelry that no longer fits your lifestyle, now is the time to explore your selling options. The professional evaluation process ensures you understand the true market value of your items, whether they're modern pieces or estate jewelry with historical significance.

Understanding the Tax Implications of Gold Sales

Strategic timing of gold and precious metals sales can have meaningful tax implications that savvy sellers consider carefully. Selling in January provides the maximum time horizon within the tax year to plan for any resulting obligations. This extended timeline allows you to work with financial advisors to understand how proceeds from selling gold fit into your broader tax strategy for 2026. Unlike rushing to sell at year-end, January sales give you flexibility in how you manage the financial outcomes.

For those holding gold coins, jewelry, or other precious metals as long-term investments, the difference between short-term and long-term capital gains treatment can be substantial. Understanding your cost basis and holding period becomes crucial in maximizing after-tax returns. Professional jewelry buyers who work regularly with clients liquidating significant holdings can often provide guidance on documentation requirements, though consulting with a tax professional remains essential for personalized advice.

The Gold Market Landscape in Early 2026

The precious metals market entering 2026 reflects a complex interplay of global economic factors, currency valuations, and investor sentiment. Gold has traditionally served as both an investment vehicle and a hedge against economic uncertainty. Whether you're holding American Eagle gold coins, Krugerrands, or fine gold jewelry, understanding current market dynamics helps you make informed decisions about timing your sale. The strength of the U.S. dollar, inflation expectations, and geopolitical conditions all influence gold pricing.

For individuals searching for reliable gold buyers near me, it's essential to recognize that not all buyers operate with the same level of transparency or expertise. Established luxury buyers with decades of experience, like those backed by trusted names in the industry, bring professional evaluation capabilities and competitive pricing that individual buyers or pawn operations cannot match. When you're ready to sell gold, choosing the right buyer makes a significant difference in the offers you receive.

Working with professionals who specialize in precious metals and luxury items ensures your gold coins, jewelry, and other valuable items receive proper authentication and evaluation. This expertise translates directly to better offers and a more secure transaction process.

Beyond Gold: Diversifying Your January Liquidation Strategy

While gold coins and bullion represent tangible assets many individuals hold, January also presents opportunities to evaluate other luxury holdings. High-end watches from manufacturers like Rolex, Patek Philippe, and Omega maintain strong resale markets throughout the year, but January's combination of inventory needs and buyer activity creates favorable conditions. If you received a luxury timepiece as a holiday gift that doesn't suit your style, or you're holding multiple watches in your collection, this timing deserves consideration.

The same strategic advantages that apply to precious metals liquidation extend to luxury watch sales. Buyers actively seek authenticated timepieces to meet early-year demand, and selling your luxury watch in January positions you advantageously. Whether you're looking to sell your watch or considering selling your Rolex, professional evaluation ensures you understand current market values and receive competitive offers.

For those holding multiple luxury assets, January offers an opportunity to comprehensively evaluate your holdings. From diamond engagement rings to designer jewelry pieces, the start of the year provides a natural checkpoint for financial optimization. Our comprehensive evaluation services cover everything from precious metals to certified diamonds and luxury timepieces.

Navigating the Sales Process with Professional Buyers

Understanding how professional buyers evaluate and price gold coins and jewelry demystifies the sales process and helps you set realistic expectations. Reputable gold jewelry buyers assess multiple factors: precious metal content, current market pricing, item condition, and for jewelry pieces, craftsmanship and brand value. Gold coins typically receive evaluation based on their gold content, condition, rarity, and numismatic value if applicable. Common bullion coins are primarily valued for their precious metal content, while rare or collectible coins may command premiums beyond their melt value.

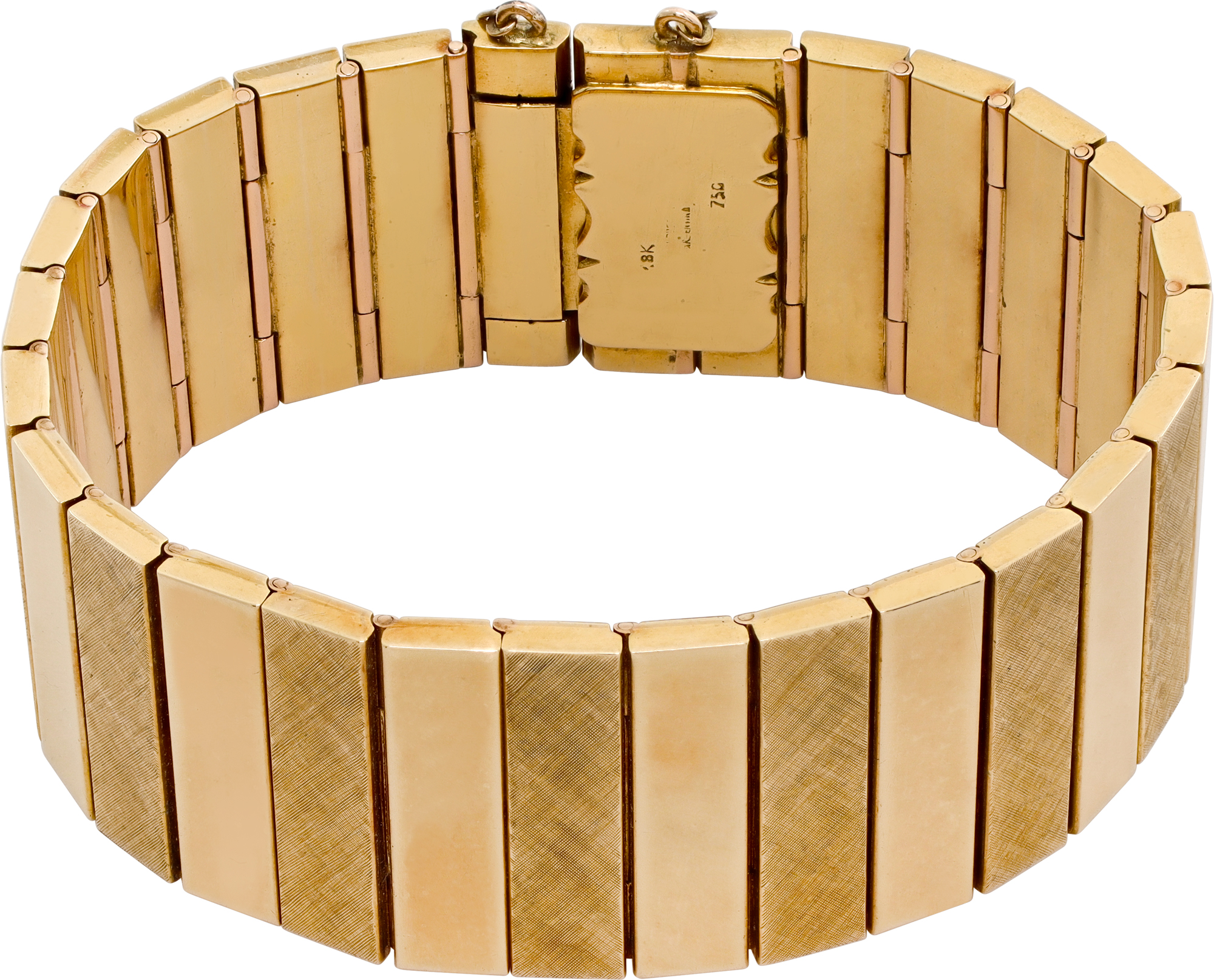

The process of selling gold jewelry involves additional considerations beyond simple gold weight. Designer pieces from houses like Cartier, Tiffany & Co., or Bvlgari carry brand value that professional buyers recognize and incorporate into their offers. Broken or damaged jewelry still holds substantial value based on precious metal content, making it worthwhile to have items evaluated regardless of condition. Experienced buyers maintain transparent pricing models and explain how they arrive at their offers, building trust through the transaction.

When you're searching for jewelry buyers near me or considering where to sell luxury items, proximity to established showrooms offers advantages. Face-to-face transactions provide immediate evaluation, the opportunity to ask questions, and same-day payment in many cases. For those unable to visit in person, professional luxury buyers also offer secure shipping options with full insurance coverage, ensuring your valuable items remain protected throughout the process.

The South Florida Advantage: Local Expertise Meets Global Markets

South Florida has long been recognized as a hub for luxury goods, from high-end watches to fine jewelry and precious metals. The concentration of wealth, international clientele, and established luxury markets creates a sophisticated buyer landscape. For residents of Miami, Boca Raton, Fort Lauderdale, and surrounding communities, access to experienced buyers who understand both local and international markets provides distinct advantages when liquidating luxury assets.

Whether you're a Boca Raton Rolex buyer seeking competitive offers or someone looking to sell diamonds in Miami, the South Florida luxury market offers depth and expertise. Established operations with decades of experience, particularly those connected to respected names in luxury retail, bring professional evaluation capabilities and fair pricing structures. These buyers maintain relationships with collectors and dealers worldwide, ensuring strong markets for the items they purchase.

The region's luxury watch market deserves particular attention, with strong demand for brands like Rolex, Patek Philippe, Audemars Piguet, and Omega. From Bay Harbor to Coral Gables, from Sunny Isles to Key Biscayne, sellers benefit from competitive markets and multiple evaluation options. When you're ready to sell your luxury watch or jewelry, working with established South Florida buyers ensures professional service and competitive offers.

Investment-Grade Timepieces: Maximizing Watch Values in 2026

The luxury watch market entering 2026 shows continued strength for iconic models and historically significant pieces. Rolex Submariner, Daytona, and GMT-Master models maintain robust markets, while Patek Philippe Nautilus and perpetual calendar pieces command premium prices. Understanding which watches hold their value best helps collectors and inheritors make informed liquidation decisions. Market dynamics favor authenticated pieces with complete documentation, original boxes, and service records.

For those wondering where to sell a Rolex or considering selling a Patek Philippe, professional buyers with in-house authentication capabilities offer significant advantages. Master-trained watchmakers can verify authenticity, assess condition, and identify any service needs that might affect value. This expertise ensures accurate valuations and protects both buyers and sellers in transactions involving high-value timepieces.

Beyond Rolex and Patek Philippe, strong markets exist for brands like Audemars Piguet, Vacheron Constantin, Omega, and Breitling. Whether you're looking to sell an Omega Speedmaster or considering offers for other Swiss luxury watches, January's market conditions favor sellers with quality pieces. The key lies in working with buyers who understand nuances in watch collecting and can accurately price pieces based on current market demand.

Sterling Silver and Beyond: Comprehensive Precious Metals Evaluation

While gold often dominates precious metals discussions, sterling silver represents another valuable asset class many individuals overlook. From sterling silver flatware sets to decorative pieces and jewelry, these items hold tangible value that professional buyers recognize. January's timing advantages apply equally to silver liquidation, particularly for those holding inherited estate silver or collections that no longer serve their current lifestyle needs.

Designer silver pieces from brands like Tiffany & Co., Cartier, and Georg Jensen can command premiums beyond their silver content value. Professional evaluation identifies these pieces and ensures you receive fair compensation for both precious metal content and brand value. If you're considering selling sterling silver, working with experienced buyers who understand both bullion and collectible markets maximizes your returns.

Designer Jewelry: Brand Value in the Resale Market

The luxury jewelry resale market reflects sophisticated buyer understanding of brand value, craftsmanship, and design significance. Pieces from heritage houses like Cartier, Van Cleef & Arpels, Bvlgari, Harry Winston, and David Yurman maintain strong secondary markets. Iconic designs like Cartier Love bracelets, Van Cleef & Arpels Alhambra pieces, and Cartier Juste un Clou jewelry command premiums that professional buyers incorporate into their valuations.

When you're ready to sell Cartier jewelry, Tiffany pieces, or other designer items, authentication and documentation significantly impact values. Original boxes, papers, and certificates provide verification that enhances buyer confidence and supports stronger offers. Professional luxury buyers maintain relationships with these brands and understand authentication markers that confirm genuineness, protecting your interests throughout the transaction.

For those holding David Yurman jewelry, Chopard pieces, or items from other contemporary luxury brands, January presents an excellent time for evaluation. Whether you received pieces as gifts that don't match your style or you're downsizing a collection, understanding current market values helps you make informed decisions. The jewelry evaluation process provides clarity on what your pieces can command in today's market.

Diamonds: Understanding Certification and Value

Diamond valuation represents one of the most technical aspects of jewelry assessment, requiring expertise in the 4Cs (cut, color, clarity, and carat weight) along with understanding of certification standards. GIA-certified diamonds receive premium valuations due to the organization's rigorous grading standards and global recognition. When you're considering selling a diamond engagement ring or other diamond jewelry, certification dramatically impacts the offers you'll receive.

Professional diamond buyers with gemological training can evaluate both certified and uncertified stones, though certification always supports stronger pricing. For significant diamonds (typically one carat and above), the investment in GIA certification before selling often pays dividends in final sale prices. Understanding factors like fluorescence, proportions, and polish helps explain value differences between seemingly similar stones.

Whether you're looking to sell a 1-carat diamond engagement ring online or evaluating options for larger stones, working with buyers who specialize in GIA-certified diamonds ensures accurate assessment and competitive offers. The combination of gemological expertise and current market knowledge translates to fair pricing and transparent transactions.

The Consignment Alternative: Maximizing Returns Through Strategic Selling

For certain high-value items, consignment offers an alternative to direct sale that can maximize returns. This approach works particularly well for rare timepieces, exceptional jewelry pieces, or items where retail values significantly exceed wholesale offers. Professional consignment services handle marketing, authentication, and sales while you maintain ownership until the piece sells. The tradeoff involves longer time horizons but potentially higher net proceeds.

Understanding when consignment makes sense versus direct sale requires professional guidance based on your specific items and financial timeline. Pieces that command strong collector interest, rare vintage watches, or exceptional jewelry with unique provenance often benefit from consignment approaches. Conversely, common models or pieces where you need immediate liquidity typically sell better through direct purchase arrangements.

Reputable luxury buyers offer both options and can explain which approach serves your interests best for specific items. Their market knowledge and established client networks ensure your pieces reach qualified buyers, whether through direct purchase or consignment arrangements. This flexibility allows you to optimize returns based on each item's characteristics and your personal timing needs.

Security and Trust: Essential Elements of Luxury Transactions

When you're selling high-value items like gold coins, luxury watches, or fine jewelry, security and trust become paramount concerns. Reputable buyers with established physical locations, long operating histories, and strong reputations provide assurances that private buyers or unknown online platforms cannot match. Verifiable business credentials, professional facilities, and transparent processes protect your interests throughout the transaction.

For those considering shipping items for evaluation, insurance coverage, tracking, and secure packaging represent essential protections. Professional buyers provide prepaid, fully insured shipping materials and maintain communication throughout the process. Face-to-face transactions offer immediacy and the comfort of in-person interaction, though secure shipping expands access for those unable to visit showrooms personally.

The importance of working with established luxury buyers cannot be overstated when dealing with valuable assets. Decades of experience, professional credentials, and verifiable track records differentiate reputable operations from less reliable alternatives. Whether you're selling gold coins received as gifts or liquidating inherited jewelry, choosing the right buyer fundamentally impacts both your experience and your financial outcomes.

Getting Started: Your Path to January Gold and Jewelry Sales

Taking the first step toward liquidating gold coins, luxury watches, or fine jewelry requires minimal effort when you work with professional buyers. Most established operations offer free, no-obligation evaluations either in person or through secure shipping arrangements. This initial assessment provides crucial information about your items' current market values without any commitment to sell, allowing you to make informed decisions about timing and pricing.

Preparing for evaluation involves gathering any documentation you have for your items: certificates, receipts, appraisals, boxes, or papers. While not always necessary, this information supports authentication and can enhance values. For jewelry, understanding precious metal content (if known) helps, though professional testing will verify purity regardless. Watch owners should note any service history, as maintenance records affect valuations for mechanical timepieces.

The January timing advantage means acting now positions you optimally for 2026 returns. Whether you received gold coins as holiday gifts, inherited jewelry you'd like to liquidate, or you're evaluating luxury watches in your collection, professional evaluation provides the clarity you need to make confident decisions.

Your Next Steps to Strategic Liquidation

The post-holiday season presents a unique opportunity to transform luxury assets into working capital while optimizing your 2026 financial position. From gold coins and precious metals to luxury watches and designer jewelry, January offers distinct timing advantages for strategic sellers. Professional evaluation, competitive pricing, and secure transactions ensure you maximize returns while protecting your interests throughout the process.

At Sell Us Your Jewelry, we bring decades of expertise to precious metals, luxury watches, and fine jewelry evaluation. Our team includes master-trained watchmakers and experienced gemologists who provide accurate assessments and fair pricing for all luxury items. Whether you're in South Florida and can visit our Surfside showroom or you're located elsewhere in the United States, we offer comprehensive services designed for your convenience.

Ready to explore what your gold coins, luxury watches, or fine jewelry could bring in today's market? Get your free, no-obligation evaluation today:

- Sell your luxury watch - Professional evaluation for Rolex, Patek Philippe, Omega, and all Swiss timepieces

- Sell your fine jewelry - Expert assessment for gold, designer pieces, and precious metals

- Sell your GIA-certified diamonds - Specialized evaluation for certified stones and engagement rings

- Sell your sterling silver - Fair pricing for flatware, decorative pieces, and silver jewelry

Discover how our streamlined process works by visiting our How It Works page, or learn more about the luxury brands we buy. With convenient locations in South Florida and secure shipping options nationwide, turning your luxury assets into cash has never been easier.

Take advantage of January's strategic timing and contact us today to begin your evaluation. Your pathway to maximum 2026 returns starts with a simple, no-obligation assessment of your valuable items.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG