January 26th, 2026

Turkey Day to Tax Strategy: Converting Your Gold Coin Portfolio Into Thanksgiving Blessings and Year-End Planning

As the holiday season approaches and year-end financial planning takes center stage, savvy investors are considering strategic portfolio rebalancing moves. If you're among those searching for gold buyers near me this fall, you're not alone. The period between Thanksgiving and year-end presents unique opportunities to sell gold and precious metals while maximizing both immediate liquidity and potential tax advantages. Whether you hold gold coins, bullion, or luxury items crafted from precious metals, understanding how to convert these assets into cash can transform your holiday season and set the stage for smart financial planning.

The connection between the Thanksgiving season and financial strategy may not be immediately obvious, but they align perfectly for those considering precious metal liquidation. This time of year offers the dual benefit of providing holiday funds while positioning your portfolio strategically before December 31st. Many families discover they can create memorable celebrations while simultaneously optimizing their financial picture through thoughtful asset management.

Why Fall is Prime Time for Portfolio Rebalancing

September through November represents a critical window for fall portfolio moves precious metals investors should seriously consider. Financial advisors consistently recommend year-end portfolio reviews, and precious metals often play a significant role in these assessments. Whether you've accumulated gold coins as an investment, inherited estate jewelry, or simply have luxury items no longer serving your lifestyle, this pre-holiday period offers strategic advantages for liquidation.

The timing couldn't be better for those considering selling their gold and precious metal holdings. Market conditions during this quarter often stabilize after summer volatility, providing clearer pricing benchmarks for sellers. Additionally, completing transactions before year-end allows you to incorporate any capital gains or losses into your current tax year planning, rather than deferring these considerations into the following year.

Understanding Your Gold Portfolio Beyond Coins

When considering gold coin liquidation, many sellers focus solely on bullion and investment-grade coins. However, your precious metal portfolio likely extends far beyond these obvious candidates. High-karat gold jewelry, luxury watches with gold cases and bracelets, designer pieces from brands like Cartier, and even inherited heirlooms represent substantial value that can be converted to cash.

At Sell Us Your Jewelry, we specialize in evaluating and purchasing the full spectrum of precious metal items. Our expertise spans from traditional gold coins and bullion to sophisticated luxury pieces that combine precious metals with exceptional craftsmanship. Whether you're ready to sell Cartier jewelry, gold-cased timepieces, or investment-grade coins, our evaluation process ensures you receive competitive offers based on current market values and the unique characteristics of each piece.

The Thanksgiving Connection: Turning Assets Into Memories

The phrase "Thanksgiving blessings" takes on new meaning when you strategically convert dormant assets into experiences and opportunities. Many families find themselves holding significant value in gold jewelry, coins, or luxury items that no longer serve their current lifestyle. Rather than letting these assets sit unused in safe deposit boxes, converting them to liquid funds can finance meaningful holiday celebrations, support charitable giving, or provide year-end financial flexibility.

Consider the widow who inherited her late husband's gold coin collection, or the divorced individual holding onto jewelry from a previous chapter. For estate executors managing inherited portfolios, or collectors downsizing their holdings, this season presents the perfect opportunity to transform these items into resources that serve current needs. The process of working with reputable jewelry buyers near me ensures these transitions happen smoothly and professionally.

Tax Strategy Considerations for Year-End Precious Metal Sales

Understanding the tax implications of selling gold and precious metals ranks among the most important aspects of year-end planning. The IRS classifies gold coins, bullion, and precious metal jewelry as collectibles, subject to specific capital gains treatment. Selling before December 31st allows you to realize gains or losses in the current tax year, which can be strategically valuable depending on your overall financial picture.

For those holding gold coins purchased as investments, documenting your cost basis becomes crucial for accurate tax reporting. Similarly, inherited precious metals receive a stepped-up basis, potentially minimizing capital gains exposure. Working with a knowledgeable buyer who understands these nuances and provides detailed documentation supports your year-end tax preparation. Our team at Sell Us Your Jewelry provides comprehensive paperwork for every transaction, ensuring you have the records needed for your tax advisor.

Beyond Gold Coins: Comprehensive Precious Metal Evaluation

While gold coins often dominate discussions of precious metal portfolios, savvy sellers recognize that value exists across multiple categories. Sterling silver flatware, for instance, represents significant worth that many families overlook. Complete or partial sets from prestigious makers can be liquidated through specialized sterling silver buyers who understand the market for these elegant pieces.

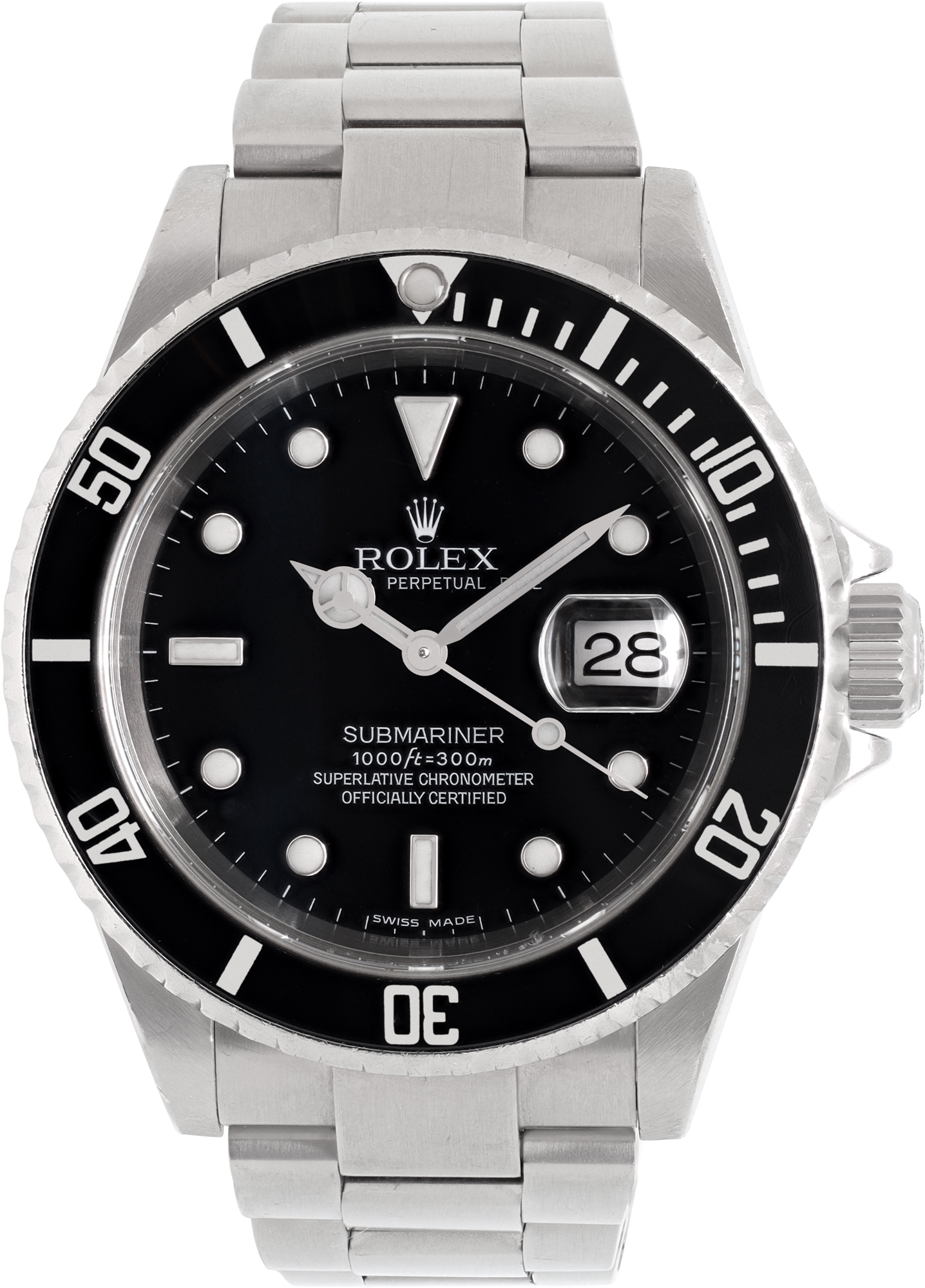

Similarly, luxury watches with gold cases or bracelets represent dual value—both in precious metal content and horological significance. A Rolex Day-Date in 18k gold, for example, offers value far exceeding its gold weight due to the brand prestige and mechanical excellence. Understanding these distinctions ensures you receive fair market value rather than mere scrap prices when you're ready to sell your watch.

The South Florida Advantage: Location Matters

For those in South Florida searching for Miami Patek Philippe buyer services or looking to sell Rolex near me, location provides distinct advantages. Our Surfside showroom, across from the iconic Bal Harbour Shops, serves clients throughout Miami-Dade, Broward, and Palm Beach counties. Whether you're in Boca Raton, Fort Myers, or the Brickell Avenue corridor, our reputation as a Boca Raton Rolex buyer and comprehensive precious metals purchaser makes us accessible for serious sellers.

The concentration of wealth and luxury goods in South Florida creates a sophisticated market where knowledgeable buyers understand true value. As a Coral Gables Cartier watch buyer and West Palm Beach Patek Philippe buyer, we've built relationships with discerning sellers who expect expertise, discretion, and competitive pricing. Our local presence means you can visit our showroom for in-person consultations, though we also serve clients nationwide through our secure online platform.

Evaluating Designer Jewelry for Maximum Returns

High-end jewelry from prestigious designers represents more than precious metal content—it embodies artistry, brand heritage, and market demand. When you're ready to sell Tiffany and Co jewelry or liquidate pieces from Cartier, Van Cleef & Arpels, or David Yurman, understanding these premium values becomes essential. A Tiffany Paloma Picasso design or a Cartier Love ring commands pricing that reflects both materials and designer provenance.

Our evaluation process considers every factor that contributes to value: precious metal purity and weight, gemstone quality, designer attribution, condition, and current market demand. For those looking to sell Van Cleef and Arpels jewelry or other high-end pieces, this comprehensive approach ensures offers that reflect the true worth of these exceptional items. We recognize that designer jewelry deserves specialized knowledge, and our team brings decades of experience to every appraisal.

Luxury Watch Liquidation: More Than Precious Metal Value

Luxury timepieces crafted in precious metals occupy a unique position in portfolio planning. An 18k gold Rolex Submariner or a platinum Patek Philippe represents substantial value extending well beyond gold content. For those wondering where to sell a Rolex or seeking the best place to sell my Rolex, understanding this distinction separates informed sellers from those who might accept inadequate offers.

Our expertise as a premier watch buyer means we evaluate timepieces holistically. A gold Rolex Yacht-Master or Datejust isn't reduced to scrap value—instead, we consider the watch's mechanical condition, model desirability, service history, and completeness of accessories. This approach benefits sellers significantly, as collectible timepieces often command multiples of their precious metal content alone. Whether you're looking to sell Omega watch models, Breitling timepieces, or haute horlogerie from prestigious manufactures, our evaluation reflects the complete market picture.

The Process: From Inquiry to Payment

Understanding how it works when selling precious metals and luxury items brings confidence to the transaction. At Sell Us Your Jewelry, we've streamlined the process to maximize convenience while maintaining the thorough evaluation these items deserve. Whether you're a local client visiting our Surfside showroom or a nationwide seller using our online platform, the experience remains professional, transparent, and efficient.

The journey begins with a simple inquiry—request jewelry quotes through our website or contact us directly. For watches, our specialized watch quote system gathers the information needed for preliminary evaluation. We also offer dedicated services for those ready to sell GIA diamonds, sell sterling silver, or liquidate complete estate jewelry collections. Each category receives specialized attention from experts who understand that market's nuances.

Comprehensive Services Across Multiple Categories

Our capabilities extend across the full spectrum of luxury items and precious metals. Beyond gold coins and bullion, we're specialists in acquiring:

- Luxury Timepieces: From vintage Rolex Submariner models to contemporary Patek Philippe complications, we purchase Swiss-made watches from dozens of prestigious manufactures

- Designer Jewelry: High-end pieces from Cartier, Tiffany & Co., Van Cleef & Arpels, Bvlgari, Chopard, and David Yurman receive specialized evaluation

- Diamond Jewelry: GIA-certified stones and fine diamond jewelry, including engagement rings and eternity bands

- Sterling Silver: Flatware sets, holloware, and decorative pieces from recognized makers

- Estate Jewelry: Complete collections or individual pieces from estates requiring professional liquidation

- Precious Metal Items: Gold and platinum in various forms, from coins to custom pieces

This comprehensive approach means sellers can consolidate their liquidation efforts with a single trusted buyer. Whether you're managing estate jewelry from an inheritance or downsizing a personal collection, we handle diverse portfolios with equal expertise.

Special Considerations for Inherited Items

Estate executors and heirs face unique challenges when liquidating inherited precious metals and luxury items. These pieces often carry emotional weight alongside financial value, requiring sensitive handling and professional expertise. Understanding market values for items that may have been acquired decades ago adds another layer of complexity to the process.

We work extensively with families navigating estate liquidation, providing patient guidance through evaluation and sale. Whether you've inherited gold coins from a numismatic collection, vintage luxury watches, or complete jewelry collections, our team brings the expertise needed to ensure proper valuation. For those managing estate jewelry sales, we offer both outright purchase and consignment options, depending on which approach best serves the estate's interests.

Building Trust Through Transparency and Expertise

The luxury buying market demands trust, expertise, and transparency—qualities that define our approach at Sell Us Your Jewelry. As the purchasing division of Gray & Sons, we bring over four decades of experience in the luxury market. Our master-trained watchmakers, experienced jewelers, and precious metals specialists ensure every item receives accurate, professional evaluation.

For sellers researching places that buy jewelry near me, credentials and reputation matter tremendously. We've built our business on fair pricing, professional service, and transparent transactions. Whether you're a first-time seller nervous about the process or an experienced collector liquidating part of your holdings, we provide the same high-level service and expertise. Our About Us page details our history and credentials, offering peace of mind to those entrusting us with valuable items.

Making Your Decision: Purchase vs. Consignment

Sellers benefit from understanding the two primary pathways for liquidating luxury items: direct purchase and consignment. Each approach offers distinct advantages depending on your timeline, the items being sold, and your financial goals. For those seeking immediate funds for holiday expenses or year-end financial planning, direct purchase provides the fastest path to liquidity.

Alternatively, consignment may yield higher returns for certain items, particularly rare collectibles or limited-edition pieces that benefit from extended market exposure. Our team helps sellers evaluate which approach best serves their interests. This flexibility, combined with our expertise across brands we buy, ensures you can make informed decisions aligned with your specific situation and goals.

The November Advantage: Timing Your Sale

November's position in the calendar creates unique advantages for precious metal and luxury item sellers. The approaching holiday season increases market activity as buyers seek gifts and year-end purchases. Simultaneously, tax planning considerations motivate strategic sellers to complete transactions before December 31st. This combination of factors often produces favorable pricing conditions for those ready to sell.

Additionally, completing sales now provides funds that can be deployed according to your holiday and year-end priorities. Whether you're funding family celebrations, supporting charitable causes, making year-end investments, or simply seeking portfolio rebalancing, early action ensures these funds are available when needed. The alternative—waiting until after the holidays—means missing both the current year's tax planning window and the seasonal market activity.

Getting Started: Your Next Steps

If you're considering selling gold coins, luxury jewelry, watches, or other precious metal items this season, beginning the evaluation process now positions you advantageously. Our team stands ready to provide professional assessments and competitive offers for items across all categories we purchase. The process begins simply: contact us through our website, visit our Surfside showroom, or request a quote through our specialized forms.

For watch owners, our watch quote system provides a streamlined path to preliminary evaluation. Jewelry sellers can access jewelry quotes that consider designer attribution, materials, and market demand. Those holding GIA-certified diamonds benefit from our specialized diamond evaluation services, while sterling silver sellers can access our silver buying expertise. Each pathway connects you with specialists who understand your items' unique characteristics and market position.

Beyond Thanksgiving: Looking Toward 2026

While this article focuses on Thanksgiving season opportunities and year-end planning, the strategic thinking behind precious metal portfolio management extends into the new year. Markets evolve, personal circumstances change, and the items that served you well in previous years may no longer align with current goals. Establishing a relationship with a trusted buyer provides ongoing flexibility as your needs develop.

Whether you're planning further portfolio adjustments in early 2026, considering gradual liquidation of collections, or simply want to establish a relationship with experts you can trust when the time comes, we welcome those conversations. Our commitment extends beyond individual transactions to building lasting relationships with clients who value expertise, fair pricing, and professional service. The brands we buy encompass dozens of luxury manufactures, ensuring we can serve your needs across multiple categories and timeframes.

Your Thanksgiving Strategy Awaits

Converting your gold coin portfolio, luxury watches, designer jewelry, or other precious metal items into liquid assets this holiday season combines immediate benefits with strategic year-end planning advantages. Whether you're seeking funds for memorable Thanksgiving celebrations, positioning your portfolio for tax optimization, or simply ready to convert dormant assets into working capital, the current market presents favorable conditions for sellers.

At Sell Us Your Jewelry, we bring over 40 years of luxury market expertise to every transaction. Our comprehensive services, professional evaluation processes, and commitment to fair pricing ensure sellers receive the value their items deserve. As you consider your options this holiday season, we invite you to experience the difference that genuine expertise and customer-focused service provide.

Ready to Turn Your Assets Into Blessings?

Don't let valuable gold coins, luxury watches, designer jewelry, or precious metal items sit unused while opportunities pass. Contact Sell Us Your Jewelry today to begin your evaluation process. Whether you prefer visiting our Surfside showroom near Bal Harbour or using our secure online platform, we make selling luxury items straightforward, professional, and rewarding.

Request your free evaluation now:

- Get a Watch Quote - Expert evaluation for luxury timepieces

- Get a Jewelry Quote - Professional appraisal for designer pieces

- Sell Your GIA Diamonds - Specialized service for certified stones

- Sell Your Sterling Silver - Fair pricing for flatware and holloware

- Explore What You Can Sell - Comprehensive buying services

Transform your portfolio this Thanksgiving season. Discover why discerning sellers throughout South Florida and nationwide trust Sell Us Your Jewelry for professional service, expert evaluations, and competitive offers on luxury items and precious metals.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG