November 4th, 2025

September Smart Money: Gold Coin Liquidation for Fall

As September arrives and investors begin their fall portfolio adjustments, smart money managers are taking a closer look at their gold coin investments and precious metals allocations. With market dynamics shifting and portfolio rebalancing becoming increasingly important, many sophisticated investors are discovering the strategic advantages of working with qualified gold buyers near me to optimize their holdings. Whether you're downsizing your collection, reallocating assets, or capitalizing on current market conditions, understanding the timing and process of gold coin liquidation can significantly impact your portfolio's performance.

The transition from summer to fall traditionally marks a period of heightened financial planning activity, as investors reassess their positions before year-end. For those holding gold coins and precious metals, this presents an opportune moment to evaluate whether these assets continue to align with their investment objectives and risk tolerance.

Why September Represents Prime Timing for Gold Liquidation

September has historically been a strategic month for precious metals buyers and sellers alike, as institutional investors return from summer schedules and begin positioning portfolios for the final quarter. Market liquidity typically increases during this period, creating favorable conditions for those looking to sell gold coins and bullion. Additionally, the approach of year-end tax planning makes September an ideal time to realize gains or losses on precious metals holdings.

The psychological aspect of seasonal transitions also plays a role in market dynamics. As collectors and investors shift their focus toward fall activities and year-end financial planning, demand patterns for collectible gold coins can create opportunities for strategic sellers. Understanding these market rhythms allows sophisticated investors to time their liquidations more effectively.

When considering portfolio rebalancing strategies, it's essential to work with experienced professionals who understand both the numismatic and investment aspects of precious metals. Our expertise in evaluating GIA-certified diamonds and precious metals ensures that sellers receive accurate assessments of their holdings' current market value.

Strategic Considerations for Gold Coin Portfolio Adjustments

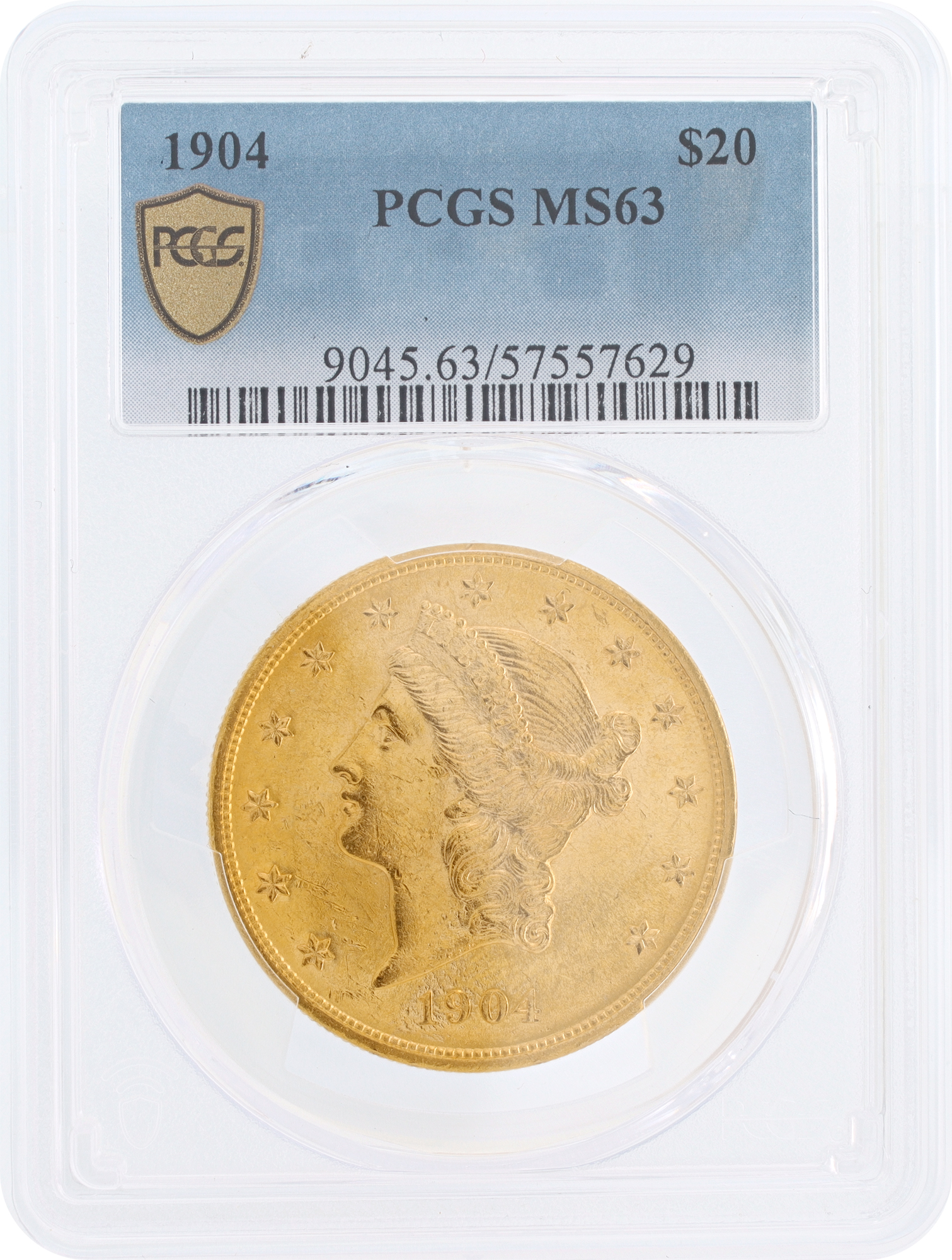

Smart investors approach gold coin liquidation with careful consideration of multiple factors beyond simple spot price movements. The numismatic value of certain coins, market conditions for specific series, and the overall health of the collectibles market all influence optimal timing decisions. Professional gold jewelry buyers and coin specialists can provide crucial insights into which pieces may command premiums above their gold content value.

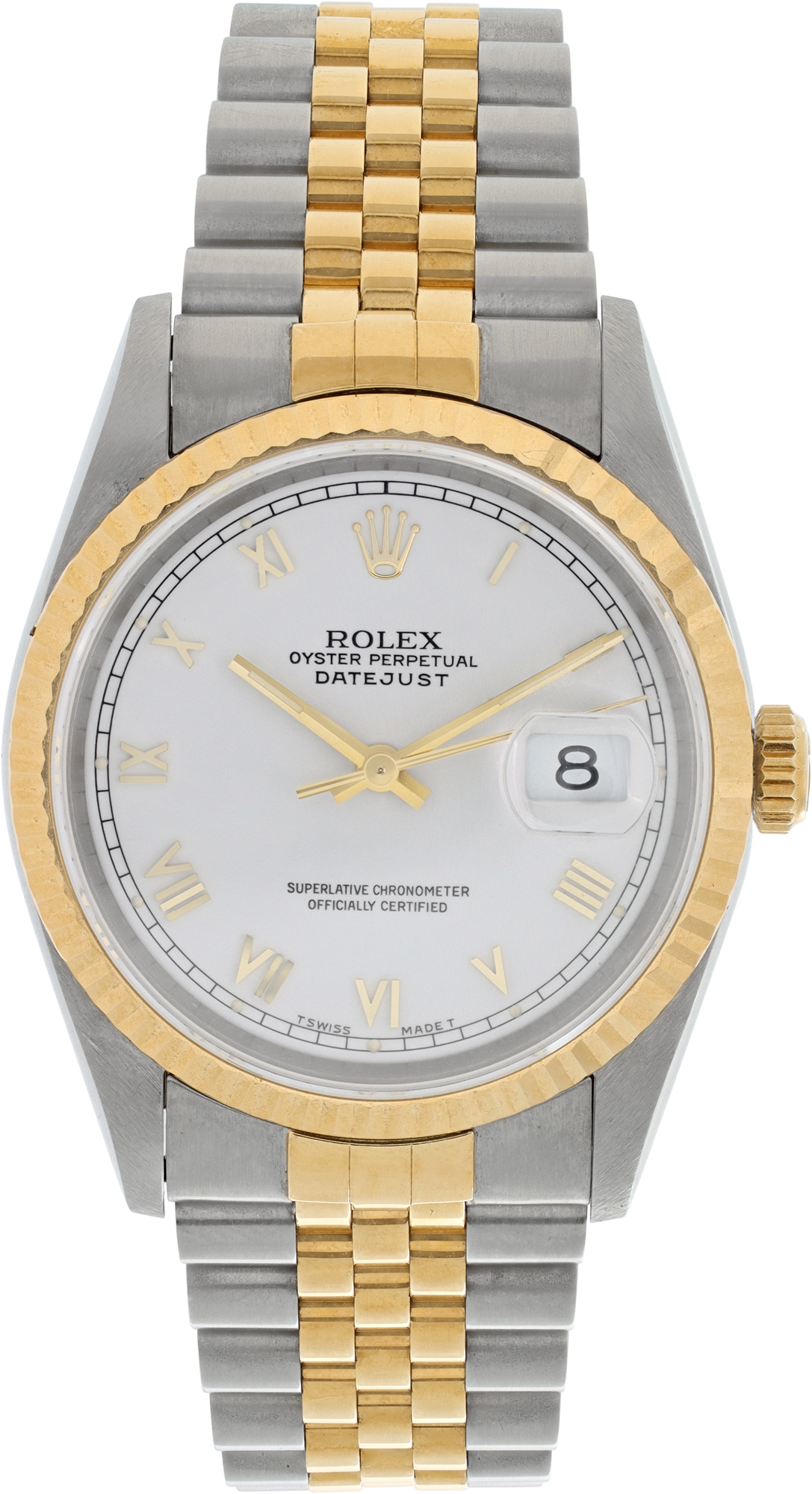

Diversification remains a cornerstone of sound investment strategy, and September's portfolio adjustment season provides an excellent opportunity to reassess precious metals allocations. Some investors may choose to reduce their gold coin exposure while maintaining positions in other luxury assets like Swiss timepieces or estate jewelry. The interconnected nature of luxury asset markets means that strategic selling in one category can fund acquisitions in another.

For those seeking to sell luxury watches or other high-value items alongside their gold coins, coordinated liquidation strategies can maximize overall returns. Working with buyers who understand multiple luxury asset categories ensures comprehensive evaluation and competitive pricing across your entire collection.

Maximizing Returns Through Professional Evaluation

The difference between casual gold buyers and professional precious metals specialists becomes apparent when dealing with rare or collectible coins. Factors such as mint marks, condition grades, and historical significance can dramatically impact valuations beyond the underlying gold content. This expertise proves particularly valuable for coins with potential numismatic premiums, where proper evaluation can mean thousands of dollars in additional value.

Documentation and provenance play crucial roles in maximizing gold coin values. Coins with original mint packaging, certificates of authenticity, or documented ownership history often command higher prices than similar pieces without such documentation. Professional buyers understand these nuances and can help sellers present their coins in the most favorable light to potential purchasers.

The evaluation process should encompass not only individual coin values but also the strategic value of selling collections as complete sets versus breaking them apart. Sometimes, maintaining collection integrity provides greater overall value, while other situations favor selective liquidation of specific pieces. Jewelry buyers near me with experience in precious metals can provide valuable guidance on these strategic decisions.

Market Dynamics and Timing Considerations

September's market dynamics often favor sellers due to increased institutional activity and renewed collector interest following summer breaks. However, understanding broader economic trends, inflation expectations, and currency movements remains essential for optimal timing. Professional precious metals buyers stay current with these macro factors and can provide valuable market insights to sellers considering liquidation.

The luxury asset market operates with its own seasonal rhythms, distinct from traditional financial markets. Fall often brings increased activity in estate jewelry, fine watches, and collectible coins as collectors prepare for holiday acquisitions and year-end financial decisions. This heightened activity can create favorable conditions for strategic sellers.

Coordination between different asset categories becomes particularly important during portfolio rebalancing periods. Sellers might discover opportunities to sell Rolex watches or other luxury timepieces alongside their gold coins, creating more comprehensive portfolio adjustments. The interconnected nature of luxury asset markets means that strategic timing across multiple categories can enhance overall returns.

The Professional Liquidation Process

Working with established precious metals buyers ensures a systematic approach to gold coin liquidation that maximizes both financial returns and transaction security. The process typically begins with comprehensive evaluation, considering not only gold content and current spot prices but also numismatic factors, market conditions for specific coin types, and optimal timing considerations.

Transparency throughout the evaluation and purchase process distinguishes professional buyers from casual dealers. This includes clear explanations of how values are determined, current market conditions affecting prices, and any factors that might influence timing decisions. Such transparency allows sellers to make informed decisions about whether to proceed with immediate liquidation or consider alternative timing.

For sellers with diverse luxury holdings, coordinated evaluation services provide significant advantages. The ability to assess sterling silver collections alongside gold coins, or to evaluate vintage timepieces concurrently with precious metals holdings, streamlines the portfolio adjustment process and ensures optimal overall outcomes.

Strategic Alternatives to Outright Sale

Sophisticated investors understand that outright sale represents only one option for gold coin liquidation. Consignment arrangements can sometimes yield higher returns, particularly for rare or highly collectible pieces, by accessing specialized collector markets. Professional buyers with established networks can facilitate such arrangements when they better serve the seller's interests.

The decision between immediate liquidation and consignment often depends on market conditions, the seller's timeline, and the specific characteristics of the coins in question. Rare coins with strong collector followings might benefit from consignment to specialized numismatic markets, while bullion coins might be better suited for immediate purchase based on current precious metals pricing.

Understanding these alternatives allows sellers to make strategic decisions aligned with their financial objectives and timelines. Professional guidance becomes invaluable in navigating these options and selecting the approach that maximizes long-term value while meeting immediate financial needs.

Preparing for Successful Transactions

Successful gold coin liquidation begins with proper preparation, including gathering all relevant documentation, organizing coins for professional evaluation, and understanding current market conditions. Sellers benefit from working with buyers who can provide educational resources about the evaluation process and market factors affecting precious metals pricing.

Security considerations play a crucial role throughout the liquidation process, from initial evaluation through final transaction completion. Professional buyers maintain secure facilities and follow established protocols to protect both the assets and the parties involved. This security extends to payment processing and ensures that transactions proceed smoothly and safely.

The timing of final transactions can significantly impact net proceeds, particularly in volatile precious metals markets. Professional buyers can provide guidance on optimal timing within the broader context of market conditions and the seller's specific objectives. This expertise proves particularly valuable during periods of heightened market volatility or significant economic events.

Ready to Optimize Your Portfolio This Fall?

Whether you're looking to sell gold coins as part of your September portfolio adjustments or exploring options for other luxury assets, our expert team provides the professional evaluation and competitive pricing you deserve. As the purchasing and consignment division of Gray & Sons, we've been helping clients unlock the value of their precious metals, fine jewelry, and luxury timepieces since 1980.

Take the first step toward strategic portfolio optimization:

- Get a professional evaluation for your gold coins and precious metals

- Discover what your luxury jewelry is worth

- Learn about our comprehensive buying process

Our South Florida showroom in Surfside welcomes local clients, while our secure online platform serves sellers nationwide. Contact us today to discover how strategic gold coin liquidation can enhance your fall portfolio adjustments and position you for long-term financial success.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG