February 20th, 2026

Winter Watch Wisdom: Why January 2026 Is the Perfect Month for Strategic Rolex and Patek Philippe Portfolio Optimization

As we welcome the new year, January 2026 presents a unique opportunity for luxury watch collectors and owners to optimize their timepiece portfolios. Whether you're looking to sell Rolex watch pieces that no longer fit your collection or considering how to sell Patek Philippe watch models to rebalance your holdings, this winter month offers strategic advantages that savvy collectors shouldn't overlook. Understanding the dynamics of the luxury watch market during this period can help you maximize returns while positioning yourself for future acquisitions.

The beginning of the year brings fresh perspectives on collecting strategies, financial planning, and personal priorities. For those managing a luxury watch portfolio, January offers a clean slate to assess which pieces truly deserve space in your collection and which might serve you better as liquid assets. This assessment becomes particularly valuable when working with established watch buyers who understand the nuanced value of premium timepieces.

Why January Creates Optimal Conditions for Watch Portfolio Decisions

January traditionally marks a period of financial reflection and goal-setting, making it the ideal time to evaluate your luxury assets. Many collectors use this month to reassess their holdings, determining which watches align with their current lifestyle and collecting philosophy. The post-holiday period also creates favorable market conditions, with serious buyers actively seeking quality pieces to begin their year.

The January watch selling market benefits from reduced competition compared to peak holiday months, allowing quality timepieces to receive proper attention from dedicated buyers. Professional Rolex watch buyer services and Patek Philippe watch buyer specialists are particularly active during this period, as they replenish inventory following the holiday season and prepare for spring demand.

If you're considering how to sell your watch, January provides the perfect timing to receive accurate valuations without the pressure of holiday deadlines. Our expert team can provide comprehensive assessments that reflect current market values, helping you make informed decisions about your collection.

Understanding the Post-Holiday Luxury Watch Market

The luxury watch market experiences distinct seasonal patterns, and understanding these cycles can significantly impact your selling strategy. After the holiday rush subsides, January brings a more measured pace that allows for thorough evaluations and fair negotiations. This environment particularly benefits those looking to sell my Rolex or pursue other premium timepiece transactions.

Buyers who specialize in luxury timepieces, including those seeking to sell Patek Philippe Nautilus models or sell Rolex GMT Master pieces, find that January offers clearer market visibility. Price fluctuations stabilize, and serious collectors emerge with refreshed budgets and refined acquisition goals. This creates an advantageous environment for sellers who prioritize fair value over rushed transactions.

For collectors exploring where to sell a Rolex, partnering with established luxury buyers ensures your timepieces receive proper evaluation by experts who understand the intricacies of premium watch markets. Our team specializes in assessing everything from classic Datejust models to professional sports watches, providing transparent pricing based on current market conditions.

Strategic Portfolio Optimization for Serious Collectors

Managing a luxury watch collection requires the same strategic thinking applied to any valuable asset portfolio. January offers an excellent opportunity to evaluate which pieces truly deserve space in your collection and which might better serve your financial or collecting goals if sold. This assessment becomes particularly important for collectors maintaining multiple high-value timepieces.

Consider which watches you actually wear regularly versus those sitting in safe deposit boxes. Models that no longer align with your style, duplicate functions in your collection, or represent outdated collecting interests might be prime candidates for liquidation. Those looking to sell Rolex Submariner Boca Raton locations or sell Rolex Submariner Miami market opportunities should know that these iconic sport watches consistently maintain strong demand.

Professional evaluation services help collectors understand the true market value of their holdings. Whether you're looking to sell Patek Philippe Perpetual Calendar complications or more accessible models, working with experienced used luxury watch buyer specialists ensures you receive fair market assessments based on current conditions, condition factors, and provenance considerations.

Rolex Models That Command Premium Attention

Rolex timepieces consistently demonstrate remarkable value retention, making them excellent candidates for strategic portfolio optimization. From vintage references to contemporary models, certain Rolex watches generate particular interest from serious collectors and investors. Understanding which models attract premium attention helps sellers time their transactions strategically.

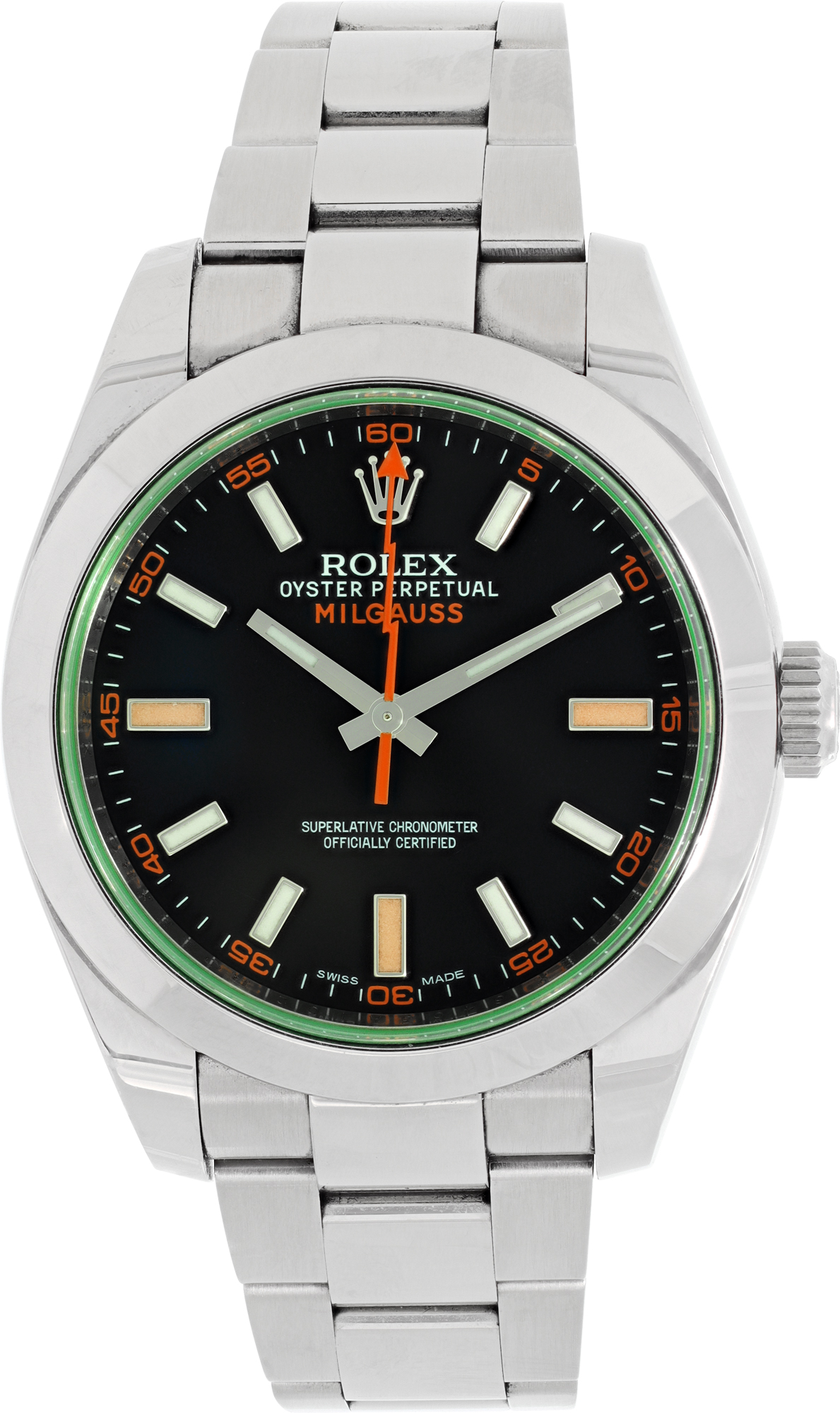

The Rolex Submariner buyer market remains exceptionally strong, with both vintage and modern references commanding significant interest. Similarly, those looking to sell Rolex Sea Dweller models or professional GMT-Master pieces find consistent demand from collectors seeking proven tool watches. Even discontinued models like the Rolex Milgauss buyer market seeks can attract dedicated enthusiasts who appreciate their unique positioning within the brand's catalog.

Classic dress watches also maintain steady appeal, particularly among collectors seeking versatile timepieces for diverse occasions. Models like the Datejust, Day-Date, and Oyster Perpetual represent Rolex's timeless design philosophy while offering excellent wearability. If you're wondering about the best place to sell my Rolex, partnering with buyers who understand the nuanced differences between references ensures accurate valuations.

Patek Philippe: The Ultimate Portfolio Investment Piece

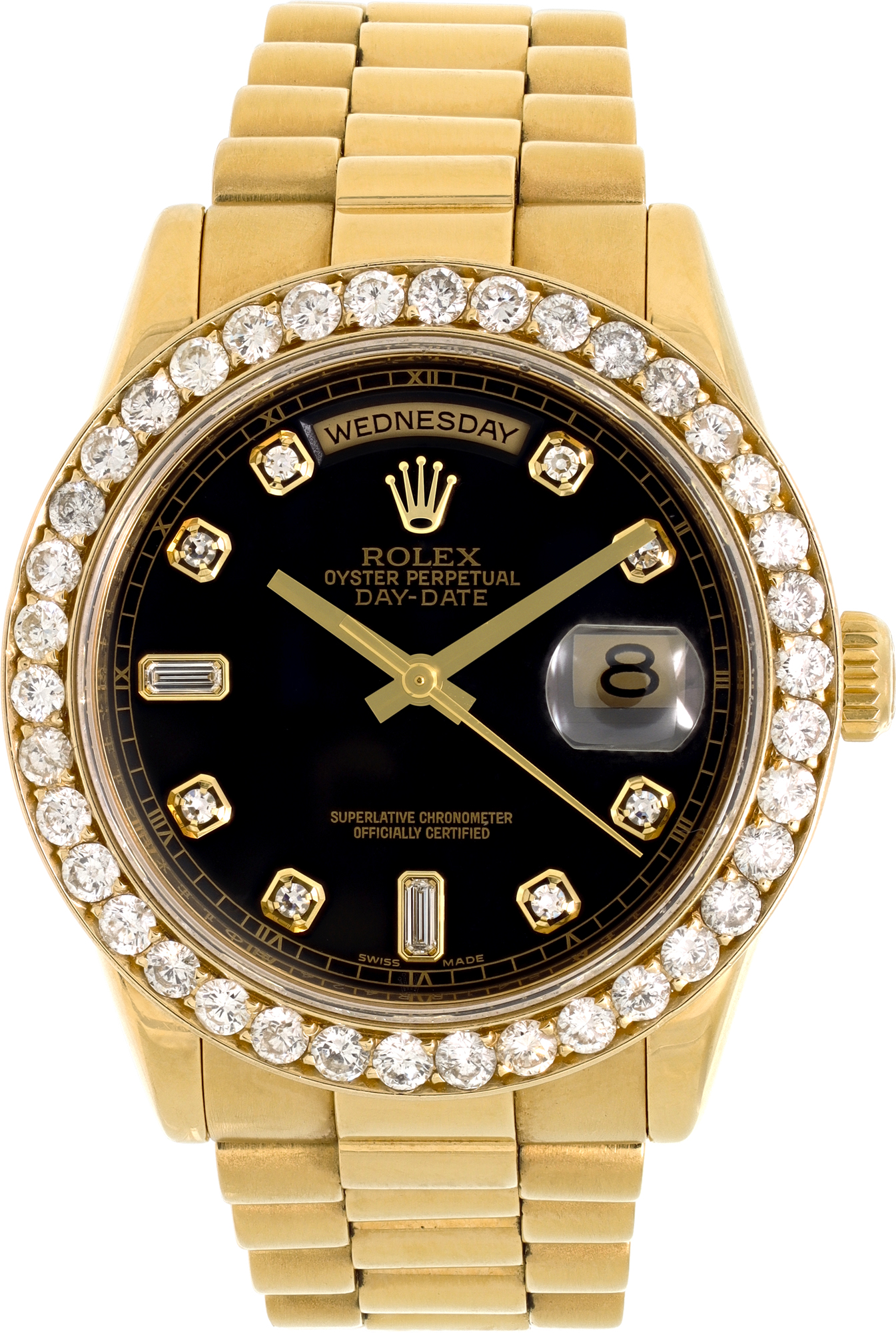

Patek Philippe represents the pinnacle of watchmaking artistry, and these timepieces often form the cornerstone of serious collections. When considering portfolio optimization, Patek Philippe watches deserve careful consideration due to their exceptional value retention and strong secondary market demand. These aren't merely timepieces—they're wearable investments that often appreciate over time.

The sell Aquanaut market demonstrates particular strength, as this relatively accessible Patek Philippe sports model attracts diverse collector interest. Meanwhile, complicated pieces command attention from advanced collectors who appreciate horological mastery. Professional Patek Philippe buyer Miami, Patek Philippe buyer Boca Raton, and Patek Philippe buyer West Palm Beach services throughout South Florida understand the unique characteristics that determine these watches' values.

Whether you own a Calatrava dress watch, a Nautilus sports model, or a complicated perpetual calendar, January provides excellent timing for professional evaluation. Our expertise extends beyond simple market values to understanding the provenance, condition factors, and collector appeal that distinguish exceptional Patek Philippe timepieces from merely good examples.

Beyond Watches: Comprehensive Luxury Portfolio Management

While watches may anchor your luxury portfolio, comprehensive wealth management often includes jewelry, diamonds, and precious metals. January's reflective atmosphere extends beyond timepieces to all luxury assets, making it an ideal time for complete portfolio assessment. Many collectors discover opportunities to optimize their entire luxury holdings simultaneously.

If you're looking to sell Cartier jewelry, sell Tiffany jewelry, or sell Van Cleef and Arpels jewelry, these iconic brands maintain consistent secondary market appeal. Particular collections like those seeking to sell Cartier Love bracelets or sell Van Cleef & Arpels Alhambra collection pieces find ready markets among enthusiasts who appreciate timeless design and exceptional craftsmanship.

Sterling silver also deserves attention during portfolio reviews. Those with inherited collections wondering how to sell sterling silver flatware or sell sterling silver tea sets should know that January's methodical pace allows for proper assessment of these substantial items. Our sterling silver buyer services provide fair evaluations based on weight, condition, and maker marks.

The diamond market operates with particular precision, especially for certified stones. Whether you're looking to sell GIA Certified Diamonds or sell AGL Certified Diamonds, professional evaluation ensures you understand how the four Cs—cut, clarity, color, and carat weight—impact your stone's value. Consider our diamond selling services for comprehensive assessment of certificated stones.

The Geographic Advantage: South Florida's Luxury Market

South Florida maintains a particularly vibrant luxury market, with collectors and buyers throughout Miami, Boca Raton, West Palm Beach, and surrounding communities. This concentration creates advantageous conditions for those selling premium timepieces and jewelry, as regional expertise and strong buyer networks ensure fair valuations.

For those searching "Rolex buyer Boca Raton," "Miami Cartier watch buyer," or "Patek Philippe buyer Aventura" options, our Surfside location across from Bal Harbour Shops provides convenient access to professional evaluation services. Our regional presence means we understand local market dynamics while maintaining national market awareness.

Whether you prefer in-person consultations or remote evaluation through our secure online process, we accommodate sellers throughout South Florida and across the United States. Our expertise extends to all major luxury watch brands, from those looking to sell Audemars Piguet watch collections to enthusiasts seeking to sell Omega watch models or sell Hublot watch pieces.

Professional Evaluation: What Sets Expert Buyers Apart

The difference between selling to a knowledgeable luxury buyer versus a general jeweler or pawnshop becomes immediately apparent during the evaluation process. Professional watch buyers understand the nuanced factors that determine value beyond basic model identification. This expertise translates directly into fair offers that reflect true market conditions.

Authentic luxury buyers recognize how condition affects value, from crystal clarity to dial patina, bracelet stretch to movement service history. They understand which complications command premium pricing and which market segments currently show strongest demand. For sellers, this expertise ensures realistic valuations that reflect your timepiece's actual secondary market potential.

Our team includes master-trained watchmakers and experienced specialists who evaluate everything from sell Vacheron Constantin watch pieces to sell IWC watch models with precision. We also handle fine jewelry evaluation, assisting those looking to sell Bvlgari jewelry, sell Chopard jewelry, or sell Harry Winston jewelry with comprehensive assessments based on materials, craftsmanship, and brand provenance.

The Consignment Alternative for Maximum Returns

While direct purchase offers immediate liquidity, consignment arrangements often yield higher returns for certain timepieces and jewelry. This approach allows your items to reach qualified buyers through established retail channels while you maintain ownership until sale completion. Our consignment program provides professional presentation, security, and marketing without upfront costs.

Consignment works particularly well for rare complications, limited editions, or vintage pieces that appeal to specialized collectors. Rather than accepting immediate liquidation prices, consignment allows your timepiece to find the right buyer willing to pay premium prices for exceptional examples. This approach benefits those with unique pieces who prioritize maximum returns over immediate payment.

Our consignment services handle everything from professional photography to authentication documentation, ensuring your watches and jewelry receive presentation worthy of their quality. Whether you're located in South Florida or shipping from elsewhere, we manage the entire process with transparency and professionalism.

Navigating the Evaluation Process with Confidence

Understanding what to expect during professional evaluation helps sellers approach the process with confidence. Reputable buyers conduct thorough assessments covering authenticity verification, condition analysis, movement inspection, and market research before presenting offers. This comprehensive approach ensures valuations reflect all factors affecting your timepiece's worth.

The evaluation begins with authentication, confirming your watch's genuineness through serial number verification, movement inspection, and component analysis. Condition assessment follows, examining everything from case wear to dial condition, crystal integrity to bracelet functionality. Movement performance testing reveals service needs that might affect value.

For those wondering where can I sell my watch, professional buyers provide detailed explanations of their valuation methodology. This transparency helps sellers understand how market conditions, condition factors, and current demand influence offered prices. Whether you're selling locally or remotely, reputable buyers ensure you comprehend every aspect of their assessment.

Timing Considerations Beyond January

While January offers strategic advantages for portfolio optimization, understanding broader market timing helps sellers make informed decisions. Luxury watch markets demonstrate seasonal patterns, with spring and fall typically showing increased activity as collectors refresh their collections. However, quality timepieces maintain consistent demand throughout the year.

Market conditions for specific brands and models fluctuate based on numerous factors—manufacturer price increases, production changes, celebrity endorsements, and collecting trends all influence secondary market values. Staying informed about these dynamics helps sellers identify optimal timing for specific pieces within their portfolios.

That said, the "perfect time" to sell often depends more on personal circumstances than market timing. Whether you're relocating, downsizing, facing financial needs, or simply refining your collection, professional buyers provide fair evaluations regardless of season. Our commitment remains consistent: offering transparent, competitive valuations based on current market conditions whenever you're ready to sell.

Taking the Next Step: Your Path Forward

If you've been contemplating optimizing your luxury watch or jewelry portfolio, January 2026 provides an excellent opportunity to take action. Whether you're curious about current market values, exploring selling options, or ready to proceed with transactions, professional evaluation services offer clarity without obligation.

Begin by gathering your timepieces' documentation—boxes, papers, service records, and purchase receipts all contribute valuable provenance information. Original documentation often enhances value, particularly for sought-after models from brands like Rolex and Patek Philippe. However, quality timepieces retain substantial value even without complete packaging.

Our evaluation process accommodates various preferences, from in-person consultations at our Surfside showroom to secure remote assessment through our online platform. We understand that luxury items represent significant value, and we handle each piece with appropriate care and professionalism throughout the evaluation process.

Your Trusted Partner for Luxury Asset Transactions

Since 1980, our reputation has been built on fair dealing, expert knowledge, and exceptional customer service. As the purchasing and consignment division of Gray & Sons, we've helped countless clients optimize their luxury portfolios while receiving competitive pricing and professional service. Our expertise spans all major luxury watch brands and fine jewelry houses.

We maintain active buyer interest for timepieces from dozens of manufacturers, including those looking to sell Breitling watch, sell Jaeger-LeCoultre watch, sell Panerai watch, sell Audemars Piguet Royal Oak Offshore, and many others. Our jewelry expertise extends to all major houses, from those seeking to sell David Yurman jewelry to collectors with sell Graff jewelry or sell Piaget jewelry requirements.

Understanding the distinction between general jewelry buyers and specialized luxury watch and jewelry buyers makes all the difference in your selling experience. Our team's expertise ensures you receive valuations that reflect true market values, not lowest-common-denominator pricing based on melt values or uninformed assessments.

Begin Your Portfolio Optimization Journey Today

This January, take control of your luxury asset portfolio with professional guidance from experienced buyers who understand the intricacies of premium timepieces and fine jewelry. Whether you're selling a single watch to fund a new acquisition or optimizing an entire collection, we provide the expertise, transparency, and competitive pricing you deserve.

Ready to discover what your luxury timepieces and jewelry are worth? Start your evaluation journey today:

- Get a watch quote for professional Rolex, Patek Philippe, and other luxury timepiece evaluation

- Request a jewelry assessment for fine jewelry from Cartier, Tiffany, Van Cleef & Arpels, and other prestigious brands

- Learn about our process to understand how we evaluate and purchase luxury items

- Explore brands we buy to see our comprehensive expertise across luxury watches and jewelry

Join the countless satisfied clients who have trusted us with their luxury portfolio optimization. Whether you're in South Florida or anywhere across the United States, our team stands ready to provide expert evaluation and competitive offers for your premium timepieces and fine jewelry. Contact us today to begin your consultation and discover why January 2026 represents the perfect time for strategic portfolio decisions.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG