February 5th, 2026

Simplify Your Move: Strategic Luxury Asset Liquidation for High-End Retirement Community Transitions This Winter

Transitioning to a high-end retirement community represents a significant life change that often requires thoughtful estate downsizing and luxury asset liquidation. As you prepare for this move this winter, understanding how to strategically manage valuable possessions—from luxury watches to fine jewelry and sterling silver—can simplify the process while maximizing the financial benefits. February 2026 presents an ideal time to begin evaluating your luxury assets and determining which pieces to bring forward into this new chapter.

Many individuals moving to retirement communities discover they've accumulated substantial collections of luxury items over decades. These pieces often include investment-quality timepieces, diamond jewelry, designer accessories, and sterling silver that may no longer fit their simplified lifestyle. Rather than leaving these valuable assets unused, converting them into liquid capital provides both financial flexibility and peace of mind during your retirement transition.

Understanding the Value of Your Luxury Watch Collection

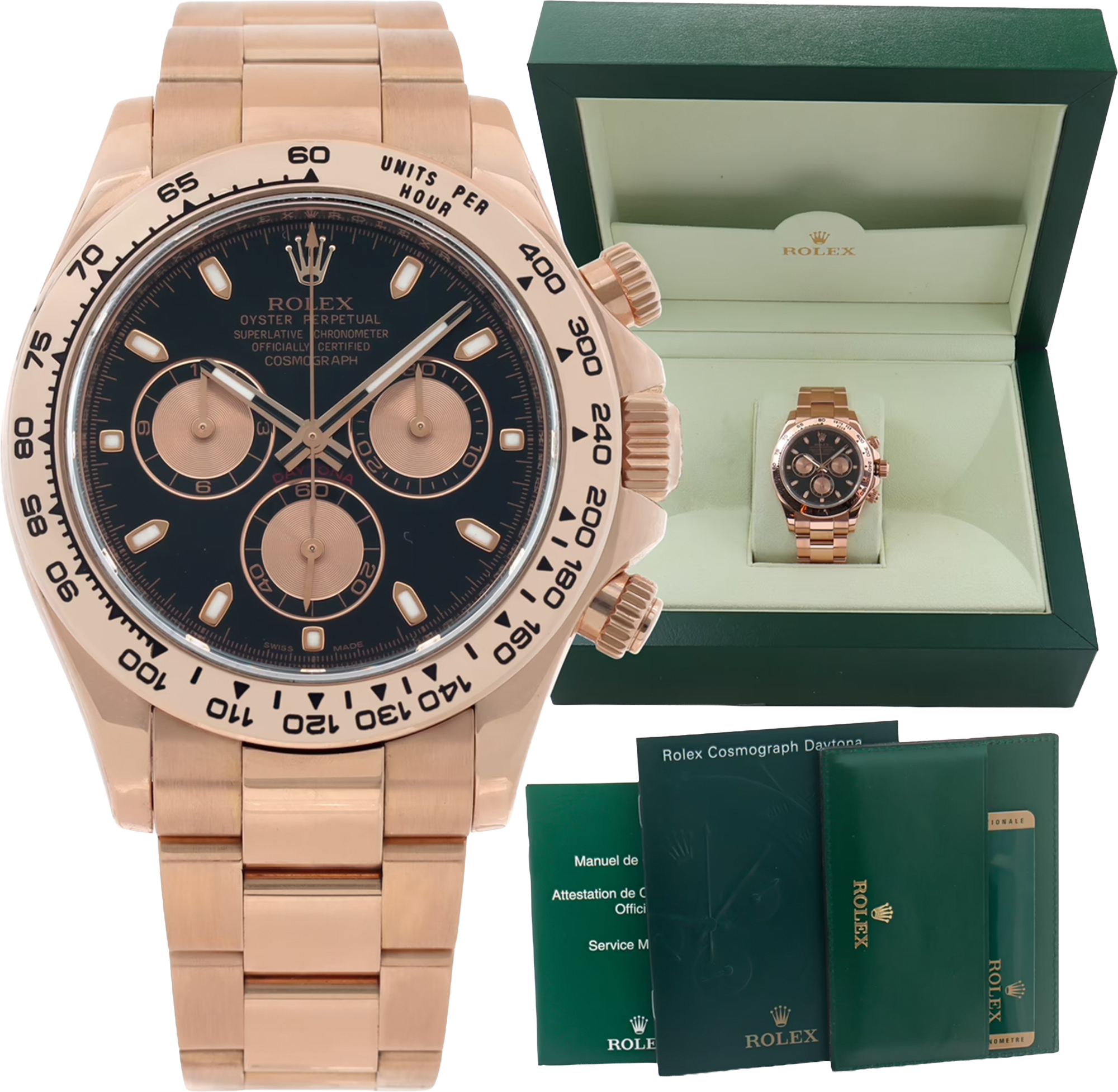

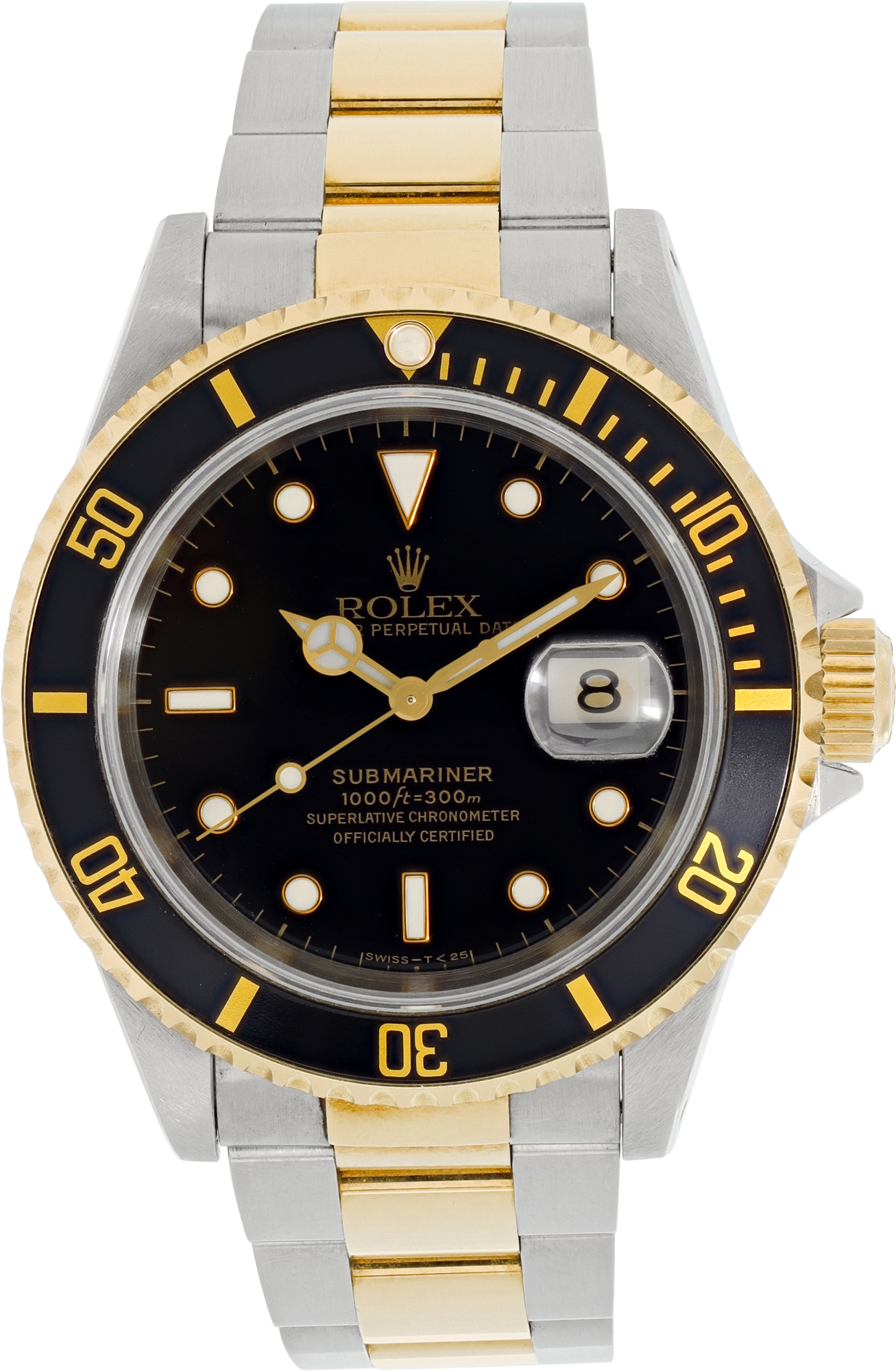

If you've been considering whether to sell luxury watch pieces from your collection, retirement downsizing provides the perfect opportunity to assess which timepieces truly matter to you. Many retirees own multiple Swiss-made luxury watches that have appreciated significantly over the years. Whether you're looking to sell Rolex Submariner models, sell Patek Philippe perpetual calendars, or sell Omega Speedmasters, understanding current market values ensures you receive fair compensation for these investment pieces.

Working with an experienced watch buyer eliminates the guesswork from selling luxury timepieces. At Sell Us Your Jewelry, our team evaluates every watch comprehensively, considering brand prestige, model rarity, condition, and current market demand. If you're wondering where to sell a Rolex or searching for a trusted Rolex buyer, our streamlined process provides professional assessments without pressure or obligation.

For those with extensive collections, you may own pieces from prestigious manufacturers like Audemars Piguet, Vacheron Constantin, Breguet, or A. Lange & Söhne. Whether you need to sell Audemars Piguet Royal Oak Offshore models, sell Jaeger-LeCoultre complications, or sell Hublot watch pieces, specialized buyers understand the nuances that determine value in haute horlogerie.

Diamond Jewelry Downsizing: Making Strategic Decisions

Diamond jewelry downsizing represents one of the most significant aspects of estate preparation when moving to a retirement community. Over the years, you may have accumulated engagement rings, anniversary bands, tennis bracelets, and statement necklaces that now sit unused in safe deposit boxes. These pieces represent both emotional memories and substantial financial value that can support your retirement lifestyle.

Professional evaluation is essential when you're ready to sell diamond engagement ring pieces or other significant jewelry. GIA Certified Diamonds command premium prices, and working with knowledgeable buyers ensures you receive appropriate compensation based on the Four Cs—cut, clarity, color, and carat weight. Whether you need to sell GIA Certified Diamonds or pieces with AGL Certified Diamonds, expert assessment protects your interests.

Many retirement transitions involve selling designer jewelry from renowned houses. If you own pieces and want to sell Cartier jewelry, sell Tiffany & Co. jewelry, or sell Van Cleef & Arpels jewelry, these brands maintain strong resale value. Iconic collections like Cartier Love bracelets, Cartier Juste un Clou bracelets, and the Van Cleef & Arpels Alhambra collection are particularly sought-after by collectors and buyers worldwide.

Designer Jewelry Collections: Understanding Market Demand

Contemporary designer jewelry from houses like Bvlgari, Chopard, and Harry Winston represents significant value in today's market. If you're looking to sell Bvlgari jewelry, the Bvlgari Serpenti collection and Bvlgari B.Zero1 collection remain highly desirable. Whether you need to sell Bvlgari rings, sell Bvlgari bracelets, sell Bvlgari necklaces, or sell Bvlgari earrings, working with a knowledgeable Bvlgari jewelry buyer ensures fair market evaluation.

Similarly, pieces from Chopard's distinctive collections maintain strong appeal. The Chopard Happy Diamonds collection with its playful moving diamonds and the Chopard Ice Cube collection with its geometric designs are particularly recognizable. If you're ready to sell Chopard jewelry, including sell Chopard rings, sell Chopard bracelets, or sell Chopard necklaces, finding an experienced Chopard jewelry buyer maximizes your return.

For those with iconic pieces from other luxury houses, the market remains robust. Whether you want to sell Harry Winston jewelry, sell Graff jewelry, or sell Piaget jewelry, these ultra-luxury brands command premium prices. Collections like the Harry Winston Winston Cluster collection and Piaget Possession collection are especially valued by discerning collectors seeking investment-quality pieces.

Heritage and Contemporary Designer Pieces

American designers and European luxury houses both contribute to valuable jewelry collections. If you own pieces and wish to sell David Yurman jewelry, the David Yurman Cable collection with its signature twisted cable design remains instantly recognizable and highly marketable. Whether you're looking to sell David Yurman rings, sell David Yurman bracelets, or sell David Yurman necklaces, these pieces appeal to buyers seeking American design excellence.

Italian craftsmanship is exemplified by Roberto Coin, whose distinctive pieces feature hidden rubies as signatures. If you're considering whether to sell Roberto Coin jewelry, collections like the Roberto Coin Princess Flower collection and Roberto Coin Roman Barocco collection showcase the artistry that commands strong prices. Whether you need to sell Roberto Coin rings, sell Roberto Coin bracelets, or sell Roberto Coin earrings, finding the right Roberto Coin jewelry buyer ensures appropriate valuation.

Other sought-after names include David Webb, whose bold, sculptural designs remain timeless. If you're ready to sell David Webb jewelry, these pieces often feature distinctive animal motifs and architectural elements. Similarly, for collectors of Spanish design looking to sell Carrera y Carrera jewelry, the intricate sculptural work and fine detailing of these pieces make them particularly valuable to the right buyers.

Sterling Silver: Valuable Assets Worth Considering

Many individuals downsizing for retirement community living overlook the substantial value in their sterling silver collections. Formal flatware sets, tea services, serving pieces, and decorative items accumulated over decades represent both precious metal value and collector appeal. If you're wondering about the fastest way to sell sterling silver, professional evaluation considers both silver content and maker marks that significantly impact value.

Working with an experienced sterling silver buyer ensures you receive fair compensation based on current precious metal prices and collectibility factors. Whether you need to sell sterling silver flatware, sell sterling silver tea sets, sell sterling silver trays, or sell sterling silver candlesticks, patterns from prestigious manufacturers like Tiffany & Co., Gorham, and Georg Jensen command premium prices beyond simple melt value.

The transition to retirement community living often means less formal entertaining, making extensive silver collections impractical. Rather than storing these pieces indefinitely, selling your sterling silver converts them into usable capital while ensuring they find new homes where they'll be appreciated and used. Professional buyers understand the nuances that separate ordinary pieces from highly collectible items.

Fashion House Jewelry: Chanel, Gucci, and Louis Vuitton

Luxury fashion houses have expanded into fine jewelry, creating pieces that blend haute couture sensibility with precious materials. If you own pieces and want to sell Chanel jewelry, the Chanel Camélia collection with its signature flower motif represents the intersection of fashion and fine jewelry. Whether you're looking to sell Chanel rings, sell Chanel bracelets, or sell Chanel necklaces, finding an experienced Chanel jewelry buyer who understands both fashion and jewelry markets is essential.

Similarly, Gucci's entry into fine jewelry has created collectible pieces worth consideration. If you're ready to sell Gucci jewelry, whether sell Gucci rings, sell Gucci bracelets, or sell Gucci earrings, these pieces appeal to buyers seeking contemporary luxury with Italian heritage. Working with a knowledgeable Gucci jewelry buyer ensures appropriate valuation that considers both brand prestige and jewelry quality.

For those with pieces from Louis Vuitton's jewelry collections, the brand's expansion beyond accessories into fine jewelry has created sought-after items. Whether you need to sell Louis Vuitton jewelry, including sell Louis Vuitton rings, sell Louis Vuitton bracelets, or sell Louis Vuitton necklaces, finding the right Louis Vuitton jewelry buyer maximizes your return on these fashion-forward luxury pieces.

The Tiffany & Co. Advantage: Iconic American Luxury

No discussion of jewelry downsizing would be complete without addressing America's most iconic jewelry house. If you're considering whether to sell Tiffany & Co. jewelry, these pieces consistently maintain strong resale value due to the brand's enduring reputation. Whether you own pieces from the Tiffany & Co. Return to Tiffany collection or the nature-inspired Tiffany & Co. Paper Flowers collection, working with an experienced Tiffany & Co. jewelry buyer ensures you receive fair market value.

Tiffany pieces span all jewelry categories, and market demand remains strong across the board. Whether you need to sell Tiffany rings, sell Tiffany bracelets, sell Tiffany necklaces, sell Tiffany earrings, or even sell Tiffany pendants, the distinctive blue box heritage provides immediate brand recognition. Additionally, Tiffany's expansion into timepieces means you may also want to sell Tiffany & Co. watch pieces from your collection.

Beyond jewelry, Tiffany silver pieces command premium prices. Collectors actively seek vintage and contemporary Tiffany sterling, making it an excellent time to evaluate pieces you no longer use. From Tiffany charms buyer to Tiffany brooch buyer specialists, the market for these items remains robust, particularly for signature designs from renowned Tiffany artists.

Comprehensive Watch Collections: Beyond Rolex

While Rolex dominates the luxury watch market, retirement downsizing often reveals collections spanning multiple prestigious manufacturers. If you're wondering where can I sell my watch, understanding which brands maintain strongest resale value helps prioritize your efforts. Beyond Rolex, watches from Patek Philippe, Audemars Piguet, and Vacheron Constantin represent the pinnacle of Swiss watchmaking.

For those with sport watches, brands like Panerai and IWC have developed loyal followings. Whether you need to sell Panerai watch models or sell IWC watch pieces, these brands' distinctive designs and quality construction maintain strong secondary market appeal. Similarly, if you're looking to sell Breitling watch chronographs or sell Omega watch pieces, these established manufacturers enjoy consistent buyer demand.

Complications and unique pieces command particular attention. Whether you're ready to sell Blancpain watch models, sell Breguet watch pieces with distinctive aesthetics, or sell Franck Muller watch complications, specialized buyers understand the technical sophistication that justifies premium valuations. Even more contemporary brands like Richard Mille and Hublot find strong markets when you sell Richard Mille watch or sell Hublot watch pieces.

Specialized Timepieces: Complications and Vintage Pieces

Independent watchmakers and historic complications represent the pinnacle of horological collecting. If you own pieces from masters like F.P. Journe and need to sell F. P. Journe watch pieces, or possess vintage complications and want to sell Jaeger-LeCoultre watch models, specialized knowledge ensures appropriate valuation. These watches often feature complications like perpetual calendars, minute repeaters, or tourbillons that demand expert assessment.

Vintage pocket watches also hold significant value for collectors. Whether you're looking to sell Pocket watch pieces from historic manufacturers or more contemporary dress watches, the market for quality timepieces remains strong. Additionally, if you own watches from distinctive brands like Corum, Chronoswiss, or Gerald Genta, finding buyers who understand these specialized manufacturers is essential.

For those with collections spanning diverse brands, you might need to sell Tag Heuer watch sports chronographs, sell Zenith watch pieces with historic El Primero movements, or sell Tudor watch models that share Rolex heritage at more accessible price points. Each brand occupies a distinct market position, and working with knowledgeable buyers ensures you receive appropriate compensation reflecting current market conditions.

The Strategic Approach: Timing and Methodology

Successful luxury asset liquidation requires strategic planning rather than rushed decisions. Begin by thoroughly cataloging your luxury items, including watches, jewelry, and sterling silver. Document any certificates, original boxes, or papers that accompany these pieces, as complete provenance significantly enhances value. For watches, service records demonstrate proper maintenance that justifies premium pricing.

Winter timing, particularly February 2026, offers distinct advantages for selling luxury items. Many buyers actively seek inventory early in the year, and retirement community moves planned for spring benefit from advance preparation. Starting the evaluation process now provides time for thoughtful decision-making without the pressure of imminent moving deadlines. This measured approach ensures you achieve optimal value while maintaining control throughout the transition.

Consider whether direct sale or consignment best serves your needs. At Sell Us Your Jewelry, we offer both options depending on your specific circumstances. Direct purchase provides immediate liquidity, ideal when you need funds quickly for retirement community deposits or moving expenses. Consignment allows us to market your items to find the right buyer, potentially maximizing return for particularly rare or valuable pieces.

Working with Professional Buyers: What to Expect

Partnering with reputable jewelry buyers near me or watch buyers near me protects your interests throughout the selling process. Professional evaluation begins with comprehensive inspection of each item, assessing condition, authenticity, and current market demand. For watches, this includes movement functionality, case condition, and originality of components. Jewelry assessment considers gemstone quality, metal purity, designer signatures, and overall craftsmanship.

Transparency distinguishes professional buyers from less scrupulous operators. Reputable buyers explain their evaluation methodology, provide detailed written offers, and allow time for consideration without pressure tactics. If you're wondering about how it works, our process emphasizes education and clarity, ensuring you understand exactly how we determine value and what to expect at each stage.

Location shouldn't limit your options. While in-person evaluation remains ideal for high-value items, professional buyers accommodate distance selling through secure, insured shipping. Whether you're based in Boca Raton, Miami, Fort Myers, or anywhere across the United States, accessing expert evaluation has never been more convenient. For those in South Florida, visiting our Surfside showroom near Bal Harbour provides face-to-face consultation and immediate assessment.

Additional Considerations: Lesser-Known Valuable Pieces

Beyond major luxury brands, many retirees own valuable pieces from respected manufacturers that deserve consideration. If you have watches and want to sell Concord watch pieces, sell Maurice Lacroix watch models, or sell Montblanc watch timepieces, these Swiss and German manufacturers maintain solid secondary markets. Similarly, jewelry from designers like John Hardy or Judith Ripka appeals to collectors seeking distinctive American design.

Even fashion watches from luxury houses hold value. Whether you're ready to sell Bvlgari watch pieces, sell Cartier watch models, or sell Chopard watch timepieces, these brands' jewelry expertise translates into watches that blend horological function with jewelry-quality aesthetics. For those with pieces from Piaget, known for ultra-thin movements and jewelry watches, or Van Cleef & Arpels, whose poetic complications command premium prices, specialized knowledge ensures appropriate valuation.

Don't overlook pieces that might seem less significant. Quality items from respected manufacturers like Ebel, Girard-Perregaux, or Ulysse Nardin find ready buyers. Even if watches are damaged or non-functional, many buyers purchase them for parts or restoration. The key is working with experienced professionals who understand the full spectrum of luxury timepieces and jewelry.

Making the Decision: Emotional and Practical Considerations

Selling luxury items accumulated over decades involves emotional considerations alongside financial factors. These pieces often carry memories of significant life events—anniversaries, career achievements, or inherited treasures from loved ones. Acknowledging these emotional connections is important, even as practical considerations guide your retirement transition decisions.

Consider which pieces truly enhance your retirement community lifestyle versus those that will remain stored and unused. High-end retirement communities often feature excellent security, but maintaining extensive collections may no longer align with your simplified living goals. Converting underutilized luxury assets into liquid capital provides financial flexibility for travel, experiences, or simply enhanced peace of mind.

For inherited items, selling can honor loved ones' memories by ensuring pieces find new homes where they'll be appreciated rather than remaining unused. The proceeds can fund meaningful experiences or provide security during retirement years, creating new positive associations while respecting the past. This perspective helps transform potentially difficult decisions into empowering choices that support your future.

Security and Safe Transactions: Protecting Your Interests

When selling high-value luxury items, security throughout the transaction process is paramount. Reputable buyers maintain comprehensive insurance covering items from the moment they receive them until sale completion or return. Verify that any buyer you consider provides documented insurance coverage and secure facilities for storage and evaluation.

Payment methods matter significantly when dealing with substantial sums. Professional buyers offer multiple secure payment options, including wire transfers, certified checks, and secure payment platforms. Avoid buyers who insist on cash transactions or unconventional payment methods that lack proper documentation and protection. Legitimate businesses understand the importance of traceable, secure financial transactions.

Privacy also deserves consideration. Selling valuable items shouldn't require sacrificing personal security or privacy. Professional buyers maintain strict confidentiality regarding your transactions, never sharing client information or transaction details. This discretion proves particularly important for high-profile individuals or those concerned about privacy during their retirement transition.

Regional Considerations: South Florida and Beyond

South Florida residents enjoy unique advantages when selling luxury items due to the region's concentration of wealth and sophisticated buyers. Whether you're searching for a Boca Raton Rolex buyer, Miami Patek Philippe buyer, or West Palm Beach Breitling buyer, the area's luxury market infrastructure provides multiple reputable options for sellers.

Specific locations like Bal Harbour, Coral Gables, and Fort Myers host communities of affluent retirees and luxury buyers. Finding a Bay Harbor Cartier watch buyer, Coral Gables Cartier watch buyer, or Fort Myers Rolex watch buyer ensures you work with professionals familiar with the regional market and its particular characteristics. Local expertise translates into fair valuations that reflect current regional demand.

Beyond South Florida, our services extend nationwide, providing the same professional evaluation and competitive offers regardless of location. Whether you're downsizing from Hollywood, Key Biscayne, Naples, or anywhere across the United States, secure shipping and comprehensive insurance make distance selling safe and convenient. Our nationwide presence ensures consistent service quality regardless of your location.

Preparing Items for Evaluation: Maximizing Value

Proper preparation before evaluation can significantly impact offers you receive. For watches, locate original boxes, papers, certificates, and service records. Complete documentation proves authenticity and provenance, often adding substantial value, particularly for highly collectible pieces. If you've lost documentation, mention this upfront—honest disclosure builds trust and prevents complications later.

For jewelry, gather any certificates for diamonds or gemstones, particularly GIA or other recognized laboratory documentation. Original purchase receipts, appraisals, and designer certificates all contribute to establishing value. Clean items gently before evaluation—presenting pieces in their best condition demonstrates care and respect for your possessions.

Sterling silver items benefit from proper identification research before evaluation. Photograph and document maker's marks, pattern names, and any identifying features. Sets with complete place settings or matching serving pieces command premium prices, so accurately inventory what you have. Understanding what you own demonstrates informed stewardship and facilitates efficient evaluation.

The Consignment Option: When It Makes Sense

For particularly rare or valuable pieces, consignment offers advantages over direct sale. This approach allows professionals to market items to collectors willing to pay premium prices for exceptional pieces. While consignment extends the timeline compared to direct purchase, potential returns often justify the wait for truly special items.

Consignment works particularly well for investment-grade watches from brands like Patek Philippe, Audemars Piguet, and Rolex, especially limited editions or vintage pieces in exceptional condition. Similarly, jewelry from ultra-luxury houses like Harry Winston, Graff, or Van Cleef & Arpels often achieves higher prices through targeted marketing to collectors rather than immediate liquidation.

Understanding consignment terms is essential. Reputable consignment arrangements clearly specify commission structures, marketing duration, minimum acceptable prices, and circumstances under which items return to you. Professional consignment provides regular updates on marketing efforts and interested parties, maintaining transparency throughout the process. This collaborative approach ensures your interests remain protected while maximizing potential returns.

Simplifying Your Retirement Transition

Strategic luxury asset liquidation transforms potentially overwhelming retirement transitions into manageable processes. By methodically evaluating your watches, jewelry, and sterling silver, you gain clarity about which pieces enhance your retirement community lifestyle versus those better converted to liquid assets. This thoughtful approach reduces both physical belongings and mental burden associated with maintaining extensive collections.

The financial flexibility gained through selling luxury assets supports your retirement community transition in multiple ways. Proceeds can cover community deposits, moving expenses, or simply provide enhanced financial security during your retirement years. Rather than viewing this process as loss, recognize it as strategic reallocation—converting underutilized assets into resources that actively support your new lifestyle.

Beginning this process this winter positions you ideally for spring transitions. February 2026 provides sufficient time for thorough evaluation, considered decision-making, and completion of sales before moving deadlines. This measured pace eliminates rushed decisions and ensures you achieve optimal value for your luxury items while maintaining control throughout your retirement transition.

Take the Next Step: Start Your Evaluation Today

Your luxury watches, fine jewelry, and sterling silver represent substantial value that can support your retirement community transition. Rather than leaving these items unused or rushing through last-minute liquidation, beginning the evaluation process now ensures strategic, informed decisions that maximize your returns while simplifying your move.

At Sell Us Your Jewelry, we specialize in helping individuals navigate luxury asset liquidation with professionalism, transparency, and respect. Our comprehensive evaluation process considers every factor affecting value, from brand prestige and condition to current market demand and collector interest. Whether you're ready to sell your watch, sell your jewelry, sell your GIA diamonds, or sell your sterling silver, our team provides expert guidance throughout the process.

Ready to simplify your retirement transition through strategic luxury asset liquidation? Contact us today to begin your complimentary evaluation. Visit our Surfside showroom near the iconic Bal Harbour Shops for in-person consultation, or request a secure shipping kit to send items from anywhere in the United States. Discover how our process works and explore the brands we buy to understand the full scope of items we evaluate. Transform your luxury collection into financial flexibility that supports your exciting new chapter in retirement community living.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG