November 4th, 2025

Smart Money Moves: Liquidating Gold for Education Costs

As fall semester approaches, many families find themselves facing substantial education expenses. From tuition and textbooks to dormitory fees and living costs, the financial demands can be overwhelming. For those who own gold coins and precious metals, this presents an opportune time to liquidate these assets and transform them into immediate cash for educational investments. Understanding how to strategically sell these valuable items can make the difference between financial stress and educational success.

The timing of liquidating precious metals for fall education expenses requires careful consideration of both market conditions and personal financial needs. Gold buyers near me are experiencing increased demand as more families recognize the practical benefits of converting their precious metal investments into liquid assets for educational purposes. By working with reputable buyers who understand the urgency of educational deadlines, families can ensure they receive fair market value while meeting critical payment schedules.

Why Precious Metals Are Ideal for Educational Funding

Gold coins and precious metals represent one of the most liquid forms of alternative investments available to families planning for educational expenses. Unlike traditional savings accounts that may offer minimal returns, precious metals have historically maintained their value and often appreciate over time, making them excellent vehicles for long-term educational planning. The intrinsic value of these assets provides a reliable foundation for families who need to access substantial funds quickly.

The stability of precious metals makes them particularly attractive for educational funding because they're not subject to the same volatility as stocks or other securities. When you sell gold for educational purposes, you're converting a tangible asset with recognized global value into immediate purchasing power. This reliability becomes especially important when dealing with non-negotiable educational deadlines and payment schedules that cannot be postponed.

When considering educational funding through precious metals liquidation, it's essential to understand the various types of assets that can be converted to cash. Beyond traditional gold coins, families often possess valuable jewelry that can be sold to supplement educational funding. Many parents and students discover that inherited jewelry pieces, engagement rings from previous relationships, or investment-grade precious metal items represent substantial value that can be transformed into educational opportunities.

Strategic Timing for Gold Coin Liquidation

The back to school funding season presents unique opportunities for strategic precious metals liquidation. Educational institutions typically require payment schedules that align with semester starts, creating predictable deadlines that allow for careful planning of asset liquidation. Understanding these timing requirements enables families to work with gold buyers near me to ensure optimal pricing and seamless transaction completion before payment deadlines.

Market conditions during late summer and early fall often favor sellers of precious metals, as demand increases from various sources including educational funding needs, holiday preparation, and end-of-year financial planning. This seasonal demand can work in favor of families looking to maximize the value of their precious metals while meeting educational payment schedules. Professional buyers understand these market dynamics and can help sellers time their transactions for optimal results.

The gold coin liquidation process requires consideration of both immediate cash needs and potential future requirements. Educational expenses often extend beyond a single semester, making it important to develop a comprehensive liquidation strategy that addresses both current and anticipated future needs. Working with experienced buyers ensures that families can plan their precious metals liquidation to align with multi-year educational timelines while maximizing overall value.

Understanding Different Types of Precious Metals for Sale

Precious metals encompass a wide range of items that can be converted to educational funding, extending far beyond traditional gold coins. Silver coins, platinum pieces, palladium items, and various forms of bullion all represent potential sources of educational funding. Each metal type has different market characteristics and pricing structures, requiring specialized knowledge to ensure optimal transaction outcomes.

Gold-filled and gold-plated jewelry, while less valuable than solid gold pieces, can still contribute meaningfully to educational funding when sold to knowledgeable buyers. Understanding the distinction between different gold content levels helps families set realistic expectations and maximize the value of all their precious metal assets. Professional evaluation services can help identify the true precious metal content of various items, ensuring nothing of value is overlooked.

Many families are surprised to discover that their sterling silver collections represent significant value that can contribute to educational funding. From inherited silver flatware sets to decorative pieces and jewelry, sterling silver items often accumulate over years and represent substantial liquidation potential. The current silver market provides favorable conditions for families looking to convert these assets into educational funding.

Working with Professional Precious Metals Buyers

Selecting the right buyer for precious metals liquidation requires careful evaluation of experience, reputation, and payment capabilities. Professional buyers who specialize in precious metals understand the unique requirements of educational funding timelines and work to ensure transactions are completed efficiently and fairly. The brands we buy include major precious metals manufacturers and designer pieces that command premium pricing in the current market.

The evaluation process for precious metals requires specialized equipment and expertise to accurately assess purity, weight, and current market value. Reputable buyers provide transparent evaluation processes that allow sellers to understand exactly how their items are being assessed and valued. This transparency becomes especially important when dealing with substantial sums needed for educational expenses, where accuracy and fairness are paramount.

Estate jewelry often represents a significant source of educational funding that many families overlook. Inherited pieces, vintage jewelry, and family heirlooms frequently contain substantial precious metal content and valuable gemstones that can be converted to educational funding. Professional evaluation services can help families understand the true value of these inherited assets and develop appropriate liquidation strategies.

Maximizing Value Through Proper Preparation

Preparing precious metals for sale involves several key steps that can significantly impact the final transaction value. Proper cleaning, organization, and documentation of items helps buyers provide accurate evaluations and ensures sellers receive fair market pricing. Understanding which items have additional collector value beyond their precious metal content can help maximize overall transaction proceeds.

Documentation such as original purchase receipts, certificates of authenticity, and appraisal documents can significantly impact the valuation of precious metals and jewelry items. While not always required, this documentation helps establish provenance and authenticity, potentially increasing the final sale value. Organized presentation of items and supporting documentation demonstrates professionalism and can positively influence the evaluation process.

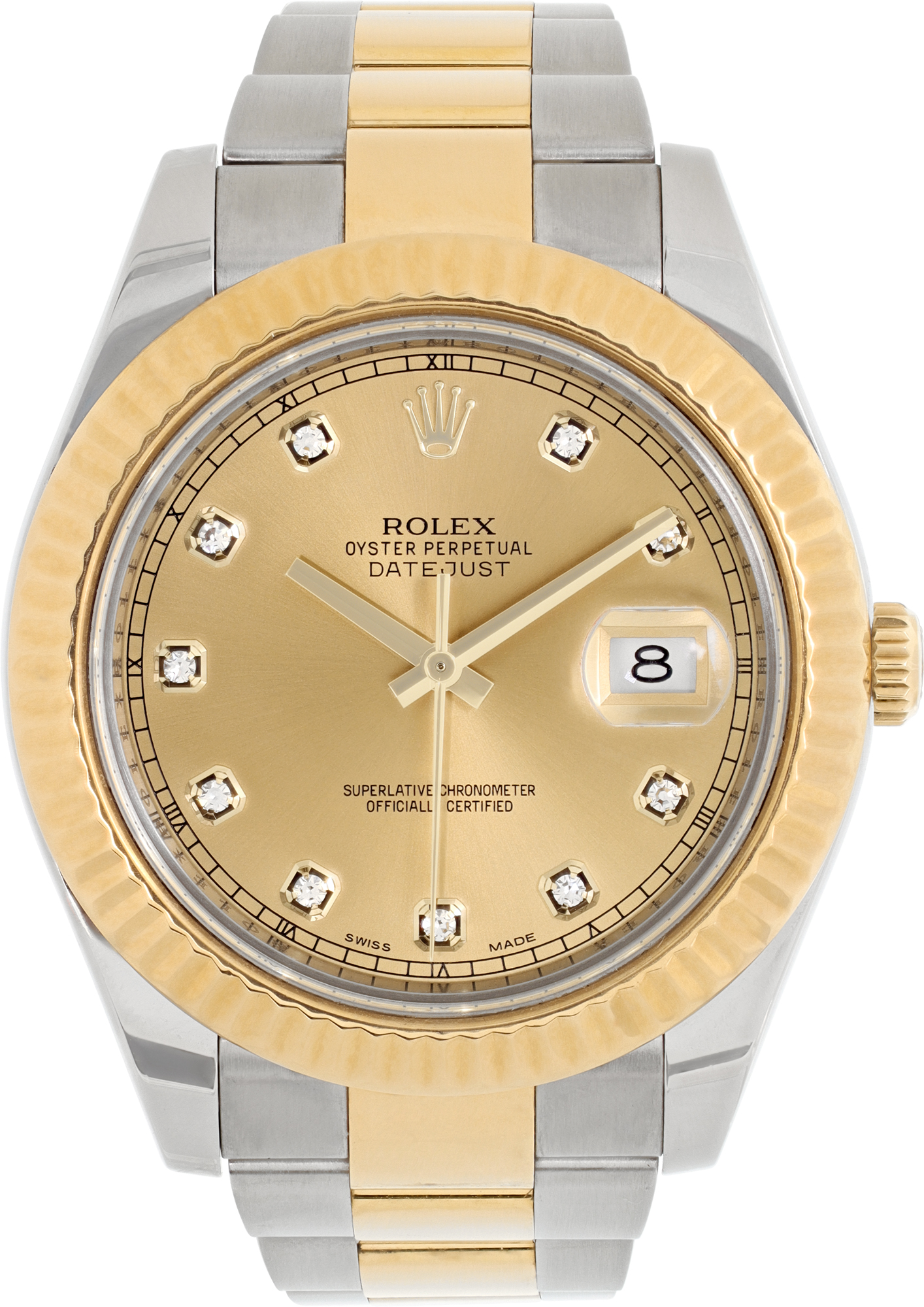

Many families discover that combining precious metals sales with other valuable items can create comprehensive educational funding solutions. Luxury watches, diamond jewelry, and other high-value items can be evaluated alongside precious metals to create complete funding packages that address all educational financial requirements.

Alternative Funding Strategies Through Consignment

For families who prefer not to sell their precious metals immediately, consignment arrangements offer alternative approaches to educational funding. Professional consignment services can help families access immediate funds while potentially maximizing long-term value through strategic market timing. This approach allows families to benefit from professional marketing and sales expertise while maintaining potential upside from favorable market conditions.

The consignment process for precious metals and luxury items requires working with established dealers who have proven track records of successful sales and fair client treatment. Understanding consignment terms, commission structures, and timeline expectations helps families make informed decisions about whether immediate sale or consignment arrangements better serve their educational funding needs.

Planning for Multi-Year Educational Expenses

Educational funding requirements often extend across multiple years, requiring strategic planning that considers both immediate and future needs. Developing a comprehensive precious metals liquidation strategy helps families optimize their assets across extended educational timelines while maintaining financial flexibility for unexpected requirements. Professional buyers can help families develop phased liquidation approaches that align with multi-year educational payment schedules.

The value of maintaining relationships with trusted precious metals buyers extends beyond single transactions. Families who establish relationships with reputable buyers benefit from ongoing market insights, preferred pricing, and streamlined processes for future transactions. These relationships become especially valuable when dealing with ongoing educational expenses that may require additional asset liquidation over time.

Making Smart Financial Decisions

Converting precious metals to educational funding represents a strategic financial decision that requires careful consideration of both immediate needs and long-term financial goals. Understanding the tax implications of precious metals sales, the impact on financial aid eligibility, and the opportunity costs of liquidating appreciating assets helps families make informed decisions that serve their overall financial interests.

Professional financial guidance can help families optimize their precious metals liquidation strategies within the context of their broader financial planning. Coordinating precious metals sales with other financial strategies ensures that educational funding decisions support rather than compromise long-term financial stability and growth objectives.

Ready to Transform Your Precious Metals into Educational Funding?

Don't let valuable precious metals sit idle while educational opportunities await. Our expert evaluation team specializes in helping families convert gold coins, precious metals, and luxury items into immediate cash for educational expenses.

Get started today with our comprehensive evaluation services:

- Get your jewelry appraised - Transform inherited pieces and investment jewelry into educational funding

- Discover your watch's value - Luxury timepieces can provide substantial educational funding

- Evaluate your sterling silver - Convert silver collections into cash for tuition and expenses

- Learn about our process - Understand our transparent, efficient evaluation and purchase process

Take advantage of our decades of experience helping families convert precious assets into educational opportunities. Contact us today to begin your journey toward stress-free educational funding through strategic precious metals liquidation.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG