February 20th, 2026

Winter Storage Costs vs. Immediate Cash: Why October is the Smart Time to Sell Your Luxury Watch Collection

As autumn settles in and the holiday season approaches, many luxury watch collectors face a familiar dilemma: should they invest in professional storage for their timepieces during the slower winter months, or is it the perfect time to sell luxury watch collections for immediate cash? For discerning collectors who've accumulated multiple pieces over the years, October presents a unique opportunity to maximize returns while avoiding the ongoing costs and concerns of winter storage.

The luxury watch market experiences distinct seasonal patterns, and understanding these cycles can significantly impact your selling strategy. Rather than paying for climate-controlled storage, insurance, and maintenance throughout the winter months, savvy collectors are discovering that fall represents an optimal selling window for their treasured timepieces.

The Hidden Costs of Winter Watch Storage

Professional watch storage involves more than simply placing your timepieces in a safe deposit box. Luxury watches require climate-controlled environments to prevent moisture damage, temperature fluctuations, and mechanical deterioration. Premium storage facilities specializing in high-value items typically charge between $200-$500 annually per piece, depending on the watch's value and the facility's security features.

Beyond storage fees, collectors must consider insurance premiums, which can range from 1-3% of the watch's appraised value annually. For a collection worth $50,000, this translates to $500-$1,500 in insurance costs alone. Additionally, watches stored for extended periods require periodic servicing to maintain their mechanical integrity, adding another $300-$800 per timepiece every few years.

When you're ready to sell your watch, timing becomes crucial for maximizing value. October's pre-holiday market conditions often favor sellers, as buyers begin preparing for year-end purchases and gift-giving occasions.

October's Market Advantages for Luxury Watch Sales

The luxury watch market traditionally experiences heightened activity during October, making it an ideal time for collectors considering whether to sell my rolex or other premium timepieces. Several factors contribute to this seasonal uptick in demand and pricing strength.

Pre-holiday purchasing drives significant market activity, as affluent buyers begin acquiring luxury gifts for the upcoming season. Corporate bonuses and year-end financial planning also influence purchasing decisions, creating a pool of qualified buyers with immediate liquidity. This increased demand often translates to competitive offers and shorter selling timeframes.

For those wondering about rolex prices and market timing, October historically shows strong price stability before the potential volatility that can accompany year-end market adjustments. Professional rolex buyer services experience increased activity during this period, creating favorable conditions for sellers seeking competitive valuations.

Geographic Advantages: Florida's Year-Round Luxury Market

Florida's unique position as a luxury destination creates distinct advantages for watch sellers, particularly in markets like miami patek philippe buyer services and boca raton rolex buyer specialists. The state's affluent seasonal residents return for winter months, creating increased demand for luxury timepieces throughout the fall and winter seasons.

Areas like bal harbour rolex watch buyer markets and boca raton patek philippe buyer services benefit from this seasonal influx of high-net-worth individuals. Similarly, fort myers rolex watch buyer and naples rolex watch buyer services see increased activity as wealthy retirees and seasonal residents establish or expand their collections for the winter season.

The concentration of luxury buyers in regions like coral gables cartier watch buyer markets and key biscayne rolex watch buyer services creates competitive environments that often result in premium offers for quality timepieces. This geographic advantage makes October particularly attractive for Florida-based collectors considering liquidating portions of their collections.

Brand-Specific Considerations for October Sales

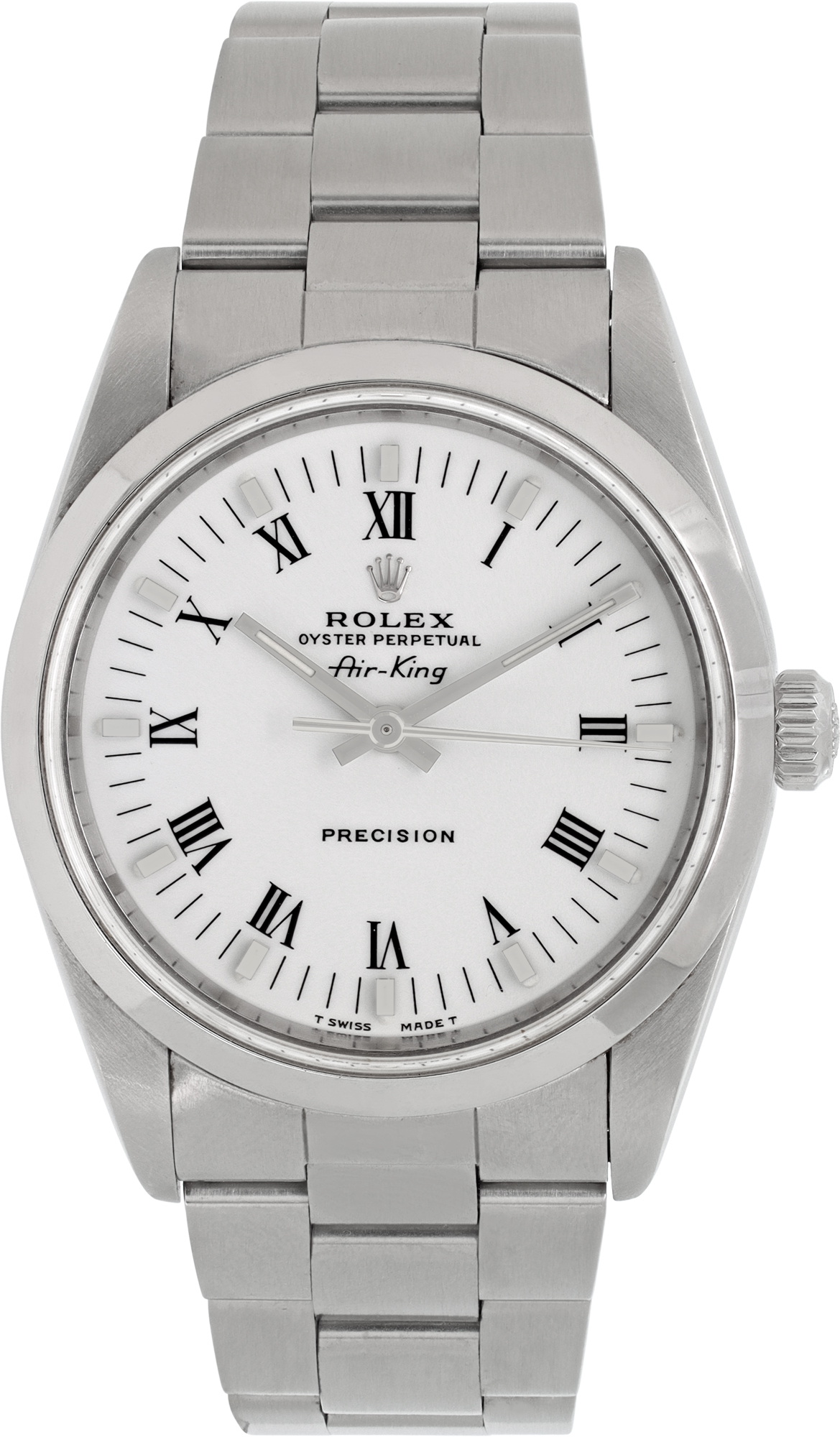

Different luxury watch brands experience varying market dynamics during the fall selling season. Rolex submariner buyer markets remain consistently strong throughout October, with models like the GMT Master and Sea-Dweller maintaining robust demand. The brand's reputation for value retention makes it an excellent choice for collectors seeking to liquidate assets before winter.

Patek Philippe buyer markets often see increased activity during October, as collectors and investors recognize the brand's exceptional long-term appreciation potential. Whether you're looking to sell patek philippe nautilus or sell patek philippe perpetual calendar pieces, the fall market typically offers favorable conditions for these ultra-premium timepieces.

Other luxury brands also benefit from October's market dynamics. Those looking to sell omega watch collections or sell breitling watch pieces often find receptive buyers during this period. The key is working with experienced professionals who understand the nuances of brands we buy and can provide accurate market valuations.

The Financial Logic of Immediate Liquidation

When comparing storage costs against immediate sale proceeds, the financial argument for October selling becomes compelling. Consider a luxury watch collection valued at $75,000: annual storage, insurance, and maintenance costs could easily reach $3,000-$5,000. Over a five-year period, these expenses total $15,000-$25,000 without generating any return on investment.

Immediate liquidation eliminates these ongoing costs while providing capital that can be invested in appreciating assets or used to address current financial needs. The liquidity advantage becomes particularly valuable during uncertain economic periods when cash positions offer flexibility and security.

For collectors maintaining multiple timepieces, selective selling can optimize their collections while generating immediate capital. Rather than storing pieces that receive limited wear time, strategic liquidation allows collectors to focus on their most treasured pieces while eliminating storage costs for the remainder.

Professional Evaluation and Market Expertise

Working with experienced luxury jewelry and watch buyer services ensures accurate market valuations and transparent transactions. Professional buyers understand current market conditions, brand-specific pricing trends, and the factors that influence individual piece valuations.

Established buyers like Gray & Sons, with decades of experience in the luxury market, provide comprehensive evaluation services that consider condition, provenance, rarity, and current market demand. This expertise becomes particularly valuable when dealing with vintage pieces, limited editions, or watches requiring authentication verification.

The evaluation process should include detailed condition assessments, market comparisons, and clear explanations of pricing rationale. Reputable buyers provide written offers with no obligation, allowing sellers to make informed decisions about their timepieces.

Beyond Watches: Comprehensive Luxury Asset Evaluation

October's favorable market conditions extend beyond luxury watches to encompass entire luxury portfolios. Collectors often discover opportunities to optimize their holdings by strategically liquidating certain pieces while retaining others. This might include decisions to sell your jewelry alongside watch collections for comprehensive portfolio rebalancing.

Estate planning considerations also make October an ideal time for luxury asset evaluation. Understanding current market values helps in insurance planning, estate documentation, and potential gifting strategies before year-end tax considerations come into play.

Professional services that handle multiple luxury categories provide convenient, comprehensive evaluations that can address entire collections simultaneously. This holistic approach often reveals opportunities for strategic selling that individual piece evaluations might miss.

Market Trends Supporting October Sales

Current luxury watch market trends support the argument for October selling rather than extended storage. The market has shown resilience despite broader economic uncertainties, with established brands maintaining strong demand and value stability. This stability makes October an opportune time to capitalize on favorable market conditions.

Additionally, the rolex price increase 2020 trend has continued, with many luxury brands implementing regular price adjustments that create opportunities for existing owners. Selling before potential market corrections allows collectors to capture current premium valuations.

Emerging collector interest in vintage and discontinued models also creates opportunities for pieces that might otherwise sit in storage. The current market's appreciation for horological history means that well-maintained vintage pieces often command surprising premiums from dedicated collectors.

Making the Smart October Decision

For luxury watch collectors weighing storage costs against immediate liquidation, October presents compelling arguments for strategic selling. The combination of seasonal market strength, pre-holiday demand, and the elimination of ongoing storage expenses creates a favorable environment for maximizing returns.

The decision ultimately depends on individual circumstances, collection goals, and financial objectives. However, the mathematical reality of storage costs, combined with October's market advantages, makes a strong case for at least evaluating current market values and considering selective liquidation.

Professional evaluation services provide the market intelligence needed to make informed decisions about luxury watch collections. Whether choosing to sell immediately or planning for future transactions, understanding current market values empowers collectors to make strategic decisions about their treasured timepieces.

Ready to explore your options? Contact our expert team for a comprehensive evaluation of your luxury watch collection. With decades of experience in the luxury market and deep knowledge of current market conditions, we provide transparent, competitive offers with no obligation. Get your watch quote today and discover why October might be the perfect time to turn your luxury timepieces into immediate cash rather than paying for winter storage. Our streamlined process ensures you receive maximum value for your collection while eliminating the ongoing costs and concerns of long-term storage.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG