February 4th, 2026

Last 48 Hours: Maximizing Your 2025 Tax Strategy Through Luxury Watch and Diamond Sales Before December 31st

As December 31st rapidly approaches, many luxury asset owners are discovering a unique opportunity to optimize their financial positioning before the calendar turns. Whether you're considering the decision to sell your watch or liquidate high-value diamond jewelry, the final hours of 2025 present a strategic window for those looking to convert luxury assets into cash while potentially capturing tax benefits. At Sell Us Your Jewelry, we're experiencing an influx of inquiries from savvy individuals who understand that timing can make a significant difference in their year-end financial planning.

The urgency of year-end asset liquidation goes beyond simple financial planning—it represents a chance to reassess your portfolio of luxury items and make strategic decisions about pieces you no longer wear or need. For those searching for a jewelry buyer near me or wondering where to sell Rolex near me, the remaining hours before year-end offer a practical deadline that can motivate action on items that have sat idle in safe deposit boxes or jewelry drawers for years.

Understanding Year-End Financial Positioning Through Luxury Asset Sales

Year-end financial planning often involves reviewing your entire asset portfolio, and luxury items represent a unique category that many overlook. High-value timepieces and fine jewelry can constitute significant portions of personal wealth, yet these assets generate no income while sitting unused. The decision to liquidate such items before December 31st can provide immediate liquidity that may be strategically advantageous for various financial planning purposes, from rebalancing portfolios to managing cash flow needs.

For those considering selling luxury watches or diamond jewelry, understanding the current market dynamics is crucial. The pre-owned luxury watch market has stabilized significantly, moving away from speculative trading toward genuine collector interest. This shift has created a more predictable pricing environment, making year-end sales more reliable for those who need certainty in their transactions. Whether you're looking to sell Patek Philippe watch pieces or diamond engagement rings, current market conditions favor transparent, professional transactions.

Our streamlined selling process is designed specifically for time-sensitive situations. We understand that the final days of December bring unique urgency, and our expert team is prepared to provide rapid evaluations and competitive offers. For South Florida residents in areas like Boca Raton, Miami, or Bal Harbour, our Surfside showroom remains open to serve sellers who prefer in-person transactions, while our online platform accommodates sellers throughout the United States.

The Strategic Advantage of Pre-Owned Luxury Watch Sales

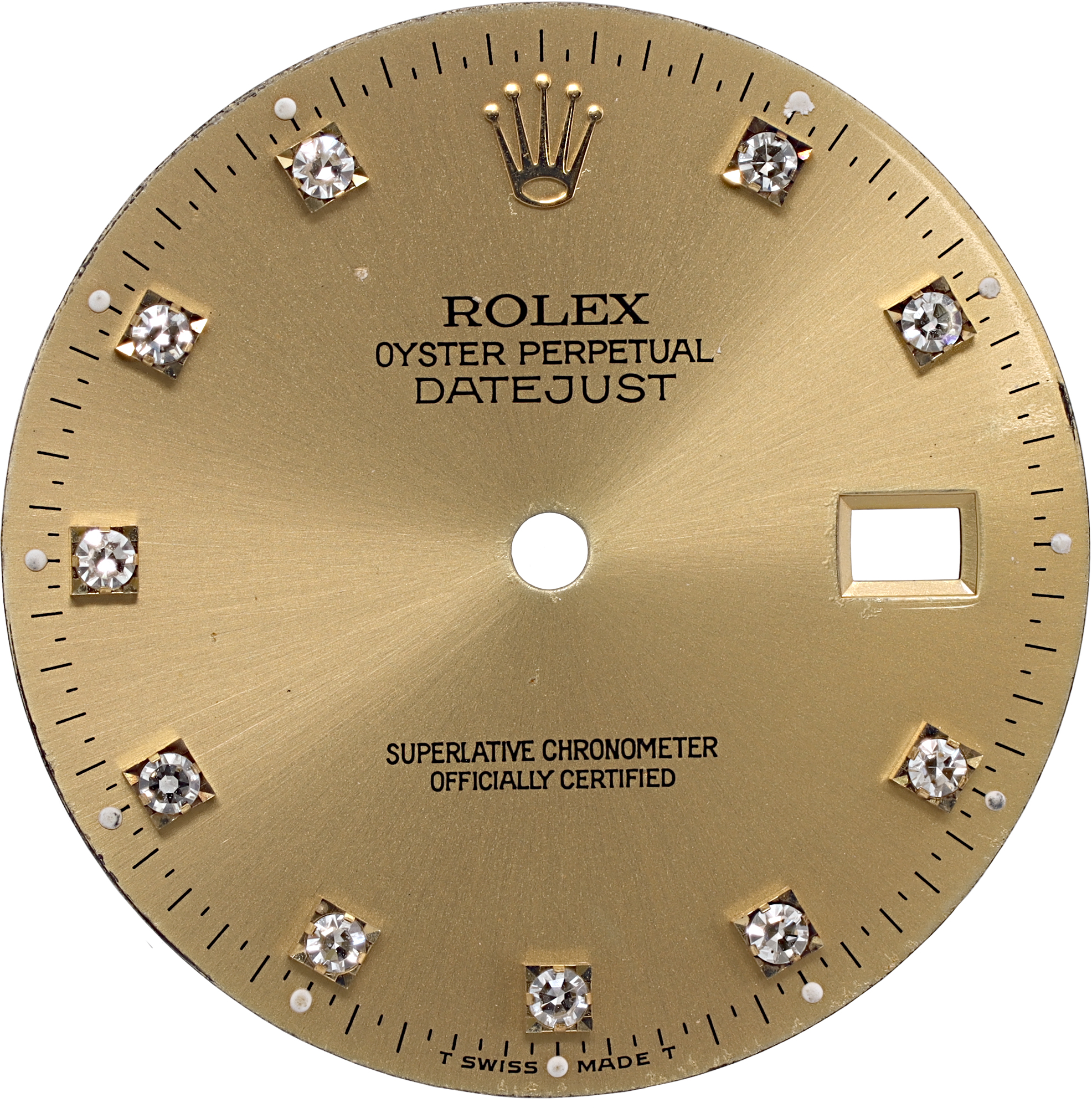

The luxury watch market has experienced notable shifts in 2025, with certain brands and models commanding particularly strong buyer interest. Rolex buyers continue to seek specific references, particularly sports models like the Submariner and GMT-Master, while collectors are increasingly drawn to brands like Patek Philippe and Omega. For those who have been considering when to sell my Rolex or liquidate other premium timepieces, current market conditions present favorable opportunities.

Geographic convenience matters when time is limited. For sellers throughout South Florida, specialized regional services provide rapid access to expert evaluation. Whether you're searching for a Boca Raton Rolex buyer, Miami Patek Philippe buyer, or West Palm Beach Breitling buyer, proximity to knowledgeable professionals can accelerate the transaction timeline significantly. Our established presence in the South Florida luxury market, combined with our national reach, ensures that sellers anywhere can access our expertise efficiently.

The types of watches commanding strong market interest include iconic references across multiple brands. Collectors seeking to sell Rolex Submariner models, particularly two-tone variations, find ready buyer interest. Similarly, those looking to sell Omega watch pieces, especially models with popular blue dials, benefit from current trend dynamics. Even specialized pieces like the Rolex Milgauss or vintage Patek Philippe Nautilus models find engaged buyers when offered through reputable channels.

Our watch evaluation service provides comprehensive assessments that consider current market trends, condition, provenance, and completeness of accessories. For those wondering about specific models—whether you want to sell Breitling watch pieces, sell Panerai Radiomir watches, or liquidate other premium brands—our expertise extends across the full spectrum of Swiss luxury watchmaking. We purchase timepieces from manufacturers including Audemars Piguet, Vacheron Constantin, Jaeger LeCoultre, and many others.

Diamond Jewelry Liquidation: Maximizing Value in Limited Time

Diamond jewelry represents another category of luxury assets that many individuals consider liquidating during year-end financial planning. Whether you're looking to sell diamond engagement ring pieces following life changes, or you've inherited estate jewelry that no longer suits your lifestyle, the remaining hours of 2025 provide a meaningful deadline for taking action. The market for high-quality diamonds, particularly those with GIA certification, remains robust throughout the year-end period.

Understanding what makes diamond jewelry valuable is essential for maximizing returns. GIA certification provides independent verification of diamond quality characteristics, establishing clear benchmarks for evaluation. When you decide to sell 1 carat diamond engagement ring online or liquidate larger stones, documentation becomes crucial. Our evaluation process for GIA-certified diamonds considers the complete picture: carat weight, color, clarity, and cut quality, along with current market demand for specific diamond profiles.

Geographic specialization extends to diamond buying as well. Sellers searching for expertise in selling diamond rings in Boca Raton, Miami, or Brickell Avenue benefit from our established South Florida presence and reputation. Similarly, those in other markets including Fort Myers and Hollywood can access our services either in person or through our secure online platform. The convenience of working with an online diamond jewelry buyer who maintains professional standards and transparent pricing cannot be overstated, particularly when time constraints exist.

Beyond engagement rings, we purchase various categories of diamond jewelry. Whether you're looking to sell diamond eternity bands, sell diamond eternity rings, or liquidate other diamond-set pieces, our expertise encompasses the full range of fine jewelry. Designer pieces from houses like Tiffany & Co., Cartier, Van Cleef & Arpels, and Harry Winston command particular interest when properly authenticated and in excellent condition.

Designer Jewelry and Estate Pieces: Capturing Hidden Value

Many individuals overlook the significant value contained in designer jewelry collections accumulated over years or inherited from family members. Pieces from renowned jewelry houses often retain substantial resale value, particularly when they feature recognizable designs and superior craftsmanship. For those considering whether to sell Cartier jewelry, sell Tiffany and Co jewelry, or liquidate other designer pieces, year-end provides an opportune moment for comprehensive portfolio review.

Cartier pieces consistently command strong buyer interest across multiple categories. Whether you're looking to sell Cartier bracelets like the iconic Juste un Clou or Love collections, sell Cartier rings, or sell Cartier necklace pieces, the market recognizes the enduring appeal of this legendary French house. Beyond jewelry, Cartier accessories including Cartier Panthère timepieces, Cartier Santos watch models, and even Cartier sunglasses find ready buyers when offered through appropriate channels.

The David Yurman market presents another strong category for sellers. Those looking to sell David Yurman jewelry—whether bracelets, rings, necklaces, pendants, or earrings—benefit from this brand's distinctive cable motif and consistent design language. Signature pieces like the Albion ring David Yurman collection maintain strong recognition and buyer interest. Similarly, Van Cleef & Arpels pieces across all categories (bracelets, necklaces, pendants, rings, and earrings) represent highly sought-after luxury items.

Our jewelry evaluation service extends to numerous other prestigious brands. For those wondering whether to sell Bvlgari jewelry (including bracelets, necklaces, rings, pendants, and earrings), sell Chopard pieces, or liquidate Roberto Coin designs across various collections (Animalier, Classica Parisienne, Palazzo Ducale, Princess Flower, Venetian Princess), our expertise ensures accurate valuation. We also purchase Tiffany pieces across all categories—bracelets, necklaces, rings, pendants, earrings, charms, brooches, and signature collections like Elsa Peretti designs, Tiffany Keys, and Paper Flowers.

Estate Jewelry and Sterling Silver: Overlooked Assets with Immediate Liquidity

Estate jewelry represents a category that many inheritors struggle to evaluate and liquidate. When you sell grandmothers estate jewelry online or liquidate inherited collections, you're often dealing with pieces that combine sentimental history with tangible monetary value. Our specialists understand the sensitivity required when handling family heirlooms, and we're committed to providing fair evaluations that honor both the craftsmanship and the materials involved.

Beyond jewelry, sterling silver flatware and hollowware constitute another frequently overlooked asset category. For those wondering about the fastest way to sell silver in Hollywood or anywhere else in South Florida, understanding current precious metal values is essential. Our role as a sterling silver flatware buyer extends to complete sets, partial services, and individual pieces from manufacturers like Cartier flatware and other prestigious silversmiths. The convenience of working with an established silver buyer who can provide immediate evaluations and competitive offers based on current metal prices eliminates the uncertainty often associated with precious metal sales.

Our sterling silver evaluation service considers both precious metal content and potential collector value for particularly notable patterns or manufacturers. Geographic accessibility matters here as well, with sellsilver Florida services available through our Surfside location for in-person transactions or via secure shipment for sellers throughout the country. The year-end deadline provides natural motivation for liquidating silver items that no longer serve practical purposes in your home.

For those managing estates or downsizing, the comprehensive approach we offer through our various services addresses multiple asset categories simultaneously. Whether you need to sell estate jewelry Orlando or liquidate collections in other markets, our national reach combined with local expertise ensures professional handling regardless of location. Understanding what are you looking to sell helps us tailor our approach to your specific needs and timeline.

Regional Expertise: South Florida's Premier Luxury Asset Buyer

Geographic specialization provides significant advantages when selling luxury items, particularly under time constraints. Throughout South Florida, from Bal Harbour to Boca Raton, from Coral Gables to Key Biscayne, our reputation as a trusted buyer spans decades. For sellers in these communities seeking a Bal Harbour Rolex watch buyer or Bay Harbour Cartier watch buyer, proximity to our Surfside showroom offers convenience without sacrificing the professional expertise these transactions demand.

The concentration of luxury asset owners throughout South Florida creates unique market dynamics. Whether you're searching for a Boca Raton Patek Philippe buyer, Coral Gables Cartier watch buyer, or Fort Myers Rolex watch buyer, understanding local market conditions and buyer preferences enhances transaction efficiency. Our established presence serves collectors and asset owners throughout the region, from Hollywood Patek Philippe buyer needs to Sunny Isles Patek Philippe buyer services, Miami Cartier watch buyer transactions to Aventura Patek Philippe buyer requirements.

Beyond South Florida's Gold Coast, our services extend to Gulf Coast markets as well. Sellers in Naples seeking to sell Omega pieces or other luxury timepieces benefit from the same expertise and competitive pricing we offer throughout the region. Similarly, those in West Palm Beach looking for West Palm Beach Patek Philippe buyer services or Breitling buyer expertise can access our team through multiple convenient channels.

The regional expertise we've developed over decades goes beyond simple geographic presence. Understanding the specific concerns of South Florida luxury asset owners—from seasonal residents managing multiple properties to individuals navigating life transitions—allows us to provide services genuinely tailored to regional needs. Our role as the mejor comprador de joyas de lujo (best luxury jewelry buyer) in the Hispanic community reflects our commitment to serving South Florida's diverse population with professionalism and cultural sensitivity.

Navigating the Sales Process: Speed, Security, and Transparency

When time is limited, understanding exactly how the sales process works becomes crucial. Our commitment to transparency begins with how it works—a straightforward explanation of our evaluation and purchasing process. For sellers wondering where to sell a Rolex or how to liquidate other luxury items quickly, our approach eliminates common frustrations associated with private sales, auction houses, or less established buyers.

The evaluation process begins with information gathering. For watches, we need to understand brand, model, reference number, condition, and whether original boxes and papers are available. For jewelry and diamonds, we assess materials, gemstone quality, designer attribution, and condition. Our online quote system allows sellers anywhere in the United States to initiate the process conveniently, while South Florida residents can visit our showroom for in-person evaluation. Whether you're looking to sell your watch through our online platform or prefer face-to-face interaction, we accommodate both approaches professionally.

Security concerns naturally arise when shipping valuable items or meeting buyers in person. Our decades-long reputation, backed by our association with Gray & Sons (a trusted name in luxury since 1980), provides assurance that transactions will be handled professionally. For those using our shipping option, we provide detailed instructions for secure packaging and fully insured transit. For in-person transactions at our Surfside location across from Bal Harbour Shops, our professional environment ensures comfortable, secure exchanges.

Transparency in pricing sets reputable buyers apart from less scrupulous operators. When you request a quote—whether through our watch quote service, jewelry quote system, or engagement ring quote platform—we provide clear explanations of how we arrived at our offer. Understanding the value of pre-owned luxury watch pieces or diamond jewelry requires considering multiple factors, and we ensure sellers comprehend the basis for our evaluations.

Making the Decision: Considerations for Year-End Liquidation

The decision to liquidate luxury assets before year-end involves multiple considerations beyond simple financial calculation. For many, these items carry emotional significance—engagement rings from ended relationships, watches inherited from beloved relatives, or gifts that no longer align with personal style. Understanding these emotional dimensions helps explain why the year-end deadline provides useful motivation for decisions that might otherwise be indefinitely postponed.

Life transitions frequently trigger the decision to sell luxury items. Those recently divorced often search for ways to sell wedding ring pieces or engagement rings that represent chapters they're closing. Estate executors managing inherited collections need efficient methods to liquidate assets fairly for beneficiaries. Collectors downsizing or refocusing their collections seek reliable buyers who understand the items' true value. Financial challenges sometimes necessitate converting luxury assets to cash quickly. In each case, reasons to sell your jewelry extend beyond pure financial calculation to encompass life circumstances that make liquidation appropriate.

For those still uncertain, considering things you can do with your old jewelry helps clarify options. Beyond selling outright, some items might be suitable for redesign or repurposing, though these approaches don't provide the immediate liquidity that year-end liquidation delivers. Understanding the full range of possibilities, from selling your pre-owned luxury watch to exploring consignment options for particularly rare or valuable pieces, ensures you make informed decisions aligned with your circumstances and goals.

The physical condition of items sometimes concerns sellers wondering whether to proceed. It's worth emphasizing that we buy broken watches and jewelry in any condition. Even non-functional timepieces contain valuable movements and materials, while damaged jewelry retains precious metal and gemstone value regardless of condition. This means that items you might assume are worthless could still generate meaningful returns when evaluated by knowledgeable professionals.

Alternative Selling Channels: Why Direct Sales to Established Buyers Make Sense

Many sellers consider alternative channels before ultimately choosing direct sales to established buyers. Understanding why platforms like selling jewelry watches on eBay Craigslist often prove frustrating helps explain the value of working with professional buyers. Online marketplaces expose you to fraud risk, require significant time investment for photographs and listings, and rarely deliver fair market value after fees and shipping costs. Private sales eliminate middleman fees but expose you to safety concerns and challenging negotiations with buyers who may lack expertise or genuine purchasing intent.

Auction houses represent another alternative frequently considered for high-value items. While auctions can occasionally deliver exceptional results for particularly rare pieces, they involve extended timelines incompatible with year-end deadlines, charge substantial seller premiums, and provide no guarantee of sale. For most sellers, the solution to selling your jewelry and watches involves direct sale to established buyers who can provide immediate liquidity and competitive pricing without extended uncertainty.

Consignment represents a hybrid approach suitable for specific circumstances. When you sell pawn consign used luxury watch pieces through our services, we handle marketing and sales on your behalf while you retain ownership until sale. This approach potentially delivers higher returns for particularly desirable pieces but extends the timeline and doesn't provide immediate liquidity. For year-end planning, understanding when consignment makes sense versus direct sale helps optimize outcomes based on your specific circumstances and timeline requirements.

Professional expertise in authentication also distinguishes established buyers from alternative channels. For sellers concerned about how to spot fake watch buyers or worried about dealing with less reputable operators, our decades-long track record and association with Gray & Sons provides assurance. We focus exclusively on authentic luxury items, ensuring that legitimate sellers receive fair treatment while protecting the broader market from counterfeit infiltration.

The Value Proposition: Why Sellers Choose Sell Us Your Jewelry

Our value proposition to sellers centers on three core elements: expertise, efficiency, and fair pricing. The expertise we bring to evaluations stems from decades of specialization in luxury watches, fine jewelry, diamonds, and precious metals. Our team includes master-trained watchmakers, experienced jewelers, and gemologists who understand how to properly assess and value luxury items across all categories. Whether you're looking to sell my watch, sell my diamond engagement ring, or liquidate other assets, this expertise ensures accurate evaluations.

Efficiency matters particularly for time-sensitive transactions like year-end sales. Our streamlined process moves quickly from initial inquiry to final payment, accommodating sellers who need rapid resolution. For those searching for the easiest way to sell your jewelry online or the fastest path to liquidating luxury watches, our approach eliminates common delays and complications. Online sellers can receive preliminary quotes within hours, while in-person evaluations at our Surfside showroom provide same-day offers for most items.

Fair pricing reflects our commitment to long-term reputation over short-term profit maximization. As a division of Gray & Sons, a respected name in luxury since 1980, we understand that treating sellers fairly generates the referrals and repeat business that sustain multi-generational enterprises. Our pricing reflects current market conditions, item condition, and completeness, providing offers that allow us to resell items profitably while ensuring sellers receive competitive value. This balance explains why so many sellers specifically seek us out when deciding where can I sell my watch or jewelry.

Special Considerations for High-Value Timepieces

Certain timepiece categories require particular expertise to evaluate properly. For those looking to sell Patek Philippe Nautilus models or sell Patek Philippe perpetual calendar complications, understanding the nuances that distinguish particular references and production years becomes essential. Similarly, collectors wondering whether to sell Audemars Piguet Royal Oak Offshore pieces or other complicated timepieces benefit from working with buyers who truly understand what makes these watches valuable.

The market for specific complications and limited editions requires specialized knowledge. Whether you're looking to sell my Jules Audemars pieces, sell my Edward Piguet watches, or liquidate other complicated timepieces from prestigious manufacturers, working with buyers who understand these specialized segments ensures fair valuation. Our expertise extends across independent manufacturers as well—for those wondering whether to sell my A Lange Sohne watch, sell my Blancpain watch, or sell my Breguet watch, we provide the same careful evaluation we apply to more mainstream luxury brands.

Even within single brands, different model lines command varying market interest. For Rolex sellers, understanding whether you're looking to sell Rolex GMT Master pieces, sell Rolex Sea Dweller models, or deal with specific Rolex Submariner two tone references helps set realistic expectations. Similarly, those considering whether to sell Aquanaut models from Patek Philippe or specific Omega Speedmaster references benefit from market intelligence about current demand trends and pricing dynamics.

Comprehensive Brand Coverage: From Mainstream Luxury to Independent Manufacturers

Our purchasing interest spans the full spectrum of Swiss and international luxury watchmaking. Beyond the mainstream luxury brands most sellers recognize, we actively purchase timepieces from independent manufacturers and smaller production houses. For those wondering whether to sell my Panerai watch pieces, sell my Piaget watch models, sell my Ulysse Nardin watch timepieces, or sell my Zenith watch pieces, our interest extends well beyond the most recognizable names.

Designer watch brands from luxury houses also command our attention. Sellers looking to sell my Chanel watch pieces, sell my Bvlgari watch models, or sell my Tiffany and Co watch timepieces find ready buyer interest when these items combine precious materials with proper authentication. Similarly, those considering whether to sell my Cartier jewelry alongside Cartier timepieces benefit from our comprehensive understanding of this legendary French house's full product range.

Sports watch specialists from manufacturers like Tudor also merit mention. For those wondering whether to sell my Tudor watch pieces—whether vintage references or modern Black Bay models—understanding this brand's relationship to Rolex and its independent collector following helps explain sustained market interest. Similarly, Tag Heuer pieces, particularly certain vintage references and limited editions, find appropriate valuation through knowledgeable buyers who understand this brand's evolution and collector base.

Our comprehensive approach to brands we buy ensures that sellers with diverse collections can consolidate transactions through a single buyer rather than seeking multiple specialists. This efficiency proves particularly valuable during time-sensitive year-end liquidation when coordinating with numerous buyers would consume precious time.

Taking Action: Your Final Hours to Complete Year-End Transactions

With December 31st approaching rapidly, taking action now becomes essential for those considering year-end luxury asset liquidation. The process begins simply—whether you visit our Surfside showroom, call our team, or use our online quote systems, initiating contact represents the crucial first step. For watch buyers near me searches or inquiries about jewelry buyers near me, understanding that we serve both local South Florida clients and sellers nationwide through our online platform expands your options significantly.

The urgency of these final hours shouldn't create pressure to accept unfair offers or work with questionable buyers. Even under time constraints, due diligence matters. Our established reputation, transparent processes, and fair pricing ensure that urgency doesn't force you to compromise on transaction quality. For those asking where do I sell my Rolex or seeking the best place to sell my Rolex, reputation and expertise should guide selection even when time is limited.

Taking inventory of what you're considering selling helps streamline the process. Gathering relevant documentation—original boxes, papers, receipts, certificates—enhances value and speeds evaluation. For items lacking complete documentation, honest disclosure about what you have available allows us to provide accurate preliminary quotes and set appropriate expectations. Whether you're preparing to sell my ring, sell my Rolex, or liquidate multiple items simultaneously, organization accelerates the timeline.

Conclusion: Seize the Year-End Opportunity

The remaining hours of 2025 present a unique window for luxury asset owners to act on decisions that might otherwise be indefinitely delayed. Whether you're motivated by year-end financial planning, life transitions, portfolio rebalancing, or simply the desire to convert unused luxury items into liquid assets, the December 31st deadline provides practical urgency. At Sell Us Your Jewelry, we're committed to making these time-sensitive transactions as smooth, secure, and rewarding as possible.

Our expertise in evaluating and purchasing luxury watches, fine jewelry, GIA-certified diamonds, estate pieces, and precious metals positions us to serve sellers' diverse needs comprehensively. Whether you're in South Florida and can visit our Surfside showroom or you're selling from anywhere in the United States through our online platform, we provide the same professional service, fair pricing, and transparent processes that have built our reputation over decades.

Don't let another year pass while valuable luxury items sit unused. Consider to sell your watch, jewelry, diamonds, or precious metals now, capturing the strategic advantages that year-end liquidation provides. Contact our team today—time is running out to complete your 2025 financial planning through luxury asset optimization.

Ready to Turn Your Luxury Items Into Cash Before Year-End?

Start your evaluation now:

- Get an instant watch quote for Rolex, Patek Philippe, Omega, and other luxury timepieces

- Request a jewelry evaluation for designer pieces, estate collections, and fine jewelry

- Receive a diamond quote for GIA-certified diamonds and engagement rings

- Evaluate your sterling silver flatware and hollowware

Visit us in person: Our Surfside showroom, located across from Bal Harbour Shops, welcomes South Florida sellers for same-day evaluations and immediate payment.

Learn more about our services:

- Discover how our streamlined process works

- Review the comprehensive list of brands we buy

- Explore specialized services for selling or consigning luxury watches in Miami

Time is running out—contact Sell Us Your Jewelry today and maximize your 2025 tax strategy through professional luxury asset liquidation.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG