February 19th, 2026

Year-End Calendar Rush: Why Your Patek Philippe Annual Calendar Commands Record December Premiums

Year-End Calendar Rush: Why Your Patek Philippe Annual Calendar Commands Record December Premiums

Table of Contents

- The Annual Calendar Advantage: Horological Sophistication Meets Practical Elegance

- December's Perfect Storm: Why Calendar Watches Peak at Year's End

- November's Market Momentum: The Runway Into Peak Season

- Collector Psychology: The Symbolic Value of Year-End Acquisitions

- Market Data & Investment Value: Quantifying the December Premium

- Geographic Advantages: South Florida's Luxury Watch Hub

As December arrives, a unique phenomenon occurs in the luxury watch market that savvy collectors and sellers have come to anticipate. If you're considering whether to sell your Patek Philippe watch, particularly an annual calendar complication, this month represents an exceptional window of opportunity. The convergence of year-end demand, calendar relevance, holiday gifting, and collector psychology creates a perfect storm that drives premium valuations for these sophisticated timepieces.

The holiday season transforms the luxury watch market. Corporate bonuses, milestone celebrations, and gift-giving traditions all funnel attention toward prestigious, mechanically impressive watches. For complicated Patek Philippe models—especially annual calendars—this means more buyers, greater urgency, and often multiple parties competing for limited inventory.

Understanding why December amplifies the value of your Patek Philippe annual calendar can help you make informed decisions about timing your sale. Whether you're a collector looking to reposition your portfolio, an estate executor managing valuable assets, or someone facing a significant life transition, recognizing these market dynamics ensures you receive the best possible return on your luxury timepiece.

The Annual Calendar Advantage: Horological Sophistication Meets Practical Elegance

The Patek Philippe annual calendar represents one of the manufacture's most compelling complications—a mechanical marvel that automatically adjusts for months of varying lengths, requiring manual correction only once per year at the end of February. This balance between sophisticated engineering and user-friendly functionality has made annual calendars increasingly desirable among collectors who appreciate haute horlogerie without the maintenance complexity of a perpetual calendar.

Annual calendar watches occupy a unique position in the horological hierarchy—more sophisticated than simple date complications, yet more practical and accessible than perpetual calendars that can cost significantly more and demand specialized servicing. This sweet spot of complexity and usability makes them particularly attractive to serious collectors who wear their watches regularly rather than keeping them in a safe.

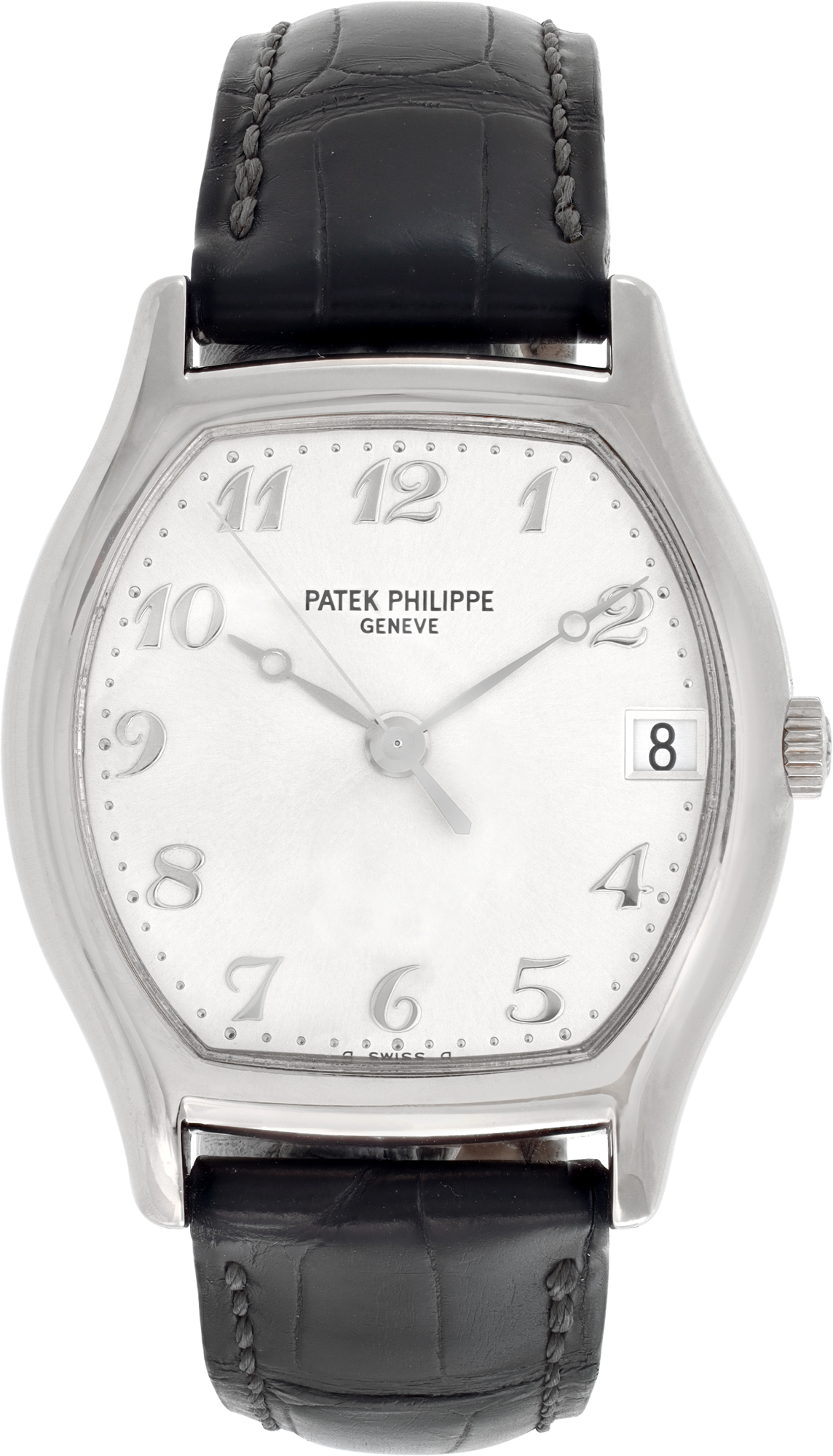

Patek Philippe's mastery of this complication, first introduced in 1996 with the reference 5035, revolutionized complicated watchmaking by offering accessible complexity. Models like the 5396, 5205, and 5326 have become icons in their own right, combining calendar functionality with moon phase displays, day/date/month windows, and elegant case designs that range from classic Calatrava-inspired dress watches to more contemporary sports-luxury styles in the Nautilus and Aquanaut families.

The technical brilliance of these timepieces stems from their ability to distinguish between 30-day and 31-day months. As each month transitions, owners experience the "mechanical poetry" of the date jumping correctly—an interaction that becomes especially noticeable at the end of November and December when people are more attuned to the calendar. This physical engagement with the watch's defining feature often prompts reflection about whether the timepiece still serves their collection goals or lifestyle needs.

Visually, Patek Philippe annual calendars are equally compelling. Most references feature harmoniously balanced subdials or apertures for day, date, and month, often complemented by moon phase indicators and, in some cases, power reserve displays. The result is an elegant dial that reads as refined rather than cluttered, whether executed in white, rose, or yellow gold, platinum, or (for select references) stainless steel.

For those considering selling your pre-owned luxury watch, understanding the technical distinction between annual and perpetual calendars is crucial. Annual calendars command significant premiums over simple date complications while maintaining greater accessibility than perpetual calendars, positioning them in a sweet spot of collectibility, wearability, and market demand.

December's Perfect Storm: Why Calendar Watches Peak at Year's End

The December market for calendar complications isn't coincidental—it's driven by multiple converging factors that create unprecedented demand. As the year draws to a close, collectors become acutely aware of their timepieces' calendar functions, often discovering the satisfaction of watching mechanical ingenuity track the passage of time. This heightened consciousness drives interest specifically in calendar watches during the holiday season.

December also compresses buying timelines. Throughout most of the year, collectors may research slowly, compare references, and negotiate over weeks. During the holidays, buyers face hard deadlines—Christmas morning, New Year's Eve, milestone birthdays or anniversaries—so they prioritize getting the right watch in time over extracting every last discount. That urgency supports firmer pricing and higher realized values for sellers. When a buyer needs the perfect gift for a spouse's milestone birthday or to commemorate a significant business achievement, finding the right timepiece takes priority over price optimization.

Gift-giving tradition further amplifies demand during December. A Patek Philippe annual calendar represents the pinnacle of meaningful luxury gifts—a piece that combines technical mastery with emotional significance and long-term value. Holiday shoppers and executives receiving year-end bonuses actively seek timepieces that embody success, achievement, and permanence. An annual calendar—literally built around tracking months and years—fits that brief perfectly. Gift-buyers strongly prefer watches that include original boxes, papers, warranty cards, and service documentation, as a complete set allows the gift recipient to experience the full Patek Philippe presentation ritual.

December also coincides with year-end financial planning. Many high-net-worth individuals rebalance portfolios, realize gains, or deploy bonuses and incentive payouts. For watch buyers, that often translates into treating themselves or loved ones to a complicated Patek Philippe that might have felt out of reach earlier in the year. Corporate executives receive year-end bonuses and look to celebrate successful years with significant purchases, while collectors often use the year-end period to rebalance their collections.

November's Market Momentum: The Runway Into Peak Season

These dynamics don't start on December 1st. November is often the "runway" into peak season, marking a critical inflection point in the watch market. As month-end approaches and owners manually adjust their annual calendars, they're reminded of the watch's defining complication and may reconsider whether it still fits their lifestyle or collecting goals. At the same time, luxury watch buyers and dealers are actively stocking up for December demand, creating strong liquidity from late November through the end of the year.

November represents exceptional acquisition opportunities as sellers recognize the strategic timing. Collectors and dealers alike are positioning their inventories for year-end transactions, creating heightened demand for prestigious brands like Patek Philippe. This timing coincides with financial planning activities, where individuals reassess their luxury asset portfolios before the calendar year concludes.

The market liquidity during this period often translates to more competitive offers and faster transactions—both critical factors for those looking to sell their watch efficiently. For sellers, this means luxury watch buyers are actively searching for well-maintained annual calendar models to meet their clients' demands.

If you're searching for a trusted Patek Philippe buyer in Miami, December (and the weeks leading into it) represents an optimal time to receive competitive offers. Our team at Sell Us Your Jewelry, the purchasing division of Gray & Sons, specializes in evaluating complicated Patek Philippe timepieces and understands the seasonal premiums that these watches command.

Collector Psychology: The Symbolic Value of Year-End Acquisitions

Beyond practical considerations, psychological factors significantly influence December's luxury watch market dynamics. Collectors often view year-end acquisitions as symbolic—marking achievements, commemorating milestones, or setting intentions for the coming year. A Patek Philippe annual calendar, with its connection to the passage of time and the turning of the calendar, becomes particularly resonant during this transitional period.

The holiday season also introduces many first-time high-end buyers: individuals receiving bonuses or inheritances who are purchasing their first serious watch. These buyers gravitate toward brands with unquestioned prestige and strong resale value, making Patek Philippe an obvious choice. They're typically less price-sensitive and more focused on "getting it right," which further supports strong December pricing. These new market entrants are less likely to quibble over premiums when acquiring a watch they know represents the pinnacle of Swiss watchmaking.

The scarcity mindset intensifies as the year concludes. Collectors recognize that certain references become increasingly difficult to source, and the year-end serves as a psychological deadline for completing collections or acquiring grail pieces. This urgency translates directly into stronger offers and faster transactions for sellers with desirable references—especially when those watches are "gift ready" with full box and papers.

For sellers throughout South Florida, whether you're in Boca Raton, Bal Harbour, Aventura, Sunny Isles, or beyond, working with an experienced Patek Philippe buyer who understands these market nuances ensures you capitalize on seasonal premiums. Our expertise in complicated timepieces means we can accurately assess condition, provenance, and market positioning to provide offers that reflect true year-end value.

Market Data & Investment Value: Quantifying the December Premium

Recent market analysis reveals that Patek Philippe annual calendar models consistently achieve 8–15% higher transaction values during November and December compared to slower periods like late winter or mid-summer. Professional luxury watch buyers and specialized dealers report this pattern year after year across a range of references.

Specific references show even more pronounced year-end appreciation. The reference 5396R in rose gold, for instance, has historically commanded December premiums approaching 18–20% above March/April values. White gold variants of the 5205 similarly benefit from year-end market conditions, particularly those with complete box and papers documentation. In platinum or limited configurations, the spread can be even more dramatic when multiple buyers compete for a scarce example.

These premiums aren't limited to six-figure references. Even more accessible annual calendar models benefit from year-end selling dynamics, making November and December an opportune time to sell your watch regardless of specific reference or vintage.

Beyond seasonal spikes, annual calendars have shown strong long-term performance. Complicated Patek Philippe models have historically outpaced inflation and, in many cases, rival traditional investments over five- and ten-year horizons. The brand's famous line—"You never actually own a Patek Philippe. You merely look after it for the next generation."—resonates because secondary-market data largely supports it. Well-maintained examples with original boxes and papers have demonstrated impressive value retention and, for certain references, sustained appreciation.

Case metal and configuration matter. Precious metal annual calendars in rose, yellow, or white gold, and especially platinum, tend to show stronger percentage appreciation, while steel examples often enjoy faster liquidity. Dial color, limited editions, and special collaborations (such as Tiffany-signed dials) can further elevate market positioning.

When evaluating whether to sell a Patek Philippe Nautilus or annual calendar model, understanding your specific reference's trajectory is essential. A qualified Patek Philippe buyer in Boca Raton, Bal Harbour, Aventura, or West Palm Beach can provide reference-specific market analysis so you can decide whether December's premium justifies parting with your watch now or holding for the longer term.

Geographic Advantages: South Florida's Luxury Watch Hub

South Florida's position as a luxury watch epicenter amplifies year-end market dynamics significantly. The region attracts international buyers, seasonal residents with enhanced purchasing power, and year-end visitors seeking tax-advantaged luxury acquisitions. This concentration of sophisticated collectors creates exceptional demand for high-complication Patek Philippe timepieces.

As a Patek Philippe buyer in Aventura, Bal Harbour, Miami, Hollywood, and throughout Miami-Dade, Broward, and Palm Beach counties, we observe firsthand how seasonal population increases drive market activity. Snowbirds returning to their Florida residences often seek to acquire or upgrade timepieces, while year

How it works

ONLINE PROCESS

1. Request a Quote Find out how much is your watch or jewelry worth? The more information & photos you share with us the more accurate the market valuation will be. Upon completion of an online submission our experts will contact you with an initial quote.

2. Send Items for Inspection We will provide Easy Ship box and packing materials with our address label. Simply take it to the post office. Send it via registered mail and fully insured*, and we will refund your cost of shipping and insurance upon purchase, up to a maximum of $100, provided you submit proper documentation.

3. Receive Payment Once the inspection is complete and details of the transaction are confirmed, you will quickly receive your payment via check or bank wire.

IN-STORE PROCESS

1. Walk-In our Showroom No appointment necessary. Visit our store at 9595 Harding Avenue, Surfside, FL 33154. Across the street form world-famous Bal Harbour Shops.

2. In-House Inspection Jewelry and Watch buying experts along with in-house master trained watchmakers on-site will perform an in-house inspection for an immediate evaluation.

3. Receive Payment Once the inspection is complete and details of the transaction are confirmed, you will quickly receive your payment via check or bank wire.

* Be sure to protect your valuables with adequate shipping insurance. IF YOU OVERPAY FOR YOUR INSURANCE, IT IS NOT OUR RESPONSIBILITY TO COVER THE EXCESS AMOUNT.DO NOT USE FEDEX OR UPS, AS THEY DO NOT INSURE JEWELRY OR WATCHES.** Gray and Sons is not responsible for shipping and insurance cost to return counterfeit watches or jewelry shall the client wishes to get them returned.

What Are You Looking To Sell?

Sell your watch

How much is your watch worth?

Sell your jewelry

How much is your jewelry worth?

Sell your diamond

How much is your diamond worth?

Sell your sterling silver

How much is your silver worth?

Get your free quote

Fill out this simple form to receive a free jewelry quote!

About Us | Sell Us Your Jewelry

Call Us Now: 305 770 6955

The Purchasing and Consignment Division of Gray & Sons

Be the first to know | SEE OUR CATALOG