November 4th, 2025

Market Corrections: Watch Volatility Creates Opportunities

The luxury watch market is experiencing unprecedented volatility in September 2025, creating unique opportunities for collectors and investors to sell luxury watch collections at advantageous prices. Market corrections, while initially concerning to watch enthusiasts, often signal the perfect time for strategic selling decisions that can maximize returns on luxury timepieces.

Understanding these market dynamics becomes crucial when deciding whether to hold or sell valuable pieces like Rolex, Patek Philippe, and other Swiss luxury brands. The current correction phase presents both challenges and opportunities that savvy sellers can leverage to their advantage.

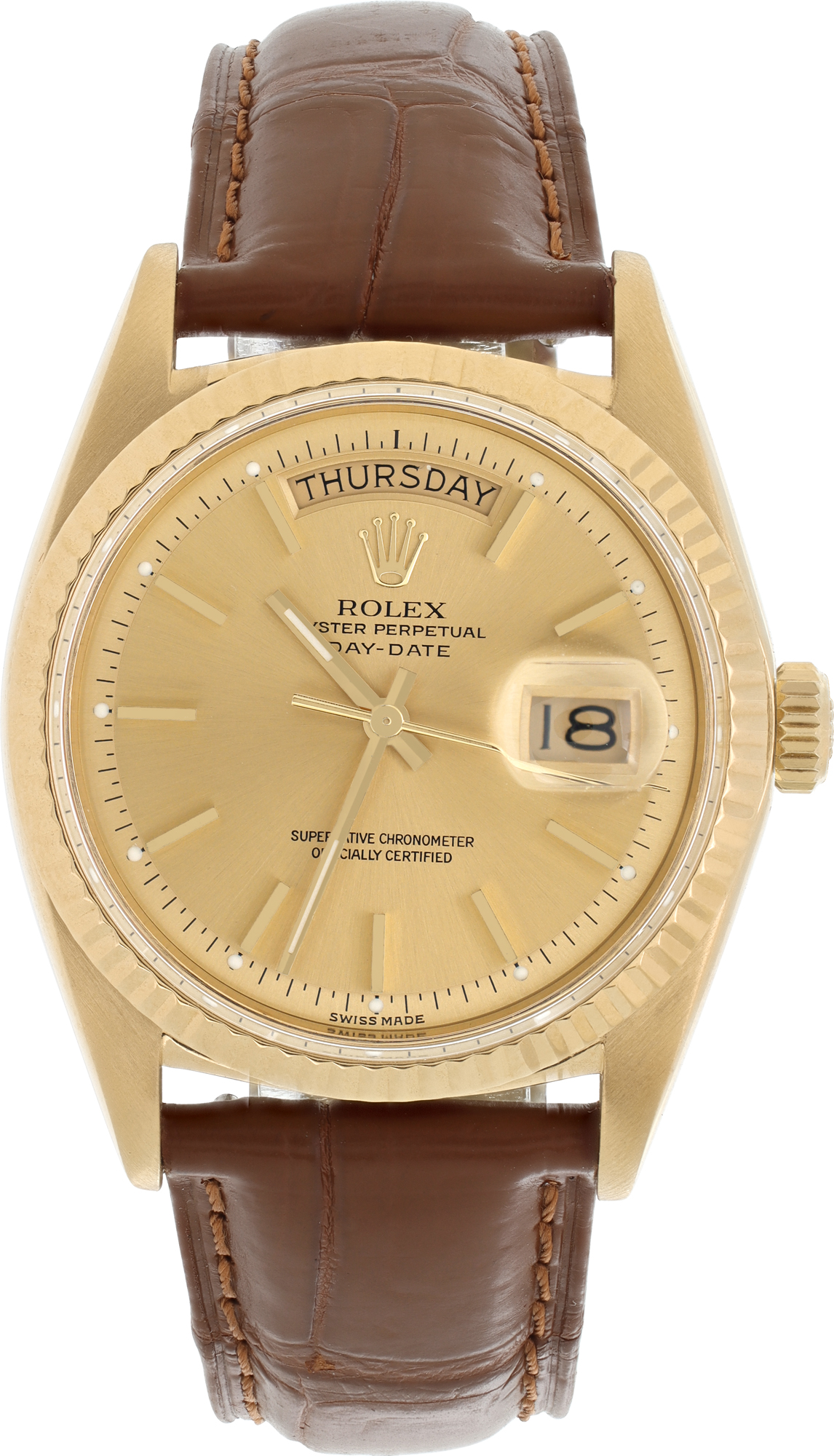

For those considering whether to sell my rolex, the current market volatility has created a complex landscape where certain models maintain premium valuations despite broader market corrections. The key lies in understanding which timepieces are best positioned for immediate sale versus those that might benefit from strategic timing.

Understanding September 2025's Market Correction Patterns

Market corrections in the luxury watch sector follow predictable patterns that informed sellers can capitalize on effectively. September 2025 has witnessed significant fluctuations in pre-owned luxury watch valuations, particularly affecting popular models from established manufacturers like Rolex, Patek Philippe, and Omega.

The correction has created a two-tiered market where incredible used rolex watches in excellent condition continue commanding premium prices, while pieces requiring service or showing wear face steeper discounts. This divergence presents opportunities for sellers with well-maintained timepieces to achieve favorable outcomes.

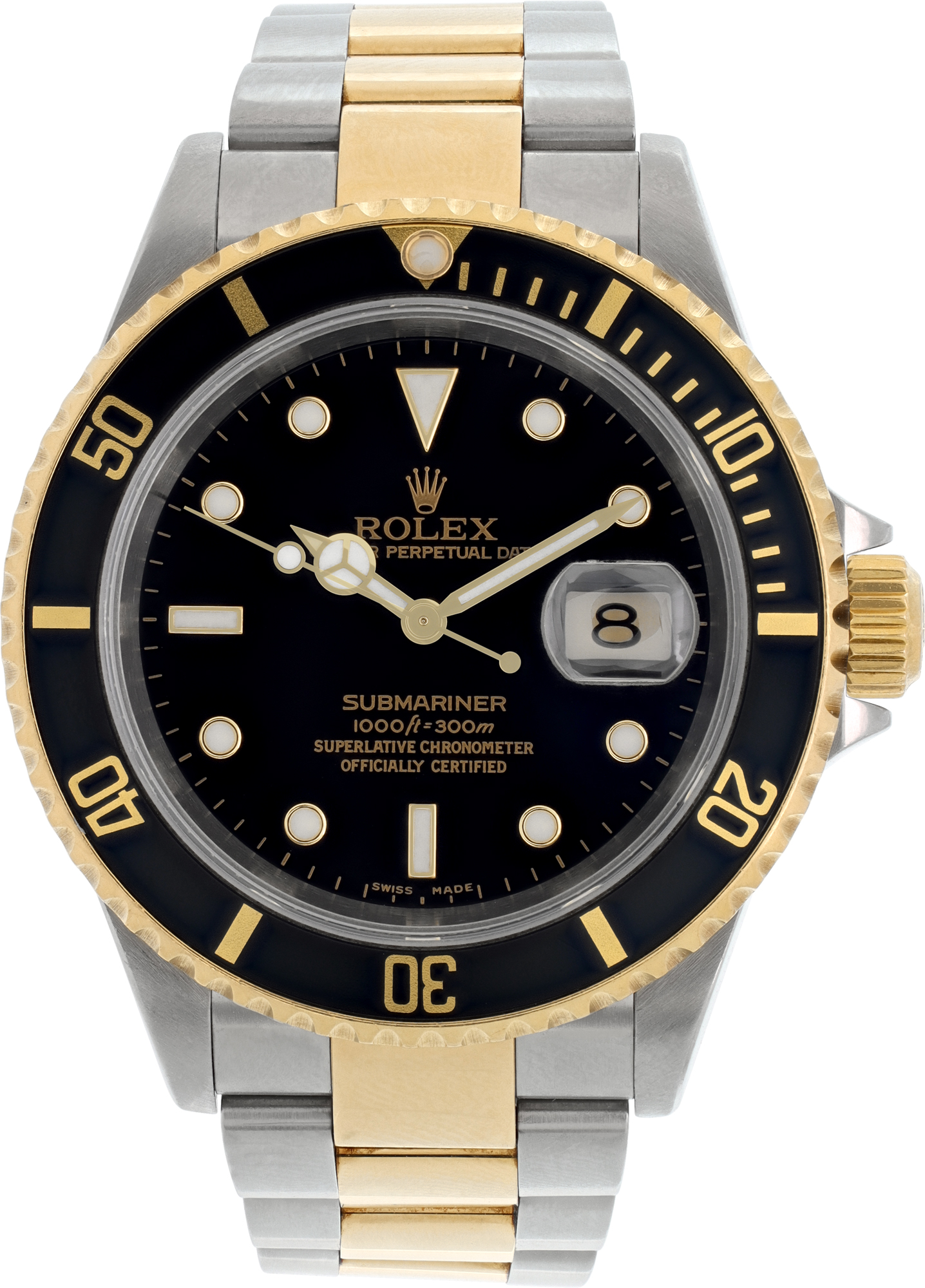

Professional rolex submariner buyer services are seeing increased activity as collectors reassess their portfolios during this correction period. The volatility has prompted many owners to consider to sell your watch collections before potential further market adjustments, creating increased supply in certain segments.

Experienced buyers recognize that market corrections often precede periods of stabilization and growth, making this an opportune time for both selling underperforming pieces and acquiring replacement timepieces at adjusted valuations.

Strategic Selling During Market Volatility

Smart sellers approach market volatility with calculated strategies rather than emotional reactions to temporary price fluctuations. The current September 2025 correction rewards those who understand which luxury watch categories remain resilient during uncertain periods.

Sports models from prestigious manufacturers like Rolex Submariner, GMT-Master, and Daytona continue attracting strong buyer interest, even during market corrections. These pieces represent the value of pre owned luxury watch collections that maintain stability during volatile periods.

Miami's luxury watch market has shown particular resilience, with patek philippe buyer miami services reporting consistent demand for exceptional pieces despite broader market uncertainty. The region's affluent collector base continues seeking premium timepieces, creating opportunities for strategic sellers.

Those wondering where can i sell my watch should focus on established buyers with proven track records during volatile market conditions. Professional evaluation services can provide accurate assessments that account for current market dynamics and realistic pricing expectations.

Identifying Peak Selling Opportunities in Correction Markets

Market corrections create temporary inefficiencies where informed sellers can achieve better outcomes than during stable market periods. September 2025's volatility has generated specific opportunities for owners of certain luxury watch categories to maximize their returns.

Vintage Rolex models, particularly those with rare dial configurations or limited production runs, often appreciate during market corrections as collectors seek tangible assets with proven historical performance. These pieces represent selling your pre owned luxury watch at optimal timing when demand exceeds available supply.

Professional used luxury watch buyer services are particularly active during correction periods, as they recognize opportunities to acquire exceptional pieces from sellers who need immediate liquidity. This increased buyer activity often translates to competitive offers for quality timepieces.

The correction has also highlighted the importance of proper documentation and provenance when selling luxury watches. Complete sets with original boxes, papers, and service records command significant premiums during volatile periods, as buyers seek assurance of authenticity and condition.

Maximizing Returns Through Professional Evaluation Services

Professional evaluation becomes critical during market corrections when pricing volatility can significantly impact sale outcomes. September 2025's market conditions require expert assessment to achieve optimal results when selling luxury timepieces.

Established buyers with decades of experience, like those at Gray & Sons since 1980, understand how to navigate volatile markets while providing fair valuations for sellers. Their expertise becomes invaluable when determining whether immediate sale or strategic timing better serves sellers' interests.

The best place to sell my rolex during correction periods is typically through experienced professionals who maintain active buyer networks and understand current market dynamics. These buyers can provide accurate assessments while offering competitive pricing despite broader market uncertainty.

For those seeking immediate liquidity, professional buyers offer the advantage of quick transactions without the uncertainty of private market sales during volatile periods. Their established relationships with collectors and dealers enable them to provide competitive offers even when broader market conditions are challenging.

Regional Market Advantages in South Florida

South Florida's luxury watch market has demonstrated remarkable resilience during September 2025's correction period, creating advantages for local sellers. The region's concentration of affluent collectors and seasonal residents maintains steady demand for premium timepieces.

Boca raton rolex buyer services report continued strong activity, particularly for sports models and vintage pieces with compelling provenance. The area's sophisticated collector base understands luxury watch values and remains active during market corrections, providing sellers with reliable exit opportunities.

Miami's luxury market extends beyond watches to encompass comprehensive luxury buying services. Professional miami patek philippe buyer operations often handle complete estate liquidations, providing sellers with convenient solutions for multiple luxury items during challenging market periods.

The convenience of working with established South Florida buyers becomes particularly valuable during volatile periods when sellers need certainty and professional guidance. These buyers understand local market dynamics while maintaining connections to national and international collector networks.

Conclusion: Leveraging Volatility for Strategic Advantage

September 2025's luxury watch market correction presents unique opportunities for informed sellers to achieve favorable outcomes through strategic timing and professional guidance. Understanding market dynamics and working with experienced buyers can transform apparent challenges into profitable opportunities.

The key to success during volatile periods lies in accurate evaluation, proper timing, and working with established professionals who understand luxury watch markets. Whether you're looking to sell your watch or explore other luxury items, professional guidance ensures optimal outcomes during uncertain market conditions.

Ready to explore your selling opportunities during this market correction? Our expert team provides comprehensive evaluations for luxury watches, jewelry, and other premium items. Get your watch quote today to discover how current market conditions might benefit your selling strategy. We also buy luxury jewelry, GIA diamonds, and sterling silver, providing complete solutions for your luxury asset needs. Learn more about our brands we buy and discover why sellers throughout South Florida trust our expertise during volatile market periods.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG