January 26th, 2026

Holiday Spirit, Holiday Funds: Why Your Luxury Watch Collection Creates Perfect December Gift Money Before Christmas

As the holiday season approaches, many luxury watch owners discover an unexpected opportunity hidden in their collections. If you're considering how to sell my Rolex or other premium timepieces to generate funds for holiday gifting, December presents an ideal window for converting your luxury watches into cash. The pre-Christmas period creates unique market conditions that benefit sellers, with increased buyer demand and established professionals ready to provide competitive offers for quality timepieces.

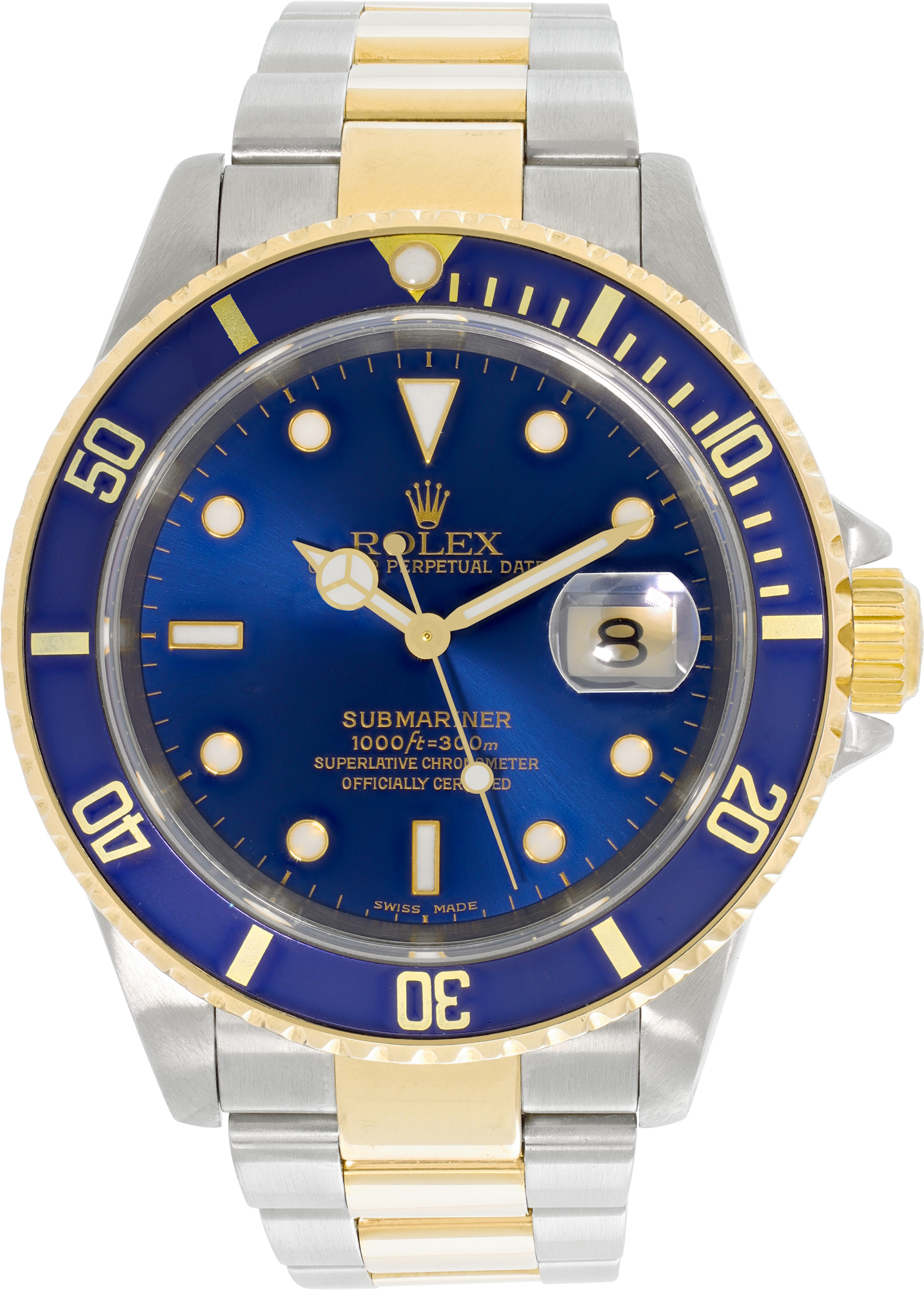

The December luxury watch market traditionally experiences heightened activity as collectors and gift-givers seek premium pieces before the year's end. Whether you own a classic Rolex Submariner, a sophisticated Patek Philippe, or other prestigious brands, understanding the strategic advantages of selling during this season can help you maximize returns while funding a memorable holiday for your loved ones.

Why December Creates Optimal Selling Conditions for Luxury Watches

December stands out as a strategic month in the luxury watch marketplace for several compelling reasons. Buyers actively search for incredible used Rolex watches and other premium brands to gift or add to their collections before year-end. This heightened demand creates favorable conditions for sellers looking to obtain competitive offers, particularly from established buyers who understand market values and maintain transparent evaluation processes.

The year-end timeline also motivates collectors to finalize acquisitions and adjust portfolios before the new year. Rolex buyers and specialists in brands like Patek Philippe increase their purchasing activity to meet this demand, creating multiple competitive outlets for sellers. Professional buyers recognize that quality inventory during December positions them advantageously for the robust January market when new collectors enter the luxury watch space.

When you're ready to sell luxury watch pieces from your collection, working with established professionals who specialize in premium timepieces ensures accurate evaluations. Patek Philippe buyer Miami services and similar specialized buyers maintain deep market knowledge, allowing them to recognize the true value of complications, vintage references, and limited editions that casual buyers might overlook.

Understanding the True Value of Your Timepiece Collection

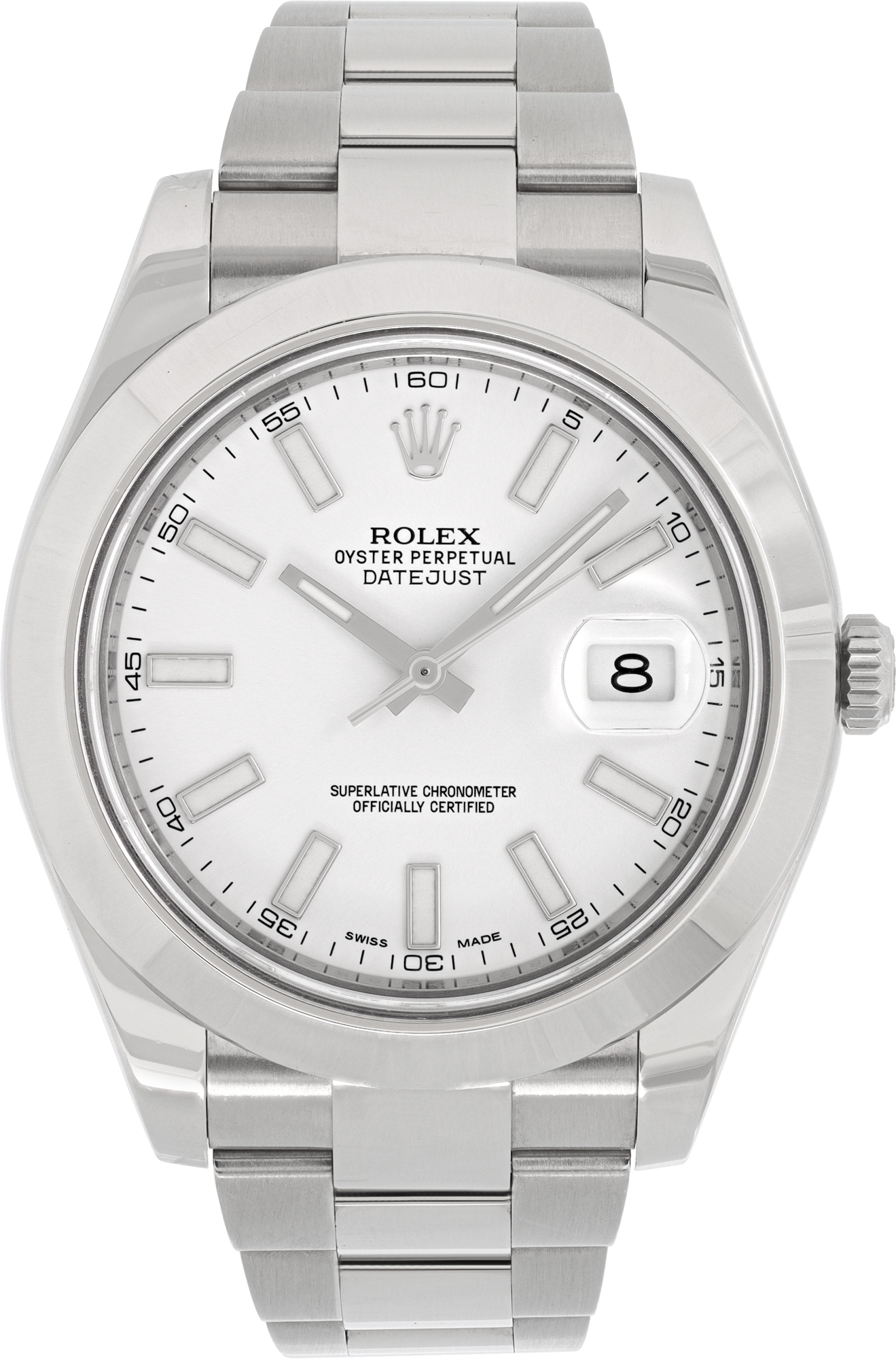

Many watch owners underestimate the liquid asset value contained within their collections. A Rolex Datejust worn occasionally or a Patek Philippe inherited from family represents substantial financial resources that can be converted into holiday funds without compromising quality of life. Understanding what constitutes the best place to sell my Rolex involves researching buyers who offer transparent evaluations, competitive pricing, and professional service standards that respect both you and your timepiece.

Professional watch evaluation considers multiple factors beyond brand recognition. Case condition, movement functionality, originality of components, and completeness of documentation all influence final offers. Experienced buyers examine these elements thoroughly, providing detailed explanations of how each factor contributes to valuation. This transparency ensures you understand exactly what you're receiving and why, building confidence in the transaction.

Whether you're looking to sell Rolex Submariner models, complicated chronographs, or dress watches, obtaining a professional quote provides clarity about your options. Services that specialize as a used luxury watch buyer understand current market dynamics and can explain how recent trends affect your specific timepiece's value, helping you make informed decisions about timing and pricing expectations.

The Strategic Advantages of Pre-Christmas Watch Sales

Selling luxury watches before Christmas offers distinct advantages that diminish significantly once the holiday season concludes. Gift-givers seeking premium presents create urgency in the marketplace, while collectors aiming to close the year with significant acquisitions increase their budgets. This combination creates a seller's market where quality timepieces command strong attention and competitive offers from multiple interested parties.

Tax considerations also factor into year-end watch transactions. Some sellers strategically time sales to align with financial planning objectives, while buyers may seek to complete acquisitions within the current tax year. These motivations create additional market activity beyond typical gift-giving considerations, further enhancing December's position as a strategic selling period for luxury timepieces.

If you're considering options to sell my watch near me, December provides timeline advantages beyond market conditions. Quick turnarounds become possible when working with established buyers who maintain efficient evaluation and payment processes. This speed proves invaluable when you need holiday funds within specific timeframes, ensuring gifts arrive before Christmas morning.

For those in South Florida, proximity to specialized services creates additional convenience. Boca Raton Rolex buyer offices, Miami Patek Philippe buyer locations, and Bal Harbour Rolex watch buyer establishments offer face-to-face transactions that build confidence through personal interaction. Meeting experts who examine your timepiece in your presence provides reassurance and immediate answers to questions about condition, authenticity, and market positioning.

Converting Multiple Watch Types Into Holiday Resources

Luxury watch collections often contain diverse pieces accumulated over years—some worn regularly, others stored away as occasional alternatives. This diversity represents flexibility in selling strategy. You might choose to part with a single high-value piece like a Rolex Daytona, or sell several mid-range watches collectively to reach your holiday funding goals while maintaining favorites in your active rotation.

Sports models traditionally attract strong buyer interest. Those looking to sell Rolex Submariner Boca Raton pieces or sell Rolex GMT Master references find consistent demand from collectors and daily wearers alike. These tool watches combine iconic design with practical functionality, creating broad appeal that translates into competitive offers and quick sales when working with knowledgeable buyers.

Dress watches and complications serve different market segments but maintain equally strong selling potential. Services that sell Patek Philippe perpetual calendar pieces or complicated annual calendars connect with collectors specifically seeking these sophisticated complications. The mechanical artistry and brand prestige behind such timepieces attract buyers willing to pay premium prices for examples in excellent condition with complete documentation.

Even if you're uncertain about your watch's current market position, professional evaluation services provide clarity without obligation. When you sell your watch through established buyers, the quote process typically costs nothing and delivers comprehensive information about your timepiece's specifications, condition assessment, and current market valuation based on recent comparable sales.

Geographic Advantages for Florida Luxury Watch Sellers

Florida's concentration of luxury watch expertise creates distinct advantages for sellers throughout the state. From Fort Myers Rolex watch buyer services to West Palm Beach Patek Philippe buyer specialists, the state maintains robust infrastructure for luxury timepiece transactions. This geographic density means competitive pricing as multiple established buyers operate within reasonable proximity, encouraging transparent offers that reflect true market values.

South Florida particularly benefits from concentrated luxury watch activity. Brickell Avenue Rolex watch buyer locations, Coral Gables Cartier watch buyer offices, and Key Biscayne Rolex watch buyer services all operate within Miami's metropolitan area, creating a competitive ecosystem that favors sellers through choice and transparency. This concentration of expertise also means specialists maintain current market knowledge through constant transaction activity, ensuring valuations reflect the latest trends.

Whether you're located in Hollywood Patek Philippe buyer territory, searching for Bay Harbour Cartier watch buyer services, or exploring options through a Boca Raton Cartier watch buyer, the state's luxury watch infrastructure provides access to professional evaluation and competitive offers. This geographic advantage proves particularly valuable during December when time constraints make efficiency essential.

Beyond Watches: Expanding Your Luxury Liquidation Strategy

While watches often represent the most obvious luxury assets for holiday funding, comprehensive approaches to luxury liquidation can maximize your available resources. If you also own fine jewelry, considering how to sell jewelry alongside timepieces creates opportunities for bundled evaluations and potentially higher combined returns through streamlined transaction processes with buyers who handle multiple luxury categories.

Diamond jewelry particularly holds strong value during the holiday season. Engagement rings, tennis bracelets, and statement necklaces all attract buyer interest during December as gift-givers seek meaningful presents. Services that help you sell diamond engagement ring pieces or sell diamond rings now maintain specialized knowledge about gemstone quality, cut precision, and current diamond market conditions that influence valuations.

Designer jewelry from prestigious houses commands strong market interest regardless of season. Those looking to sell Cartier jewelry, sell Tiffany jewelry, or sell Van Cleef and Arpels jewelry find consistent demand from collectors and fashion enthusiasts who appreciate these brands' craftsmanship and heritage. The combination of precious materials and designer provenance creates value that transcends seasonal fluctuations.

Estate jewelry represents another often-overlooked asset category. If you've inherited pieces or own vintage jewelry that no longer suits your style, professional buyers who specialize in estate jewelry can evaluate these items alongside your watches. This comprehensive approach to luxury asset evaluation ensures you understand the full scope of resources available for holiday funding through your existing collections.

The Professional Evaluation Process Explained

Understanding what happens during professional watch evaluation removes uncertainty from the selling process. Reputable buyers begin with visual inspection, examining case condition, crystal clarity, bezel integrity, and bracelet wear. They assess whether the watch appears consistent with its stated age and usage history, identifying any modifications or non-original components that might affect valuation.

Movement examination follows external inspection. While complete disassembly isn't standard during initial evaluation, experts assess timekeeping accuracy, winding smoothness, and functionality of complications. They verify that reference numbers match between case, movement, and documentation, confirming authenticity through multiple verification points that counterfeiters rarely replicate perfectly across all components.

Documentation review completes the evaluation process. Original boxes, papers, service records, and purchase receipts all contribute to establishing provenance and completeness—factors that significantly influence market value. Complete sets typically command premiums over watch-only offerings, though desirable references in excellent condition maintain strong value even without accompanying documentation.

Throughout this process, professional buyers explain their findings and how various factors contribute to the final offer. This educational approach ensures you understand the valuation logic, building confidence in the transaction whether you ultimately decide to sell immediately or wait for different market conditions.

Making Your Decision: Timing, Trust, and Transaction Security

December selling decisions involve balancing multiple considerations. Holiday funding needs create urgency, while market conditions might suggest waiting for specific circumstances. Professional buyers help navigate these decisions by providing transparent information about current market dynamics, recent comparable sales, and realistic expectations for timing if you choose to pursue private sales or auctions instead.

Trust forms the foundation of successful luxury watch transactions. Working with established businesses that maintain physical locations, verified track records, and professional credentials provides security that protects both parties. Watch buyers near me with permanent operations and long-term community presence stake their ongoing reputation on every transaction, creating natural incentives for fair dealing and transparent communication.

Transaction security extends beyond reputation to include payment methods, documentation practices, and legal protections. Professional buyers provide clear purchase agreements, secure payment options, and proper documentation for significant transactions. These practices protect your interests while ensuring compliance with regulations governing luxury goods transactions, precious metals purchases, and high-value asset transfers.

When evaluating where to sell, consider the full service package beyond just the quoted price. Convenience, speed, transparency, professional treatment, and transaction security all contribute value that should factor into your decision. The best place to sell my Rolex combines competitive pricing with excellent service standards that make the experience straightforward and pleasant.

Specialized Buying Services for Diverse Watch Portfolios

Different watch brands and styles require specialized knowledge for accurate evaluation. Services that position themselves as a Rolex buyer maintain deep expertise in that brand's extensive model range, reference variations, and period-specific details that influence collectibility. This specialization ensures accurate identification and appropriate valuation for everything from vintage Bubblebacks to modern Submariners.

Similarly, those seeking a Patek Philippe buyer Boca Raton specialist or Patek Philippe buyer West Palm Beach service benefit from experts who understand the nuances distinguishing standard production from limited editions, recognize significant complications, and track market trends specific to this prestigious manufacture. This brand-specific knowledge proves essential for maximizing returns on high-complication pieces and rare references.

Other prestigious brands similarly benefit from specialist attention. If you need to sell Audemars Piguet Royal Oak Offshore pieces, sell Vacheron Constantin watch examples, or sell Omega watch models, working with buyers who regularly handle these brands ensures valuations reflect current market realities rather than generic luxury watch pricing formulas that fail to account for brand-specific market dynamics.

Even less common brands maintain specialized buyer networks. Those looking to sell Breitling watch pieces, sell Panerai Radiomir watches, or sell Jaeger LeCoultre timepieces should seek buyers familiar with these manufacturers' distinctive characteristics, typical condition issues, and collector preferences that influence pricing within these specific market segments.

Understanding Market Dynamics for Different Watch Categories

The luxury watch market isn't monolithic—different categories experience distinct trends that influence optimal selling strategies. Sports watches from Rolex, Omega, and other tool watch specialists maintain relatively stable demand patterns, making them straightforward to price and quick to sell. Their practical appeal crosses collector and daily-wearer markets, creating broad buyer bases that support consistent valuations.

Complicated watches follow different patterns. Perpetual calendars, minute repeaters, and tourbillon pieces serve smaller, more specialized markets where buyers possess both financial resources and horological knowledge to appreciate mechanical complexity. These pieces may require longer selling timelines but often command premium pricing when matched with appropriate buyers who understand their significance.

Vintage watches represent another distinct category with unique market dynamics. Collectors seek specific reference numbers, dial variations, and condition characteristics that casual buyers overlook. Professional buyers who understand vintage market nuances can identify valuable variants and provide appropriate valuations for watches that generic luxury buyers might significantly undervalue due to age or cosmetic wear consistent with vintage pieces.

Understanding these category distinctions helps set realistic expectations about pricing and selling timelines. A modern Rolex Submariner two tone model sells through different market channels than a vintage Rolex Submariner 16803 reference, though both maintain strong inherent value. Professional buyers explain these distinctions and how they apply to your specific timepiece.

The Comprehensive Approach to Holiday Luxury Liquidation

Maximizing holiday funding opportunities often involves looking beyond individual high-value items to consider comprehensive luxury asset assessment. If you own multiple watches plus jewelry, diamonds, and precious metals, consolidated evaluation through a buyer who handles all these categories streamlines the process while potentially providing better combined offers through reduced transaction overhead.

Services that help you sell your jewelry alongside watches recognize that many clients own diverse luxury assets accumulated over years. A comprehensive evaluation session can assess everything from diamond engagement rings to sterling silver flatware, providing complete clarity about available resources without requiring multiple appointments across different specialized buyers.

This comprehensive approach proves particularly valuable during December when time constraints make efficiency essential. Rather than scheduling separate evaluations for your Rolex, your wife's diamond bracelet, and inherited silver, consolidated assessment with a luxury jewelry and watch buyer service completes everything in a single session, providing immediate clarity about total available resources for holiday funding.

Getting Started: The Simple Path to Holiday Funds

Beginning the process of converting luxury watches into holiday funds requires just initial contact with professional buyers. Most established services offer multiple communication channels—phone consultations, online quote requests, or in-person appointments—allowing you to choose the approach that best matches your comfort level and timeline requirements.

For those who prefer thorough research before committing to evaluation, brands we buy resources provided by professional buyers outline accepted manufacturers, typical model ranges, and condition requirements. This information helps you understand whether your specific timepieces qualify for purchase before investing time in formal evaluation processes.

If you're uncertain about the selling process or your watch's approximate value, educational resources help build confidence. Understanding how it works through clear explanations of evaluation steps, pricing methodologies, and transaction procedures removes uncertainty that sometimes prevents owners from exploring selling opportunities that could significantly benefit their holiday planning.

The December timeline creates urgency for those who want funds available before Christmas, but professional buyers maintain efficient processes that accommodate tight schedules. Many complete evaluations and payment within days of initial contact, ensuring your holiday shopping timeline remains feasible even if you're just now considering watch liquidation as a funding strategy.

Making This Holiday Season Memorable Through Strategic Asset Management

The holiday season represents opportunity—not just for celebration, but for strategic decisions about luxury assets that no longer serve their original purposes. A watch worn occasionally or stored away represents dormant value that could transform into memorable experiences, meaningful gifts, and holiday joy for yourself and those you love.

Professional luxury watch buyers understand that selling significant possessions involves emotional considerations beyond pure financial transactions. Reputable services treat sellers with respect, acknowledge the significance of parting with valuable items, and conduct transactions with professionalism that honors both the timepiece and its owner. This approach makes potentially difficult decisions easier by ensuring positive experiences throughout the process.

Whether you ultimately decide to sell one significant piece or liquidate several watches to fund a truly exceptional holiday season, professional evaluation provides the information needed for confident decisions. Understanding your options creates flexibility—you control the timeline, choose which pieces to sell, and decide whether offers meet your expectations before committing to any transaction.

Transform Your Luxury Watch Collection Into Holiday Magic

This December presents unique opportunities to convert luxury timepieces into holiday resources that create lasting memories. Whether you're funding dream vacations, purchasing meaningful gifts, or simply ensuring financial flexibility during this expensive season, your watch collection represents accessible value that professional buyers stand ready to unlock through fair, transparent transactions.

Don't let valuable timepieces sit unused when they could fund experiences and gifts that create genuine joy. Professional watch buyer services maintain the expertise, market knowledge, and financial resources to provide competitive offers for quality pieces regardless of brand, age, or condition. Even watches with minor issues maintain significant value when evaluated by experts who recognize both precious metal content and horological significance.

The time to act is now—December's advantages diminish as the holiday season progresses and market dynamics shift into post-Christmas patterns. Take the first step toward understanding your luxury watch portfolio's value by requesting a professional evaluation. The process costs nothing, creates no obligation, and provides valuable information whether you sell immediately or simply gain clarity about options for future consideration.

Ready to discover what your luxury timepiece could contribute to your holiday season? Get a watch quote today and learn how professional buyers can transform your collection into holiday funds before Christmas arrives. For comprehensive assessment of all your luxury assets, explore options to sell your jewelry, sell GIA diamonds, or even sell sterling silver alongside your timepieces.

Our team of experts provides transparent evaluations, competitive pricing, and efficient transactions that respect both your timeline and your valuable possessions. Visit our about us page to learn more about our experience and commitment to excellence, or contact us directly to begin your journey toward a more abundant holiday season funded by luxury assets you no longer need.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG