February 20th, 2026

December's Final Week: Strategic Luxury Asset Liquidation for Last-Minute 2025 Tax Benefits and Year-End Cash Flow

As December's final week approaches, many asset holders find themselves evaluating strategic opportunities for year-end financial planning. For those considering luxury asset liquidation, the window is rapidly closing to capture potential tax benefits and optimize cash flow before 2025 ends. Whether you're looking to sell luxury watch collections, sell diamond jewelry, or liquidate other high-value assets, understanding the timing and process can make a significant difference in your financial outcomes.

The year-end period presents unique advantages for those looking to convert luxury assets into immediate liquidity. From managing capital gains to rebalancing portfolios, the strategic timing of luxury asset sales can align with broader financial objectives. This is particularly relevant for owners of premium timepieces and fine jewelry who have been considering liquidation but waiting for the optimal moment.

Understanding Year-End Tax Strategy for Luxury Assets

Year-end tax planning requires careful consideration of asset liquidation timing, especially when dealing with high-value luxury items. For many individuals, selling Rolex watches, Patek Philippe timepieces, or significant diamond jewelry pieces before December 31st can provide strategic advantages. Capital losses from luxury asset sales can potentially offset capital gains from other investments, creating opportunities for tax optimization that disappear once the calendar year closes.

The complexity of luxury asset taxation makes professional guidance essential, but understanding the basic principles empowers sellers to make informed decisions. Luxury watches and jewelry are typically classified as collectibles for tax purposes, which may have different tax treatment than traditional investments. Timing your sale to align with your overall tax strategy can maximize your financial benefit while ensuring compliance with applicable regulations.

For those seeking expert assistance with luxury timepieces, our specialized service to sell your watch provides professional evaluation and competitive pricing. Whether you're a Miami Patek Philippe buyer searching for the best market value or considering options to sell Patek Philippe watches, working with experienced professionals ensures accuracy and fair pricing during this critical year-end period.

Why December Presents Unique Opportunities for Luxury Asset Sales

December traditionally represents peak demand in the luxury market as dealers and collectors seek to complete acquisitions before year-end. This heightened market activity often translates to competitive pricing for sellers, particularly those offering highly sought-after brands. The urgency factor works in sellers' favor, as buyers racing against their own year-end deadlines may be more motivated to close transactions quickly.

Additionally, many luxury watch and jewelry buyers are actively replenishing inventory for the new year, anticipating strong demand in the first quarter. This creates favorable conditions for sellers of premium brands like Rolex, Patek Philippe, Cartier, and high-quality estate jewelry. The convergence of tax planning needs, inventory requirements, and market timing makes December an exceptionally strategic month for luxury asset liquidation.

For South Florida residents, working with established watch buyers near me offers the advantage of in-person evaluation and immediate transaction capabilities. Whether you're a Boca Raton Rolex buyer prospect or considering options as a West Palm Beach Patek Philippe buyer candidate, local expertise combined with national market knowledge ensures optimal outcomes.

Premium Watch Brands: Strategic December Liquidation

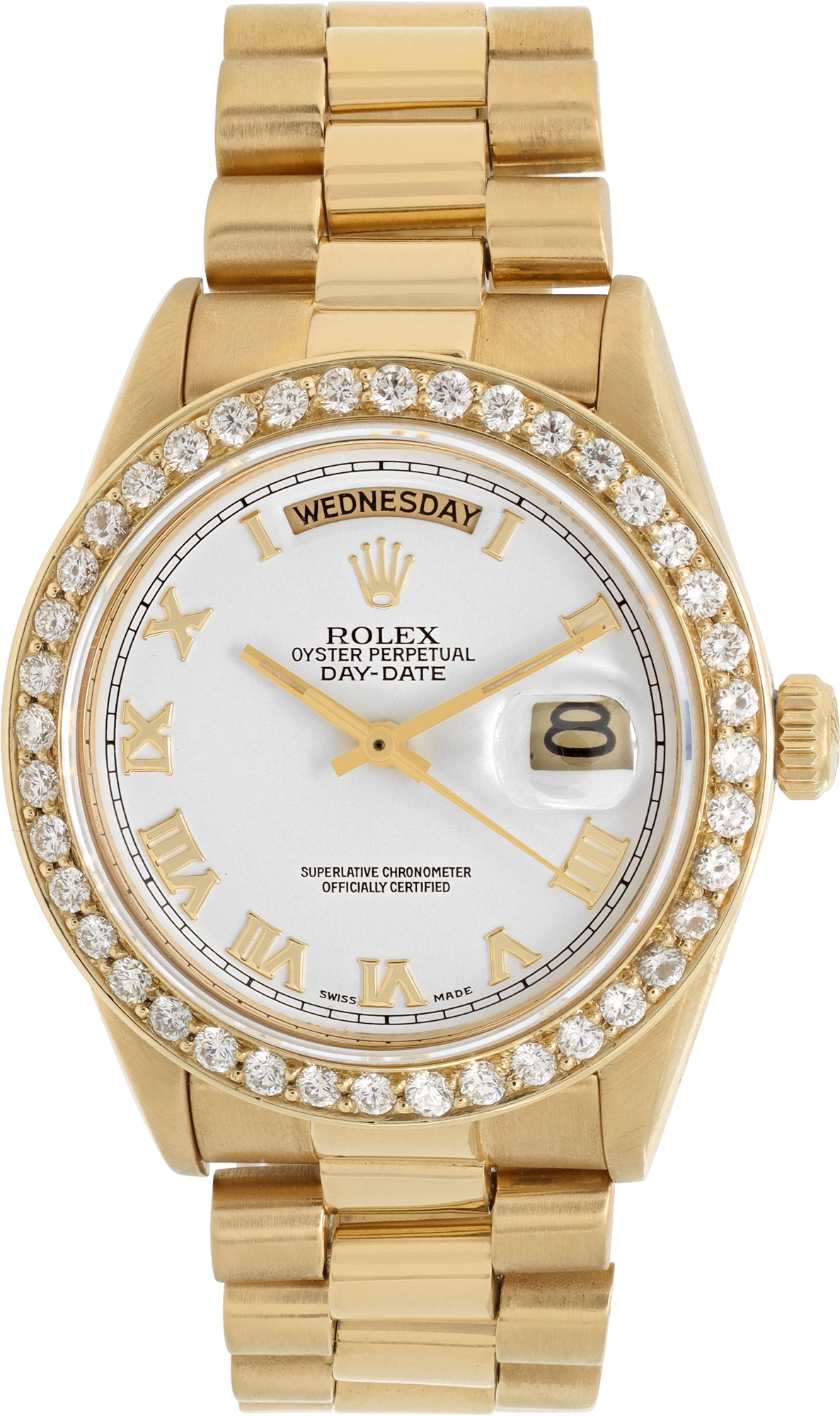

The luxury watch market maintains strong demand for iconic brands, making December an ideal time to sell Rolex timepieces, Patek Philippe watches, and other prestigious Swiss manufacturers. Rolex models—particularly the Submariner, Daytona, GMT-Master, and Day-Date—consistently command premium prices in the secondary market. The enduring appeal of these timepieces ensures liquidity even during year-end market fluctuations.

Patek Philippe watches represent another category of exceptional value retention. Whether you possess a Nautilus, Aquanaut, or Calatrava, these timepieces are actively sought by collectors and dealers alike. The combination of limited production, exceptional craftsmanship, and brand prestige makes Patek Philippe watches among the most liquid luxury assets available. Those looking to sell Patek Philippe Nautilus models or sell Patek Philippe perpetual calendar watches often find December advantageous for achieving premium pricing.

Beyond Rolex and Patek Philippe, other Swiss manufactures maintain strong market positions. To sell Audemars Piguet Royal Oak Offshore models, sell Vacheron Constantin watches, or liquidate pieces from Omega, Cartier, Jaeger-LeCoultre, and Breitling, December's heightened market activity provides favorable conditions. Professional buyers actively seek these brands to meet year-end acquisition goals and prepare for new year inventory demands.

If you're ready to explore your options, our streamlined process helps you sell consign your watch in Miami or from anywhere across the United States. We specialize in purchasing premium timepieces from Boca Raton Patek Philippe buyer inquiries to Coral Gables Cartier watch buyer transactions, ensuring competitive offers and professional service throughout the process.

Diamond Jewelry and Estate Pieces: Maximizing Year-End Value

Diamond jewelry represents another category of luxury assets with strong December liquidation potential. Whether you're looking to sell diamond engagement rings, diamond eternity bands, or statement necklaces, the year-end period offers strategic advantages. High-quality diamonds with GIA certification maintain consistent value, and established buyers actively seek these pieces to meet inventory requirements and client demands.

Estate jewelry encompasses a broad category including signed pieces from renowned designers, vintage collections, and contemporary fine jewelry. To sell Cartier jewelry, sell Tiffany and Co jewelry, or liquidate pieces from Van Cleef & Arpels, David Webb, Bvlgari, and Harry Winston, December presents optimal timing. The combination of holiday gift-giving and year-end financial planning creates heightened demand across all categories of fine jewelry.

For those holding diamond pieces, our specialized service to sell your GIA Diamonds ensures professional evaluation based on current market conditions. Whether you're seeking to sell diamond rings Miami or exploring options to sell diamond engagement ring online, working with experienced professionals guarantees accurate assessment and competitive pricing. From diamond engagement rings buyer inquiries to sell 1 carat diamond engagement ring online transactions, December offers strategic timing for optimal results.

Designer jewelry maintains particularly strong demand during year-end liquidation periods. Those looking to sell David Yurman jewelry, including David Yurman bracelets, David Yurman rings, and David Yurman earrings, often find excellent pricing in December. Similarly, to sell Cartier bracelets, sell Cartier rings, or sell Chopard jewelry, the year-end window provides favorable market conditions supported by active buyer demand.

The Sell Us Your Jewelry Advantage: Professional December Liquidation

Sell Us Your Jewelry, the purchasing and consignment division of Gray & Sons, has served luxury asset holders since 1980. Our reputation for competitive pricing, professional service, and transparent transactions makes us a trusted partner for December liquidation needs. Whether you're seeking a jewelry buyer near me or researching the best place to sell my Rolex, our expertise spans premium timepieces, estate jewelry, diamonds, and sterling silver.

Our team includes master-trained watchmakers and experienced jewelers who provide accurate evaluations based on current market conditions. This expertise ensures you receive competitive offers reflecting true market value, not arbitrary assessments. For South Florida residents, our Surfside showroom across from Bal Harbour Shops offers convenient in-person evaluation. For sellers across the United States, our online platform provides the same trusted experience with secure shipping and prompt payment.

The December timeline requires efficiency and reliability. Our streamlined process ensures quick turnaround without compromising accuracy or professionalism. From initial evaluation to final payment, we prioritize transparency and clear communication. Whether you're a Fort Myers Rolex watch buyer candidate or considering options through our Brickell Avenue Rolex watch buyer services, our commitment to exceptional service remains consistent across all transactions.

Strategic Considerations for Year-End Luxury Asset Sales

Successful year-end liquidation requires strategic planning beyond simply deciding to sell. Documentation preparation streamlines the process significantly—gathering original boxes, papers, certificates, and purchase receipts accelerates evaluation and often enhances value. For watches, service records demonstrate proper maintenance and can positively impact pricing. For diamonds, GIA or other reputable laboratory certificates provide essential documentation for accurate valuation.

Timing within December matters strategically. While the entire month offers advantages, earlier action provides flexibility for evaluation, negotiation, and transaction completion before year-end. This is particularly important if you're coordinating with tax advisors or incorporating the sale into broader financial planning strategies. Waiting until the final days of December creates unnecessary pressure and may limit options if complications arise.

Understanding your liquidation goals clarifies decision-making throughout the process. Are you prioritizing maximum value, requiring immediate liquidity, or balancing both objectives? This clarity helps determine whether direct purchase or consignment better serves your needs. For high-value pieces, consignment may yield higher returns but extends the timeline. For year-end tax planning, direct purchase ensures transaction completion within the calendar year.

Our comprehensive approach addresses all categories of luxury assets. Beyond timepieces and jewelry, we offer specialized services to sell your sterling silver, including flatware, serving pieces, and decorative items. This versatility makes us your single-source solution for December liquidation needs, whether you're managing estate settlements, portfolio rebalancing, or strategic asset repositioning.

Regional Expertise: Serving South Florida and Beyond

Our South Florida presence provides significant advantages for regional sellers. Whether you're a Miami Cartier watch buyer prospect, Boca Raton Omega buyer candidate, or exploring options through our Naples Rolex watch buyer services, local expertise ensures understanding of regional market dynamics. Our Surfside location welcomes walk-in evaluations, providing immediate assessment and often same-day payment for approved transactions.

Beyond South Florida, our national reach serves sellers across the United States. Our secure shipping process with fully insured transit ensures safe handling of high-value items regardless of location. This national scope combined with local expertise creates optimal conditions for luxury asset liquidation, whether you're in Miami, Los Angeles, New York, or anywhere between.

The reputation we've built over four decades reflects our commitment to fair dealing and professional service. When searching for jewelry buyers near me or researching where to sell a Rolex, reputation and reliability matter enormously. Our extensive experience across all categories of luxury assets—from Rolex Submariner buyer inquiries to sell grandmothers estate jewelry online transactions—demonstrates the breadth and depth of our expertise.

Taking Action: Your December Liquidation Timeline

With December's final weeks upon us, taking prompt action maximizes your options and outcomes. The process begins with evaluation—gathering documentation, researching current market values, and contacting professional buyers. For timepieces, our specialized watch quote service provides detailed assessment based on brand, model, condition, and market demand. For fine jewelry, our jewelry quote service offers comprehensive evaluation across all categories.

The evaluation process considers multiple factors beyond brand and model. For watches, condition assessment includes mechanical functionality, case and bracelet condition, dial originality, and completeness of accessories. For jewelry, evaluation examines metal purity, gemstone quality, designer attribution, and overall condition. This thorough approach ensures accurate pricing reflecting true market value.

Once evaluation is complete, transaction options become clear. Direct purchase provides immediate liquidity—ideal for year-end tax planning or urgent cash flow needs. Consignment offers potential for higher returns by accessing retail markets, though timelines extend beyond year-end. Understanding these trade-offs helps determine the optimal approach for your specific situation and objectives.

Comprehensive Asset Categories: Beyond Watches and Jewelry

While premium timepieces and fine jewelry represent our primary focus, our expertise extends to additional luxury asset categories. Sterling silver maintains consistent value, particularly high-quality flatware from prestigious manufacturers like Tiffany, Cartier, and Georg Jensen. Those looking to sell sterling silver flatware or other silver pieces find December advantageous for year-end liquidation, as this timing aligns with estate planning activities and tax considerations.

Gold in all forms—jewelry, coins, and bullion—maintains strong market demand. Whether you're searching for gold buyers near me or researching options to sell gold jewelry, December's year-end window provides strategic timing. Current precious metal pricing, combined with year-end financial planning needs, creates favorable conditions for gold liquidation across all categories.

Our commitment to purchasing luxury items in any condition expands opportunities for sellers. Broken watches, damaged jewelry, or incomplete pieces retain value based on materials and components. This inclusive approach ensures you can liquidate luxury assets regardless of condition, maximizing recovery value even for pieces that no longer function or show wear from decades of use.

Learn more about our comprehensive approach by exploring the brands we buy—from Rolex and Patek Philippe to Cartier, Omega, Audemars Piguet, and dozens of other prestigious manufacturers. Whether you're looking to sell Breitling watch pieces, sell Omega watch collections, or liquidate designer jewelry from Bvlgari, Chopard, or Van Cleef & Arpels, our expertise ensures accurate evaluation and competitive pricing.

Understanding Market Dynamics: Luxury Asset Values in 2025

The luxury watch and jewelry markets continue demonstrating resilience and stability in 2025. Premium brands maintain strong value retention, with iconic models from Rolex, Patek Philippe, and Audemars Piguet consistently commanding robust pricing in secondary markets. This stability provides confidence for sellers, knowing their luxury assets retain significant value even as broader economic conditions fluctuate.

Market demand remains particularly strong for sports models, including the Rolex Submariner, GMT-Master, and Daytona, as well as the Patek Philippe Nautilus and Aquanaut. These models consistently attract collector interest and maintain waiting lists at authorized dealers, supporting strong secondary market pricing. For sellers of these sought-after references, December liquidation can capture premium pricing driven by year-end buyer urgency.

Diamond jewelry maintains value based on the fundamental qualities of the stones themselves—carat weight, clarity, color, and cut. High-quality diamonds with GIA certification provide portable, liquid wealth that translates efficiently into cash. Designer pieces from Cartier, Tiffany, Van Cleef & Arpels, and Harry Winston combine intrinsic diamond value with brand premium, creating additional value layers that appeal to collectors and investors.

Understanding these market dynamics helps sellers set realistic expectations and make informed decisions. Working with experienced professionals who monitor market trends, track auction results, and maintain active dealer networks ensures your assets are valued accurately based on current conditions rather than outdated pricing or arbitrary assessments.

The Importance of Professional Authentication and Evaluation

Professional authentication forms the foundation of luxury asset transactions. Counterfeit watches and jewelry proliferate in secondary markets, making expert evaluation essential for protecting both buyers and sellers. Our team's extensive experience and technical expertise enable accurate authentication across all brands and models, ensuring confidence in every transaction we complete.

For watches, authentication examines movement construction, case markings, dial details, and component originality. Our master-trained watchmakers possess the specialized knowledge required to identify authentic pieces and detect counterfeits or modified components. This expertise protects sellers from unknowingly possessing non-authentic items while ensuring buyers receive genuine articles.

Jewelry authentication considers metal composition, gemstone authenticity, designer signatures, and construction techniques. Our experienced jewelers utilize advanced testing equipment and decades of hands-on expertise to verify authenticity and assess quality accurately. For diamond jewelry, we rely on GIA and other reputable laboratory certifications while also conducting independent verification of stone characteristics.

This commitment to authentication and professional evaluation distinguishes reputable buyers from less scrupulous operators. When researching how to spot fake watch buyers or seeking trustworthy partners for luxury asset liquidation, authentication expertise should rank among your primary considerations. Our reputation built over four decades reflects this unwavering commitment to accuracy and integrity.

Maximizing Value: Condition, Documentation, and Presentation

Several factors significantly impact the value realized from luxury asset sales. Condition ranks among the most important—well-maintained pieces command premium pricing while those showing excessive wear or requiring service may be discounted accordingly. For watches, regular servicing demonstrates care and often enhances value. For jewelry, professional cleaning and minor repairs can yield returns exceeding the modest investment required.

Documentation substantially affects value, particularly for high-end timepieces. Original boxes, warranty papers, service records, and purchase receipts all contribute to establishing provenance and completeness. These elements provide confidence to buyers and often justify premium pricing. While their absence doesn't prevent sale, complete documentation typically yields 10-20% higher values for comparable pieces.

Presentation matters even in wholesale transactions. Clean, well-organized items with proper storage demonstrate care and respect for quality. Taking time to properly prepare pieces for evaluation—cleaning, organizing documentation, and presenting items professionally—reflects positively and can influence pricing outcomes. These small efforts signal that items have been well-maintained throughout ownership.

Our evaluation process considers all these factors comprehensively. Whether you're preparing to sell Rolex GMT Master watches, sell diamond eternity rings, or liquidate estate jewelry collections, proper preparation maximizes value realization. Our team provides guidance throughout the process, ensuring you understand factors affecting pricing and opportunities to enhance value before finalizing transactions.

Estate Settlement and Inheritance: December Planning Opportunities

Estate settlement often necessitates luxury asset liquidation, and December timing can provide strategic advantages for executors and beneficiaries. Year-end liquidation allows inclusion of proceeds in current-year estate accounting and tax reporting. This timing clarity simplifies administration and provides beneficiaries with liquid assets rather than property requiring ongoing storage, insurance, and eventual disposition.

Inherited luxury items frequently include watches, jewelry, and sterling silver accumulated over decades. These collections may contain significant value but require expert evaluation to determine market worth. Our estate jewelry expertise helps executors and heirs understand what they possess and make informed decisions about liquidation versus retention. This guidance proves invaluable during emotionally challenging periods when objective professional advice brings clarity.

The breadth of our purchasing capabilities simplifies estate liquidation significantly. Rather than engaging multiple specialists for watches, jewelry, diamonds, and silver, our comprehensive approach provides single-source convenience. This efficiency matters enormously during estate administration when executors juggle multiple responsibilities and deadlines.

For those managing inherited luxury assets, our service to sell your jewelry provides the starting point for understanding value and exploring options. Whether you're an executor seeking to liquidate an entire estate or a beneficiary deciding which items to keep versus sell, professional guidance ensures informed decisions based on accurate market knowledge.

Final Week Action Plan: Securing Your Year-End Benefits

As December's final week approaches, creating an action plan ensures successful completion of year-end liquidation goals. Begin by inventorying luxury assets you're considering selling—watches, jewelry, diamonds, and silver pieces. Gather all available documentation including boxes, papers, certificates, and receipts. This preparation streamlines evaluation and accelerates the transaction process.

Next, contact professional buyers to initiate evaluation. For watches, provide details including brand, model, reference number, approximate age, condition, and accessory completeness. For jewelry, describe metals, gemstones, designer attribution, and condition. Clear, detailed descriptions combined with quality photographs enable preliminary assessment and establish realistic value expectations before formal evaluation.

Schedule evaluations promptly to allow time for transaction completion before December 31st. For South Florida residents, our Surfside showroom welcomes walk-ins and appointments throughout December. For national sellers, our insured shipping process ensures safe transit, though overnight or two-day delivery services help maintain tight timelines during this final week.

Understanding how it works helps establish realistic timeline expectations and ensures smooth process flow. From initial contact through final payment, our commitment to transparency and professionalism provides confidence throughout December's time-sensitive window. Whether you're completing strategic tax planning, addressing urgent cash flow needs, or executing estate administration responsibilities, our expertise ensures optimal outcomes within your required timeframe.

Conclusion: Capturing December's Strategic Window

December's final week represents a closing window for strategic luxury asset liquidation that captures year-end tax benefits and optimizes cash flow. Whether you're looking to sell luxury watches, sell diamond jewelry, or liquidate estate pieces, the timing advantages available now disappear permanently on December 31st. Taking action during this critical period positions you to maximize both financial outcomes and strategic advantages.

Sell Us Your Jewelry brings four decades of expertise to your December liquidation needs. Our comprehensive approach spans premium timepieces, fine jewelry, GIA-certified diamonds, and sterling silver. Our commitment to competitive pricing, professional service, and transparent transactions has earned trust among thousands of satisfied sellers across South Florida and nationwide.

The combination of year-end market dynamics, tax planning opportunities, and strategic timing creates optimal conditions for luxury asset liquidation. Our team stands ready to provide expert evaluation, competitive offers, and efficient transaction completion during December's final days. Whether you possess a single high-value piece or comprehensive collections requiring evaluation, our expertise ensures you receive fair market value based on current conditions.

Don't let December's strategic window close without exploring your opportunities. Contact us today to begin the evaluation process and discover the value your luxury assets represent. Your path to optimized year-end financial outcomes begins with a simple conversation—let's discuss how we can help you achieve your liquidation goals before 2025 ends.

Ready to Unlock Your Luxury Asset Value This December?

Time is of the essence as December's final week rapidly approaches. Take the first step toward strategic year-end liquidation by requesting your professional evaluation today:

Get Your Free Quote:

- Sell Your Watch - Premium timepieces from Rolex, Patek Philippe, Omega, and more

- Sell Your Jewelry - Fine jewelry from Cartier, Tiffany, Van Cleef & Arpels, and designer estates

- Sell Your GIA Diamonds - Certified diamonds and diamond jewelry

- Sell Your Sterling Silver - Flatware, serving pieces, and decorative items

Learn More:

- Explore the brands we buy across watches, jewelry, and luxury accessories

- Discover how it works from evaluation through payment

- Find trusted watch buyers near me in South Florida and nationwide

Contact Sell Us Your Jewelry today—December's strategic advantages won't last beyond this month. Let our expertise and commitment to fair dealing help you optimize your year-end financial outcomes through professional luxury asset liquidation.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG