February 20th, 2026

Estate Sales Essentials: Your Complete Guide to Liquidating Inherited Jewelry and Silver During Probate

Navigating the probate process can be overwhelming, especially when you're responsible for liquidating inherited jewelry and estate silver. Understanding how to properly assess, value, and sell these items is crucial for maximizing returns and ensuring a smooth probate jewelry liquidation. Whether you've inherited a collection of luxury pieces or need to settle an estate efficiently, this comprehensive guide will walk you through every essential step of the estate sales process.

The emotional weight of handling a loved one's possessions combined with legal obligations makes estate jewelry liquidation particularly challenging. Many executors and beneficiaries find themselves uncertain about where to begin, how to identify valuable pieces, or which buyers to trust with precious heirlooms. This guide addresses these concerns with practical advice backed by decades of experience in the luxury jewelry and sterling silver market.

Understanding Your Legal Obligations During Probate

Before you sell inherited jewelry, it's essential to understand your legal responsibilities as an executor or estate administrator. Probate laws vary by state, but most require a comprehensive inventory of all estate assets, including jewelry, watches, and sterling silver. This inventory must accurately reflect the fair market value of each item to properly settle the estate and distribute assets to beneficiaries.

Working with experienced jewelry buyers who understand probate requirements can streamline this process significantly. Professional appraisers and buyers can provide documented valuations that satisfy court requirements while ensuring you receive competitive offers. Keep detailed records of all appraisals, communications, and transactions throughout the liquidation process to maintain transparency with beneficiaries and meet legal obligations.

Many estates include luxury timepieces alongside jewelry collections. If you're wondering where to sell my watch, choosing a reputable buyer with probate experience ensures proper documentation and fair pricing. Our team specializes in evaluating complete estate collections, from Rolex and Patek Philippe watches to luxury jewelry from brands like Cartier, Tiffany & Co., and Van Cleef & Arpels.

Identifying Valuable Pieces in Your Estate Collection

Not all inherited jewelry holds significant monetary value, but knowing what to look for can prevent costly oversights. Designer pieces from prestigious houses like Cartier, Bvlgari, Harry Winston, and Van Cleef & Arpels typically command premium prices in the secondary market. Look for maker's marks, hallmarks, and signatures that indicate provenance and authenticity.

Sterling silver flatware and serving pieces often constitute substantial portions of estate value. Complete sets from renowned silversmiths like Tiffany & Co., Georg Jensen, or Gorham can be worth thousands of dollars. Check for hallmarks indicating sterling content (typically marked "925" or "Sterling") and manufacturer stamps. Even incomplete sets or damaged pieces have intrinsic metal value that shouldn't be overlooked.

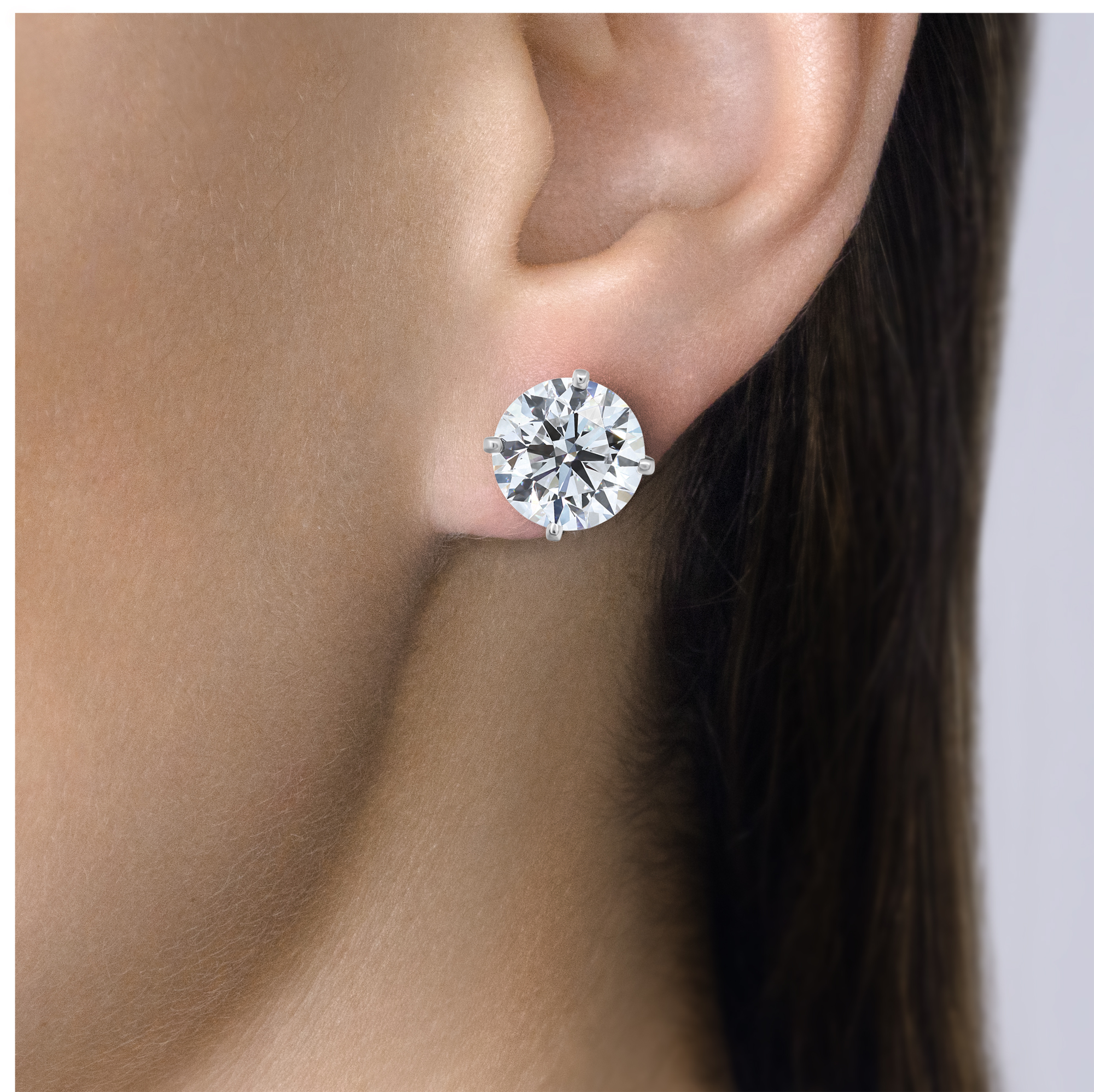

Diamond jewelry requires special attention during estate liquidation. GIA Certified Diamonds and other professionally graded stones maintain their value exceptionally well. If certificates are available, keep them with the corresponding pieces. For uncertified diamonds, professional evaluation by a trusted diamond buyer ensures accurate pricing based on cut, clarity, color, and carat weight.

Luxury watch collections often represent significant estate value. Brands like Audemars Piguet, Rolex, Omega, Patek Philippe, Vacheron Constantin, and Hublot maintain strong secondary market demand. Even non-working timepieces have value—we buy broken watches and jewelry in any condition, as they can be restored or valued for their precious metal and component worth.

Organizing and Documenting Your Estate Jewelry Collection

Proper organization is fundamental to successful estate jewelry liquidation. Create a detailed inventory with photographs of each piece, noting any visible hallmarks, signatures, or unique characteristics. Separate items by category: fine jewelry, costume jewelry, watches, sterling silver, and loose gemstones. This systematic approach facilitates accurate valuation and helps potential buyers assess your collection efficiently.

Documentation adds tremendous value to inherited pieces. Locate any original purchase receipts, certificates of authenticity, appraisal documents, or provenance records. Pieces with documented history from prestigious brands often command higher prices. For example, Cartier Love bracelets, Tiffany & Co. engagement rings, and Van Cleef & Arpels Alhambra collection items with original boxes and papers typically sell for premium prices.

For those handling complete estate liquidations, understanding how the selling process works with reputable buyers simplifies what can otherwise be an overwhelming task. Professional buyers evaluate entire collections, provide comprehensive quotes, and handle transactions efficiently—essential when managing probate timelines and beneficiary expectations.

Getting Professional Appraisals and Valuations

Professional appraisals provide the foundation for fair estate jewelry liquidation. While insurance appraisals may exist for some pieces, these typically reflect replacement value rather than current market resale value. Seek appraisals specifically for estate liquidation purposes, as these reflect what buyers will actually pay in today's market.

When you sell Cartier jewelry, sell Tiffany & Co. jewelry, or other luxury brands, experienced buyers familiar with these makers provide the most accurate valuations. These specialists understand brand-specific value factors, market demand for particular collections like the Cartier Panthère collection or Bvlgari Serpenti collection, and how condition affects pricing. Their expertise ensures you receive competitive offers that reflect true market value.

Sterling silver buyers can evaluate flatware sets, tea services, trays, and decorative items based on weight, pattern rarity, and condition. Even tarnished or damaged silver has value based on precious metal content. Professional buyers weigh and test silver to determine purity and provide offers based on current precious metal markets plus any additional value for rare or complete sets.

Choosing Between Direct Sale and Consignment

Estate executors face an important decision: sell items outright for immediate payment or place them on consignment for potentially higher returns. Direct sales provide quick liquidity—essential when settling estate debts or distributing assets to beneficiaries. Consignment may yield higher prices but involves longer timeframes and uncertain outcomes.

Direct sales to established jewelry buyers near me offer several advantages during probate. You receive immediate payment, eliminate storage and insurance concerns, and close estate accounts promptly. For high-value pieces like Rolex Submariner watches, Patek Philippe Nautilus models, or significant diamond jewelry, reputable buyers provide competitive cash offers based on current market conditions.

Consignment works well for exceptionally rare pieces that may attract premium prices from collectors. Items like vintage Harry Winston jewelry, rare Patek Philippe complications, or signed pieces by renowned designers like David Webb or Graff might benefit from consignment exposure to specialized buyers. However, consignment involves ongoing communication, potential price adjustments, and delayed payment—factors to weigh against probate timeline requirements.

Selling Designer Jewelry and Luxury Watches

Designer jewelry and luxury watches represent the highest-value items in most estate collections. Cartier, Bvlgari, Chopard, Van Cleef & Arpels, and Tiffany & Co. pieces maintain strong secondary market demand. Understanding which collections command premium prices helps prioritize evaluation and marketing efforts.

When you sell Bvlgari jewelry, pieces from iconic collections like B.Zero1 and Serpenti typically attract strong buyer interest. Similarly, Cartier Love bracelets and Juste un Clou bracelets remain among the most sought-after items in estate sales. Condition matters significantly—original boxes, papers, and certificates can increase value by 15-30% compared to pieces without documentation.

Luxury watches require specialized knowledge for accurate valuation. Rolex models like the Submariner, GMT-Master, and Daytona maintain exceptional resale value. Patek Philippe watches, particularly perpetual calendars and complicated models, represent significant investments. Even if you're unsure about a watch's value, consulting with experienced watch buyers ensures you don't inadvertently undersell valuable timepieces.

Contemporary designer pieces also hold value in estate sales. David Yurman jewelry, particularly the Cable collection, Chopard Happy Diamonds, and Roberto Coin pieces like the Princess Flower collection attract buyers seeking recognizable luxury at accessible price points. When you sell David Yurman jewelry or similar contemporary designers, condition and completeness significantly impact offers.

Liquidating Sterling Silver Collections

Sterling silver flatware, hollowware, and serving pieces often represent substantial estate value. Complete flatware services for twelve or more settings can be worth thousands of dollars, while sterling tea sets, trays, and candlesticks add significant value to estate inventories. Understanding how silver is valued ensures you receive fair compensation for these items.

Professional silver buyers evaluate pieces based on weight, pattern desirability, manufacturer, and condition. Popular patterns from prestigious makers command premiums beyond melt value. However, even common patterns have intrinsic value based on current silver prices. Damaged or incomplete pieces should never be discarded—the precious metal content alone makes them worth selling.

When you sell sterling silver flatware, buyers typically weigh complete sets and calculate offers based on troy ounces. Sterling contains 92.5% pure silver, with current market prices fluctuating daily. Reputable buyers provide transparent calculations showing weight, purity, and market-based pricing. Additional value accrues for complete sets, rare patterns, or pieces from renowned silversmiths like Tiffany & Co. or Georg Jensen.

Silver tea sets, serving trays, and decorative items require individual evaluation. Ornate Victorian pieces, Art Deco designs, or items from prestigious makers often sell above melt value to collectors. Even heavily tarnished pieces retain full value—tarnish is easily removed and doesn't affect the underlying silver content or structural integrity.

Handling Gemstones and Diamond Jewelry

Diamond jewelry constitutes some of the highest-value items in estate liquidations. Whether selling engagement rings, tennis bracelets, or loose stones, understanding diamond grading basics helps you work effectively with buyers and recognize fair offers. The four Cs—cut, clarity, color, and carat weight—determine diamond value, with certification from GIA, AGS, or other recognized laboratories providing definitive quality documentation.

When you sell diamond engagement rings, buyers evaluate both the center stone and the mounting. Platinum and high-karat gold settings add value beyond the diamond itself. Vintage mountings, particularly Art Deco designs or pieces from prestigious jewelers, may command premiums from collectors. Modern engagement rings with GIA Certified Diamonds typically receive the highest offers due to documented quality specifications.

Diamond bracelets, particularly tennis-style designs with well-matched stones, represent significant value in estate jewelry. The uniformity of stone quality throughout the bracelet affects pricing—pieces with consistently high-quality diamonds command premium prices. When selling diamond jewelry, providing any existing certifications or appraisals helps buyers make accurate offers quickly.

Colored gemstones require specialized evaluation. Rubies, sapphires, and emeralds from reputable sources maintain strong value, particularly with certification from AGL or other recognized gemological laboratories. Even without certification, experienced buyers can assess quality and provide fair offers based on color, clarity, size, and origin.

Working With Professional Estate Jewelry Buyers

Selecting the right buyer significantly impacts your estate liquidation success. Established firms with decades of experience, transparent processes, and strong reputations provide the security and fairness essential during probate. Look for buyers who specialize in the types of items you're selling—luxury watches, designer jewelry, or sterling silver—as specialists typically offer better prices than generalists.

At Sell Us Your Jewelry, we've served as the trusted jewelry and watch buyer for estate executors throughout South Florida and across the United States since 1980. Our expertise spans all luxury categories, from Rolex and Patek Philippe watches to jewelry from Cartier, Van Cleef & Arpels, Harry Winston, and other prestigious makers. We understand probate requirements and work efficiently to meet estate settlement timelines.

Our process begins with a comprehensive evaluation of your entire collection. Whether you visit our showroom in Surfside, across from the iconic Bal Harbour Shops, or work with us remotely, we provide detailed assessments and competitive offers for all items. We buy jewelry, watches, diamonds, and sterling silver in any condition, ensuring nothing of value is overlooked during estate liquidation.

Understanding Market Timing and Pricing Factors

Luxury jewelry and watch markets fluctuate based on numerous factors. Precious metal prices change daily, affecting the baseline value of gold, platinum, and silver items. Designer brand popularity shifts over time—currently, Cartier watches and jewelry are experiencing strong demand, while certain vintage Rolex models command record prices. Understanding these market dynamics helps set realistic expectations for estate sales.

Some items benefit from timing flexibility. Rare Patek Philippe complications or exceptional vintage pieces might achieve better prices during major auction seasons when serious collectors are most active. However, most estate situations require prompt liquidation to meet probate timelines. Working with buyers who understand current market conditions ensures you receive fair pricing even when timing isn't optimal.

Condition significantly impacts pricing across all categories. Well-maintained pieces with minimal wear command premiums, while items requiring repair or restoration sell for less. However, even damaged jewelry and broken watches have value. We specialize in buying items in any condition, evaluating them for precious metal content, gemstones, and restoration potential.

Maximizing Value Through Proper Preparation

Simple preparation steps can significantly impact the offers you receive for estate jewelry. Clean pieces gently to reveal maker's marks, hallmarks, and stone quality. Don't attempt aggressive cleaning or repairs—professional buyers prefer evaluating items in their actual condition. Gather all documentation, including original boxes, certificates, receipts, and appraisal papers.

Organize similar items together and prepare basic inventories before contacting buyers. This organization demonstrates professionalism and helps buyers quickly assess your collection's scope and value. For large estates, consider having buyers visit to evaluate everything in person rather than transporting valuable items unnecessarily.

When selling luxury brands like Bvlgari, Chopard, Tiffany & Co., or Van Cleef & Arpels, original packaging significantly enhances value. A Cartier Love bracelet with its original box and screwdriver, for example, commands higher prices than the bracelet alone. If packaging is missing, don't be discouraged—the pieces themselves still have substantial value based on their inherent quality and brand prestige.

Navigating Tax Implications of Estate Sales

Estate jewelry liquidation involves tax considerations that executors must understand. The estate itself may owe taxes on asset appreciation from the date of death valuation to the sale date. Beneficiaries who inherit items directly may face different tax implications when they eventually sell. Consulting with estate attorneys and tax professionals ensures compliance with all applicable regulations.

Professional appraisals establish the stepped-up basis for inherited items, which becomes crucial for tax calculations. This date-of-death valuation determines capital gains when items are eventually sold. Keeping detailed records of appraisals, sales proceeds, and buyer information simplifies tax reporting and provides documentation if questions arise during estate settlement.

Working with established buyers who provide proper documentation supports your tax reporting obligations. Legitimate businesses issue appropriate paperwork for all transactions, including detailed item descriptions and sale prices. This documentation proves invaluable when preparing estate tax returns or responding to beneficiary questions about asset distribution.

Avoiding Common Estate Liquidation Mistakes

Estate executors often make costly mistakes during jewelry liquidation. Selling to the first buyer without obtaining multiple quotes frequently results in below-market prices. Taking time to consult several reputable buyers, particularly specialists in luxury items, ensures you receive competitive offers that maximize estate value.

Another common error involves discarding items assumed to have little value. Costume jewelry sometimes contains valuable signed pieces from designers like Chanel or vintage items that collectors seek. Broken watches, even non-working Rolex or Omega timepieces, have significant value for parts or restoration. Never dispose of jewelry or watches without professional evaluation—you might be discarding thousands of dollars in hidden value.

Rushing the process leads to poor decisions. While probate timelines create pressure, hasty sales to questionable buyers or acceptance of lowball offers costs estates significantly. Reputable buyers provide prompt evaluations while allowing reasonable decision-making time. Balancing efficiency with due diligence protects estate interests and ensures beneficiaries receive maximum value from liquidated assets.

Special Considerations for Luxury Watch Collections

Luxury watch collections require specialized handling during estate liquidation. Brands like Rolex, Patek Philippe, Audemars Piguet, Vacheron Constantin, and A. Lange & Söhne maintain exceptional secondary market value. Understanding what makes certain models particularly valuable helps prioritize evaluation efforts and set realistic expectations.

Vintage sports models from Rolex—particularly Submariners, GMT-Masters, and Daytonas—consistently achieve strong prices. Complicated watches from Patek Philippe, including perpetual calendars, minute repeaters, and tourbillons, represent significant value even in non-working condition. When handling luxury watch estates, consulting with specialized watch buyers ensures accurate identification and valuation of potentially rare pieces.

Original papers and boxes substantially enhance watch values. A Rolex with its original warranty papers, box, and hang tags commands premiums of 15-30% over identical models without documentation. Service records demonstrate proper maintenance and provide provenance that serious collectors value highly. Even without documentation, luxury Swiss watches maintain strong inherent value based on brand, model, condition, and market demand.

Non-working watches shouldn't be dismissed as worthless. Many vintage timepieces require simple service to restore functionality, while others have value for precious metal cases, original dials, or collectible movements. We regularly buy watches in any condition, evaluating them for restoration potential or parts value when appropriate.

Getting Started With Your Estate Liquidation

Beginning the estate jewelry liquidation process starts with comprehensive inventory and organization. Photograph all items, note any visible markings or signatures, and separate pieces by category. Locate any existing documentation, including purchase receipts, appraisals, and certificates. This preparation streamlines evaluation and helps buyers provide accurate quotes quickly.

Reach out to reputable buyers with estate liquidation experience. At Sell Us Your Jewelry, we've handled countless estate collections, providing executors with expert guidance, fair pricing, and efficient transactions. Our team evaluates complete estates, from individual pieces to entire collections spanning multiple luxury categories. We understand probate pressures and work diligently to meet your timeline requirements.

For South Florida residents, visit our showroom in Surfside to meet with our expert team in person. Bring your items for immediate evaluation and receive offers the same day. For sellers throughout the United States, our remote evaluation process provides the same professional service and competitive pricing. We accept shipments of insured items or can arrange secure transportation for high-value collections.

Your Trusted Partner in Estate Jewelry Liquidation

Navigating estate jewelry and silver liquidation during probate requires expertise, transparency, and trustworthy partnerships. Since 1980, Sell Us Your Jewelry has served as the purchasing and consignment division of Gray & Sons, building a reputation for fair dealing and competitive pricing across all luxury categories. Our master-trained watchmakers and experienced jewelers ensure every piece receives accurate evaluation and appropriate valuation.

Whether you're selling a complete estate collection or individual items, our comprehensive approach maximizes value while minimizing stress. We purchase luxury watches from brands including Rolex, Patek Philippe, Audemars Piguet, Omega, Cartier, and dozens of other prestigious makers. Our jewelry expertise spans Cartier, Tiffany & Co., Van Cleef & Arpels, Harry Winston, Bvlgari, Chopard, and many other luxury brands.

Our sterling silver expertise includes flatware, hollowware, tea sets, and decorative items from all major manufacturers. We evaluate diamond jewelry of all sizes and qualities, with particular expertise in GIA-certified stones. From engagement rings to tennis bracelets, estate necklaces to loose diamonds, our team provides accurate assessments and competitive offers based on current market conditions.

Ready to Begin Your Estate Liquidation?

Don't navigate the complex probate jewelry liquidation process alone. Our expert team stands ready to evaluate your estate collection, answer questions, and provide the competitive pricing you deserve. Whether you're in South Florida or anywhere across the United States, we make selling inherited jewelry and silver straightforward and stress-free.

Get started today:

- Sell your jewelry – Request a quote for luxury jewelry from all major designers

- Sell your watches – Receive competitive offers for Swiss luxury timepieces

- Sell your diamonds – Get expert evaluation for certified and uncertified diamonds

- Sell your sterling silver – Maximize returns on flatware, tea sets, and serving pieces

- Learn about our process – Discover how easy estate liquidation can be

- Explore brands we buy – See our comprehensive list of luxury brands

For personalized assistance with your estate liquidation, contact our team today. We're here to make the probate jewelry and silver selling process as seamless and rewarding as possible, ensuring your estate receives the full value it deserves.

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG