January 26th, 2026

Thanksgiving to Tax Time: How Strategic November Luxury Asset Sales Maximize Your 2025 Year-End Deductions

As the Thanksgiving season approaches and we enter the final weeks of 2025, savvy asset holders are recognizing a unique opportunity to optimize their financial portfolios through strategic year-end planning. Whether you're looking to sell luxury watch collections, sell gold holdings, sell jewelry pieces, or sell diamonds you've inherited or collected, November through December presents an ideal window for liquidating luxury assets. This approach not only provides immediate liquidity but also creates potential tax advantages that can significantly impact your 2025 financial picture.

Understanding the intersection of luxury asset liquidation and year-end financial planning empowers you to make informed decisions about your valuable possessions. The period between Thanksgiving and tax time offers sufficient processing time to complete transactions, receive funds, and work with your financial advisor to incorporate these sales into your overall tax strategy for maximum benefit.

Why November Matters for Luxury Asset Sales

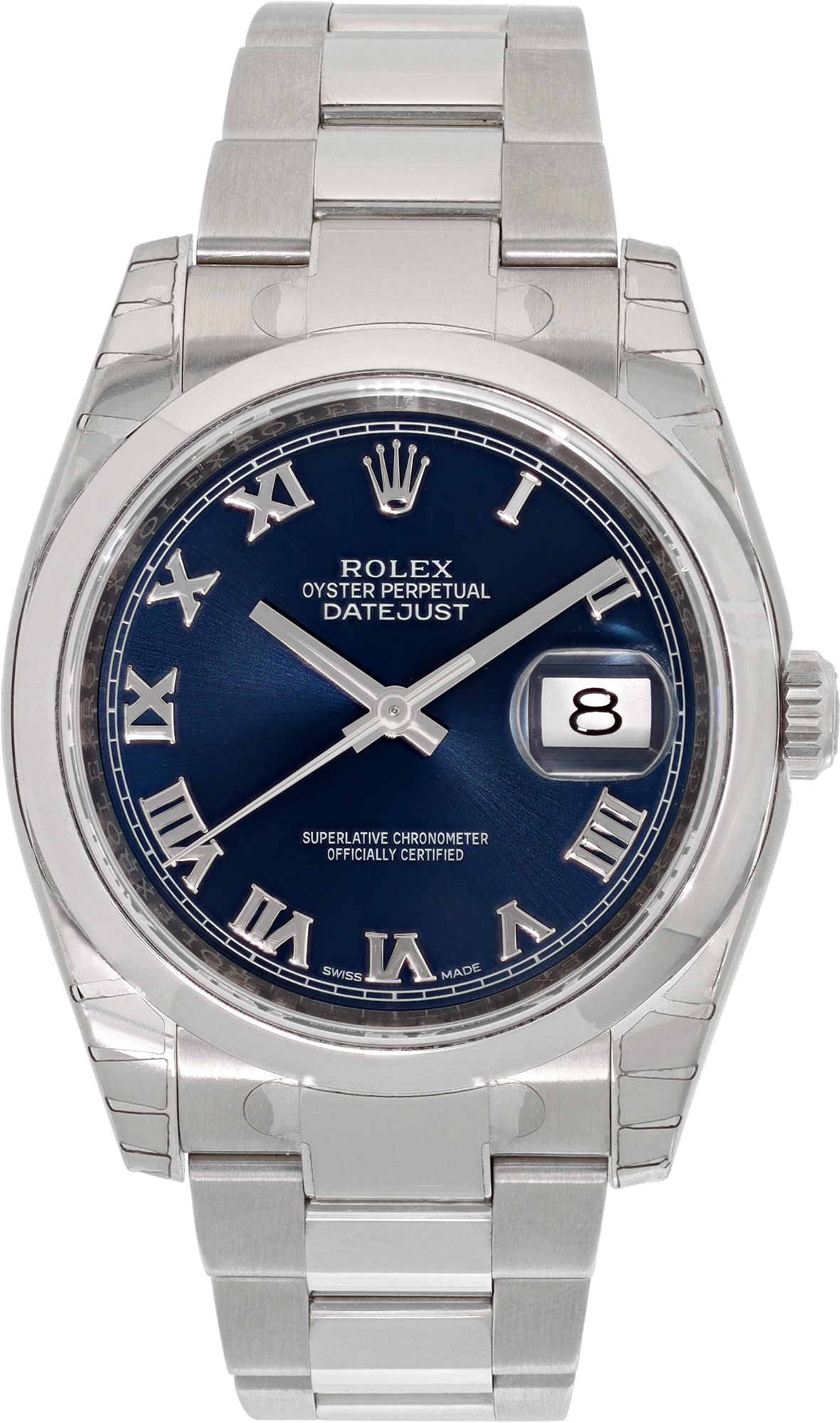

November represents the sweet spot for year-end asset liquidation planning. Waiting until December creates unnecessary time pressure, while acting now allows adequate time for professional evaluations, secure transactions, and proper documentation for tax purposes. For those holding valuable timepieces from brands like Rolex, Patek Philippe, or Omega, or fine jewelry from Cartier, Tiffany & Co., or Van Cleef & Arpels, this timing proves especially strategic.

The luxury resale market remains robust heading into 2025's final quarter, with strong demand for authenticated pre-owned pieces. If you've been considering whether to sell my Rolex or liquidate other premium assets, current market conditions support competitive valuations. Working with established luxury jewelry and watch buyers ensures you receive fair market value while meeting year-end financial deadlines.

Strategic Tax Considerations for Luxury Asset Sales

When you sell luxury assets, the transaction may have tax implications depending on how long you've owned the item and whether it has appreciated in value. Capital gains considerations, loss harvesting opportunities, and portfolio rebalancing all factor into strategic year-end planning. Assets that have depreciated from their original purchase price may present opportunities to offset other capital gains in your portfolio.

For inherited pieces or estate jewelry received as part of a bequest, selling before year-end can simplify estate settlement and provide clarity for tax filings. Many individuals managing estates discover that liquidating luxury assets through reputable buyers streamlines the process considerably. Whether you're managing diamond engagement rings, vintage timepieces, or sterling silver collections, professional evaluation services provide the documentation needed for accurate tax reporting.

Those in South Florida seeking miami patek philippe buyer services or a boca raton rolex buyer will find that established local buyers offer both convenience and expertise. Similarly, sellers throughout Florida—from fort myers rolex watch buyer needs to west palm beach patek philippe buyer requirements—benefit from working with experienced professionals who understand the nuances of luxury asset transactions.

Identifying Which Luxury Assets to Liquidate

The end of the year provides an ideal moment to assess your luxury holdings and determine which pieces no longer serve your needs or investment strategy. Perhaps you have watches sitting unused in a safe, jewelry that no longer matches your style, or inherited pieces with sentimental value but no practical purpose in your daily life. Each of these situations presents a legitimate reason to consider liquidation.

Rolex buyers report consistent demand for models including the Submariner, GMT-Master, and Sea-Dweller, making these excellent candidates for year-end sales. If you're holding a rolex submariner in models like the rolex submariner 16803 or other vintage references, the current market offers competitive returns. Similarly, those wondering where to sell a rolex benefit from understanding that specialized buyers provide significantly better returns than general pawn shops or consignment stores.

Beyond Rolex, other luxury watch brands command strong resale values. Those looking to sell patek philippe nautilus models, sell audemars piguet royal oak offshore timepieces, or sell omega watch collections find receptive markets. Even if you're wondering how to sell breitling watch or sell cartier santos watch pieces, specialized buyers maintain interest across premium Swiss watchmaking brands.

Fine jewelry presents equally compelling liquidation opportunities. Pieces from designers like Roberto Coin—including items from the roberto coin palazzo ducale buyer market, roberto coin princess flower buyer segment, and roberto coin venetian princess buyer category—maintain excellent resale value. Similarly, sell cartier jewelry pieces, especially from the cartier juste un clou collection, continue attracting strong buyer interest.

For those holding Tiffany & Co. pieces, the market for authenticated pre-owned items remains vibrant. Whether you're looking to sell tiffany bracelets, sell tiffany rings, or sell tiffany necklace pieces, these iconic items hold value well. The same applies to pieces from collections like tiffany keys buyer markets and tiffany paper flowers buyer segments. Specialized buyers understanding these brands' nuances ensure you receive appropriate valuations reflecting current market conditions.

The Evaluation Process: What to Expect

When you decide to pursue luxury asset liquidation, understanding the evaluation process helps set realistic expectations. Professional buyers employ multiple assessment criteria including brand reputation, model desirability, condition, completeness of original materials, and current market demand. For watches, factors such as service history, authenticity of components, and whether you have the original box and papers significantly impact valuation.

Obtaining a watch quote begins with providing detailed information about your timepiece, including brand, model number, serial number, and condition. High-quality photographs from multiple angles help evaluators provide accurate preliminary estimates. This same process applies whether you're seeking to sell cartier watch pieces, sell hublot watch models, or sell omega speedmaster editions.

Jewelry evaluation follows similar principles but incorporates gemological considerations. When you sell diamonds, factors including carat weight, cut quality, color grade, and clarity ratings all influence value. For pieces with GIA certification, having documentation readily available expedites the evaluation process. Those looking to sell diamond engagement ring pieces or sell diamond eternity bands boca raton area residents prefer working with evaluators who understand gemological standards thoroughly.

The jewelry evaluation process examines precious metal content, gemstone quality, designer attribution, craftsmanship, and condition. Signed pieces from recognized designers typically command premium valuations. Whether you're looking to sell david yurman jewelry, sell bvlgari jewelry, or sell van cleef and arpels jewelry, having pieces authenticated and properly documented enhances the transaction experience.

For those with extensive collections, some buyers offer specialized services for multiple items. If you're managing estate jewelry or downsizing a significant collection, professional buyers can evaluate entire lots, streamlining what might otherwise be a complex, time-consuming process. This approach proves particularly valuable for estate executors or individuals relocating who need to liquidate assets efficiently.

Geographic Considerations for South Florida Sellers

Sellers throughout South Florida benefit from access to established luxury buyers with decades of experience. Whether you need a miami rolex watch buyer, a coral gables cartier watch buyer, or a key biscayne rolex watch buyer, working with local professionals offers convenience and the opportunity for in-person transactions. Similarly, those in northern areas seeking a boca raton patek philippe buyer or fort myers cartier watch buyer find that regional expertise provides advantages.

The bal harbour rolex watch buyer market benefits from proximity to affluent communities where luxury timepiece ownership rates run high. This concentration of wealth and sophisticated collectors creates competitive buying conditions. Similarly, the brickell avenue rolex watch buyer segment serves Miami's business district, where professionals often accumulate fine timepieces over their careers.

For specialized needs such as finding a chopard happy diamonds buyer or chopard l'heure du diamant buyer, working with buyers maintaining relationships across diverse luxury segments proves advantageous. The same applies for those seeking cartier panthere buyer services or looking to sell unique pieces like cartier clock buyer markets or cartier flatware buyer opportunities.

Beyond Watches: Diversifying Your Luxury Asset Sales

While luxury watches often dominate conversations about high-value personal assets, jewelry and precious metal holdings represent equally significant opportunities for year-end liquidation. Those holding gold jewelry, gold coins, or bullion can benefit from current market conditions by connecting with reputable precious metal buyers.

Sterling silver collections, particularly flatware and serving pieces, maintain steady demand. Whether you have complete sets or partial collections, professional evaluators can assess value based on weight, pattern, manufacturer, and condition. For those wondering about the fastest way to sell silver, working with established buyers familiar with sterling patterns and makers ensures fair, efficient transactions.

Diamond sales require particular attention to certification and documentation. When you sell 1 carat diamond engagement ring online or pursue other diamond liquidations, having GIA or other recognized laboratory certification significantly streamlines the process. Professional buyers understand examples of diamonds we buy across the quality spectrum and can provide guidance on maximizing value through proper presentation and documentation.

Designer jewelry pieces often carry value beyond their precious metal and gemstone content. Signed pieces from Cartier, Van Cleef & Arpels, David Yurman, and Bulgari command premiums reflecting brand prestige and design excellence. Whether you're looking to sell cartier bracelets, sell van cleef & arpels earrings, or sell david yurman rings, specialized buyers recognize these attributes and incorporate them into valuations.

Alternative Selling Methods: Understanding Your Options

When liquidating luxury assets, you'll encounter various selling methods, each with distinct advantages and considerations. Direct sale to established buyers offers speed, certainty, and immediate payment. Jewelry consignment arrangements provide potential for higher returns but involve longer timeframes and less certainty. Understanding which approach aligns with your timeline and financial goals proves essential.

Many sellers wonder about selling jewelry watches on ebay craigslist platforms versus working with professional buyers. While online marketplaces offer broad exposure, they also involve risks including fraud, authentication challenges, and time-consuming negotiations. For high-value items, the security and expertise professional buyers provide typically outweigh potential marginal price advantages from private sales.

For those interested in selling or consigning watches in Miami, understanding the distinction between these approaches helps clarify expectations. Consignment involves the buyer marketing your piece on your behalf, taking a commission when it sells. Direct purchase means immediate payment at agreed-upon values. Your financial timeline, asset type, and market conditions all influence which approach optimizes your outcome.

Preparing Your Luxury Assets for Sale

Proper preparation enhances both the efficiency of the selling process and the value you receive. For watches, gather any original documentation including warranty papers, service records, and certificates of authenticity. Original boxes, instruction manuals, and extra links (for bracelets) all contribute to value. Even if you're selling your pre owned luxury watch in used condition, complete documentation demonstrates provenance and authenticity.

Jewelry preparation involves similar considerations. Locate any original receipts, appraisals, or gemological certificates. For diamond pieces, GIA reports prove particularly valuable. If you've had pieces custom-designed or modified, documentation of those changes helps evaluators understand the piece's history. Even items requiring repair maintain value—many buyers buy jewelry in various conditions, including pieces needing restoration.

For selling diamonds important things to remember include understanding that professional buyers evaluate based on objective criteria rather than emotional attachment or original purchase price. The "four Cs"—cut, color, clarity, and carat weight—form the foundation of diamond valuation, supplemented by considerations like fluorescence, certification, and setting quality.

When preparing precious metals for sale, simple cleaning can improve presentation without affecting intrinsic value. For sterling silver, gentle polishing removes tarnish and showcases pieces more effectively. However, avoid aggressive cleaning methods that might damage finishes or remove hallmarks. Professional buyers evaluate precious metals primarily by weight and purity, but presentation still matters.

Timing Strategies: November Through Year-End

As we progress through late November into December, specific timing considerations become relevant. Completing transactions before December 31st ensures any tax implications fall within the current tax year, allowing you to incorporate results into your 2025 planning. However, rushing the process rarely serves your interests—working with professional buyers who can expedite evaluations without sacrificing thoroughness proves ideal.

Holiday shopping season creates increased liquidity in luxury markets as collectors and gift-givers seek premium pieces. This elevated demand can benefit sellers, particularly for highly desirable models and designer pieces. Whether you're looking to sell rolex gmt master watches, sell patek philippe perpetual calendar complications, or designer jewelry, market conditions heading into year-end typically favor sellers of exceptional pieces.

For those managing estates or downsizing, using the Thanksgiving holiday when family gathers provides an opportunity to discuss asset distribution and liquidation plans. Adult children can help elderly parents inventory jewelry and watch collections, research values, and coordinate with professional buyers. This collaborative approach often reveals reasons to sell your jewelry ranging from security concerns to desire for assets to benefit family members during lifetimes rather than as inheritances.

Working With Professional Buyers: What to Look For

Selecting the right buyer for your luxury assets significantly impacts your experience and outcome. Look for buyers with established reputations, physical locations, and demonstrated expertise in your asset categories. For watches, buyers employing master watchmakers and maintaining relationships with manufacturers bring valuable technical knowledge to evaluations.

The value of pre owned luxury watch transactions depends heavily on accurate authentication and condition assessment. Professional buyers invest in tools, training, and relationships enabling them to verify authenticity, identify service needs, and determine fair market values. This expertise protects you from unknowingly accepting undervaluations while ensuring transactions proceed smoothly.

When researching jewelry buyers near me or watch buyers near me, consider factors beyond simple proximity. Reputation, expertise, transaction transparency, and payment methods all merit consideration. Established buyers typically offer multiple payment options including immediate bank transfer, cashier's check, or wire transfer, providing flexibility based on your preferences.

Understanding how to spot fake watch buyers helps protect you from fraud. Legitimate buyers maintain physical locations, provide detailed contact information, offer transparent evaluation processes, and never pressure you into immediate decisions. They welcome questions about their authentication processes, market knowledge, and business history. Red flags include requests for upfront fees, pressure tactics, or reluctance to provide detailed written offers.

Special Considerations for Specific Luxury Brands

Different luxury brands present unique considerations when selling. Rolex, as the most recognized luxury watch brand globally, maintains strong secondary market demand across its lineup. From the accessible Datejust to the sporty Submariner to the sophisticated Day-Date, most Rolex models find ready buyers. Those asking where do i sell my rolex or seeking the best place to sell my rolex benefit from this robust market.

Patek Philippe occupies the pinnacle of luxury watchmaking, with models like the Nautilus and Aquanaut commanding extraordinary premiums in secondary markets. However, authentication and provenance verification prove especially critical for these high-value pieces. Professional buyers specializing in Patek Philippe understand the nuances distinguishing valuable references from less sought-after models and can guide you through selling my used watch consigning trading decisions.

For jewelry, brands like Cartier, Van Cleef & Arpels, and Tiffany & Co. maintain brand premiums reflecting their design heritage and craftsmanship. When you sell cartier jewelry pieces, documentation proving authenticity significantly enhances value. The same applies when you sell van cleef & arpels jewelry or sell my tiffany and co watch items—provenance matters.

Designer jewelry from Roberto Coin demonstrates how contemporary designers build valuable brands. Collections like the roberto coin animalier buyer market or roberto coin classica parisienne buyer segment show how signature design elements create recognition and value. Even pieces from more accessible luxury brands like David Yurman—including the popular albion ring david yurman design—maintain resale value when authenticated and well-maintained.

Documentation and Record-Keeping for Tax Purposes

Proper documentation of luxury asset sales proves essential for accurate tax reporting. When you sell high-value items, maintain detailed records including original purchase documentation, appraisals, evaluation reports from buyers, final sale prices, and transaction dates. This documentation helps your tax advisor accurately calculate any capital gains or losses and properly report transactions.

For inherited items, establishing cost basis can prove challenging but remains important. Estate documents, probate records, and date-of-death appraisals all help establish values for tax purposes. When selling inherited diamond jewelry or watches, working with buyers who provide detailed written evaluations creates documentation supporting your tax positions.

Professional buyers typically provide comprehensive transaction documentation including detailed item descriptions, valuation methodologies, and payment records. Retain these documents as part of your permanent financial records. If you're selling your pre-owned luxury watch or jewelry collection, this documentation may prove valuable beyond immediate tax considerations, particularly if you have insurance claims or future authentication needs.

The Online Versus In-Person Transaction Debate

The rise of online luxury transactions creates new opportunities but also new challenges. For sellers in major metropolitan areas like Miami, Fort Lauderdale, Boca Raton, or West Palm Beach, in-person transactions offer advantages including immediate evaluation, face-to-face interaction, and ability to assess buyer professionalism directly. However, reputable buyers also maintain robust online processes serving clients nationwide.

When conducting online transactions for luxury assets, security becomes paramount. Established buyers provide insured shipping labels, signature-required delivery, and detailed documentation at every process stage. They maintain secure facilities for receiving and evaluating items and offer clear communication throughout the transaction. This infrastructure helps the easiest way to sell your jewelry online remain safe and efficient.

Understanding how luxury buying works helps clarify what to expect whether transacting in-person or remotely. Professional buyers follow structured processes including initial inquiry, preliminary evaluation, formal assessment, offer presentation, negotiation if applicable, and payment. This systematic approach provides consistency and security regardless of transaction method.

Making the Decision: Is Now the Right Time?

As you consider whether to pursue luxury asset liquidation during this strategic window between Thanksgiving and year-end, several factors merit consideration. First, assess your financial planning needs and whether converting illiquid assets to cash serves your broader goals. Second, evaluate current market conditions for your specific assets—are you holding pieces experiencing strong demand, or would waiting potentially benefit you?

Third, consider your timeline and stress tolerance. If you need certainty and immediate liquidity, direct sale to professional buyers offers clear advantages. If maximizing absolute price matters more than timing, alternative approaches merit consideration. However, for year-end tax planning purposes, direct sale typically aligns better with timeframe requirements.

Finally, reflect on your emotional attachment to items under consideration. While luxury assets hold monetary value, they often carry sentimental significance as well. Ensuring you're comfortable with liquidation decisions prevents later regrets. However, remember that converting unused assets to working capital often serves your interests better than items sitting unused in safes or safety deposit boxes.

Taking Action: Your Next Steps

If you've determined that strategic year-end luxury asset liquidation aligns with your financial goals, taking action now maximizes your options and ensures adequate time for completing transactions. Begin by inventorying items you're considering selling, gathering any available documentation, and researching current market conditions for your specific pieces.

Next, connect with established professional buyers who specialize in your asset categories. Whether you're looking to sell your watch, sell your jewelry, sell GIA certified diamonds, or sell sterling silver, working with experienced evaluators ensures you receive fair market valuations and professional service throughout the transaction.

For comprehensive guidance on asset types and brands accepted by professional buyers, reviewing information about brands we buy helps clarify whether your items fit within their purchasing parameters. Most established buyers maintain broad acquisition interests spanning major watch manufacturers, recognized jewelry designers, certified diamonds, and precious metals in various forms.

Conclusion: Opportunity Awaits

The weeks between Thanksgiving and year-end present a unique convergence of favorable market conditions, tax planning opportunities, and adequate transaction timing for luxury asset liquidation. Whether you're holding watches you no longer wear, jewelry that no longer suits your style, inherited pieces you're ready to monetize, or precious metals you want to convert to working capital, this strategic window offers compelling advantages.

By working with professional buyers who understand luxury markets, provide transparent evaluations, and maintain secure transaction processes, you can convert illiquid assets to cash efficiently while potentially optimizing your 2025 tax position. The key lies in taking action now, during this strategic window when timing, market conditions, and financial planning considerations align.

Don't let valuable assets sit unused when they could be working for you. The period from Thanksgiving through year-end offers an ideal opportunity to assess your luxury holdings, make strategic liquidation decisions, and position yourself for financial success heading into 2026.

Ready to Unlock Your Luxury Assets' Value?

Take the first step toward strategic year-end asset liquidation today. Whether you're holding a single premium timepiece or an extensive collection of fine jewelry, professional evaluation services provide the insights you need to make informed decisions.

Get your complimentary evaluation:

- Request a watch quote for Rolex, Patek Philippe, Omega, and other luxury timepieces

- Request a jewelry quote for designer pieces, estate jewelry, and fine gemstones

- Request a diamond quote for GIA-certified and other premium diamonds

- Request a sterling silver quote for flatware, serving pieces, and hollow ware

Discover what you're looking to sell and learn how our streamlined process converts your luxury assets to cash quickly and securely. With decades of experience, master-trained specialists, and a reputation for fair, competitive valuations, we provide the professional service your valuable items deserve.

Contact us today to begin your year-end asset optimization strategy. Time is limited—ensure your transactions complete before December 31st to maximize your 2025 financial planning opportunities.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG