January 26th, 2026

Seven Days to Savings: Strategic Gold Coin and Precious Metals Liquidation Before December 31st Tax Deadline

As the calendar year draws to a close, many owners of luxury assets find themselves considering strategic financial moves before the December 31st tax deadline. If you're looking to sell gold, liquidate precious metals, or convert gold jewelry into cash, the final week of the year presents unique opportunities for tax planning and portfolio rebalancing. Understanding how to navigate this critical timeframe can help you maximize returns while meeting important financial deadlines.

The year-end period offers a valuable window for individuals holding gold coins, bullion, sterling silver, and precious metal jewelry to make informed decisions about their assets. Whether you're an estate executor finalizing year-end accounts, a collector rebalancing your portfolio, or someone facing financial transitions, knowing where to find reputable gold buyers near me becomes essential during this crucial seven-day countdown.

Understanding Year-End Precious Metals Liquidation

The December 31st deadline carries significant weight for tax planning purposes, particularly when dealing with collectible assets like gold coins and precious metals. Capital gains or losses from the sale of these items must be reported for the tax year in which they're sold, making timing a crucial consideration. Many financial advisors recommend evaluating your precious metals holdings before year-end to strategically position your tax situation.

Gold coins, whether American Eagles, Canadian Maple Leafs, or historic numismatic pieces, fall under specific IRS guidelines as collectibles. The same applies to gold jewelry, silver flatware, and bullion bars. Understanding the tax implications of selling these items allows you to make informed decisions that align with your broader financial strategy. Our experienced team provides transparent evaluations to help you understand the true market value of your holdings.

For those searching for a trusted gold jewelry buyer sell gold jewelry service, working with established professionals ensures you receive competitive pricing based on current precious metals markets. At Sell Us Your Jewelry, our expert evaluators provide thorough assessments of gold content, weight, and market value, ensuring you understand exactly what your items are worth before making any decisions.

The Strategic Advantage of December Liquidation

Timing your precious metals sale in late December offers several strategic advantages beyond tax considerations. The year-end period typically sees increased activity in precious metals markets as institutional investors and collectors finalize their annual positions. This heightened market activity can work to your advantage when seeking competitive offers for your gold coins, bullion, or precious metal jewelry.

Additionally, liquidating assets before December 31st provides you with immediate access to capital that can be redirected toward other investments or financial priorities for the new year. Whether you're looking to rebalance your investment portfolio, address unexpected expenses, or simply convert non-performing assets into liquid funds, the year-end timeframe offers clarity and closure for your financial planning.

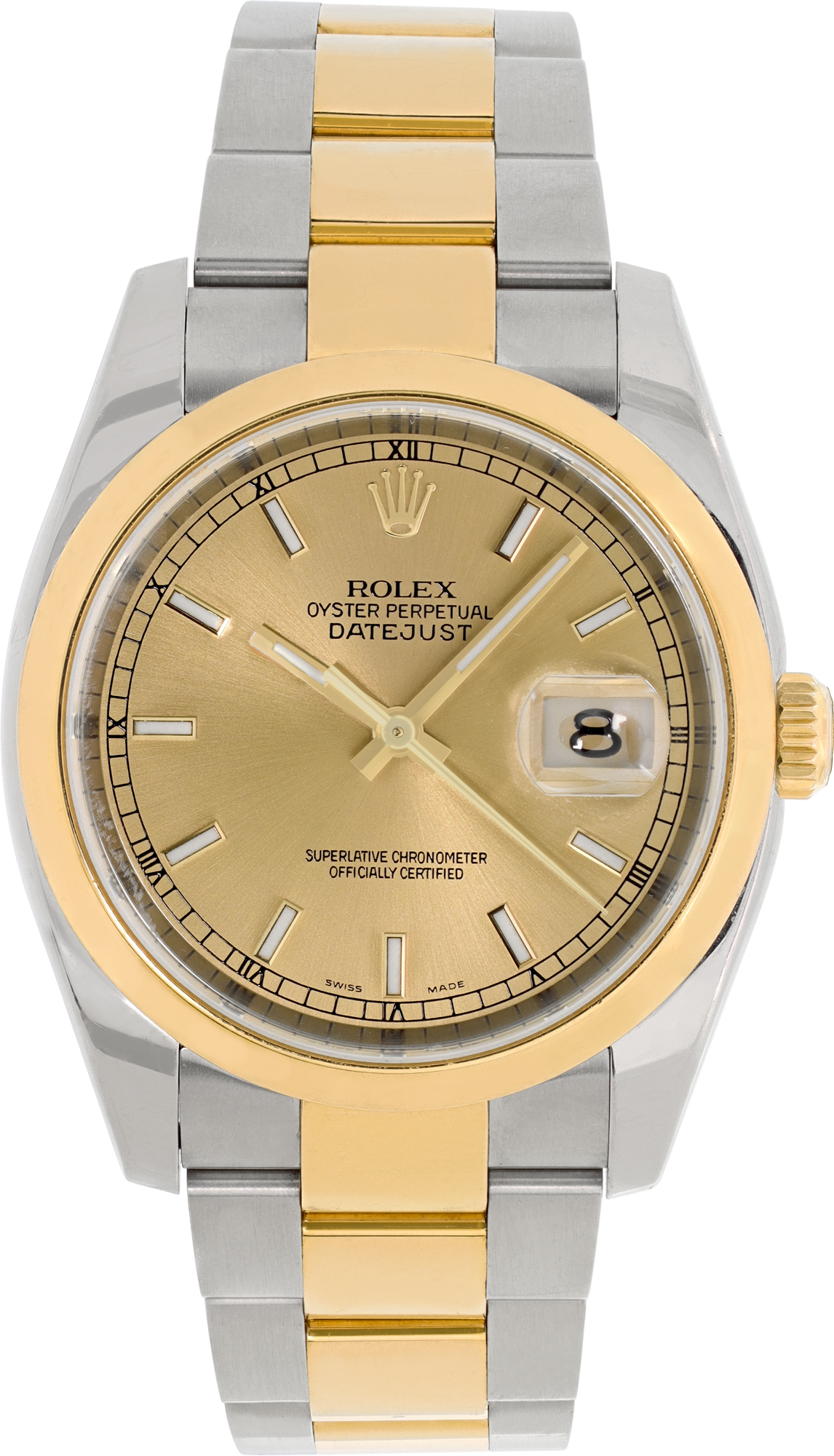

If you're wondering about where to sell a rolex or other luxury items alongside your precious metals, consider working with buyers who understand multiple asset classes. Our expertise extends beyond gold and silver to include luxury watches, estate jewelry, and GIA-certified diamonds, allowing you to consolidate multiple transactions with a single trusted partner.

Gold Coins and Bullion: What Buyers Look For

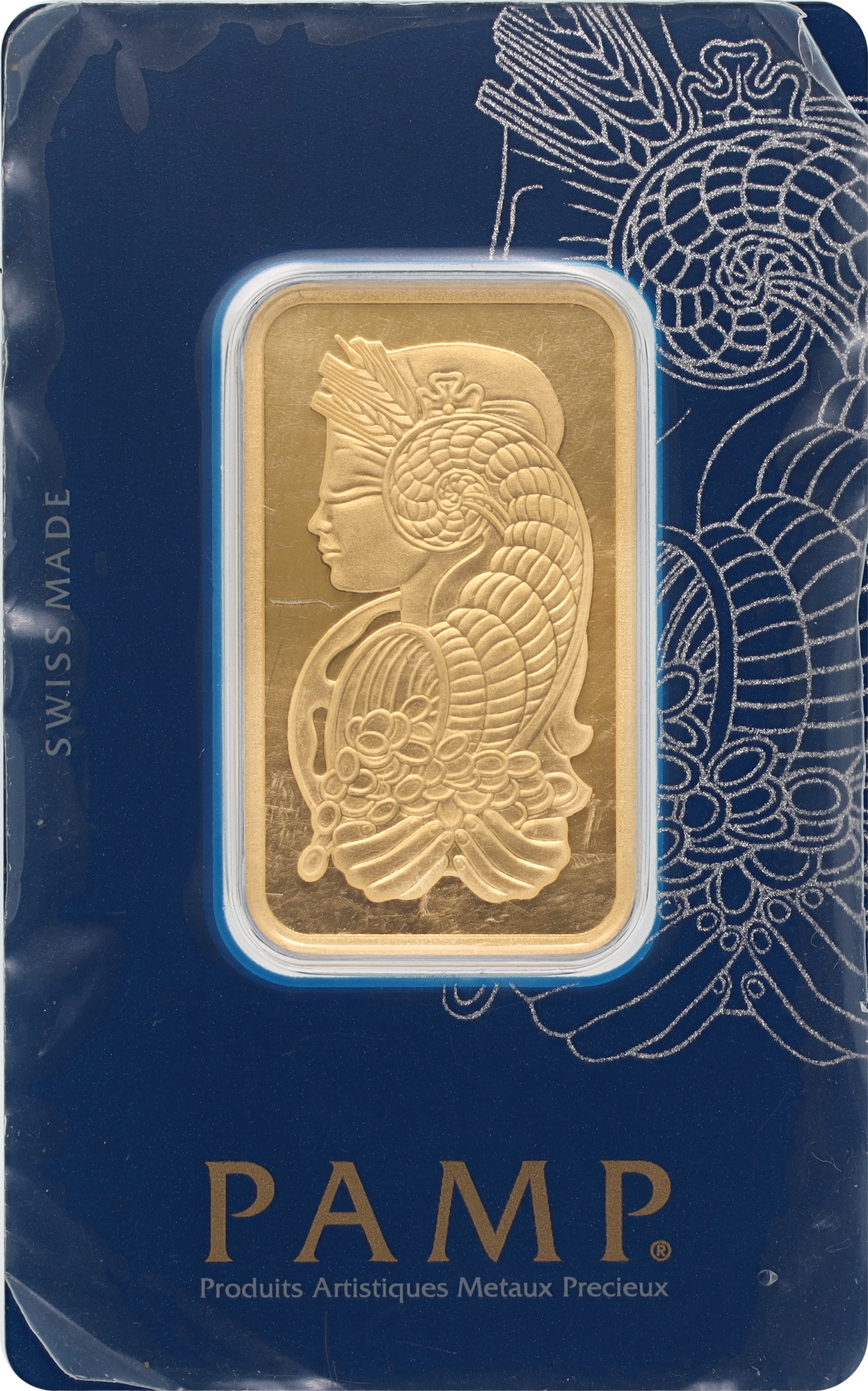

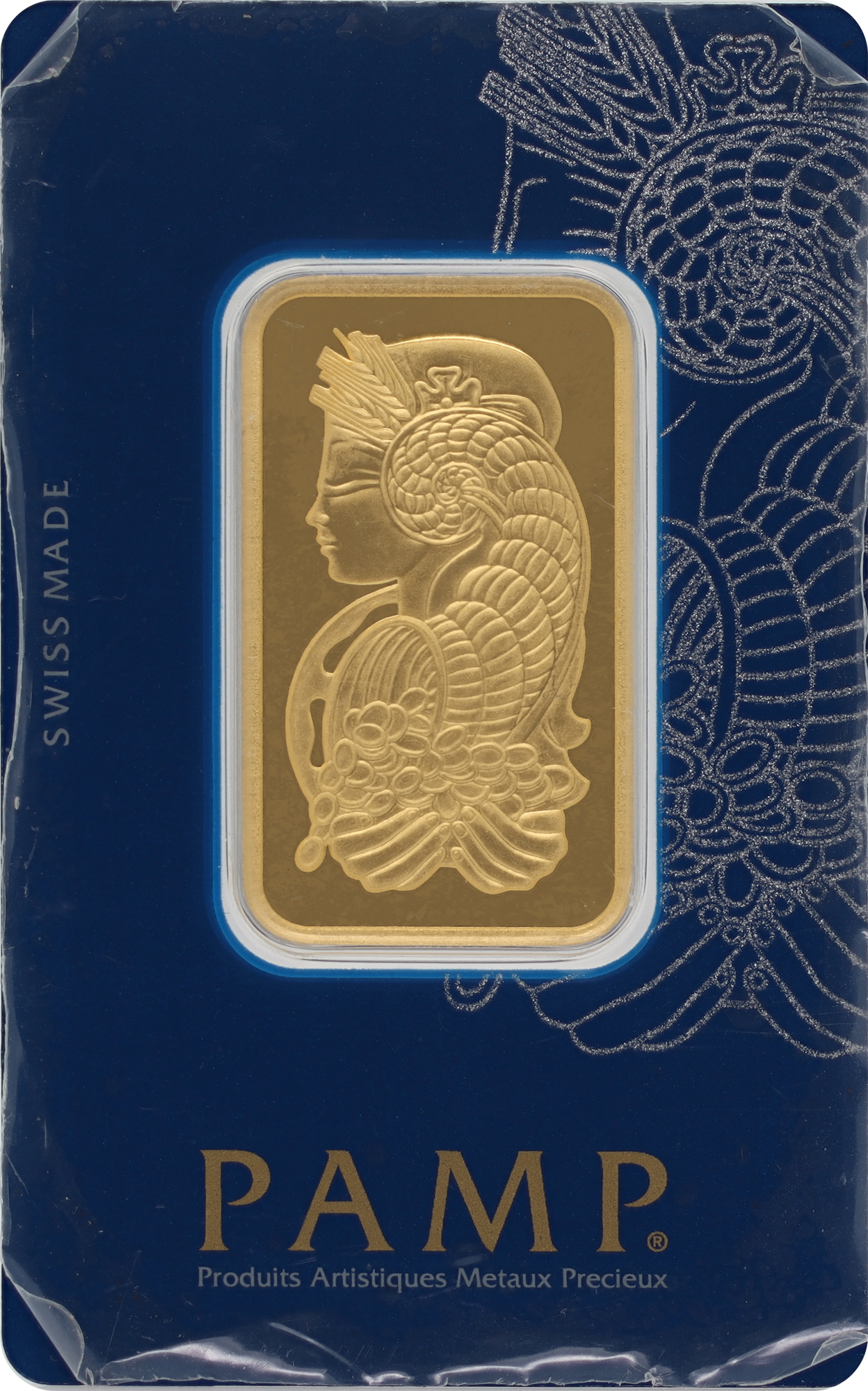

When evaluating gold coins for purchase, professional buyers consider several critical factors that determine value. Purity levels, typically expressed in karats for jewelry or fineness for coins and bullion, directly impact the intrinsic metal value. Weight measurements in troy ounces for coins and bars, or grams for jewelry, establish the baseline precious metal content. Market premiums for certain coins, such as rare dates or limited mintages, can significantly increase value beyond the base gold content.

Condition matters, particularly for numismatic gold coins where wear, damage, or cleaning can affect collectible value. However, even damaged or broken gold jewelry retains full melt value based on its gold content. Our evaluators use precise testing methods, including X-ray fluorescence (XRF) analysis, to accurately determine gold purity and weight, ensuring you receive fair market value for your items regardless of condition.

Common gold coins we purchase include American Gold Eagles, American Gold Buffalo coins, Canadian Gold Maple Leafs, South African Krugerrands, and various historic gold pieces. For gold jewelry, we evaluate items of all karats—10K, 14K, 18K, 22K, and 24K—including broken chains, single earrings, and outdated styles. The actual gold content determines value, making even damaged pieces valuable to sell gold for immediate cash.

Sterling Silver and Precious Metals: Beyond Gold

While gold often captures the spotlight, sterling silver represents another significant category of precious metals many people hold without fully appreciating its value. Sterling silver flatware sets, tea services, decorative items, and jewelry all contain valuable silver content that can be liquidated for immediate cash. For Florida residents specifically searching sellsilver florida options, understanding local market dynamics and finding reputable buyers becomes essential.

Sterling silver's value derives from both its precious metal content and, in certain cases, its collectible or antique status. Signed pieces from renowned silversmiths like Tiffany & Co., Gorham, or Georg Jensen may command premiums beyond melt value. Our evaluators assess each piece individually, considering both precious metal content and potential collector interest to ensure you receive the maximum possible offer.

Those seeking the fastest way to sell silver in hollywood or throughout South Florida can benefit from our streamlined evaluation process. We provide immediate assessments of silver content, weight, and market value, with offers extended on the spot for items we purchase. For those interested in exploring similar services for other luxury items, our sterling silver flatware buyer expertise extends to comprehensive evaluations of complete silver services and individual pieces.

The Seven-Day Timeline: Maximizing Your Year-End Sale

With just seven days remaining until December 31st, understanding the timeline for precious metals liquidation becomes crucial. Day one should focus on inventory assessment—gathering all gold coins, jewelry, silver items, and bullion you're considering selling. Organize items by category and note any original purchase documentation, certificates of authenticity, or appraisals you may have.

Days two and three represent the evaluation phase. Contact reputable buyers to schedule assessments and obtain preliminary quotes. For those unable to visit in person, many established buyers offer free, insured shipping for valuable items. Day four involves comparing offers and selecting your preferred buyer based on reputation, pricing, and transaction terms. Days five and six finalize the transaction, with payment typically processed immediately upon acceptance of the offer.

This timeline allows for day seven as a buffer for any unexpected complications while still meeting the December 31st deadline. Our team understands the time-sensitive nature of year-end transactions and prioritizes expedited evaluations for clients working within this critical timeframe. Whether you're looking to sell your jewelry or liquidate precious metals, we streamline the process without compromising thoroughness.

Working with Established Precious Metals Buyers

Selecting the right buyer for your gold coins, precious metals, and jewelry significantly impacts your experience and financial outcome. Established buyers with decades of experience, like Sell Us Your Jewelry, bring professional expertise, transparent pricing, and secure transaction protocols that protect your interests. Our reputation since 1980 reflects our commitment to fair dealing and customer satisfaction.

Professional buyers provide several advantages over alternative selling channels. We offer immediate cash payment or bank wire transfers, eliminating the uncertainty and delays associated with online marketplaces or consignment arrangements. Our in-house testing capabilities ensure accurate evaluations of precious metal content, while our market expertise allows us to recognize premium items that may hold value beyond melt worth.

For South Florida residents, our Surfside showroom location across from the iconic Bal Harbour Shops provides convenient access to our services. Those searching for miami patek philippe buyer services or evaluations for other luxury items can combine multiple transactions in a single visit. Our comprehensive approach means we can evaluate your estate jewelry, luxury watches, diamonds, and precious metals simultaneously, saving you valuable time.

Beyond Precious Metals: Comprehensive Luxury Asset Liquidation

Many individuals holding gold coins and precious metals also possess other luxury assets they may wish to liquidate before year-end. Fine jewelry featuring diamonds, colored gemstones, or designer signatures from brands like Cartier, Van Cleef & Arpels, or Tiffany & Co. can be evaluated alongside precious metals. Similarly, luxury timepieces from Rolex, Patek Philippe, Omega, and other prestigious Swiss manufacturers represent significant value.

Our expertise spans multiple categories of luxury assets, making us a comprehensive solution for year-end portfolio adjustments. Whether you're looking to sell cartier jewelry, liquidate a rolex submariner buyer might seek, or convert diamond jewelry into cash, our team provides professional evaluations across all categories. This multi-category expertise proves particularly valuable for estate executors managing diverse holdings.

For those managing inherited collections or downsizing estates, our ability to evaluate everything from diamond engagement rings buyer interests to gold coin collections streamlines the liquidation process. Learn more about our comprehensive approach through our brands we buy page, which details the extensive range of luxury items we purchase directly from the public.

Tax Considerations and Documentation

Understanding the tax implications of precious metals sales helps you make informed decisions aligned with your broader financial strategy. The IRS classifies gold coins, bullion, and precious metals as collectibles, subject to specific capital gains treatment. Long-term capital gains on collectibles face a maximum federal rate of 28%, higher than the rates applied to stocks and bonds, making timing and planning particularly important.

Maintaining accurate documentation proves essential for tax reporting purposes. Retain records of your original purchase prices, dates of acquisition, and any improvements or evaluations performed over your ownership period. When you sell, reputable buyers provide detailed documentation of the transaction, including item descriptions, weights, purity assessments, and purchase prices—all critical information for your tax records.

For significant transactions, consulting with a qualified tax professional before selling can help you understand your specific situation's implications. They can advise on strategies such as tax-loss harvesting, where selling items at a loss might offset other gains, or timing considerations that optimize your overall tax position. Our team works transparently, providing all necessary documentation to support your tax reporting requirements.

The Sell Us Your Jewelry Advantage for Precious Metals

As the purchasing and consignment division of Gray & Sons, a trusted name in luxury since 1980, Sell Us Your Jewelry brings unparalleled expertise to precious metals evaluation and acquisition. Our master-trained staff includes specialists in precious metals testing, numismatic evaluation, and luxury jewelry assessment. This comprehensive expertise ensures accurate, fair evaluations that reflect true market value.

Our reputation throughout South Florida extends from Miami to Boca Raton, from Fort Myers to West Palm Beach. Whether you're a boca raton rolex buyer client or someone seeking to liquidate gold coins, our consistent approach to fair dealing and transparent pricing has earned us the trust of thousands of clients. We purchase items in any condition, from pristine collectible gold coins to broken jewelry chains valued solely for gold content.

The convenience we offer proves particularly valuable during time-sensitive year-end transactions. Walk-in evaluations provide immediate assessments, while our free insured shipping program serves clients nationwide who cannot visit our Surfside location. We understand that December's final week brings competing demands on your time, which is why we've streamlined our process to provide efficient service without sacrificing thoroughness.

How to Get Started Before December 31st

Taking action on your precious metals liquidation requires just a few simple steps. Begin by gathering all items you're considering selling—gold coins, jewelry, silver flatware, bullion bars, or other precious metal items. No need for extensive cleaning or preparation; we evaluate items in any condition and assess value based on precious metal content and intrinsic characteristics.

Next, contact us to schedule your evaluation. South Florida residents can visit our Surfside showroom for immediate, in-person assessments. We're conveniently located across from Bal Harbour Shops, easily accessible from Miami, Fort Lauderdale, Boca Raton, and throughout Palm Beach County. For those unable to visit, request a free, fully insured FedEx shipping label through our website to send items securely for evaluation.

Our evaluation process typically takes 24-48 hours once items reach our facility, with offers extended immediately upon completion. You maintain complete control throughout the process—accept our offer for immediate payment, decline and have items returned fully insured, or discuss consignment options for items that might benefit from broader market exposure. Learn more about our straightforward process by visiting our how it works page.

Making Your Year-End Deadline Count

The final seven days before December 31st represent a critical window for strategic financial decisions involving precious metals and luxury assets. Whether you're motivated by tax planning, portfolio rebalancing, or immediate cash needs, professional guidance and efficient service make the difference between meeting your deadline and missing valuable opportunities.

At Sell Us Your Jewelry, we've built our reputation on helping clients navigate time-sensitive transactions with confidence and ease. Our expertise in precious metals, combined with our comprehensive luxury asset knowledge, positions us as your single-source solution for year-end liquidation needs. From gold coins to sterling silver, from broken jewelry to pristine collectibles, we provide fair, transparent evaluations backed by decades of industry experience.

Start Your Year-End Liquidation Today

Don't let the December 31st deadline pass without exploring the value of your precious metals holdings. Whether you're sitting on inherited gold coins, unused silver flatware, broken gold jewelry, or other precious metal items, now is the time to convert these assets into immediate cash.

Ready to get started? Contact Sell Us Your Jewelry today for your complimentary evaluation:

- Visit our Surfside showroom across from Bal Harbour Shops for immediate, in-person evaluations

- Request your free quote for sterling silver items

- Explore selling options for luxury jewelry and fine watches

- Learn about our process and see the comprehensive range of brands we buy

- Get started today by visiting our homepage to begin your selling journey

With seven days until the year-end deadline, time is of the essence. Our experienced team stands ready to provide the professional service, fair pricing, and efficient transaction processing you need to meet your financial goals before December 31st. Whether you're liquidating gold coins, silver flatware, precious metal jewelry, or exploring options for luxury watches and designer jewelry, trust Sell Us Your Jewelry to deliver the expertise and integrity that have defined our reputation since 1980.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG